Kentucky Rights And Responsibilities of Chapter 13 Debtors And Their Attorneys are the laws that govern the rights and responsibilities of debtors and creditors when filing for bankruptcy under Chapter 13 in the state of Kentucky. This includes the duties of debtors, creditors, and attorneys involved in the process, as well as the rights of debtors and creditors. The main types of Kentucky Rights And Responsibilities of Chapter 13 Debtors And Their Attorneys include filing requirements, the duties of debtors and creditors, the obligations of attorneys, and the rights of debtors and creditors. Filing requirements for Chapter 13 debtors include filing a petition, schedules of assets and liabilities, income and expenses, and a statement of financial affairs. Creditors must also be listed in the filing. The duties of debtors include providing accurate and honest information to creditors, making payments on time, and keeping accurate records of payments. Creditors must comply with the bankruptcy court orders and provide accurate information to the court. The obligations of attorneys include providing legal advice to debtors, representing debtors in court, and making sure that the debtor meets all applicable filing requirements. They must also ensure that the debtor is complying with all the court’s orders. The rights of debtors and creditors include the right to object to the discharge of certain debts, the right to receive notice of all court proceedings, and the right to receive a discharge order at the end of the bankruptcy process. In summary, Kentucky Rights And Responsibilities of Chapter 13 Debtors And Their Attorneys are the laws that govern the rights and responsibilities of debtors and creditors when filing for bankruptcy under Chapter 13 in the state of Kentucky. This includes filing requirements, the duties of debtors and creditors, the obligations of attorneys, and the rights of debtors and creditors.

Kentucky Rights And Responsibilities of Chapter 13 Debtors And Their Attorneys

Description

How to fill out Kentucky Rights And Responsibilities Of Chapter 13 Debtors And Their Attorneys?

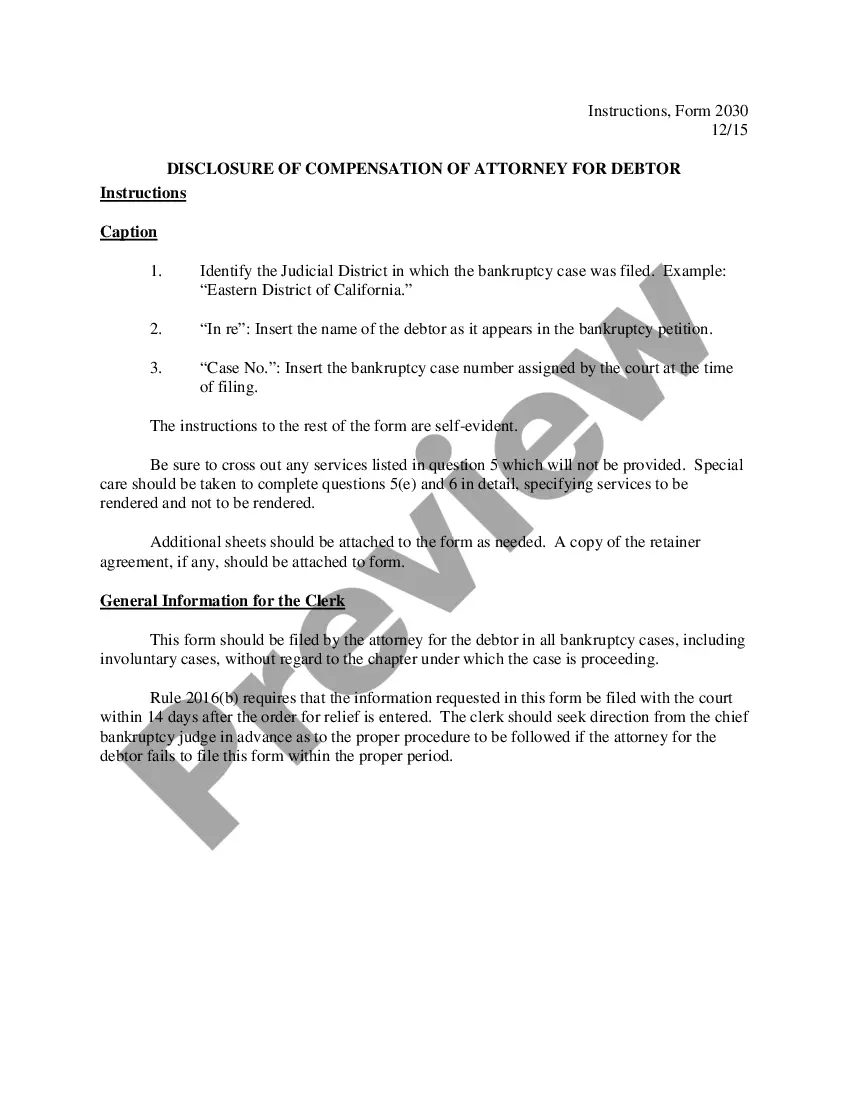

Handling legal documents necessitates focus, precision, and the use of properly formulated templates. US Legal Forms has been assisting individuals nationwide with this for 25 years, so when you select your Kentucky Rights And Responsibilities of Chapter 13 Debtors And Their Attorneys template from our platform, you can be assured that it complies with both federal and state laws.

Utilizing our service is simple and quick. To obtain the required document, all you need is an account with an active subscription. Here’s a concise guide to acquire your Kentucky Rights And Responsibilities of Chapter 13 Debtors And Their Attorneys in just minutes.

