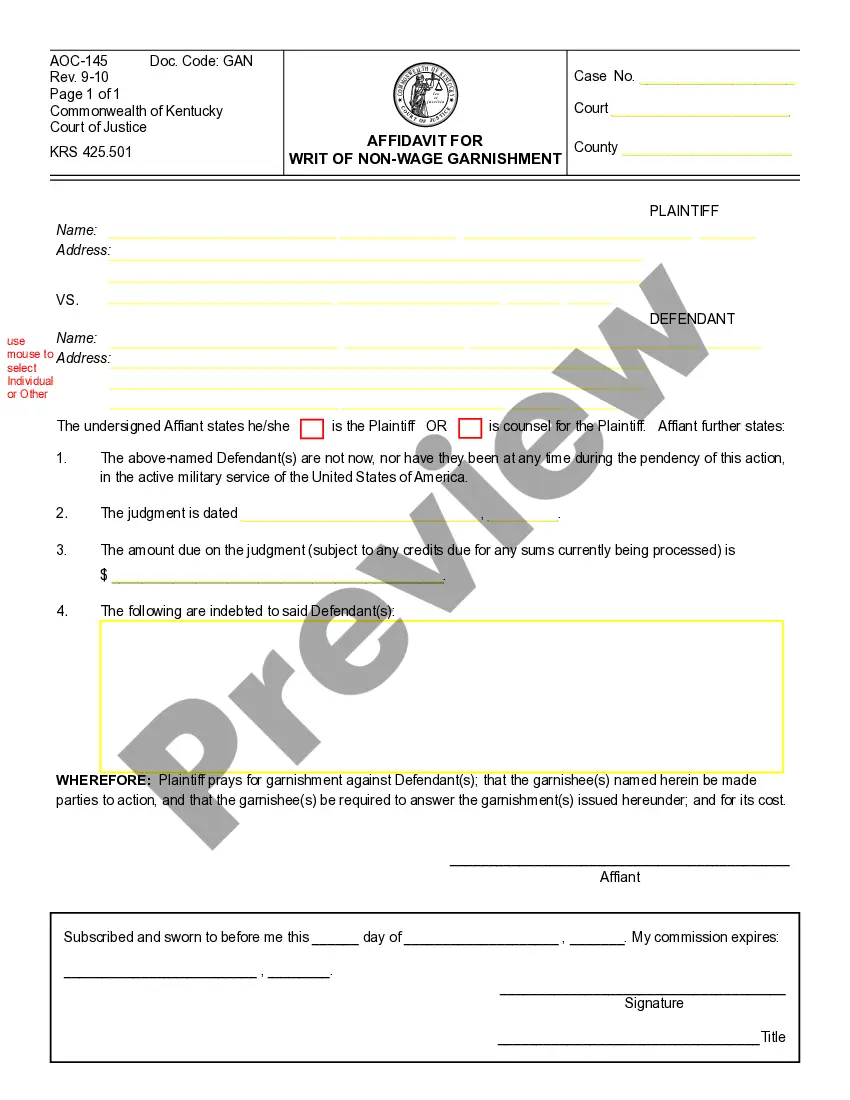

The Kentucky Affidavit For Order of Garnishment (Non-Wage) is a form used to request a court order for the garnishment of non-wage assets from a debtor to a creditor. The form must be completed by the creditor and submitted to the court for approval. The form is used by creditors to collect unpaid debts from debtors who have failed to pay their debts. There are two types of Kentucky Affidavit For Order of Garnishment (Non-Wage): 1) Garnishment of Bank Accounts/Interests, and 2) Garnishment of Other Assets. The Garnishment of Bank Accounts/Interests requires the creditor to list the debtor's bank accounts and the amount they wish to garnish. The Garnishment of Other Assets requires the creditor to list the debtor's other assets, such as real estate, stocks, bonds, and other property, and the amount they wish to garnish. The Kentucky Affidavit For Order of Garnishment (Non-Wage) form also includes information about the creditor's legal right to collect the debt, the debtor's contact information, and an explanation of the garnishment process.

Kentucky Affidavit For Order of Garnishment (Non-Wage)

Description

How to fill out Kentucky Affidavit For Order Of Garnishment (Non-Wage)?

Drafting legal documents can be a significant hassle unless you have pre-prepared editable forms. With the US Legal Forms online library of official paperwork, you can have assurance in the forms you receive, as all of them comply with national and state regulations and have been reviewed by our experts.

Obtaining your Kentucky Affidavit For Order of Garnishment (Non-Wage) from our collection is as simple as 1-2-3. Existing users with an active subscription only need to Log In and press the Download button after locating the correct template. Subsequently, if needed, users can access the same document from the My documents section of their account. However, even newcomers to our service can register with a valid subscription in just a few moments. Here’s a brief guide for you.

Haven’t you used US Legal Forms yet? Register for our service today to access any official document swiftly and effortlessly every time you need to, and maintain your paperwork in order!

- Document compliance verification. You should thoroughly examine the content of the form you wish to use and ensure that it fits your requirements and adheres to your state law stipulations. Previewing your document and checking its general outline will assist you in this.

- Alternative search (optional). If there are any discrepancies, explore the library using the Search tab at the top of the page until you discover a suitable template, and click Buy Now when you find what you’re looking for.

- Account creation and form purchase. Register for an account with US Legal Forms. After verifying your account, Log In and select your desired subscription plan. Make a payment to proceed (both PayPal and credit card options are available).

- Template download and further usage. Select the file format for your Kentucky Affidavit For Order of Garnishment (Non-Wage) and click Download to save it on your device. Print it to fill in your forms manually, or utilize a feature-rich online editor to prepare an electronic version more quickly and effectively.

Form popularity

FAQ

The intent of having wages garnished is to pay off the entire debt. An amount of about 25% of your paycheck will be taken out each time and sent to the creditor until the debt is paid. However, be aware that the percentage of pay to repay child support, student loans, or taxes could be higher.

A Kentucky non-wage garnishment gives your creditor permission to directly tap into your bank account, which means that they can take some or all of the money in your account.

For example, Social Security benefits, workers' compensation benefits, retirement income, and unemployment benefits can't be garnished by most creditors. Any alimony or child support payments that you receive will also generally be treated asexempt from garnishment, just as they would be if you filed for bankruptcy.

Kentucky. Follows federal wage garnishment guidelines. Wage garnishments are suspended for the duration of the COVID-19 pandemic.

A Kentucky non-wage garnishment gives your creditor permission to directly tap into your bank account, which means that they can take some or all of the money in your account.

If you wish to stop wage garnishment in Kentucky there are several options available to you. Pay the Debt and Avoid the Suit. The best way to stop the garnishment you're experiencing in Kentucky is to pay the debt off.Appeal to the Court in Kentucky.Bankruptcy in Kentucky.Seek Legal Assistance.

The written objection should include: the case number (a unique set of numbers or letters specific to your case) your name, address, and phone number. a detailed explanation of your reasons for challenging the garnishment. a request for a hearing if the court has not already set a hearing date.

While states are free to impose stricter limits, Kentucky's law is the same as federal law. On a weekly basis, the garnishment can't exceed the lesser of: 25% of your disposable earnings for that week, or. the amount by which your disposable earnings for that week surpasses 30 times the federal minimum hourly wage.