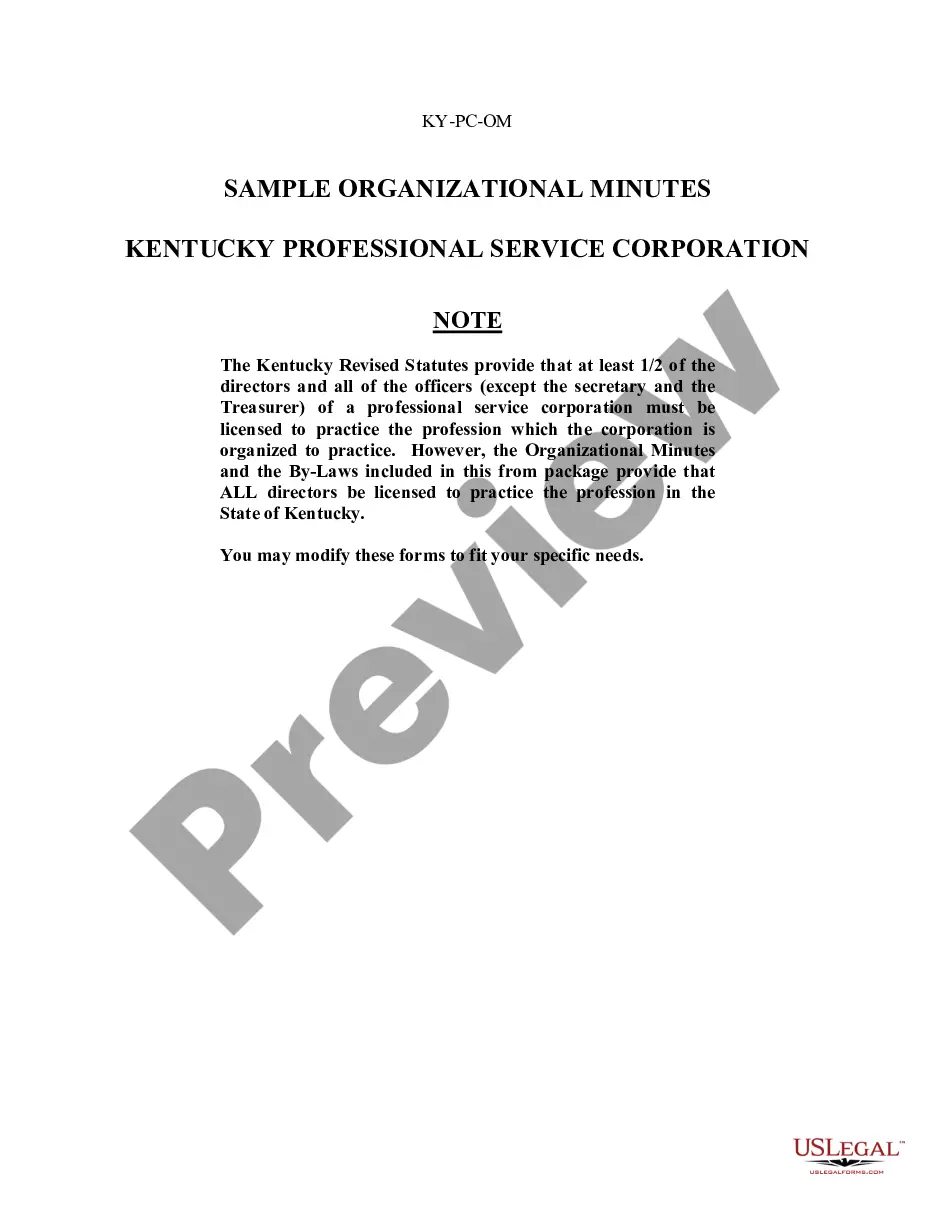

Annual Minutes document any changes or other organizational activities of a Professional Corporation during a given year.

