A Kentucky Certificate of Withdrawal is a document issued by the Kentucky Secretary of State when a business entity wishes to terminate its registration in the state. The certificate is issued for both domestic and foreign business entities, and includes the name of the business, its registration number, and the date of the filing. For domestic business entities, the Certificate of Withdrawal is used to dissolve a corporation, limited liability company, limited partnership, or a registered limited liability partnership. For foreign business entities, the Certificate of Withdrawal is used to terminate the registration of a foreign business entity that has been registered to do business in Kentucky. The Certificate of Withdrawal must be filed by the entity's registered agent. Once the certificate is filed and approved, the entity ceases to exist in Kentucky and is no longer subject to the state's business regulations.

Kentucky Certificate of Withdrawal (Domestic Or Foreign Business Entity)

Description

Key Concepts & Definitions

Certificate of Withdrawal Domestic or Foreign: This refers to the document issued to businesses that have decided to cease operations in a particular state where they previously registered as either a domestic entity (formed within that state) or a foreign entity (formed outside that state but registered to operate within it). Compliance regulations require this formal documentation to properly dissolve the entity's legal obligations in that state.

Step-by-Step Guide

- Initiate Request: Start by requesting information or the necessary forms from the local secretary of state's office or via their website.

- Complete Required Paperwork: Fill out the certificate of withdrawal documentation accurately, attaching any required legal or financial documents.

- Submit and Pay Fees: Submit the completed forms to the secretary of state along with any applicable filing fees.

- Receive Confirmation: Wait for confirmation that the state has processed your withdrawal and issued the certificate.

Risk Analysis

- Legal Risks: Failure to properly withdraw can lead to continued tax liability and legal obligations in the state.

- Financial Risks: There may be penalties and accrued taxes that need to be settled which could impact your business financially.

- Reputation Risk: Non-compliance can affect future business endeavors in the state or other jurisdictions.

Key Takeaways

Streamlining the Process: Employing management software or consulting with a company like CT Corporation can help navigate the complexities of compliance regulations associated with the withdrawal process. This aids in ensuring all factors such as tax accounting and business technology are adequately addressed.

Best Practices

- Early Planning: Prepare for the withdrawal well in advance to ensure all compliance regulations are met.

- Consulting Experts: Leverage expert insights to guide you through the legal and financial obligations involved in the withdrawal process.

- Using Technology: Implement management software solutions that can simplify handling important documents and compliance timelines.

Real-World Applications

Many companies leverage online platforms to handle filings and communicate with state offices effectively. For example, businesses often use platforms to manage their online revenue streams while maintaining compliance with state laws during the withdrawal process.

