Kentucky Employment Application for Accountant

Description

How to fill out Employment Application For Accountant?

Should you require to accumulate, obtain, or print authentic document templates, utilize US Legal Forms, the most extensive collection of legitimate templates available online.

Take advantage of the site's straightforward and user-friendly search functionality to locate the documents you need. Various templates for business and personal purposes are categorized by type and region, or keywords.

Utilize US Legal Forms to retrieve the Kentucky Employment Application for Accountant with just a few clicks.

Every legitimate document template you acquire is yours indefinitely. You have access to every form you acquired in your account. Click the My documents section and choose a form to print or download again.

Complete and download, and print the Kentucky Employment Application for Accountant with US Legal Forms. There are millions of professional and state-specific templates available for your business or personal needs.

- If you are an existing US Legal Forms user, Log In to your account and click the Get button to access the Kentucky Employment Application for Accountant.

- You can also view documents you previously obtained in the My documents section of your account.

- If you are accessing US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct state/region.

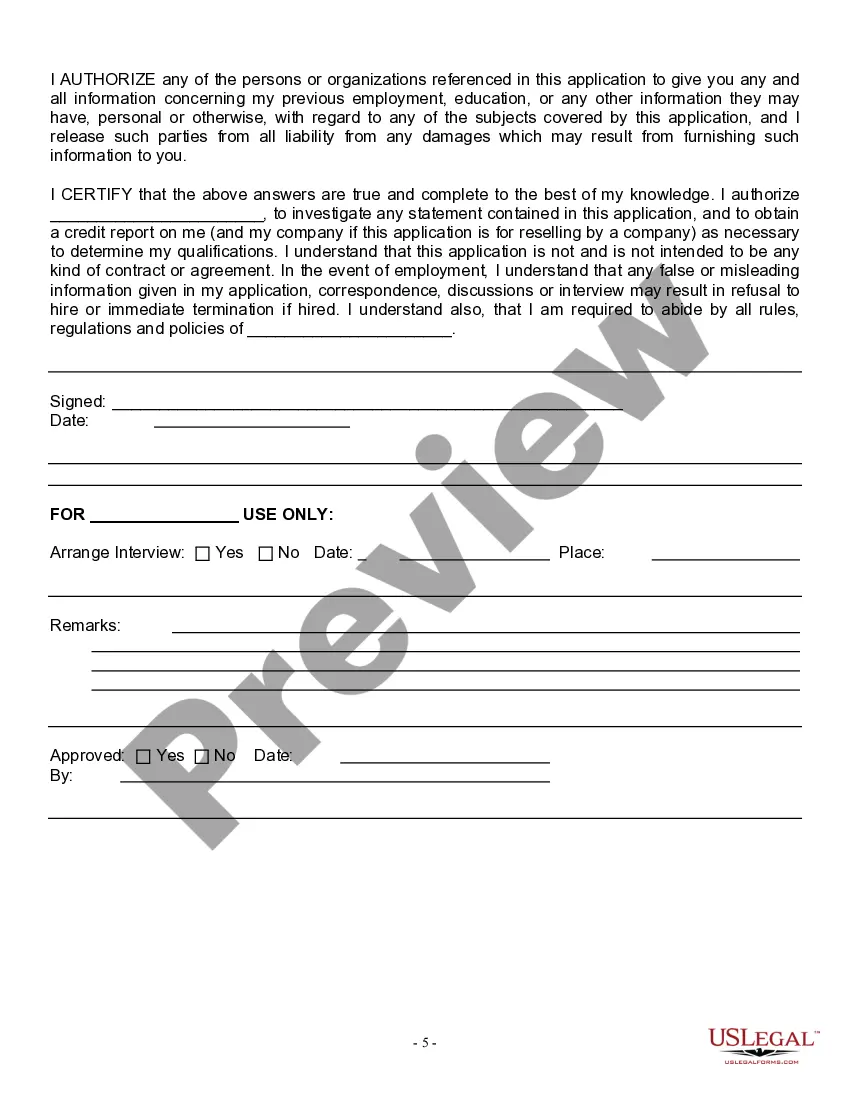

- Step 2. Use the Review button to examine the form's details. Be sure to read the description carefully.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative versions of the legitimate form template.

- Step 4. Once you have found the form you need, click the Get now button. Choose your preferred pricing plan and enter your details to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Fill out, modify, and print or sign the Kentucky Employment Application for Accountant.

Form popularity

FAQ

4. Get Your Kentucky CPA LicenseComplete 150 semester hours of college credit, including an accounting concentration, and earn at least a bachelor's degree.Pass the Uniform CPA Exam.Fulfill one year of experience.Have your verifying CPA complete and sign the Certificate of Experience.

A CPA, or Certified Public Accountant, is a trusted financial advisor who helps individuals, businesses, and other organizations plan and reach their financial goals.

Because a CPA's toolbox includes everything from tax preparation, to financial statements, to financial planning, to forensic accounting, to internal auditing, to income tax, the CPA's primary function is to help businesses thrive. And while a CPA is an accountant, not all accountants are CPAs.

Aspiring accountants need a bachelor's degree in accounting or business to begin work in the field. A bachelor's degree usually takes about four years and 120 credits to complete. Those with an associate degree might enter the field as bookkeepers or accounting clerks.

CPA = certified practising accountant.

Kentucky CPA license requirements Kentucky requires all candidates to complete 2,000 hours of accounting or attestation experience while employed in an accounting or auditing position in public practice, industry or government that should be verified by a certified public accountant.

Send the form to the state Board(s) of Accountancy where you are currently licensed and were an exam candidate. If it is the same state, only one form is necessary. Certificate of Experience showing a minimum of 1 year and 2,000 hours in an accounting or attest position.

Kentucky CPA Exam Fees The cost to take all four sections of the CPA exam in Kentucky is $788.50 plus the initial $30 application fee and $30 per each section you sign up for. The $30 per section fee is also added to the cost listed below for each additional section you need to retake.

Almost all states require CPA candidates to complete 150 semester hours of college coursework to be licensed, which is 30 hours more than the usual four-year bachelor's degree. Add this together, and you can expect to spend at least five years in your journey to become an accountant.

The main difference between Accountants and CPAs is that Accountants record and report the financial affairs of companies in such a way that shows the financial situation of each company, while CPAs are designated by the American Institute of Certified Public Accountants after passing the CPA examination.