Sample Annual Minutes for a Kentucky Professional Service Corporation

Description

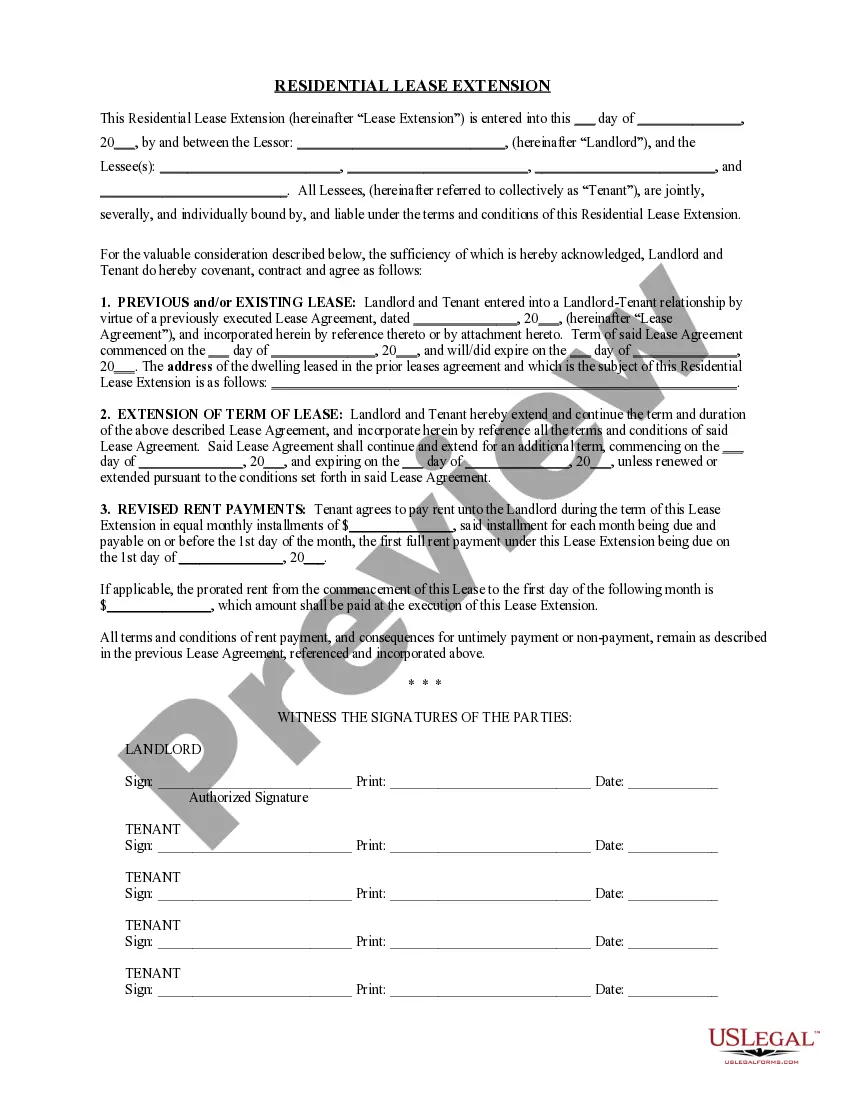

How to fill out Sample Annual Minutes For A Kentucky Professional Service Corporation?

Searching for Sample Annual Minutes for a Kentucky Professional Service Corporation templates and completing them may pose a difficulty.

To conserve considerable time, expenses, and effort, utilize US Legal Forms and discover the suitable template specifically for your state in just a few clicks.

Our legal experts prepare each document, so you merely need to complete them.

