This lease rider form may be used when you are involved in a lease transaction, and have made the decision to utilize the form of Oil and Gas Lease presented to you by the Lessee, and you want to include additional provisions to that Lease form to address specific concerns you may have, or place limitations on the rights granted the Lessee in the “standard” lease form.

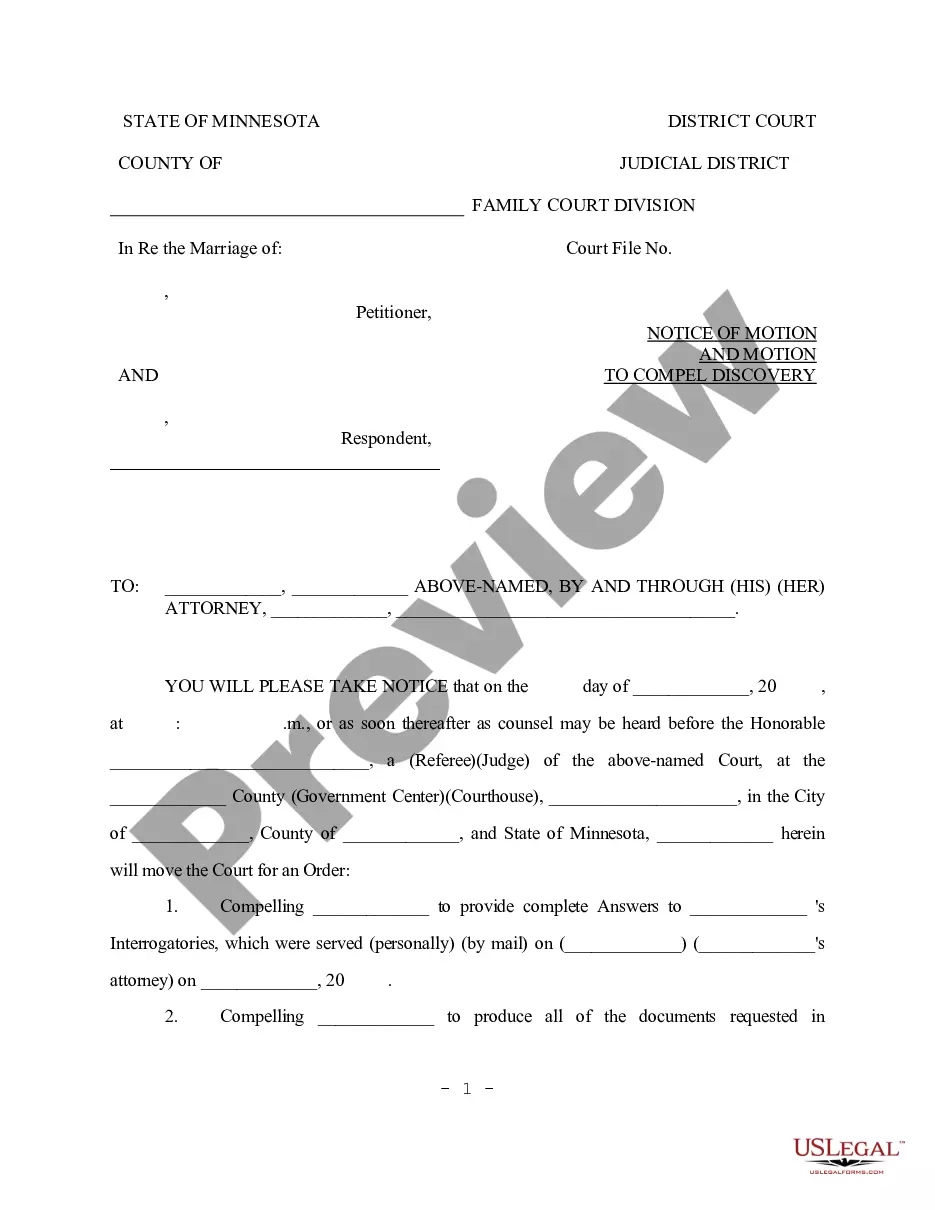

Kansas Reservation of Additional Interests in Production

Description

How to fill out Reservation Of Additional Interests In Production?

US Legal Forms - one of several largest libraries of lawful forms in America - provides a variety of lawful papers layouts you are able to download or print. While using site, you can get a huge number of forms for organization and personal uses, categorized by classes, suggests, or keywords and phrases.You will discover the latest types of forms like the Kansas Reservation of Additional Interests in Production in seconds.

If you have a registration, log in and download Kansas Reservation of Additional Interests in Production through the US Legal Forms local library. The Download button will show up on every form you look at. You have accessibility to all earlier saved forms within the My Forms tab of the accounts.

If you would like use US Legal Forms the very first time, allow me to share simple instructions to help you get began:

- Ensure you have chosen the right form for your personal city/state. Go through the Preview button to check the form`s information. Look at the form description to actually have selected the proper form.

- In case the form does not suit your requirements, take advantage of the Look for area on top of the monitor to get the one that does.

- In case you are satisfied with the shape, confirm your decision by clicking the Get now button. Then, opt for the pricing program you prefer and provide your credentials to register on an accounts.

- Process the deal. Make use of credit card or PayPal accounts to accomplish the deal.

- Choose the structure and download the shape on your product.

- Make adjustments. Fill up, modify and print and indicator the saved Kansas Reservation of Additional Interests in Production.

Each and every template you included with your money does not have an expiration time and is your own permanently. So, if you would like download or print an additional copy, just proceed to the My Forms segment and then click in the form you want.

Obtain access to the Kansas Reservation of Additional Interests in Production with US Legal Forms, one of the most substantial local library of lawful papers layouts. Use a huge number of specialist and state-distinct layouts that satisfy your business or personal demands and requirements.

Form popularity

FAQ

The Business Personal Property Division appraises all business' tangible personal property, also known as commercial and industrial machinery and equipment. Article 11, Section 1 of the Kansas Constitution establishes that these assets are assessed at 25 percent of their appraised value.

To register a foreign LLC in Kansas, you must file an Application for Registration of Foreign Covered Entity with the Kansas Secretary of State. You can submit this document by mail, fax, or in person. The application costs $165 to file. (Add $20 if filing by fax.)

You may itemize your deductions on your Kansas Return even if you did not itemize your deductions on your federal return. Kansas instructions state "you may choose to itemize your deductions or claim the standard deduction on your Kansas return whichever is to your advantage".

The assessment rate for individual personal property is 30% of the appraised value, except for truck beds, which are on schedule 5 at 25% of the appraised value. Individual Personal Property | Sedgwick County, Kansas Sedgwick County ? appraiser ? individ... Sedgwick County ? appraiser ? individ...

The assessment rate for individual personal property is 30% of the appraised value, except for truck beds, which are on schedule 5 at 25% of the appraised value. Manufactured housing is assessed at 11.5% of the appraised value.