Kentucky General Guaranty and Indemnification Agreement

Description

How to fill out General Guaranty And Indemnification Agreement?

If you seek extensive, download, or printing legal document templates, utilize US Legal Forms, the largest compilation of legal forms available online.

Employ the site's straightforward and convenient search to acquire the documents you require.

A selection of templates for business and personal purposes are organized by categories and states, or keywords.

Every legal document template you purchase is yours indefinitely.

You have access to every type you acquired within your account. Visit the My documents section and choose a form to print or download again. Compete and download, and print the Kentucky General Guaranty and Indemnification Agreement with US Legal Forms. There are millions of professional and state-specific forms you can utilize for your business or personal needs.

- Utilize US Legal Forms to obtain the Kentucky General Guaranty and Indemnification Agreement with just a few clicks.

- Should you already be a US Legal Forms user, Log In to your account and click the Obtain button to retrieve the Kentucky General Guaranty and Indemnification Agreement.

- You can also access forms you previously acquired from the My documents section of your account.

- If you are utilizing US Legal Forms for the first time, follow the instructions listed below.

- Step 1. Ensure you have selected the form for the correct area/state.

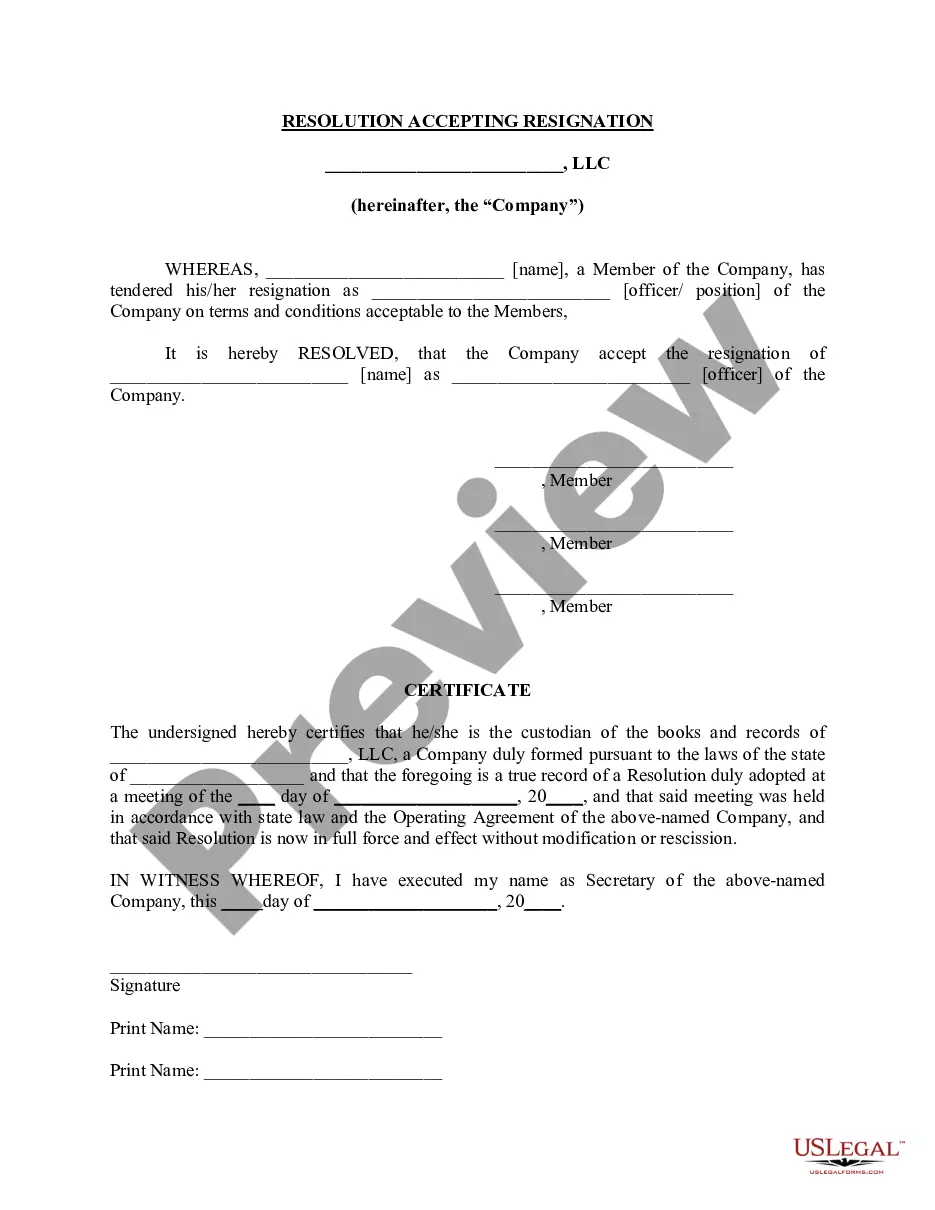

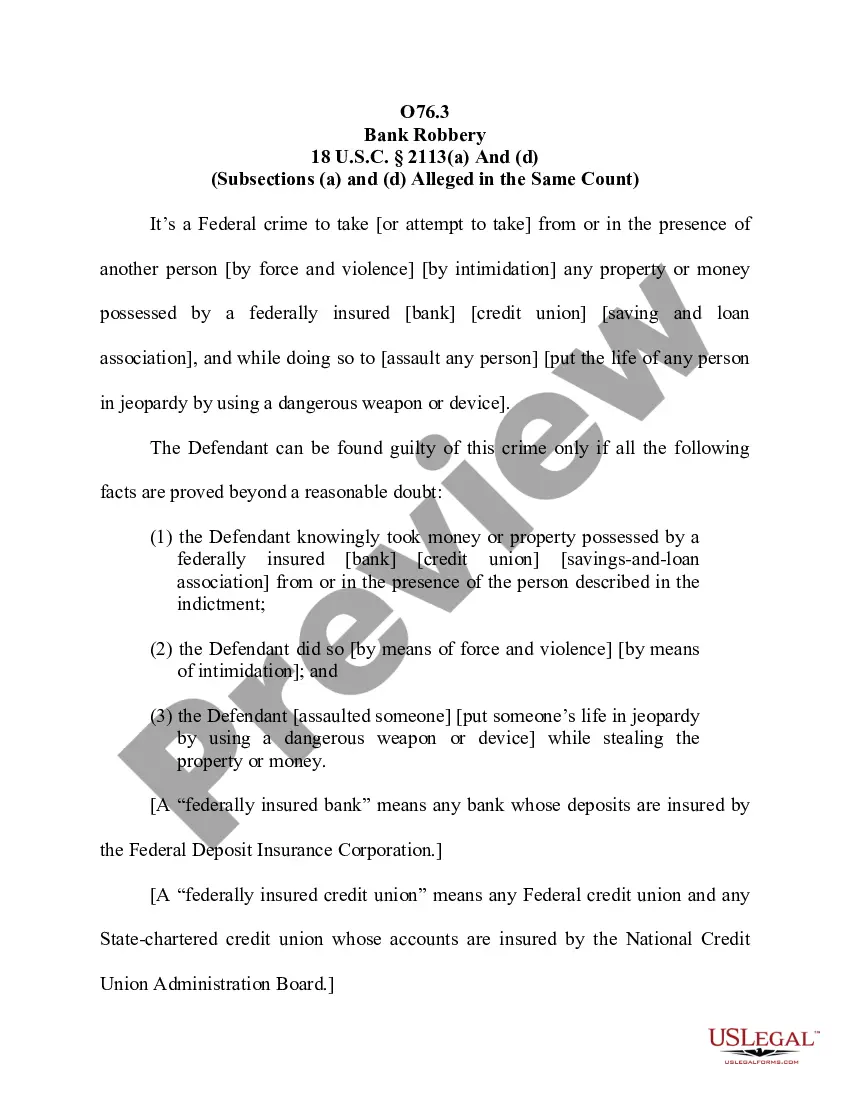

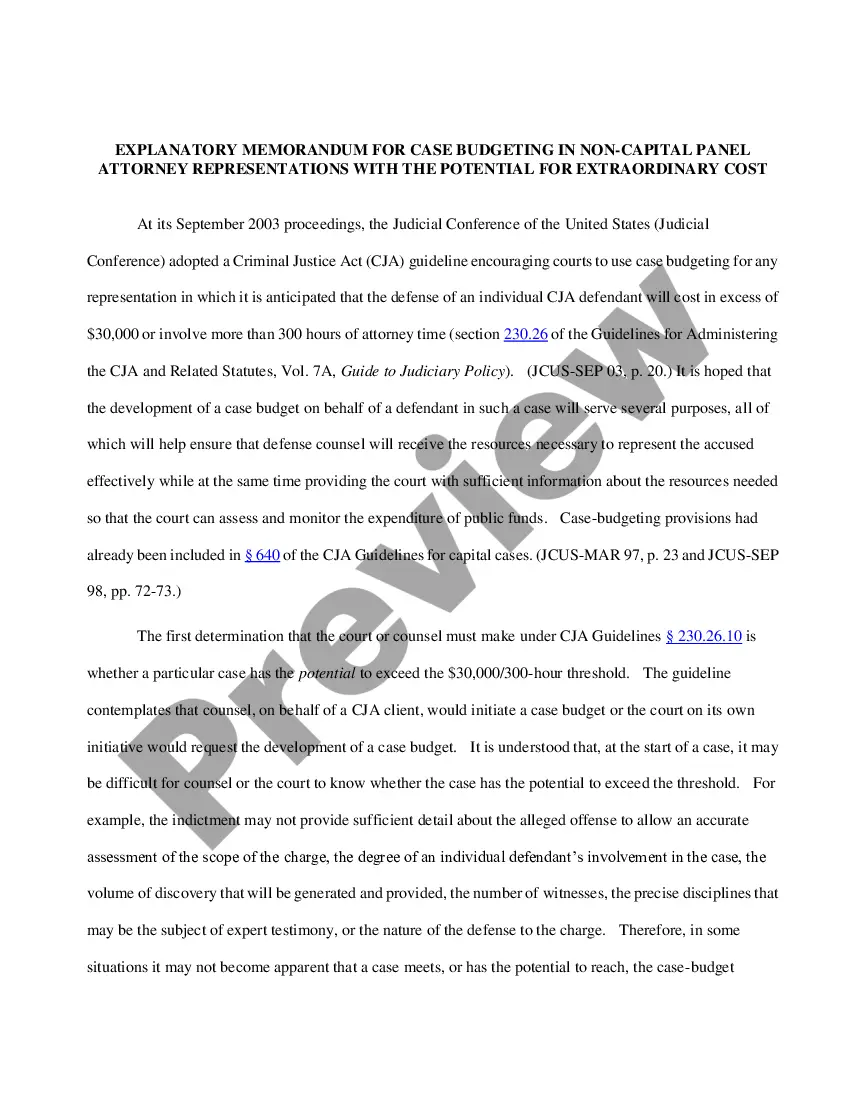

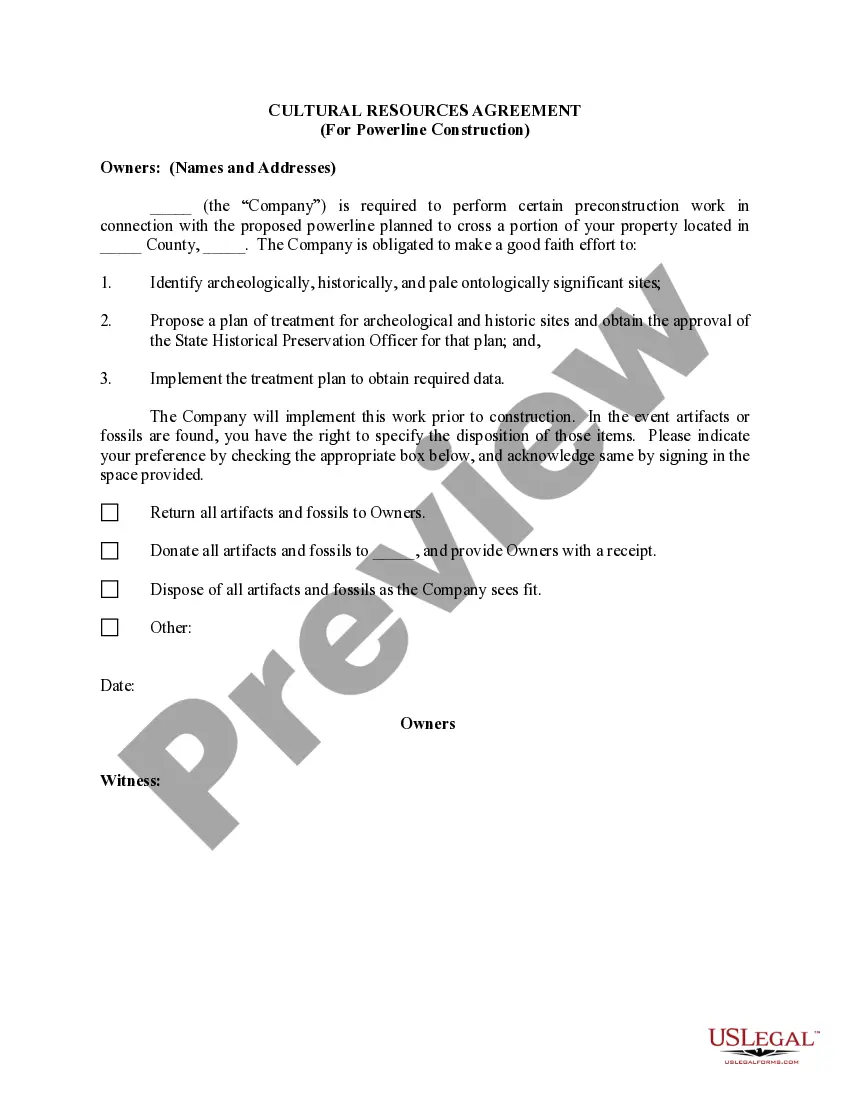

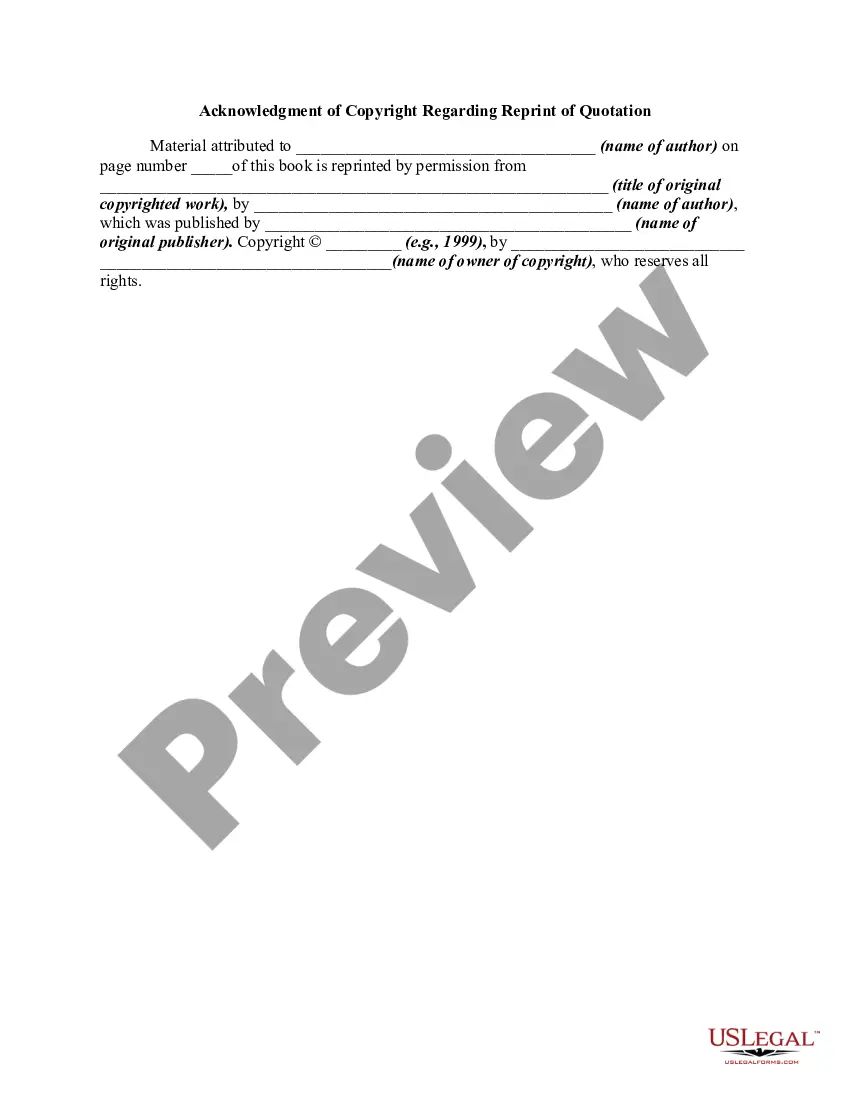

- Step 2. Use the Review option to examine the content of the form. Remember to read the description.

- Step 3. If you are dissatisfied with the form, use the Lookup section at the top of the screen to find other types of your legal form template.

