Kentucky Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate

Description

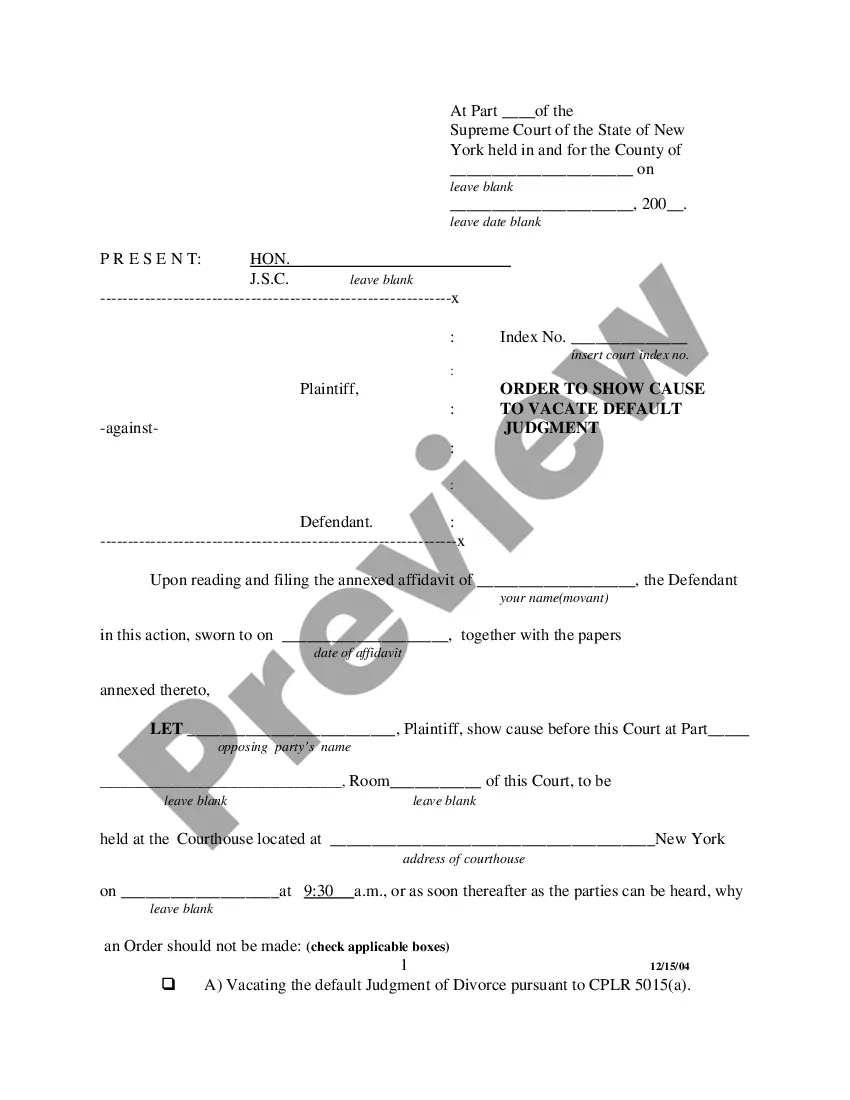

How to fill out Lease Of Retail Store With Additional Rent Based On Percentage Of Gross Receipts - Real Estate?

You might spend time online searching for the legal document template that meets the federal and state requirements you require. US Legal Forms offers thousands of legal forms that can be examined by professionals.

You can download or print the Kentucky Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate from my service.

If you have a US Legal Forms account, you can Log In and then click the Acquire button. Afterwards, you can complete, edit, print, or sign the Kentucky Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate. Every legal document template you obtain is yours indefinitely.

Complete the transaction. You can use your Visa or Mastercard or PayPal account to pay for the legal form. Choose the format of the document and download it to your device. Make changes to your document if necessary. You can complete, edit, sign, and print the Kentucky Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate. Acquire and print thousands of document templates using the US Legal Forms website, which offers the largest selection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- To obtain another copy of a purchased form, visit the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions outlined below.

- First, ensure that you have selected the correct document template for the state/region of your choice. Read the form description to make sure you have chosen the appropriate form.

- If available, use the Preview button to view the document template as well.

- If you wish to obtain another version of the form, use the Search area to find the template that meets your needs and specifications.

- Once you have located the template you require, click Purchase now to proceed.

- Select the payment method you prefer, provide your details, and register for an account on US Legal Forms.

Form popularity

FAQ

To calculate a percentage, divide the part by the whole and then multiply by 100. For instance, if you want to find out what 20% of $1,000 is, you would calculate it as ($1,000 x 0.20). In the context of a Kentucky Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate, this skill is useful for determining amounts owed in percentage rent.

The formula to calculate rental fees typically includes the base rent plus any additional rent based on sales percentages. For a Kentucky Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate, the formula may look like this: Total Rent = Base Rent + (Gross Sales x Agreed Percentage). This structure provides clarity on rental obligations.

To calculate percentage rent, first determine the gross sales of your retail store within the specified period. Then, apply the percentage rate outlined in your lease. This calculation is crucial for a Kentucky Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate, as it directly affects your rental obligations and budget.

Yes, rental income is generally taxable in Kentucky. Landlords must report all rental income, including amounts collected from a percentage rent agreement. If you're navigating a Kentucky Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate, it's vital to understand these tax implications to ensure compliance.

The sales tax on a lease in Kentucky can vary based on the type of item being leased. Typically, the state imposes a 6% sales tax on most leases, including commercial rentals. When engaging in a Kentucky Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate, it’s essential to account for this tax within your budgeting.

Yes, in Kentucky, rental equipment is generally subject to sales tax. This means that when you lease equipment, you should factor in the applicable sales tax on top of the rental fees. Be sure to confirm this with your Kentucky Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate details or consult a tax professional for clarity.

To calculate a lease percentage, take the total sales of the retail store and multiply the gross receipts by the agreed percentage in the lease agreement. This approach is a standard practice in many Kentucky Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate agreements. Ensure you review the lease terms to determine the specific percentage that applies.

A percentage rent deal is a rental agreement where part of the rent is based on the tenant's sales revenue. This arrangement is common in retail spaces, especially in a Kentucky Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate. It allows landlords to share in the success of their tenants, making it a mutually beneficial option.

The percentage rent clause is a provision in a lease that outlines how additional rent is calculated based on a tenant's gross sales. This clause specifies the percentage of sales that will be charged once the sales exceed a particular breakpoint. Having a clear understanding of the percentage rent clause is crucial for tenants in a Kentucky Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate, as it ensures transparency and protects both parties.

The formula for a percentage lease typically combines a base rent with a percentage of gross sales over a defined breakpoint. For example, if your rent is $1,000 with an additional rent of 5% on sales over $200,000, your total rent adjusts according to sales performance. Understanding this formula helps businesses effectively manage their expenses under a Kentucky Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate.