Kentucky Consulting Agreement - with Former Shareholder

Description

How to fill out Consulting Agreement - With Former Shareholder?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a vast selection of legal form templates that you can download or print.

Through the website, you can access thousands of forms for business and personal purposes, categorized by type, state, or keywords.

You can find the latest editions of forms like the Kentucky Consulting Agreement - with Former Shareholder in just a few minutes.

Check the form description to confirm that you have selected the correct form.

If the form does not meet your needs, use the Search feature at the top of the screen to find one that does.

- If you have a monthly subscription, Log In and download the Kentucky Consulting Agreement - with Former Shareholder from the US Legal Forms library.

- The Download button will appear on each form you view.

- You can access all previously downloaded forms from the My documents section of your account.

- For first-time users of US Legal Forms, here are simple steps to get started.

- Make sure you have chosen the correct form for your area/county.

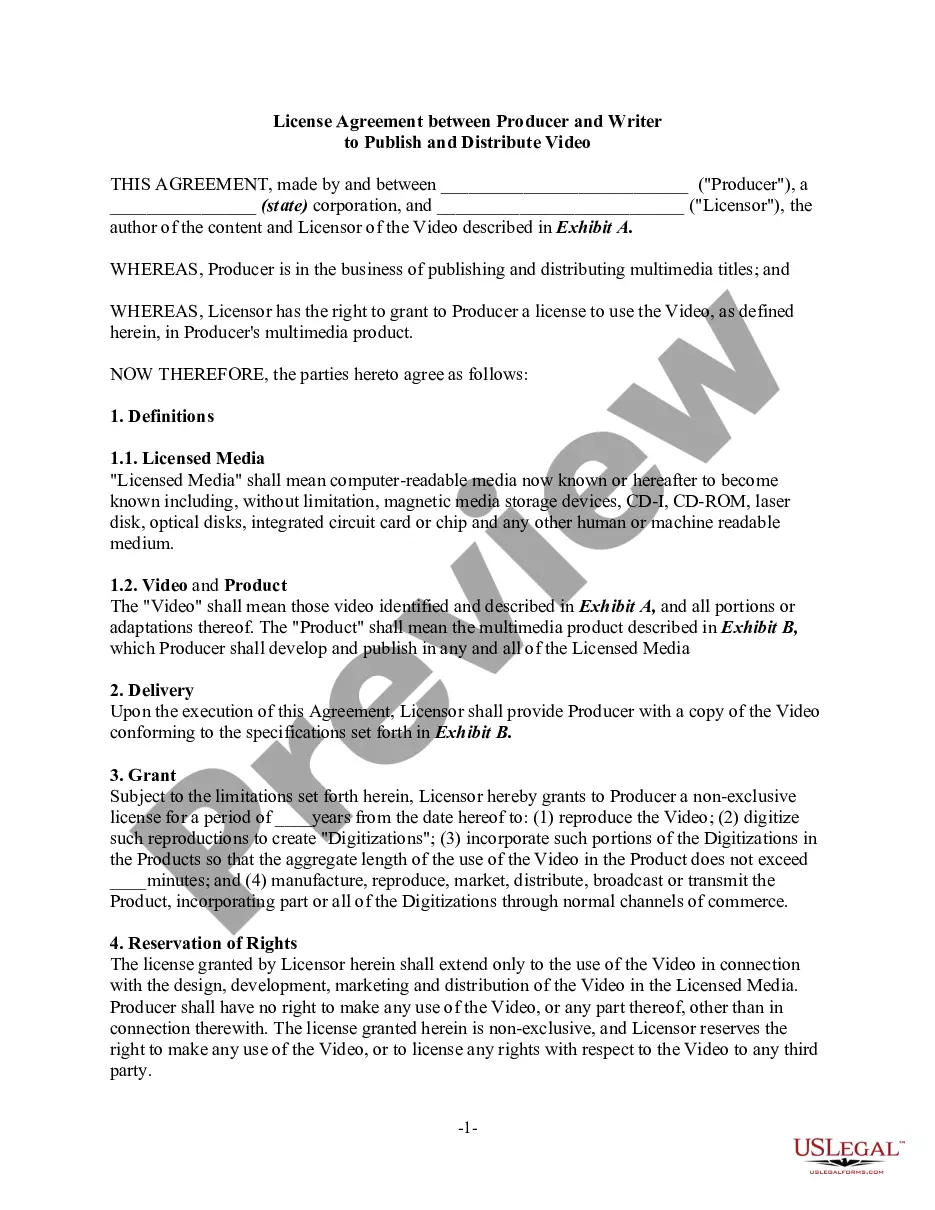

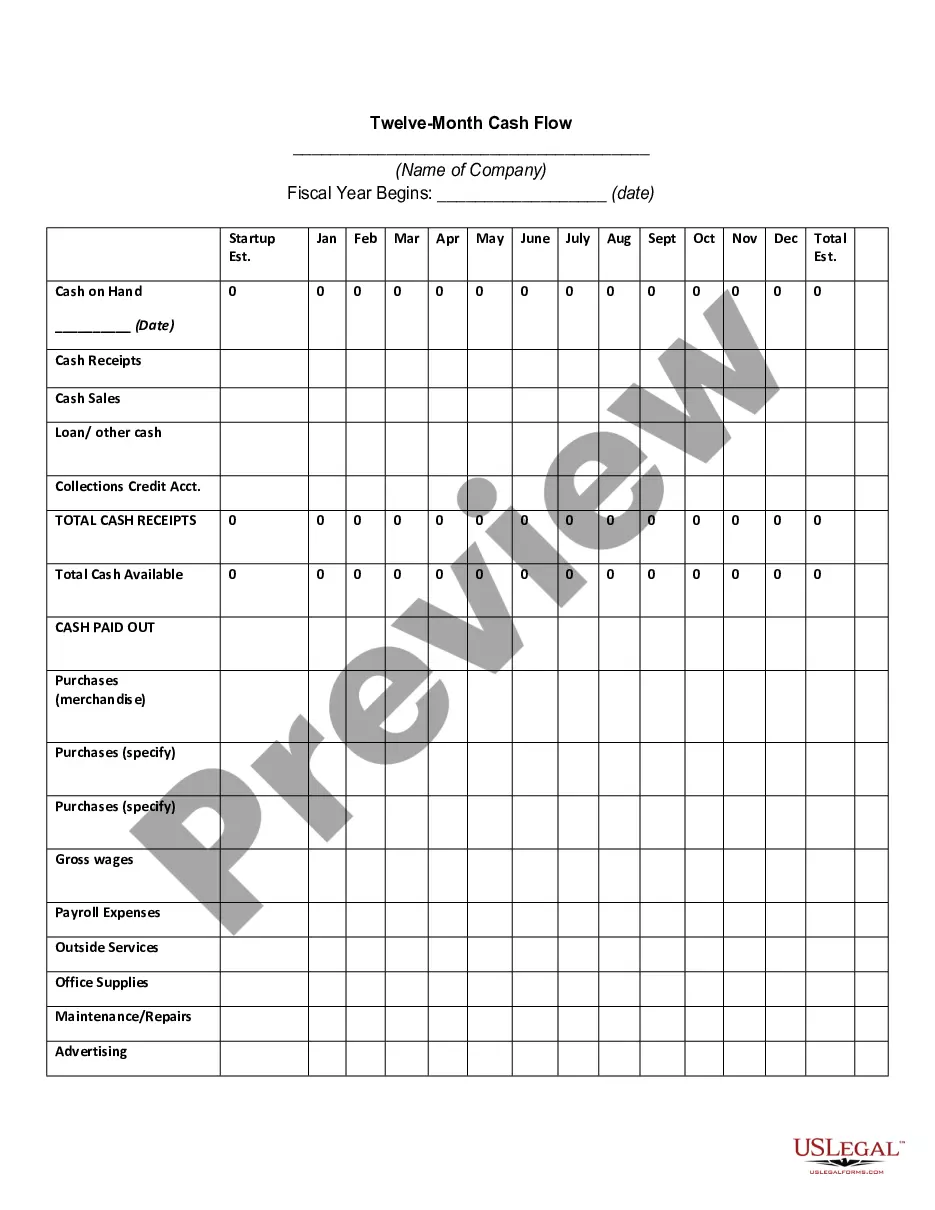

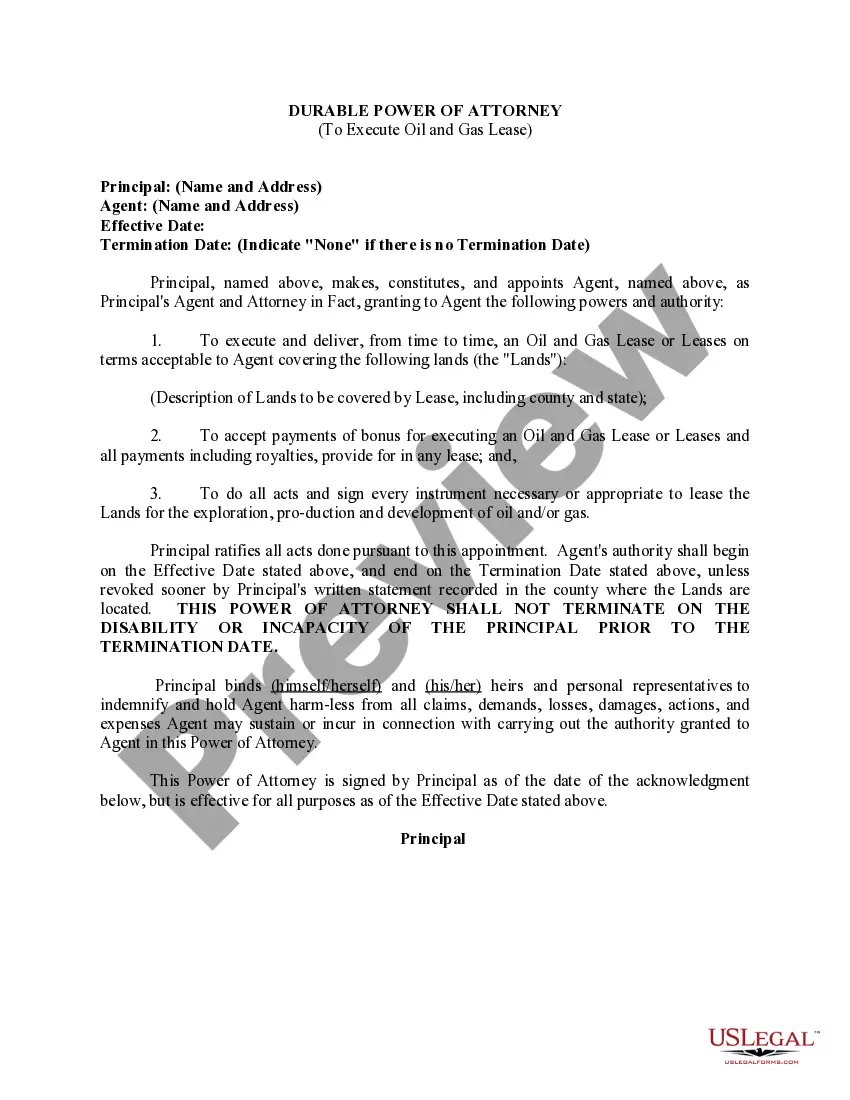

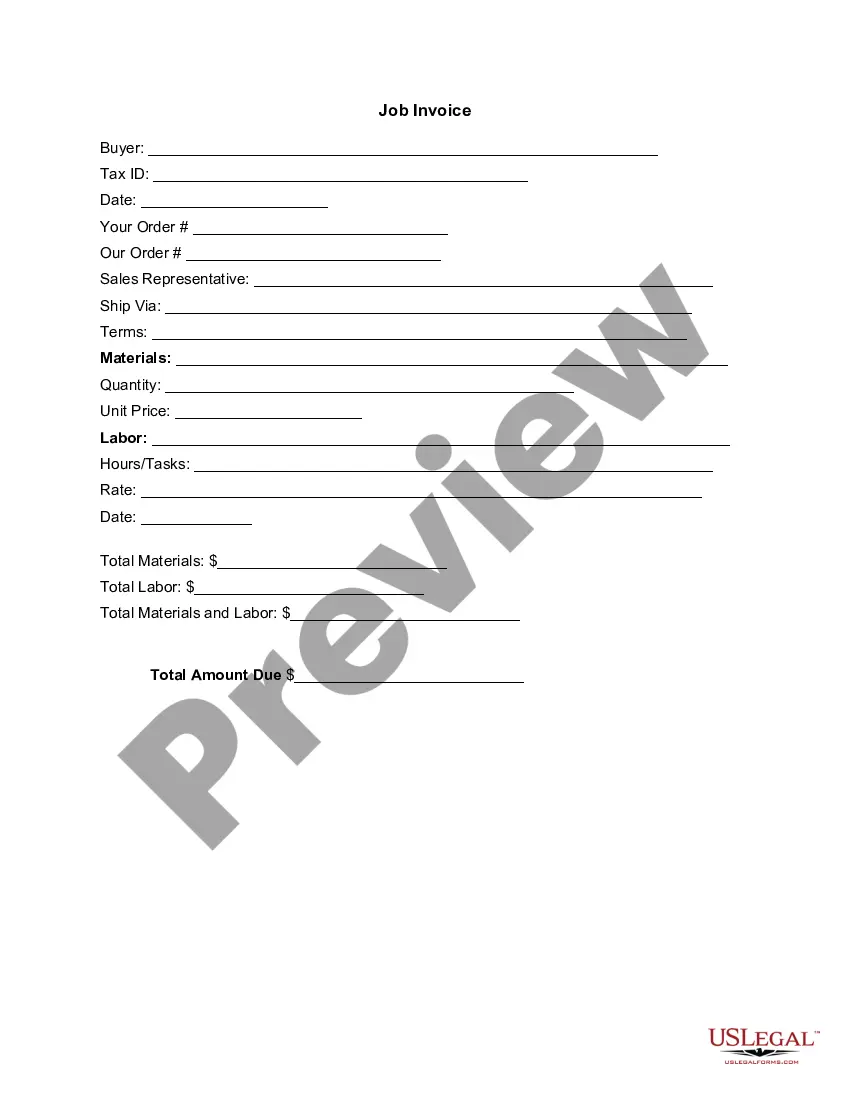

