Kentucky Guaranty of Open Account - Alternate Form

Description

How to fill out Guaranty Of Open Account - Alternate Form?

Are you in a situation where you require documents for both business or particular reasons on a daily basis.

There are numerous legal document templates available online, but finding ones you can rely on isn't straightforward.

US Legal Forms offers a vast array of form templates, including the Kentucky Guaranty of Open Account - Alternate Form, which is designed to meet state and federal requirements.

If you find the right form, click Download now.

Choose the pricing plan you prefer, fill in the necessary information to create your account, and complete the purchase using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have a free account, simply Log In.

- Then, you can download the Kentucky Guaranty of Open Account - Alternate Form template.

- If you don’t have an account and wish to start using US Legal Forms, follow these steps.

- Select the form you need and ensure it is for the correct city/region.

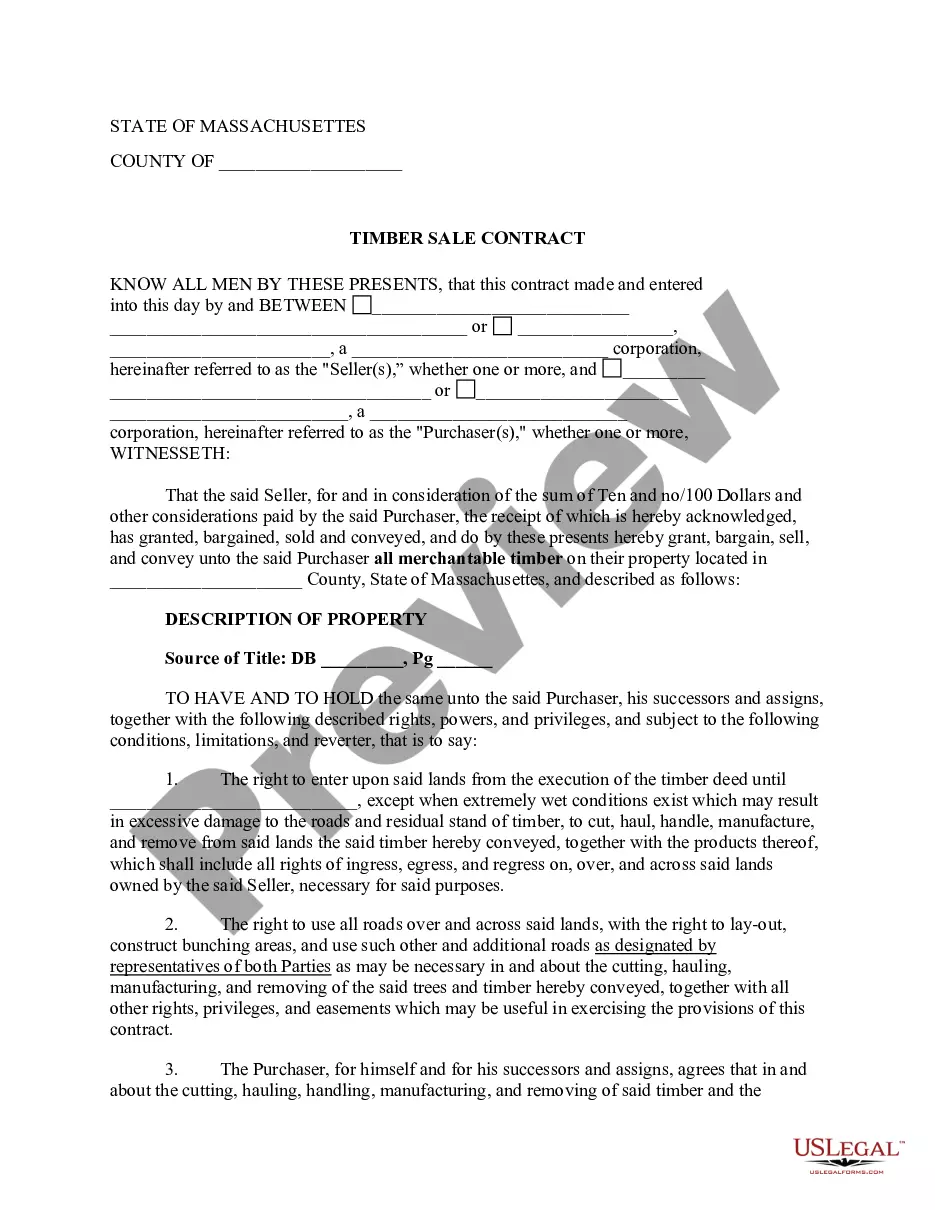

- Use the Preview button to review the form.

