A corporation is an artificial person that is created by governmental action. The corporation exists in the eyes of the law as a person, separate and distinct from the persons who own the corporation (i.e., the stockholders). This means that the property of the corporation is not owned by the stockholders, but by the corporation. Debts of the corporation are debts of this artificial person, and not of the persons running the corporation or owning shares of stock in it. The shareholders cannot normally be sued as to corporate liabilities. However, in this guaranty, the stockholders of a corporation are personally guaranteeing the debt of the corporation in which they own shares.

Kentucky Continuing Guaranty of Business Indebtedness By Corporate Stockholders

Description

How to fill out Continuing Guaranty Of Business Indebtedness By Corporate Stockholders?

Are you in a situation where you require documents for either business or personal purposes each day.

There are numerous legitimate document templates accessible online, but finding forms that you can trust is not easy.

US Legal Forms offers thousands of form templates, such as the Kentucky Continuing Guaranty of Business Indebtedness By Corporate Stockholders, which can be filled out to meet federal and state requirements.

Once you locate the appropriate form, click Buy now.

Choose the pricing plan you want, enter the necessary information to create your account, and complete your purchase using PayPal or a credit card.

- If you are currently familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Kentucky Continuing Guaranty of Business Indebtedness By Corporate Stockholders template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you require and ensure it is for the correct city/county.

