Kansas Acquisition Worksheet

Description

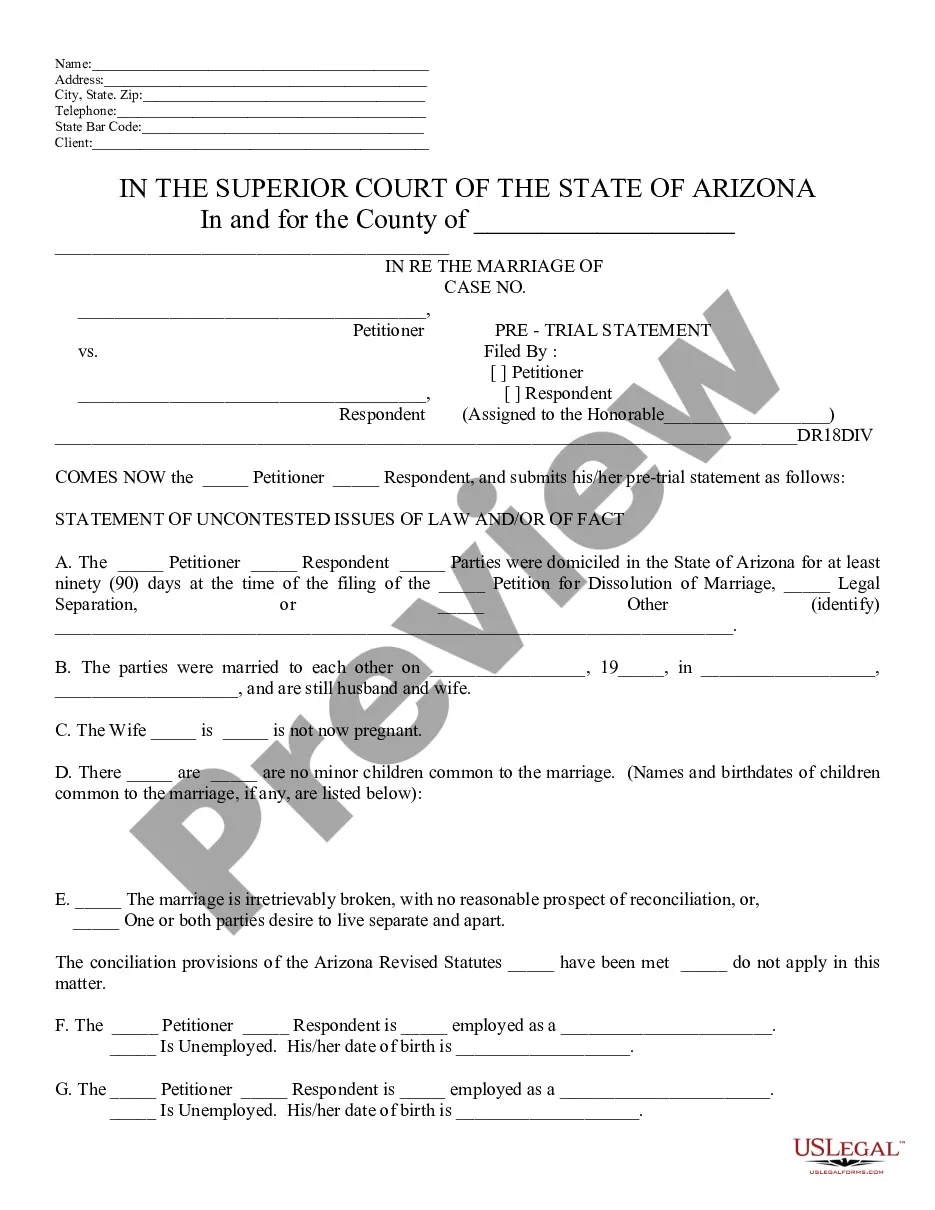

How to fill out Acquisition Worksheet?

If you need to comprehensive, acquire, or print legal document themes, use US Legal Forms, the largest assortment of legal types, that can be found on-line. Make use of the site`s easy and practical research to obtain the papers you need. Numerous themes for organization and person reasons are sorted by categories and says, or keywords and phrases. Use US Legal Forms to obtain the Kansas Acquisition Worksheet with a few click throughs.

Should you be currently a US Legal Forms consumer, log in to the profile and then click the Down load switch to obtain the Kansas Acquisition Worksheet. Also you can entry types you formerly downloaded in the My Forms tab of your respective profile.

If you use US Legal Forms the very first time, refer to the instructions beneath:

- Step 1. Be sure you have selected the shape for the appropriate city/region.

- Step 2. Make use of the Preview method to look over the form`s articles. Don`t neglect to read through the outline.

- Step 3. Should you be not happy using the kind, make use of the Research industry at the top of the monitor to find other versions of your legal kind template.

- Step 4. When you have discovered the shape you need, go through the Purchase now switch. Pick the costs prepare you choose and put your accreditations to sign up for an profile.

- Step 5. Approach the purchase. You may use your charge card or PayPal profile to complete the purchase.

- Step 6. Choose the format of your legal kind and acquire it on the system.

- Step 7. Total, revise and print or signal the Kansas Acquisition Worksheet.

Each legal document template you get is the one you have eternally. You possess acces to every kind you downloaded in your acccount. Click the My Forms area and choose a kind to print or acquire again.

Be competitive and acquire, and print the Kansas Acquisition Worksheet with US Legal Forms. There are millions of professional and state-particular types you may use for your organization or person requirements.

Form popularity

FAQ

You will pay property tax when you initially register a vehicle and each year when you renew your vehicle registration. Use the Kansas Department of Revenue Vehicle Property Tax Calculator to estimate vehicle property tax by make/model/year, VIN or RV weight/year, for a partial or full registration year.

Did you purchase a new or used boat from a Dealer? You must pay sales tax before registering your boat. If you bought your boat from an out of state dealer, take your invoice or bill of sale to the County Treasurer's Office in the county you plan to store your boat to receive a Sales Tax Paid receipt.

The assessment rate for individual personal property is 30% of the appraised value, except for truck beds, which are on schedule 5 at 25% of the appraised value. Manufactured housing is assessed at 11.5% of the appraised value.

How are business personal property taxes calculated in Kansas? To determine property tax on business personal property, the appraised value is multiplied by the appropriate percentage established in Article 11, Section 1 of the Kansas Constitution to determine the assessed value.

You may not be required to pay California use tax if the only use of the vessel in California is to remove it from the state and it will be used solely thereafter outside this state. This exclusion only applies to a purchase that would otherwise be subject to use tax.

* 30% is the assessment rate for property in the ?motor vehicle? or ?other? subclass of personal property. ** 133.046 is the 2021 statewide average mill levy. Contact the county clerk in the county where the property is taxed for the correct mill levy to use.

Boats, boat trailers, boat motors, personal watercraft and all other watercraft are reported on schedule 7 at the rate of 5% of the appraised value.

Watercraft is appraised at market value using guides and publications as prescribed by the State of Kansas Property Valuation Department. The assessment rate is 5%. Business Equipment and Machinery is taxed based on cost. A taxing factor is applied to the Retail Cost New Price to determine appraised value.

Personal Exemptions Wearing apparel of every person, pick-up truck shells, sailboards, etc. Land used exclusively as graveyards. All real property upon which surface mining operations were conducted prior to January 1, 1969, but which has been reclaimed and returned to productive use. Exemption is for 5 years.

Pre- acquisition entries are required to eliminate the carrying amount of parent investments and subsidiary against the pre - acquisition equity of that subsidiary and also the transaction between the entities within the group.