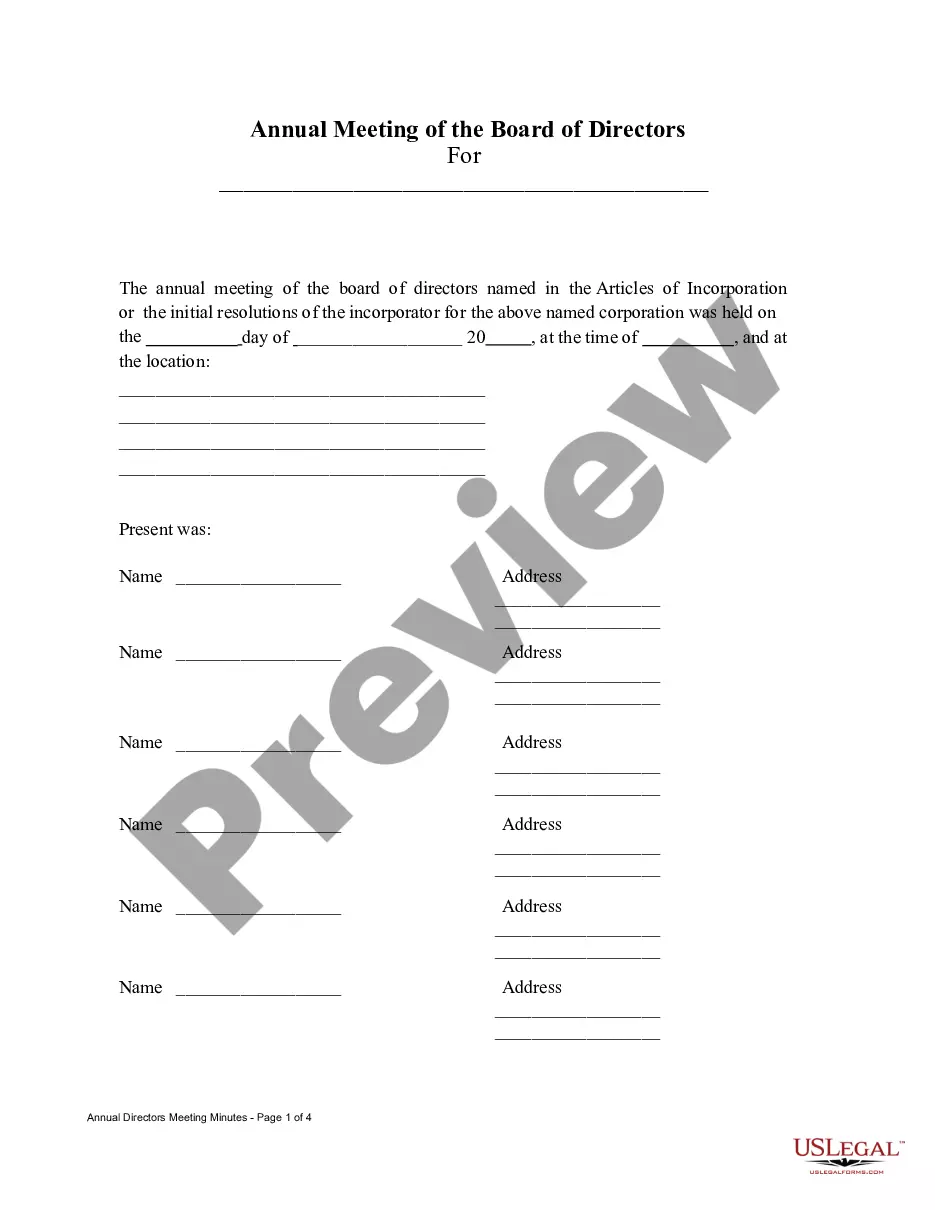

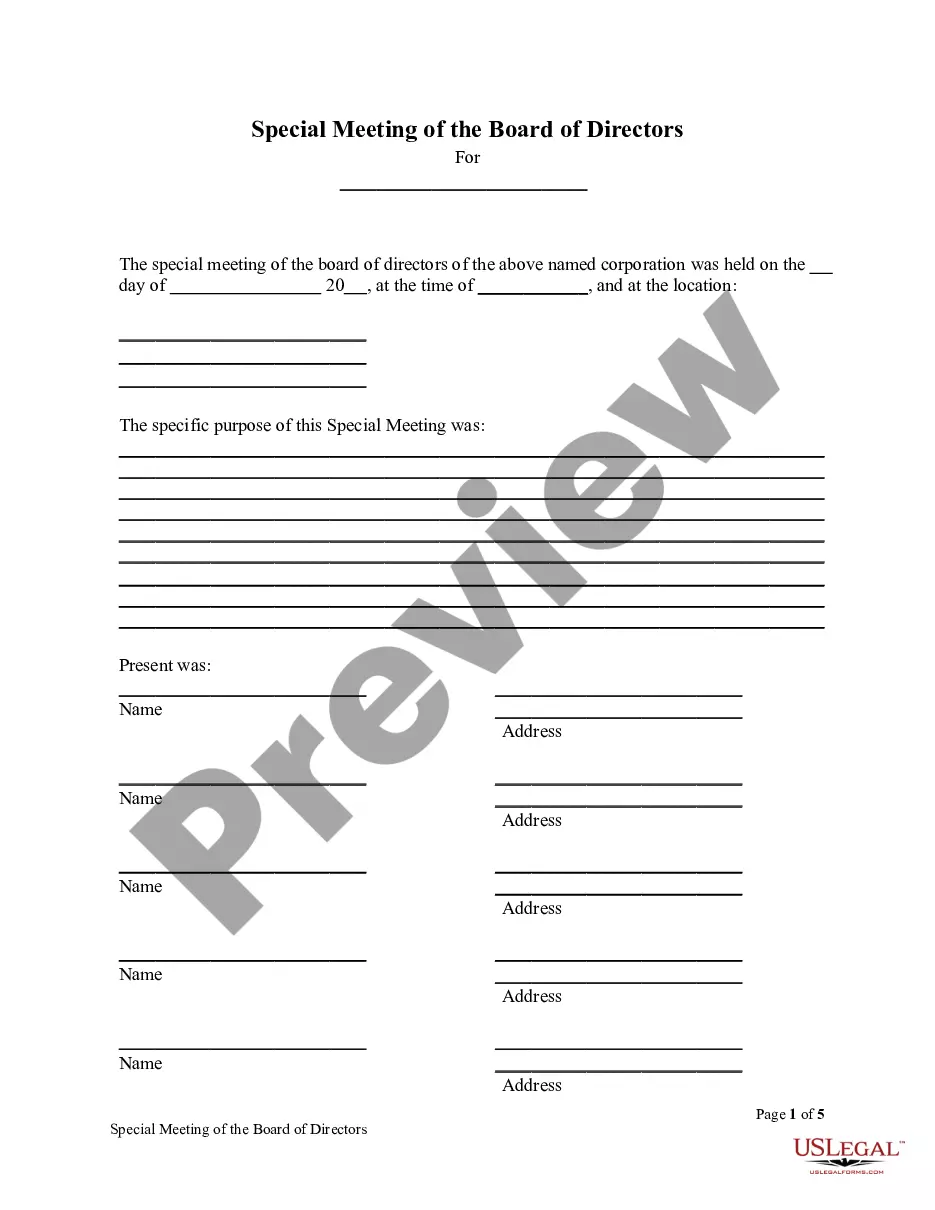

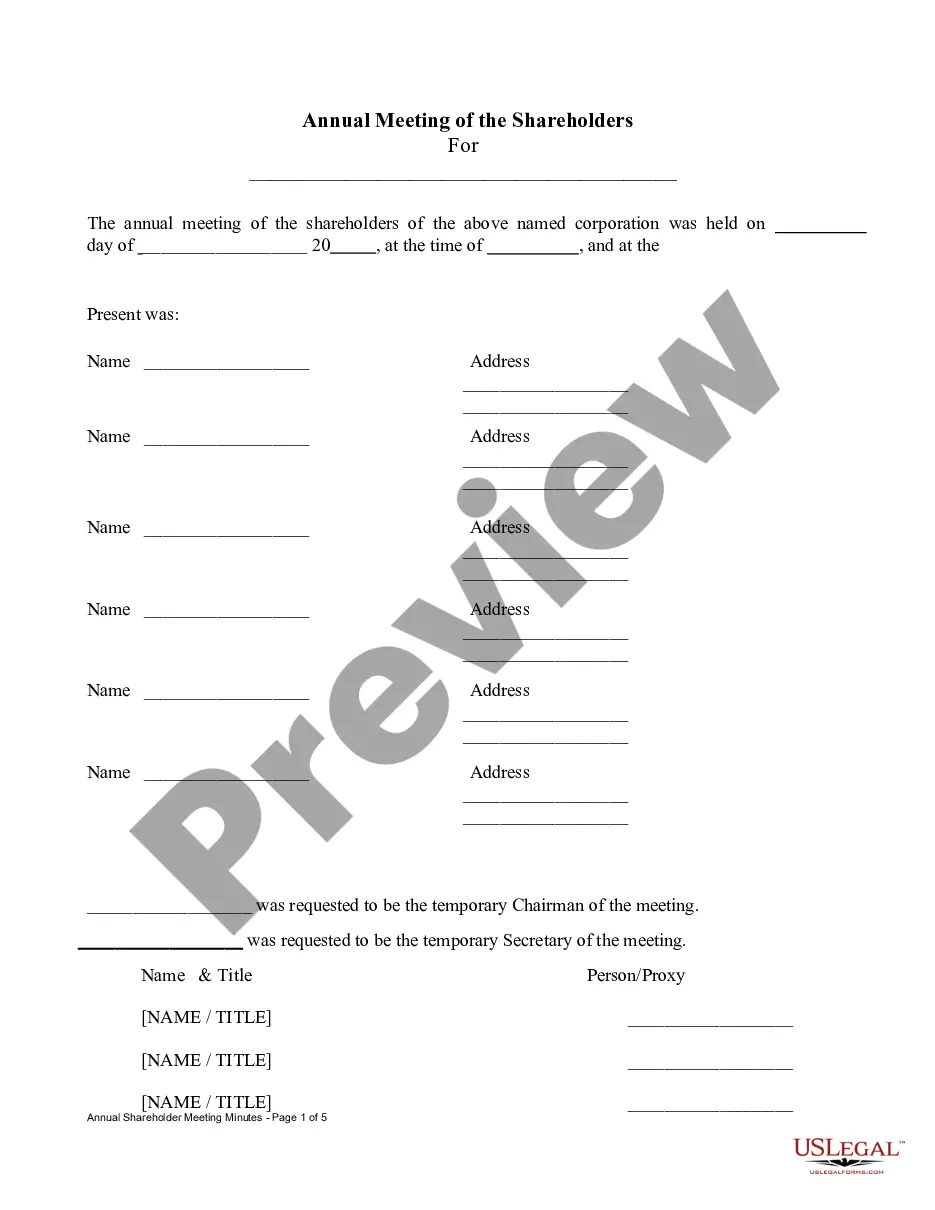

You can print the Sample Annual Minutes for a Kentucky Professional Service Corporation template or complete it using any online editor. No need to be concerned about making errors because your sample can be used, sent, and printed as frequently as you require. Try US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- Log in to your account and navigate back to the form's page to download the sample.

- All of your stored samples are kept in My documents and are accessible at any time for future use.

- If you haven't registered yet, you need to create an account.

- Follow our comprehensive instructions on how to obtain your Sample Annual Minutes for a Kentucky Professional Service Corporation sample in just minutes.

- To acquire a valid template, ensure its suitability for your state.

- Utilize the Preview option to examine the form (if available).

- If a description is present, read it to understand the details.

- Click Buy Now if you discover what you are looking for.

- Select your plan on the pricing page and set up your account.