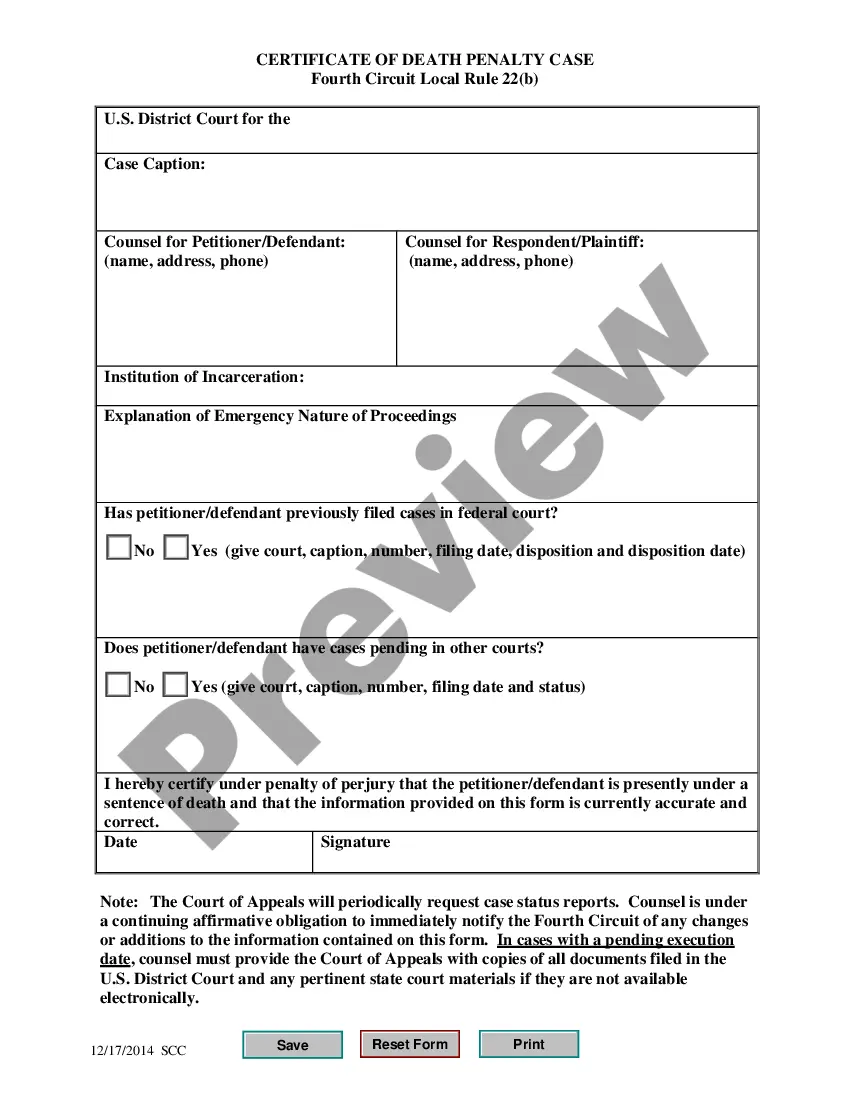

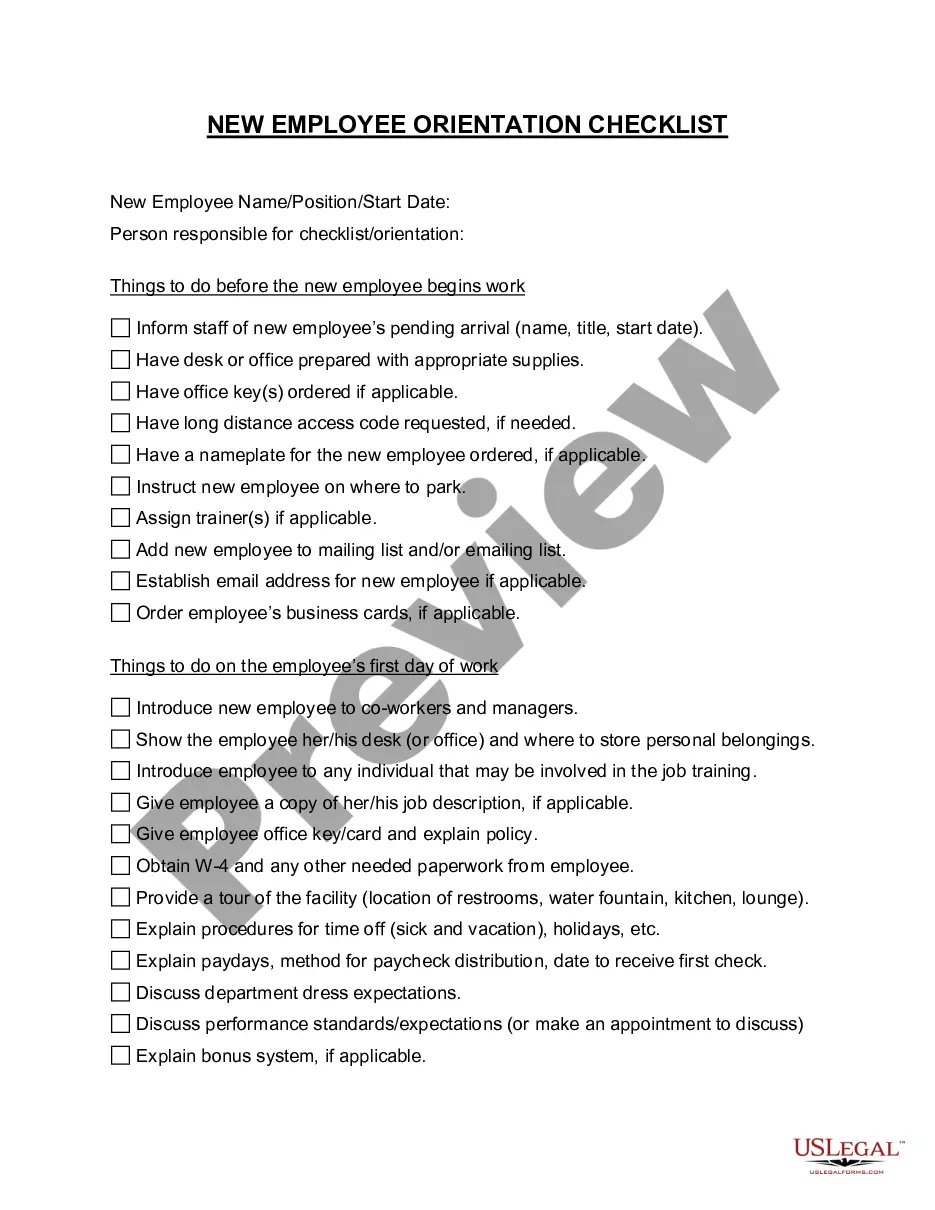

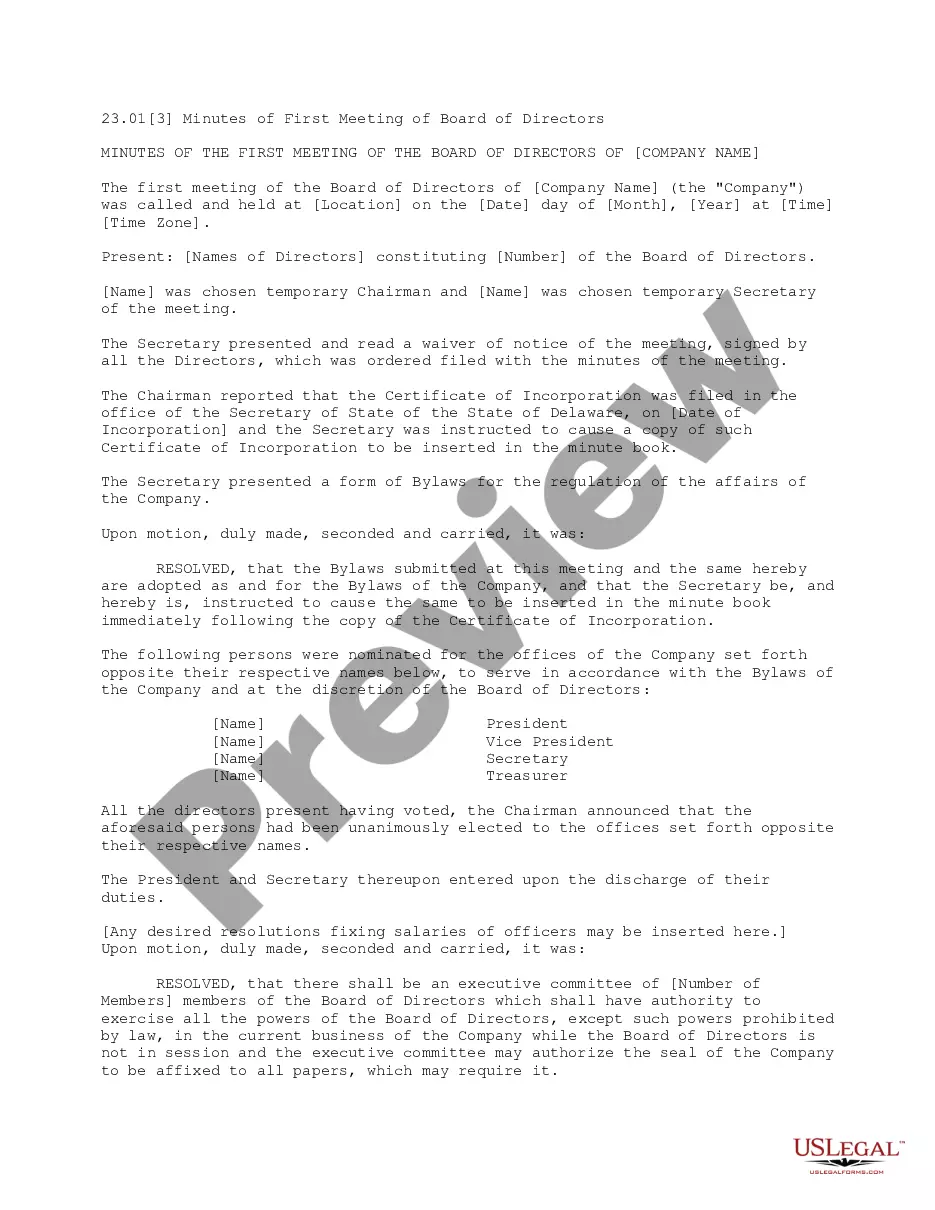

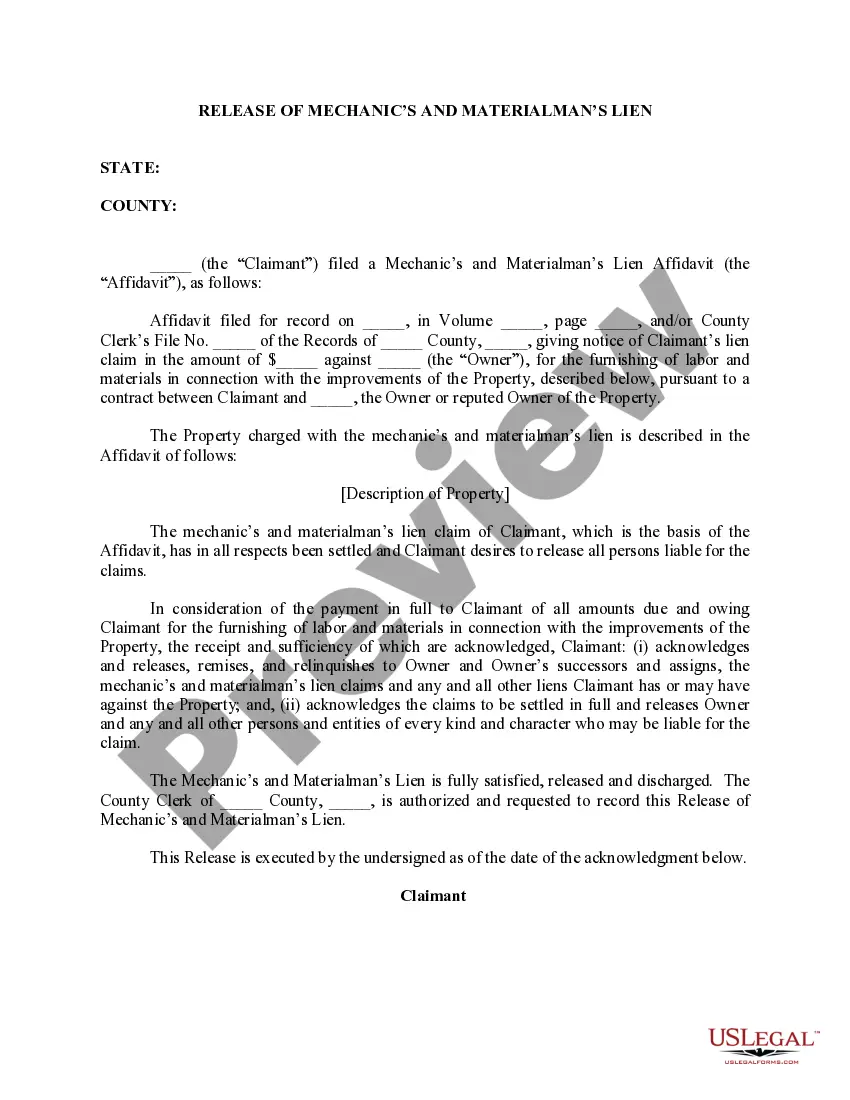

- Utilize the Review button to assess the form.

- Check the description to ensure that you have selected the right form.

- If the form is not what you are seeking, utilize the Search field to find the form that suits your needs.

Form popularity

FAQ

Types of GuaranteesBid/Tender Guarantee. Issued in support of an exporter's bid to supply goods or services and, if successful, ensures compensation in the event that the contract is not signed.Performance Guarantee.Advance Payment Guarantee.Warranty Guarantee.Retention Guarantee.

Properly drafted, this guaranty permits the lender to force one or more of the guarantors to make every payment that would have been due from the borrower. In other words, whatever the borrower's obligations to the lender may be (at least in terms of payment), the guarantor has the same obligations.