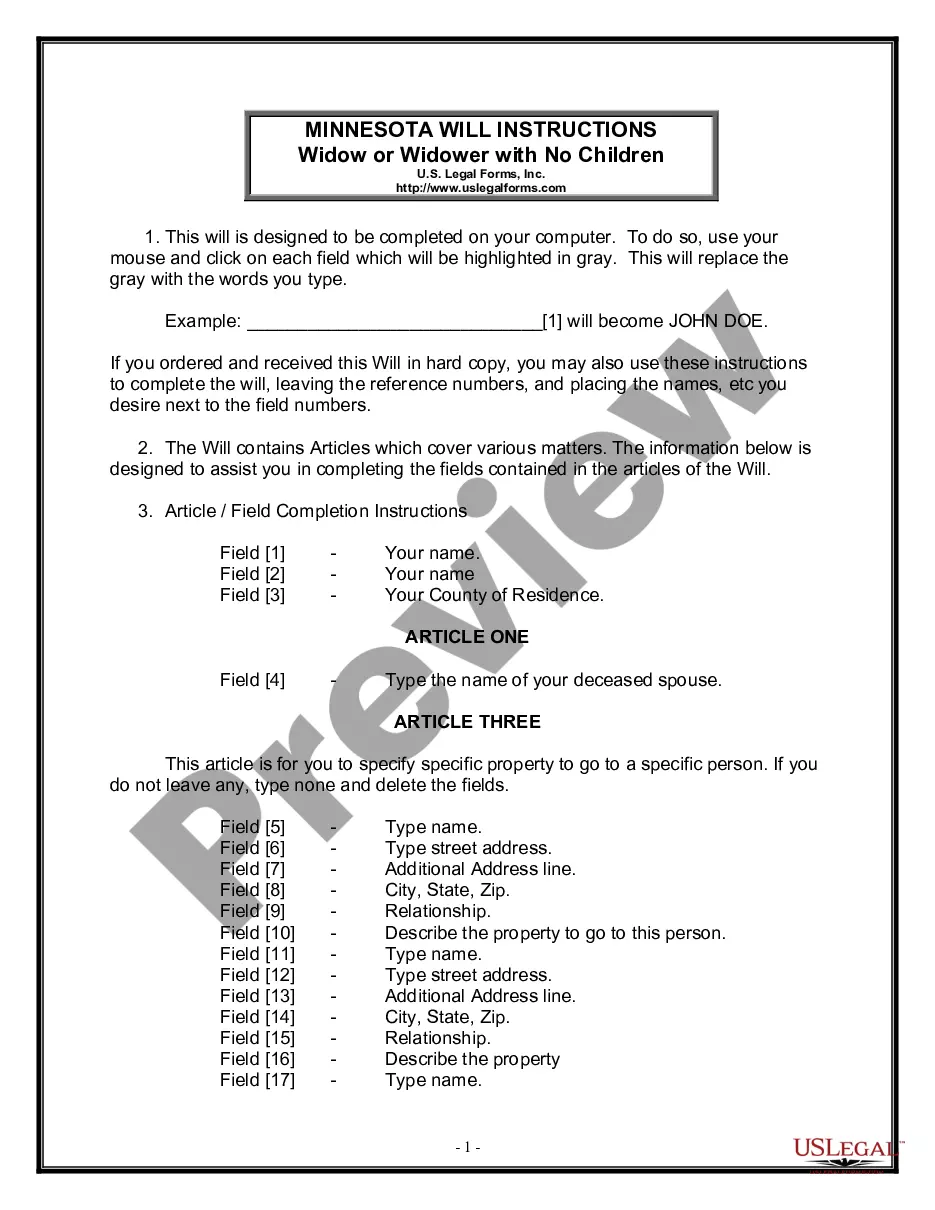

How to fill out Kentucky Certificate Of Withdrawal (Domestic Or Foreign Business Entity)?

Engaging with legal paperwork necessitates focus, accuracy, and utilizing meticulously prepared templates. US Legal Forms has been assisting individuals nationwide in achieving just that for 25 years, so when you select your Kentucky Certificate of Withdrawal (Domestic Or Foreign Business Entity) form from our collection, you can be confident that it adheres to federal and state laws.

Using our platform is straightforward and fast. To obtain the required documents, all you need is an account with an active subscription. Here’s a brief guide for you to acquire your Kentucky Certificate of Withdrawal (Domestic Or Foreign Business Entity) within moments.

All documents are designed for multiple uses, like the Kentucky Certificate of Withdrawal (Domestic Or Foreign Business Entity) that appears on this page. If you need them again, you can fill them out without additional payment - just access the My documents tab in your profile and finalize your document anytime you require it. Experience US Legal Forms and prepare your business and personal documents swiftly and in complete legal conformity!

- Ensure you thoroughly verify the form content and its alignment with general and legal standards by previewing it or reviewing its description.

- Look for another official template if the previously accessed one does not suit your circumstances or state regulations (the option for that is located at the top page corner).

- Log into your account and obtain the Kentucky Certificate of Withdrawal (Domestic Or Foreign Business Entity) in your preferred format. If this is your first visit to our site, click Buy now to proceed.

- Set up an account, select your subscription tier, and pay using your credit card or PayPal account.

- Choose the format in which you wish to save your document and click Download. Print the template or import it into a professional PDF editor to complete it electronically.

