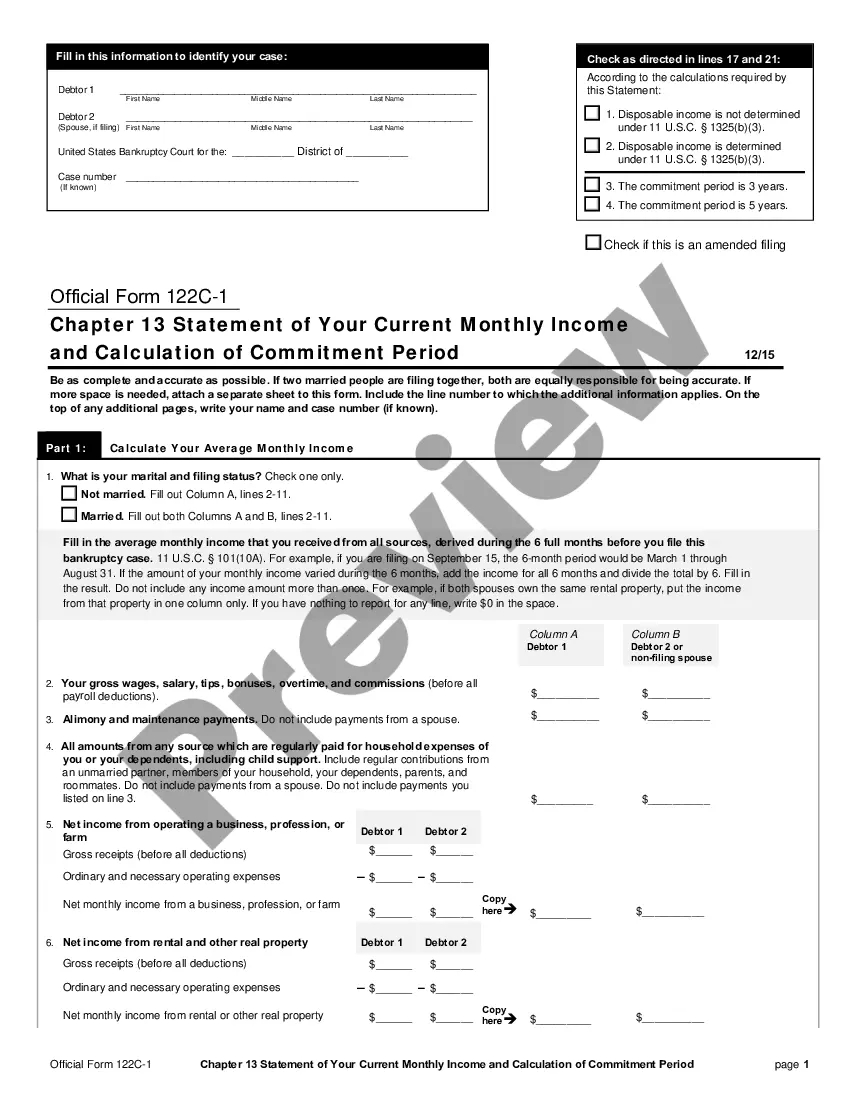

The Kentucky Chapter 11 Statement of Your Current Monthly Income is a form used by individuals seeking to file Chapter 11 bankruptcy in the state of Kentucky. The form is used to provide the court with information about the debtor's current monthly income, such as wages, salaries, commissions, self-employment income, government benefits, pension income, alimony and other sources of income. The form also requires the debtor to provide information on any deductions from income, such as taxes, health insurance premiums, and other deductions. The form is used by the court to determine if the debtor qualifies for Chapter 11 reorganization. There are two types of Kentucky Chapter 11 Statement of Your Current Monthly Income: one for individuals and one for businesses.

Kentucky Chapter 11 Statement of Your Current Monthly Income

Description

How to fill out Kentucky Chapter 11 Statement Of Your Current Monthly Income?

Managing government documentation necessitates focus, precision, and utilizing correctly formulated forms. US Legal Forms has been assisting individuals across the nation to do just that for 25 years, so when you select your Kentucky Chapter 11 Statement of Your Current Monthly Income template from our service, you can be assured it complies with federal and state laws.

Utilizing our service is simple and quick. To acquire the required document, all you need is an account with an active subscription. Here’s a short guide for you to locate your Kentucky Chapter 11 Statement of Your Current Monthly Income in just minutes.

All documents are created for multiple uses, like the Kentucky Chapter 11 Statement of Your Current Monthly Income you see on this page. If you require them in the future, you can complete them without additional payment - simply access the My documents tab in your profile and finalize your document whenever you need it. Experience US Legal Forms and manage your business and personal paperwork swiftly and in full legal compliance!

- Ensure to carefully review the form content and its alignment with standard and legal standards by previewing it or reviewing its description.

- Look for an alternative official template if the one you initially opened does not align with your circumstances or state requirements (the option for that is located on the top page corner).

- Log in to your account and save the Kentucky Chapter 11 Statement of Your Current Monthly Income in your desired format. If it’s your first encounter with our website, click Buy now to continue.

- Establish an account, select your subscription plan, and pay using your credit card or PayPal account.

- Select the format in which you wish to receive your form and click Download. Print the document or import it into a professional PDF editor to complete it electronically.

Form popularity

FAQ

Unsecured personal loans can be eliminated or discharged through a bankruptcy filing. Unsecured loans are those not backed by your personal property. In addition, personal loans from friends, family, or employers are also eligible to be discharged.

A case filed under chapter 11 of the United States Bankruptcy Code is frequently referred to as a "reorganization" bankruptcy. Usually, the debtor remains ?in possession,? has the powers and duties of a trustee, may continue to operate its business, and may, with court approval, borrow new money.

Creditors' Rights for Unsecured Claims As an unsecured creditor, you can file a proof of claim, attend the first meeting of creditors, and file objections to the discharge. You can review the bankruptcy papers that were filed to determine whether there are any inaccuracies.

The unsecured creditor gets no such protection; its best method of repayment from its debtor is voluntary repayment. Otherwise, short of bankruptcy proceedings, the unsecured creditor must sue and win a judgment to get repaid on a defaulted debt.

Most Chapter 11 debtors receive a moratorium on the payment of most of their general unsecured debts for the period between the filing of the case and the confirmation of a plan. This period usually lasts for six to twelve months.

Meanwhile, repayment to unsecured creditors is generally dependent on bankruptcy proceedings or successful litigation. An unsecured creditor must first file a legal complaint in court and obtain a judgment before proceeding with collection through wage garnishment and other types of liquidated borrower-owned assets.