Kentucky Corporate Resolution Authorizing a Charitable Contribution

Description

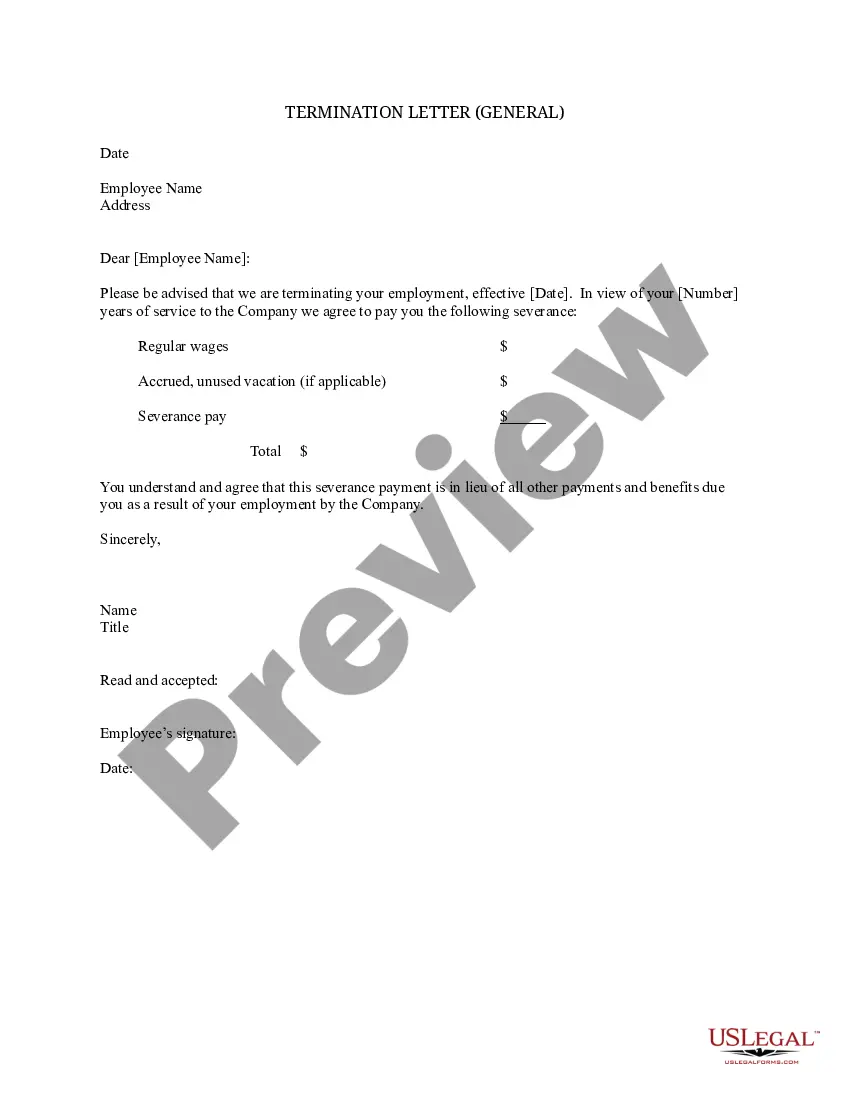

The RMBCA even authorizes a corporation to make charitable contributions. The following form is a sample of a corporate resolution authorizing a charitable contribution.

How to fill out Corporate Resolution Authorizing A Charitable Contribution?

If you require to complete, secure, or generate sanctioned document templates, utilize US Legal Forms, the largest assortment of legal forms, which can be accessed online.

Utilize the site's easy and convenient search function to locate the documents you need.

A range of templates for business and personal purposes are categorized by types and states, or keywords.

Each legal document template you purchase is yours indefinitely. You will have access to every form you saved in your account. Go to the My documents section and select a form to print or download again.

Fill out and download, and print the Kentucky Corporate Resolution Authorizing a Charitable Contribution with US Legal Forms. There are thousands of professional and state-specific forms available for your business or personal needs.

- Utilize US Legal Forms to obtain the Kentucky Corporate Resolution Authorizing a Charitable Contribution in just a few clicks.