Form popularity

FAQ

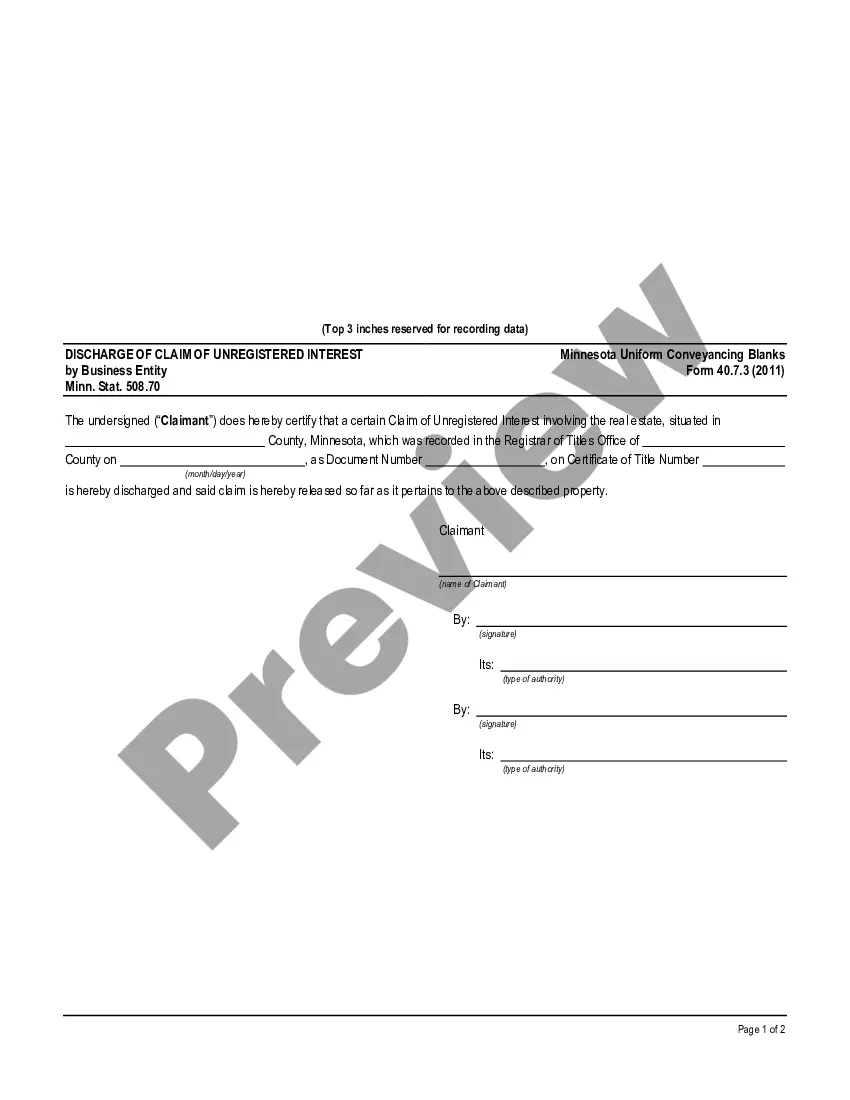

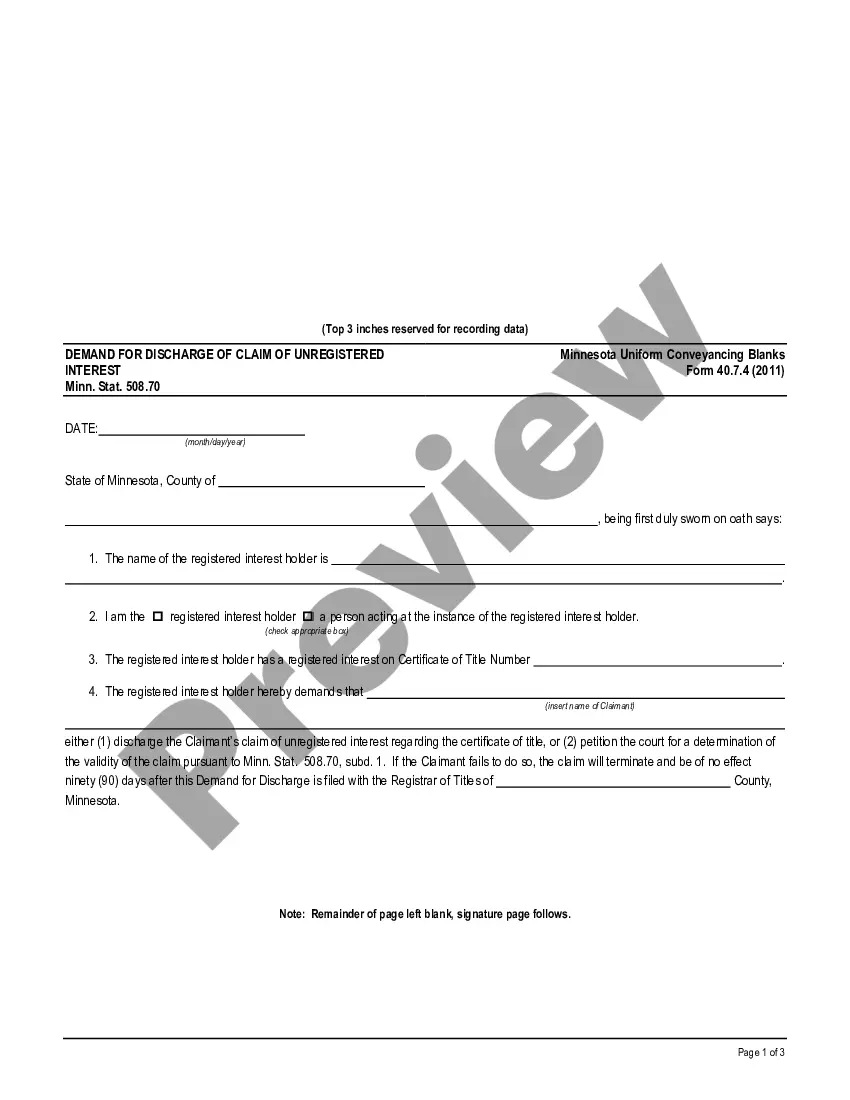

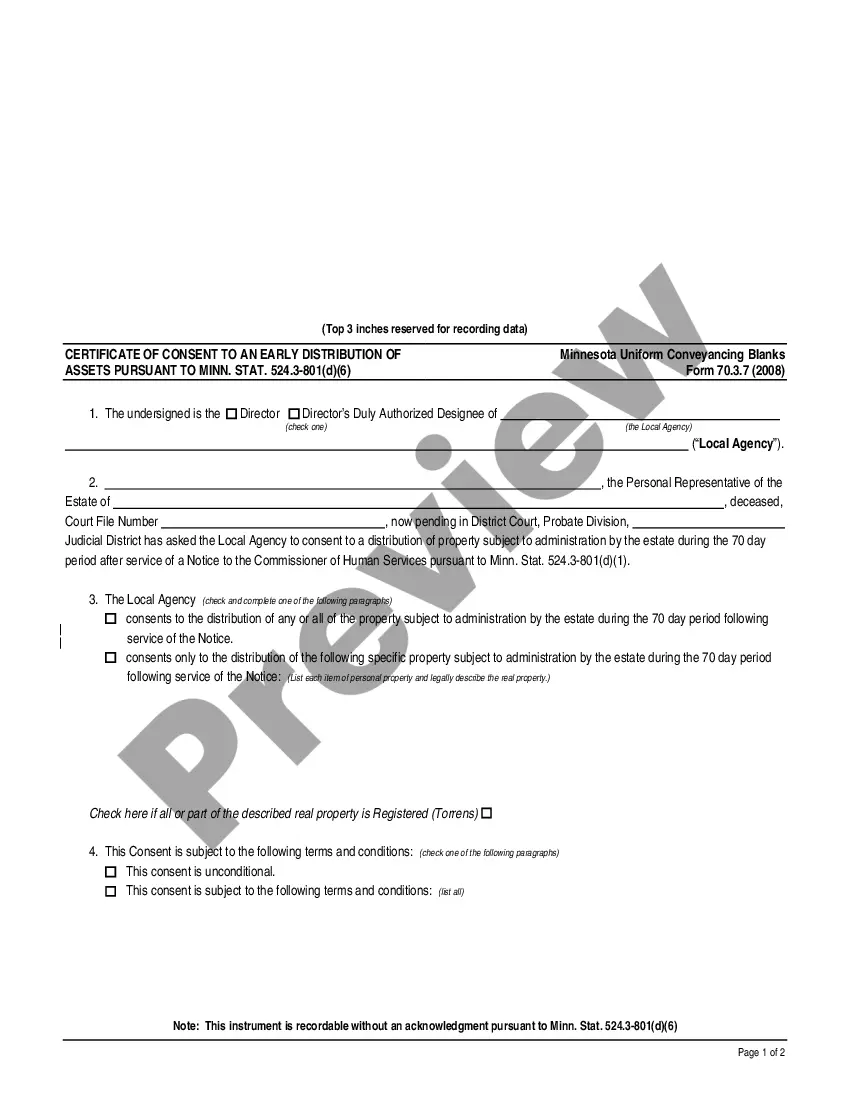

If a foreign corporation or foreign LLC registered in Kentucky no longer wants to do business there, it can apply to withdraw its registration in the state. To do so, the corporation or LLC would submit a Certificate of Withdrawal, and an exact copy, to the Kentucky Secretary of State (SOS) by mail or in person.

Here's what you'll need to do: Comply with Kentucky Revised Statutes.Update your Kentucky LLC Operating Agreement.Check your Kentucky LLC Articles of Organization.Contact the IRS.

Is there a filing fee to dissolve or cancel a Kentucky LLC? There is a $40 filing fee to file Kentucky Articles of Dissolution.

In Kentucky, business entities are required by law to formally dissolve. In order to properly close, a domestic entity must file articles of dissolution, and a foreign entity must file a certificate of withdrawal. These forms are available for download on this website.

Kentucky businesses are not legally required to obtain a certificate of existence. However, your business may choose to get one if you decide to do business outside of Kentucky or get a business bank account.

In Kentucky, business entities are required by law to formally dissolve. In order to properly close, a domestic entity must file articles of dissolution, and a foreign entity must file a certificate of withdrawal. These forms are available for download on this website.

To register a foreign corporation in Kentucky, you must file a Kentucky Certificate of Authority with the Kentucky Secretary of State. You can submit this document by mail, online, or in person. The Certificate of Authority for a foreign Kentucky corporation costs $90 to file.

Starting an LLC costs $40 in Kentucky. This is the state filing fee for a document called the Kentucky Articles of Organization. The Articles of Organization are filed with the Kentucky Secretary of State.