- Step 4. Once you have located the form you need, click on the Acquire now option. Choose your preferred pricing plan and provide your details to register for the account.

- Step 5. Complete the transaction. You may use your credit card or PayPal account to finalize the payment.

- Step 6. Select the format of your legal form and download it to your device.

- Step 7. Complete, modify, print, or sign the Kentucky General Guaranty and Indemnification Agreement.

Form popularity

FAQ

An indemnity agreement is a contract that protect one party of a transaction from the risks or liabilities created by the other party of the transaction. Hold harmless agreement, no-fault agreement, release of liability, or waiver of liability are other terms for an indemnity agreement.200c

Guaranty Agreement a two-party contract in which the first party agrees to perform in the event that a second party fails to perform. Unlike a surety, a guarantor is only required to perform after the obligee has made every reasonable and legal effort to force the principal's performance.

An indemnity is a contract by one party to keep the other harmless against loss, but a contract of guarantee is a contract to answer for the debt, default or miscarriage of another who is to be primarily liable to the promisee .

The person who gives the guarantee is called the "surety": the person in respect of whose default the guarantee is given is called the "principal debtor", and the person to whom the guarantee is given is called the "creditor".

IN WRITINGWhile the law provides that a guaranty must be written, inventive creditors have sought to impose liability on the verbal "guarantors" by claiming constructive fraud, negligent misrepresentation and piercing the corporate veil theories.

Differences between guarantees and indemnitiesa guarantee is a secondary liability, which means that there will be another person who is primarily liable for the obligation; whereas, an indemnity imposes a primary liability.

A contract by which one party promises to save the other from loss caused to him by the conduct of the promisor himself, or by the conduct of any other person, is called a contract of indemnity. Illustration.

All the three parties to the contract i.e the principal debtor, the creditor, and the surety must agree to make such a contract with the agreement of each other.

Indemnity is when one party promises to compensate the loss occurred to the other party, due to the act of the promisor or any other party. On the other hand, the guarantee is when a person assures the other party that he/she will perform the promise or fulfill the obligation of the third party, in case he/she default.

To have a guarantee and indemnity, you need three parties: Party One, Party Two, and a third party which can be a Guarantor and/or Indemnifier.