This form is a deed of trust modification. It is to be entered into by a borrower, co-grantor, and the lender. The agreement modifies the mortgage or deed of trust to secure a debt described within the agreement. Other provisions include: renewal and extension of the lien, co-grantor liability, and note payment terms.

Kentucky Change or Modification Agreement of Deed of Trust

Description

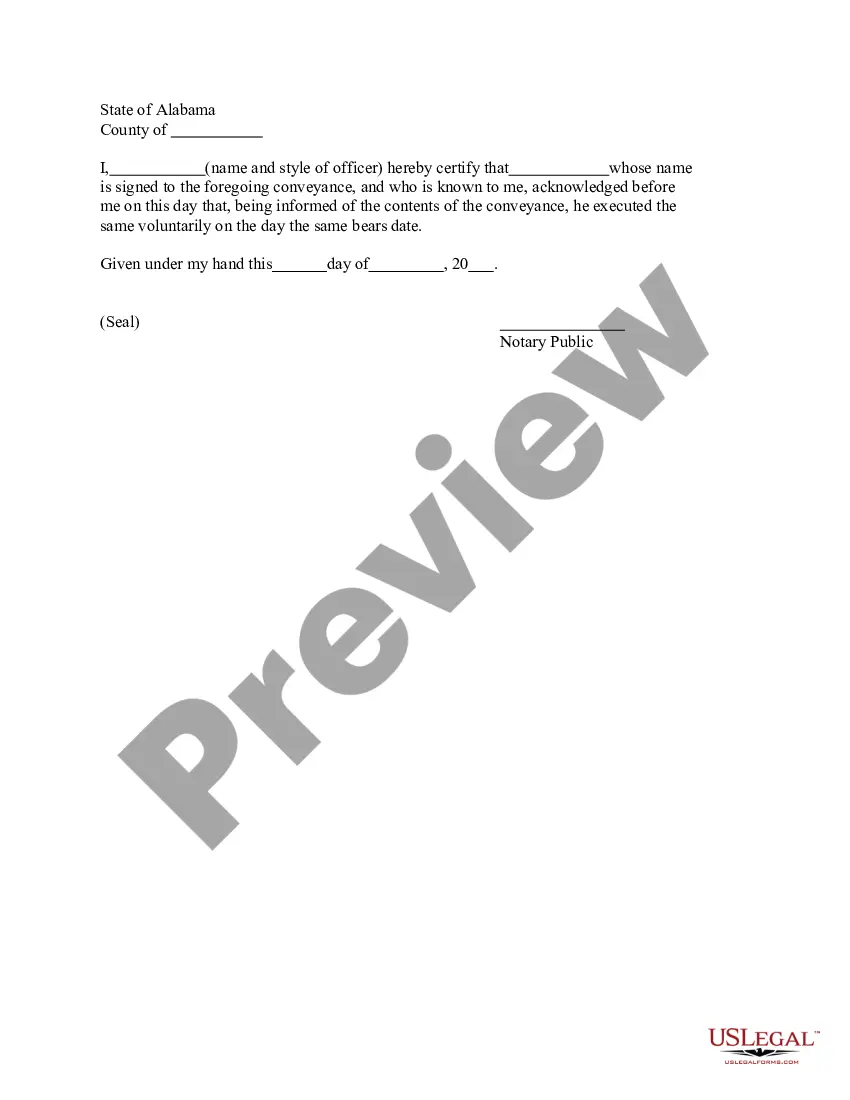

How to fill out Change Or Modification Agreement Of Deed Of Trust?

Finding the correct genuine document template can be a challenge. Clearly, there are numerous templates accessible online, but how do you locate the genuine version you require? Utilize the US Legal Forms website. The service provides thousands of templates, including the Kentucky Change or Modification Agreement of Deed of Trust, which can be utilized for both business and personal purposes. All forms are reviewed by experts and adhere to federal and state regulations.

If you are already registered, Log In to your account and click on the Obtain button to download the Kentucky Change or Modification Agreement of Deed of Trust. Use your account to browse through the legal forms you have previously acquired. Navigate to the My documents tab of your account and download an additional copy of the document you require.