- Indicate your preferred payment method, either via credit card or PayPal.

- Download the form in your chosen file format.

Form popularity

FAQ

If you are a corporation, LLC, or partnership conducting business in Kansas, you must pay $50 to file an annual report every year.

If you've incorporated as a business As an LLC, LLP, S-Corp or C-Corp, you must file an annual report, normally with your state's Secretary of State. This applies no matter how big or small your business is. Typically, sole proprietors and partnerships do not have to file an annual report.

After a certain amount of time past the due date, if the report still isn't filed, the jurisdiction will revoke your company's good standing or put it into a forfeited status.Most states require the past due annual report as well as an additional certificate of reinstatement and more fees.

For many businesses, filing annual reports is among them. If you operate your business as an LLC or corporation (depending on the state in which your company is registered), you may need to publish an annual report to keep in good standing with the state.

Visit the FastTrack Business Entity Search Station. http://web.sos.ky.gov/ftsearch/ Search Your LLC Name. Browse the Results.

Annual reports became a regulatory requirement for public companies following the stock market crash of 1929, when lawmakers mandated standardized corporate financial reporting. The intent of the required annual report is to provide public disclosure of a company's operating and financial activities over the past year.

Annual reports are entity information updates due to the secretary of state each year. LLCs, corporations, and nonprofits are required to file annual reports to maintain good standing. Due dates, filing fees, and forms vary greatly by entity type and whether the entity is domestic or foreign to the state.

In Florida, an annual report is a regular filing that your LLC must complete every year. An annual report is essentially updating your registered agent address and paying a $138.75 fee. All LLCs are required to file their annual report with the Florida Department of State.

Gives information on the company's financial position. Introduce you're the key members of the business to stakeholders and the general public. Tells shareholders and employees the company's strategy for growth in the coming year. Useful as a decision-making tool for managers.