- Check the description to confirm that you have selected the correct form.

- If the form isn't what you're looking for, use the Search field to find the form that meets your needs.

Form popularity

FAQ

A form of guarantee serves as a written promise that one party will cover the debt or obligations of another. It is essential in establishing trust and security in various financial agreements. The Kentucky Guaranty of Open Account - Alternate Form is an example of such documentation, ensuring that all parties are aware of their responsibilities. By using platforms like US Legal Forms, you can easily access and create these important legal documents to protect your interests.

A short form guaranty is a simplified version of a guarantee document, designed for straightforward transactions. This version often outlines essential terms without extensive legal jargon, making it easier for parties to understand their commitments. Utilizing a Kentucky Guaranty of Open Account - Alternate Form ensures you maintain clarity and efficiency in your agreements. This streamlined approach can enhance your business dealings and improve relationship management.

In the realm of financial agreements, the three types of guarantees include personal guarantees, corporate guarantees, and bank guarantees. Each of these plays a crucial role in securing a Kentucky Guaranty of Open Account - Alternate Form. Personal guarantees involve an individual's promise to repay a debt, while corporate guarantees involve a company backing the obligation. Bank guarantees provide reassurance from a financial institution regarding the fulfillment of the obligations by the borrower.

A form of guaranty is a legal commitment where one party agrees to be responsible for the debt or obligations of another. The Kentucky Guaranty of Open Account - Alternate Form is a specific type of guaranty that businesses often use to secure credit arrangements. It provides reassurance to sellers by ensuring they will receive payment, even if a buyer defaults. This type of form is critical for fostering trust in commercial transactions.

Kentucky Form 725 is related to the state's tax structure and serves multiple purposes, including its relevance to the Kentucky Guaranty of Open Account - Alternate Form. This form provides essential information about the financial standing of a business and its obligations. Properly filling out KY Form 725 can enhance your financial credibility. Businesses should ensure accurate completion to facilitate better credit terms.

To get a Kentucky Corporation llet account number, you need to register your corporation with the Kentucky Secretary of State. Once your registration is approved, you will be issued a llet number. It is essential for tax filings and complying with state regulations. The Kentucky Guaranty of Open Account - Alternate Form can provide valuable resources for corporations as they navigate this process.

The Kentucky llet account number typically consists of 10 digits. This unique number is vital for businesses as it is used in various tax-related documents and communications with the state. Having the correct number ensures that all tax filings are processed accurately. Remember, using the Kentucky Guaranty of Open Account - Alternate Form can also facilitate easier management of your business account numbers.

A llet, or an account number, in Kentucky is a unique identifier assigned to businesses for tax purposes. This number helps the state track business activities, such as revenue and taxes owed. Obtaining a llet number is crucial for any business operating in Kentucky to comply with state regulations. Consider the Kentucky Guaranty of Open Account - Alternate Form to simplify aspects of your business operations and tax filings.

KY Form 725 must be filed by businesses that operate in Kentucky and have earned income during the tax year. This includes corporations, partnerships, and certain individuals who meet specific requirements. Filing this form accurately is important to avoid penalties and ensure you’re fulfilling your tax obligations. The Kentucky Guaranty of Open Account - Alternate Form could be beneficial for your record-keeping when preparing this form.

You can get a Kentucky withholding account number by applying through the Kentucky Department of Revenue's online portal. It involves filling out the required forms and providing your business information. This account number is necessary for employers to manage state income tax withholdings. The Kentucky Guaranty of Open Account - Alternate Form can assist in ensuring you remain compliant while handling your tax responsibilities.