Kentucky Corporate Resolution for LLC

Description

How to fill out Corporate Resolution For LLC?

You have the capability to spend time on the internet seeking the legal document format that meets the requirements of both state and federal regulations.

US Legal Forms offers a vast array of legal forms that can be reviewed by specialists.

You can conveniently acquire or print the Kentucky Corporate Resolution for LLC from the platform.

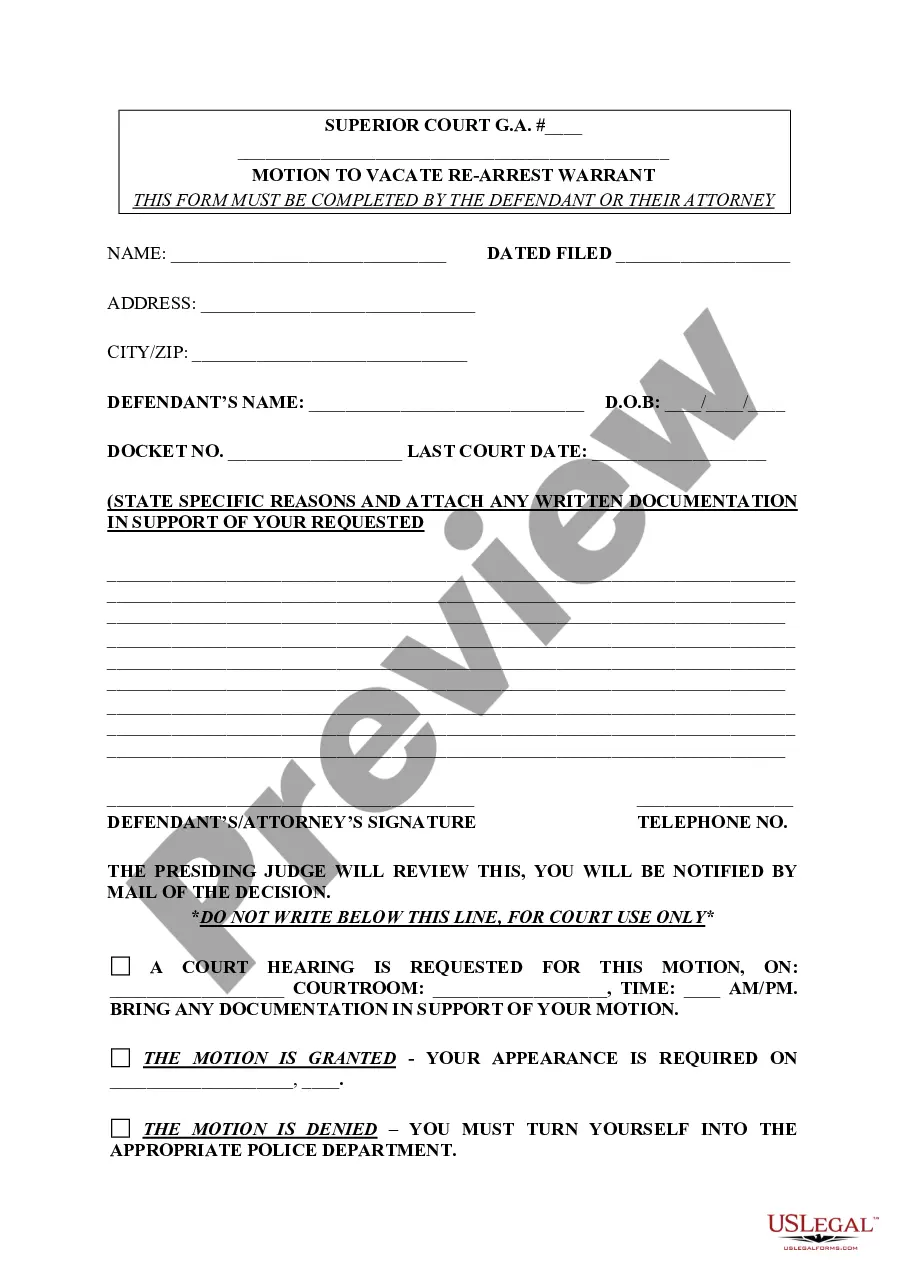

If available, use the Review button to look through the document format as well.

- If you already have a US Legal Forms account, you can Log In and select the Download button.

- After that, you can complete, modify, print, or sign the Kentucky Corporate Resolution for LLC.

- Each legal document format you obtain is yours indefinitely.

- To get another copy of any downloaded form, navigate to the My documents tab and click the appropriate button.

- If you are visiting the US Legal Forms website for the first time, follow the straightforward instructions below.

- First, confirm that you have chosen the correct document format for the county/city of your preference.

- Review the form description to ensure you have selected the right form.

Form popularity

FAQ

Any LLC member can propose a resolution, but all members must vote on it. Typically a majority of the members is needed to pass the resolution, but each LLC may have different voting rights. Some LLCs give a different value to each member's vote based on their percentage of interest in the company.

In Kentucky, business entities are required by law to formally dissolve. In order to properly close, a domestic entity must file articles of dissolution, and a foreign entity must file a certificate of withdrawal. These forms are available for download on this website.

Most LLC operating agreements are short and sweet, and they typically address the following five points:Percent of Ownership/How You'll Distribute Profits.Your LLC's Management Structure/Members' Roles And Responsibilities.How You'll Make Decisions.What Happens If A Member Wants Out.More items...?01-Jun-2019

To dissolve an LLC in Kentucky, simply follow these three steps: Follow the Operating Agreement. Close Your Business Tax Accounts....Step 1: Follow Your Kentucky LLC Operating Agreement.Step 2: Close Your Business Tax Accounts.Step 3: File Articles of Dissolution.

The form and contents of operating agreements vary widely, but most will contain six key sections: Organization, Management and Voting, Capital Contributions, Distributions, Membership Changes, and Dissolution.

Get together with your co-owners and a lawyer, if you think you should (it's never a bad idea), and figure out what you want to cover in your agreement. Then, to create an LLC operating agreement yourself, all you need to do is answer a few simple questions and make sure everyone signs it to make it legal.

Creating an LLC Corporate ResolutionOnce committed to writing, all managing members or the chairperson of the board should sign the resolutions. In a corporate structure, the board's secretary typically prepares the resolution based on the minutes from the meeting in which the resolution was voted upon and passed.

An operating agreement is a key business document that shows your business operates like a legit company. Without the operating agreement, your state might not acknowledge you as an LLC, and which means someone could sue to go after you without there being any shield to protect your personal assets.

To dissolve an LLC in Kentucky, simply follow these three steps: Follow the Operating Agreement. Close Your Business Tax Accounts....Step 1: Follow Your Kentucky LLC Operating Agreement.Step 2: Close Your Business Tax Accounts.Step 3: File Articles of Dissolution.

An LLC operating agreement is not required in Kentucky, but is highly advisable. This is an internal document that establishes how your LLC will be run. It sets out the rights and responsibilities of the members and managers, including how the LLC will be managed.