In case of non-payment, a guarantor is liable to legal action. If the lender files a recovery case, it will file the case against both the borrower and the guarantor. A court can force a guarantor to liquidate assets to pay off the loan," added Mishra.

A continuing guaranty is an agreement by the guarantor to be liable for the obligations of someone else to the lender, even if there are several different obligations that are made, renewed or repaid over time. In contrast, a specific guaranty is limited only to one individual transaction.

7 Ways to Avoid a Personal GuaranteeBuy insurance.Raise the interest rate.Increase Reporting.Increased the Frequency of Payments.Add a Fidelity Certificate.Limit the Guarantee Time Period.Use Other Collateral.26-Mar-2015

The probable benefits achieved with guarantees can be summarized as follows:secure payment,the seller can obtain advance payment,the buyer/seller can offer credit and/or obtain financing, and.secured compensation for non-fulfilment of any important obligations.

Put another way, a guaranty of collection requires that the debtor must exhaust certain remedies against the debtor before proceeding against the guarantor, while a guaranty of payment means that the lender can proceed directly against the guarantor even if the debtor is solvent and otherwise able to pay.

A limited guaranty is a written undertaking to fulfill a specific obligation. Ordinarily, a limited guaranty is restricted in its application to a single transaction. A limited guarantee is limited to the amount, time, or type of loss.

A guaranty of payment is an independent agreement by a person or an entity to pay the loan when it goes into default. Even if the borrower is unable or unwilling to pay back the loan, the Bank can require the guarantor to pay it back.

Guarantee of collection means a loan guarantee under which the authority agrees to pay according to the terms of the guarantee agreement if the instrument is not paid when due and the participating lender has pursued all reasonable efforts relative to collection.