Kansas Assignment of Overriding Royalty Interest (No Proportionate Reduction)

Description

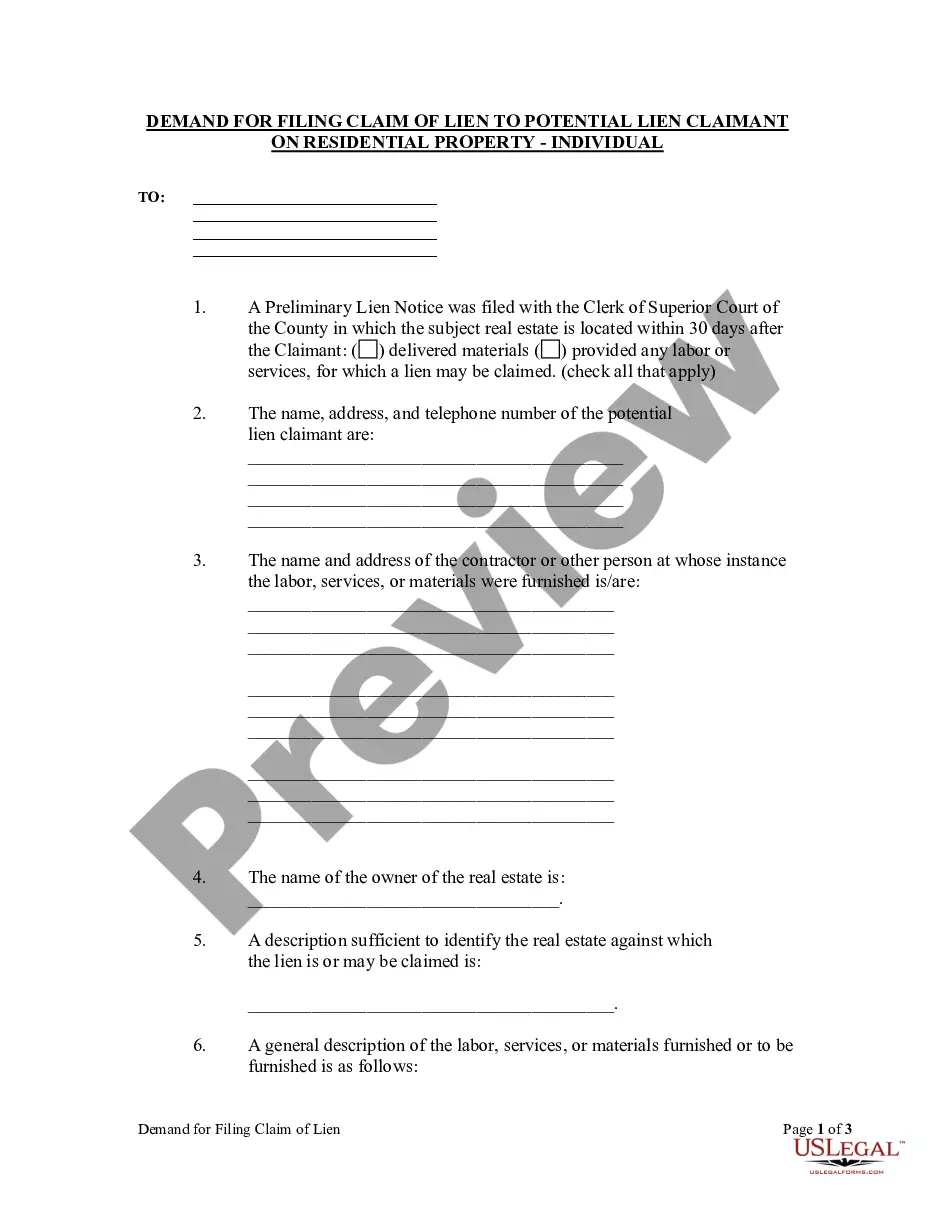

How to fill out Assignment Of Overriding Royalty Interest (No Proportionate Reduction)?

If you have to full, obtain, or printing legal document web templates, use US Legal Forms, the most important collection of legal types, that can be found online. Utilize the site`s simple and hassle-free lookup to get the documents you want. A variety of web templates for organization and specific purposes are sorted by groups and suggests, or search phrases. Use US Legal Forms to get the Kansas Assignment of Overriding Royalty Interest (No Proportionate Reduction) with a handful of clicks.

Should you be presently a US Legal Forms client, log in in your account and then click the Acquire key to have the Kansas Assignment of Overriding Royalty Interest (No Proportionate Reduction). You may also accessibility types you formerly delivered electronically from the My Forms tab of the account.

If you use US Legal Forms the very first time, follow the instructions below:

- Step 1. Ensure you have chosen the form to the appropriate area/country.

- Step 2. Make use of the Review method to look over the form`s content material. Do not neglect to read through the description.

- Step 3. Should you be not happy together with the form, utilize the Look for industry towards the top of the monitor to discover other models from the legal form format.

- Step 4. Once you have located the form you want, select the Acquire now key. Opt for the prices plan you prefer and put your accreditations to sign up on an account.

- Step 5. Method the deal. You may use your bank card or PayPal account to accomplish the deal.

- Step 6. Select the format from the legal form and obtain it on your own system.

- Step 7. Total, revise and printing or indication the Kansas Assignment of Overriding Royalty Interest (No Proportionate Reduction).

Every single legal document format you purchase is the one you have permanently. You might have acces to every form you delivered electronically with your acccount. Click the My Forms area and pick a form to printing or obtain yet again.

Contend and obtain, and printing the Kansas Assignment of Overriding Royalty Interest (No Proportionate Reduction) with US Legal Forms. There are many specialist and condition-particular types you can use for your personal organization or specific demands.

Form popularity

FAQ

Calculating Overriding Royalty Interest An ORRI is a straight percentage. For example, a 2% override would appear on the royalty statement as 0.02 interest in the proceeds from the sale of the leased hydrocarbons.

You may convey overriding royalty interest on either an Assignment of Record Title Interest (Form 3000-3), a Transfer of Operating Rights (Form 3000-3a), or on a private assignment. We only require filing of one signed copy per assignment plus a nonrefundable filing fee found at 43 CFR 3000.12.

An overriding royalty interest (ORRI) is an undivided interest in a mineral lease giving the holder the right to a proportional share (receive revenue) of the sale of oil and gas produced. The ORRI is carved out of the working interest or lease.

Overriding royalty interest: Unlike mineral and royalty interests, an overriding royalty interest runs with a lease and not with the land. Therefore, they only remain in effect for as long as a lease is in effect and they expire when a lease expires.

ORRIs are created out of the working interest in a property and do not affect mineral owners. An overriding royalty interest (ORRI) is often kept or assigned to a geologist, landman, brokerage, or any entity that was able to reserve an interest in the properties.

An overriding royalty interest (ORRI) is an undivided interest in a mineral lease giving the holder the right to a proportional share (receive revenue) of the sale of oil and gas produced. The ORRI is carved out of the working interest or lease.

Overriding Royalty Interest Conveyance means an assignment, in form and substance acceptable to Lender, pursuant to which Borrower grants in favor of Lender an overriding royalty interest equal to six and one-fourth percent (6.25%) of Hydrocarbons produced, saved and sold or used off the premises of the relevant Lease, ...