If you are a new user of US Legal Forms, here are simple instructions for you to follow: First, ensure you have selected the appropriate form for your city/state. You can review the form using the Preview button and read the form description to confirm it is suitable for you. If the form does not meet your requirements, use the Search field to find the correct form. Once you are certain the form is accurate, click the Acquire now button to obtain the form. Choose the pricing plan you prefer and enter the necessary information. Create your account and complete the payment using your PayPal account or Visa or Mastercard. Select the document format and download the legal document template for your needs. Finally, complete, customize, print, and sign the obtained Kentucky Change or Modification Agreement of Deed of Trust.

US Legal Forms provides a comprehensive solution for obtaining legally compliant document templates efficiently.

- US Legal Forms is the largest collection of legal forms.

- You can explore various document templates.

- Utilize the service to acquire professionally crafted documents.

- All documents comply with state regulations.

- The platform offers templates for both personal and business use.

- Expert reviews ensure the forms meet legal standards.

Form popularity

FAQ

You can prepare your own deed in Kentucky, but it is crucial to ensure that it meets all legal requirements. A properly drafted deed must include specific elements, such as the names of the parties involved and a clear property description. While it is possible to create your own deed, many find it beneficial to use resources like a Kentucky Change or Modification Agreement of Deed of Trust for guidance and to avoid potential mistakes.

Yes, in Kentucky, it is essential to record a deed to make the transfer of property ownership publicly recognized. Recording the deed protects the interests of the new owner and provides legal proof of ownership. Without this step, the new owner's rights may be challenged by others claiming interest in the property. Utilizing a Kentucky Change or Modification Agreement of Deed of Trust can help you navigate the recording process more effectively.

To transfer a property deed in Kentucky, you must first prepare a new deed that clearly states the transfer details. This document should include the names of the current owner and the new owner, along with a legal description of the property. Once completed, you must sign the deed in front of a notary public. Finally, to ensure the transfer is officially recognized, record the deed with the county clerk's office. If you need assistance, consider using a Kentucky Change or Modification Agreement of Deed of Trust to streamline the process.

A modification of deed of trust refers to a formal change to the original terms of the trust deed. This may include adjustments to payment terms, interest rates, or other key provisions. A Kentucky Change or Modification Agreement of Deed of Trust serves as the official document that outlines these modifications. For your convenience, US Legal Forms offers easy access to the necessary forms and instructions to help you through this process.

To amend a trust deed, you must create a Kentucky Change or Modification Agreement of Deed of Trust. This document outlines the specific changes you wish to make and must be signed by all parties involved. After drafting the agreement, you should file it with the appropriate county office to ensure it is legally recognized. Utilizing platforms like US Legal Forms can simplify this process, providing templates and guidance.

To make an amendment in a trust deed, begin by drafting a written document that outlines the specific changes you wish to implement. This amendment should be signed by the trustee and may require witnessing or notarization depending on state laws. Familiarizing yourself with the Kentucky Change or Modification Agreement of Deed of Trust will help ensure that your amendment is valid. For templates and further guidance, uslegalforms is a valuable resource.

Generally, the individual who created the trust, known as the grantor, can modify the trust as long as they are alive and competent. Additionally, a trustee may modify the trust under certain conditions outlined in the trust document. Understanding the implications of the Kentucky Change or Modification Agreement of Deed of Trust can help clarify this process. For assistance, consider using uslegalforms to access the necessary documentation.

To modify a trust deed, you typically need to draft an amendment that specifies the changes to be made. This document should be signed and dated by the trustee, and in some cases, it may need to be notarized. Understanding the nuances of the Kentucky Change or Modification Agreement of Deed of Trust is vital for ensuring compliance. You can use uslegalforms for templates and instructions to guide you through this process.

Yes, a trustee has the authority to amend a trust deed, provided they follow the procedures set forth in the trust document. Amendments may be necessary to reflect changes in circumstances or to clarify terms. It is important to ensure that any changes comply with the Kentucky Change or Modification Agreement of Deed of Trust. Consulting with a legal professional or using uslegalforms can simplify this process.

A modification of a deed of trust refers to changes made to the original agreement, which can include altering terms such as interest rates or payment schedules. This process is crucial for borrowers who need to adjust their financial commitments. Understanding the Kentucky Change or Modification Agreement of Deed of Trust is essential for ensuring that all modifications are legally binding. You can find resources and templates to facilitate this process on uslegalforms.