Pennsylvania Owner Financing Contract for Moblie Home

Description

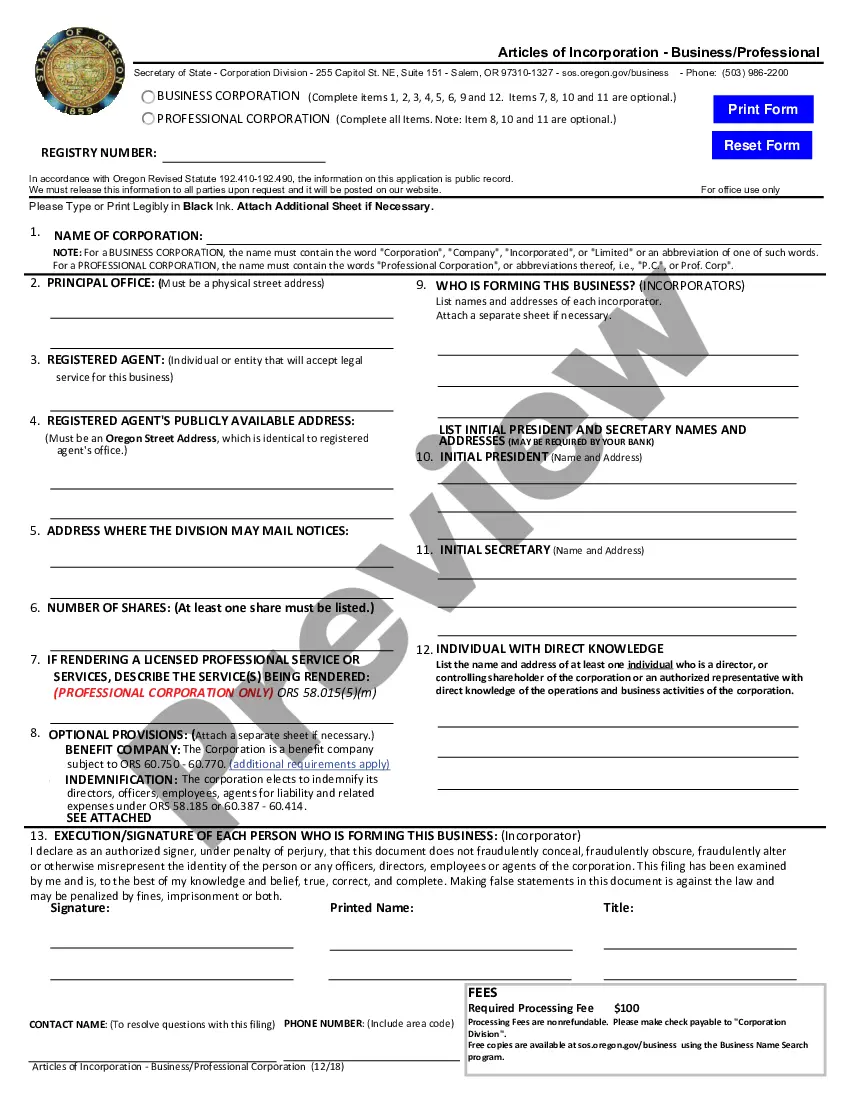

How to fill out Owner Financing Contract For Moblie Home?

US Legal Forms - one of the largest collections of legal forms in the United States - provides a broad selection of legal document templates that you can download or print.

By using the website, you can access thousands of forms for business and personal purposes, categorized by sections, states, or keywords. You can find the most current versions of forms such as the Pennsylvania Owner Financing Contract for Mobile Home in just moments.

If you already have a monthly subscription, Log In and download the Pennsylvania Owner Financing Contract for Mobile Home from the US Legal Forms library. The Download option will appear on every form you view. You can access all previously acquired forms from the My documents tab of your account.

Process the transaction. Use your credit card or PayPal account to complete the purchase.

Choose the file format and download the form to your device. Make modifications. Complete, revise, print, and sign the acquired Pennsylvania Owner Financing Contract for Mobile Home. Every template added to your account has no expiration date and is yours indefinitely. Therefore, to download or print another copy, simply go to the My documents section and click on the form you need. Access the Pennsylvania Owner Financing Contract for Mobile Home with US Legal Forms, the most extensive collection of legal document templates. Leverage thousands of professional and state-specific templates that meet your business or personal requirements.

- To utilize US Legal Forms for the first time, here are some straightforward guidelines to help you begin.

- Ensure you have chosen the correct form for your city/state.

- Select the Preview option to examine the form's content.

- Review the form outline to confirm you have selected the right one.

- If the form does not meet your needs, use the Search box at the top of the screen to find the suitable one.

- If you are satisfied with the form, confirm your selection by clicking the Buy now button.

- Then, choose the payment plan you prefer and provide your details to register for an account.

Form popularity

FAQ

Writing a seller-financed contract involves outlining essential details like payment schedule, interest rate, and default terms. It's crucial to include information about the mobile home and the responsibilities of both parties. A well-structured Pennsylvania Owner Financing Contract for Mobile Home ensures clarity and legal protection. You can find templates and guidelines on USLegalForms to help you draft a contract.

Typical terms for seller financing include a down payment of 10% to 20%, a fixed interest rate, and a repayment period ranging from 5 to 30 years. The specifics may vary based on negotiation between buyer and seller. A Pennsylvania Owner Financing Contract for Mobile Home clearly details these terms, making the transaction transparent. Utilize USLegalForms to draft an agreement that meets your needs.

In Pennsylvania, a mobile home can be classified as real property if it is permanently attached to the land and has an appropriate foundation. This classification may affect financing and property taxes. When pursuing a Pennsylvania Owner Financing Contract for Mobile Home, it’s crucial to understand how this classification impacts your investment.

The credit score required to buy a mobile home usually varies by lender and financing option. Generally, a score of 620 or higher is preferred, but some options may be available for those with lower scores. Using a Pennsylvania Owner Financing Contract for Mobile Home might give you easier access to financing, even with less-than-perfect credit.

Financing a mobile home can indeed be more challenging than financing a traditional home. Lenders typically have stricter requirements and may require higher down payments. However, exploring a Pennsylvania Owner Financing Contract for Mobile Home can simplify the process and provide flexibility that traditional lenders may not offer.

Banks often see mobile homes as a higher risk compared to traditional homes. This is primarily because mobile homes can depreciate in value more quickly, making banks hesitant to provide financing. If you are looking for options, consider a Pennsylvania Owner Financing Contract for Mobile Home, which can offer a viable alternative to traditional bank loans.

Typical terms for owner financing can vary, but they often include a down payment of 10-20%, an interest rate that is slightly higher than conventional loans, and a repayment term of 3 to 15 years. These terms can be customized based on the agreement between the buyer and seller. Use a Pennsylvania Owner Financing Contract for Mobile Home to formalize these terms.

To write up an owner finance contract, you should start with basic information about the buyer and the seller. Specify the terms of financing, including payment amounts and due dates. A well-crafted Pennsylvania Owner Financing Contract for Mobile Home will help avoid misunderstandings down the road.

Most insurance companies will not insure mobile homes older than 1976 due to safety concerns and the lack of compliance with modern codes. However, some insurers may consider unique situations involving the Pennsylvania Owner Financing Contract for Mobile Home. It’s wise to shop around for insurance providers familiar with the nuances of mobile home coverage.

Yes, a mobile home can be financed through the FHA if it meets specific criteria, including being classified as real property. The Pennsylvania Owner Financing Contract for Mobile Home can also be an alternative option for financing, as it may bypass some conventional requirements. Check with your lender to ensure eligibility under FHA guidelines.