- Click the Preview button to review the content of the form.

Form popularity

FAQ

An unsigned shareholders agreement is typically not legally binding, as consent from all parties is necessary for enforceability. However, certain provisions may be considered valid if the parties have acted in accordance with the agreement. When dealing with a Kentucky Consulting Agreement - with Former Shareholder, it is essential to ensure all agreements are signed to avoid legal issues.

In Kentucky, an LLC is generally treated as a pass-through entity for tax purposes, meaning profits are taxed at the member level rather than the entity level. This can appeal to business owners engaged in consulting agreements, including a Kentucky Consulting Agreement - with Former Shareholder, as it potentially lowers the overall tax burden. However, it is advisable to consult with a tax professional for specific circumstances.

Terminating a shareholders agreement often requires a formal process outlined in the agreement itself. Typically, you will notify all shareholders, and they may need to consent formally. This step can be vital in situations involving a Kentucky Consulting Agreement - with Former Shareholder, as it helps clarify the terms and responsibilities of all parties.

For online submissions, you do not mail your Kentucky state tax return. Instead, you file directly through the Kentucky Department of Revenue’s online portal. This process is efficient, especially if you are dealing with matters such as a Kentucky Consulting Agreement - with Former Shareholder, ensuring everything is managed electronically.

To change a shareholders agreement, you typically need to draft an amendment that outlines the new terms. Ensure all shareholders agree to these changes, and get the amendment signed by everyone involved. This process is crucial when addressing issues linked to a Kentucky Consulting Agreement - with Former Shareholder, as clear agreements help avoid future conflicts.

Yes, you can file Kentucky Form 725 electronically through the Kentucky Department of Revenue's website. E-filing provides a faster and more efficient way to submit your form, especially if you are managing a Kentucky Consulting Agreement - with Former Shareholder. This method ensures that your submission is processed quickly and securely.

To mail your Kentucky Form 725, direct it to the Kentucky Department of Revenue. The specific address will depend on whether you are a corporation or if you are mailing other forms related to a Kentucky Consulting Agreement - with Former Shareholder. Make sure to check the latest instructions provided by the Department of Revenue for any updates.

If there is no shareholders' agreement, disputes may arise regarding decision-making and ownership rights, leading to potential conflicts among stakeholders. In such cases, state laws will dictate how these issues get resolved, which may not align with the best interests of your business. Engaging in a Kentucky Consulting Agreement - with Former Shareholder may offer a structured approach to mitigate risks and clarify roles.

To set up a consulting agreement, start by defining the scope of services you need from the consultant and the terms of payment. Then, detail the responsibilities and rights of both parties in the written agreement. When dealing with former shareholders, a Kentucky Consulting Agreement - with Former Shareholder can ensure that the consulting arrangement is clearly outlined, protecting both your interests and those of the consultant.

Creating a shareholder agreement involves discussing key components such as ownership percentages, management structure, and roles of shareholders. Once you identify these elements, you can draft the agreement, ensuring it reflects the needs of all parties. For scenarios involving former shareholders, a Kentucky Consulting Agreement - with Former Shareholder can be a smart choice to navigate any potential conflicts.