- If you are already a US Legal Forms member, Log In to your account and click on the Download button to find the Kentucky Corporate Resolution Authorizing a Charitable Contribution.

- You can also access forms you previously saved within the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Take advantage of the Review option to browse the form's details. Remember to read the description.

- Step 3. If you are dissatisfied with the form, use the Search field at the top of the screen to find other variations of the legal form template.

- Step 4. Once you have found the form you need, click the Buy now button. Choose the pricing plan you prefer and provide your information to create an account.

- Step 5. Process the payment. You can use your credit card or PayPal account to complete the transaction.

- Step 6. Retrieve the format of the legal form and download it to your device.

- Step 7. Complete, modify and print or sign the Kentucky Corporate Resolution Authorizing a Charitable Contribution.

Form popularity

FAQ

In 2024, Kentucky residents may benefit from a pension exclusion where a portion of retirement income is exempt from state income tax. This is particularly beneficial for retirees looking to ensure their contributions remain intact, possibly requiring a Kentucky Corporate Resolution Authorizing a Charitable Contribution if they wish to donate part of their retirement funds. Understanding the details of this exclusion is crucial for financial planning. Consulting with a tax professional can provide tailored advice.

KY Form 725 is a tax form used for reporting income and expenses of pass-through entities, such as partnerships and limited liability companies. If your entity is making charitable contributions, you might need a Kentucky Corporate Resolution Authorizing a Charitable Contribution to ensure compliance. Completing this form correctly is essential, as it impacts how the entities distribute income to partners. Consulting with a tax advisor can help clarify your obligations under this form.

In Kentucky, certain individuals may be exempt from income tax. This typically includes organizations classified as charities or non-profits, which may also require a Kentucky Corporate Resolution Authorizing a Charitable Contribution for donations. Additionally, certain retirees, disabled veterans, and low-income earners might qualify for exemptions. It’s vital to check additional requirements with a tax professional to understand specific eligibility.

Yes, charitable donations made in Kentucky are generally tax-deductible, which can significantly reduce your taxable income. To qualify for deductions, donations must be made to IRS-approved organizations. As you prepare a Kentucky Corporate Resolution Authorizing a Charitable Contribution, you should gather the necessary documentation to ensure you receive the full tax benefits associated with your generous act.

For most taxpayers, the Kentucky standard deduction for single filers is $2,480, while married filers can claim $4,960. This deduction can significantly lower your taxable income. If you’re preparing a Kentucky Corporate Resolution Authorizing a Charitable Contribution, applying the standard deduction can provide further tax relief and simplify your filing process.

Kentucky offers a flat income tax rate for individual filers, which is currently set at 5%. However, tax deductions can vary based on different income levels and specific situations. When you draft a Kentucky Corporate Resolution Authorizing a Charitable Contribution, it is crucial to consider how your charitable donations may influence overall taxable income and deductions.

Yes, Kentucky conforming to section 174 means that the state generally follows the federal guidelines regarding research and experimental expenditures. This conformity impacts how business expenses related to innovation are treated for taxation purposes. Therefore, if you are preparing a Kentucky Corporate Resolution Authorizing a Charitable Contribution, understanding section 174 ensures you handle your deductions correctly.

To acquire a Kentucky tax ID number, you typically need to fill out an application through the Kentucky Department of Revenue. This number is vital for all business operations, especially when planning a Corporate Resolution Authorizing a Charitable Contribution. You can find all the relevant forms and resources on the uslegalforms website, which can guide you through the application requirements seamlessly.

Getting a Kentucky llet number requires filing through the Kentucky Secretary of State. When you move forward with your Corporate Resolution Authorizing a Charitable Contribution, having a llet number will help you manage any financial aspects correctly. It is advisable to consult with professionals or use platforms like uslegalforms to access necessary documents and expert advice.

Acquiring a Kentucky withholding number involves registering your business with the Kentucky Department of Revenue. This registration is essential for businesses planning to make charitable contributions. If you're drafting a Corporate Resolution Authorizing a Charitable Contribution, having this number ensures that all tax obligations are met. Utilizing uslegalforms can simplify the registration process with up-to-date forms and guidance.