All documents are designed for multiple uses, like the Kentucky Rights And Responsibilities of Chapter 13 Debtors And Their Attorneys displayed on this page. If you require them again in the future, you can fill them out without additional payment - simply access the My documents tab in your profile and finalize your document whenever needed. Experience US Legal Forms and complete your business and personal documentation swiftly and with full legal compliance!

- Ensure to thoroughly review the form content and its alignment with general and legal standards by previewing it or examining its description.

- Seek another official template if the one you have opened does not fit your circumstances or state regulations (the option for that is located on the upper page corner).

- Log in to your account and save the Kentucky Rights And Responsibilities of Chapter 13 Debtors And Their Attorneys in your preferred format. If this is your first visit to our website, click Buy now to proceed.

- Create an account, select your subscription plan, and pay using your credit card or PayPal account.

- Choose the format in which you wish to save your form and click Download. Print the document or upload it to a professional PDF editor for electronic submission.

Form popularity

FAQ

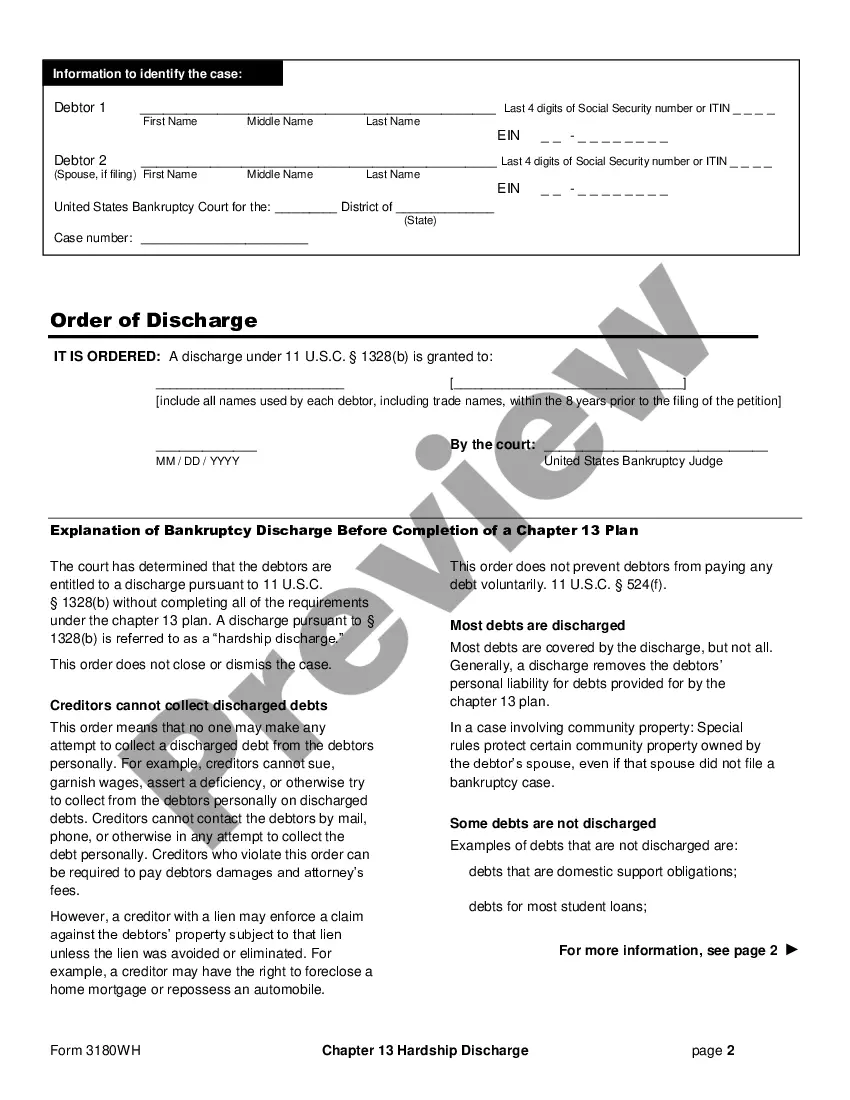

This goal is accomplished through the bankruptcy discharge, which releases debtors from personal liability from specific debts and prohibits creditors from ever taking any action against the debtor to collect those debts.

In essence, your creditors will always get an amount equal to your nonexempt property or more, regardless of whether you file for Chapter 7 or 13 bankruptcy. Your creditors will get even more if your disposable income exceeds the value of your nonexempt property.

If a creditor objects to your repayment plan, you will have an opportunity to respond to the objection. If you are able to overcome the objection, then your repayment plan will be approved, and you can proceed with your bankruptcy case.

Unlike chapter 7, creditors do not have standing to object to the discharge of a chapter 12 or chapter 13 debtor. Creditors can object to confirmation of the repayment plan, but cannot object to the discharge if the debtor has completed making plan payments.

Under Chapter 13, the debtor retains all of his or her assets and the debtor formulates a plan under which he or she proposes to re-pay creditors all or a portion of the debt owed to them over a period of three to five years.

Advantages Offered in Chapter 13 but Not Chapter 7 You Can Catch Up on a Mortgage or Car Loan.You Can Force a Creditor Into a Payment Plan.You Can Protect a Codebtor on a Personal Debt.You Can Keep Property You'd Lose in Chapter 7.

The discharge releases the debtor from all debts provided for by the plan or disallowed (under section 502), with limited exceptions. Creditors provided for in full or in part under the chapter 13 plan may no longer initiate or continue any legal or other action against the debtor to collect the discharged obligations.

Secured Creditors in Chapter 13 In general, a secured creditor is entitled to receive either the value of the collateral or the value of the debt (whichever is lower) over the course of the plan, plus interest for any delays caused by payment being split over three to five years.