Kansas Statement to Add to Credit Report

Description

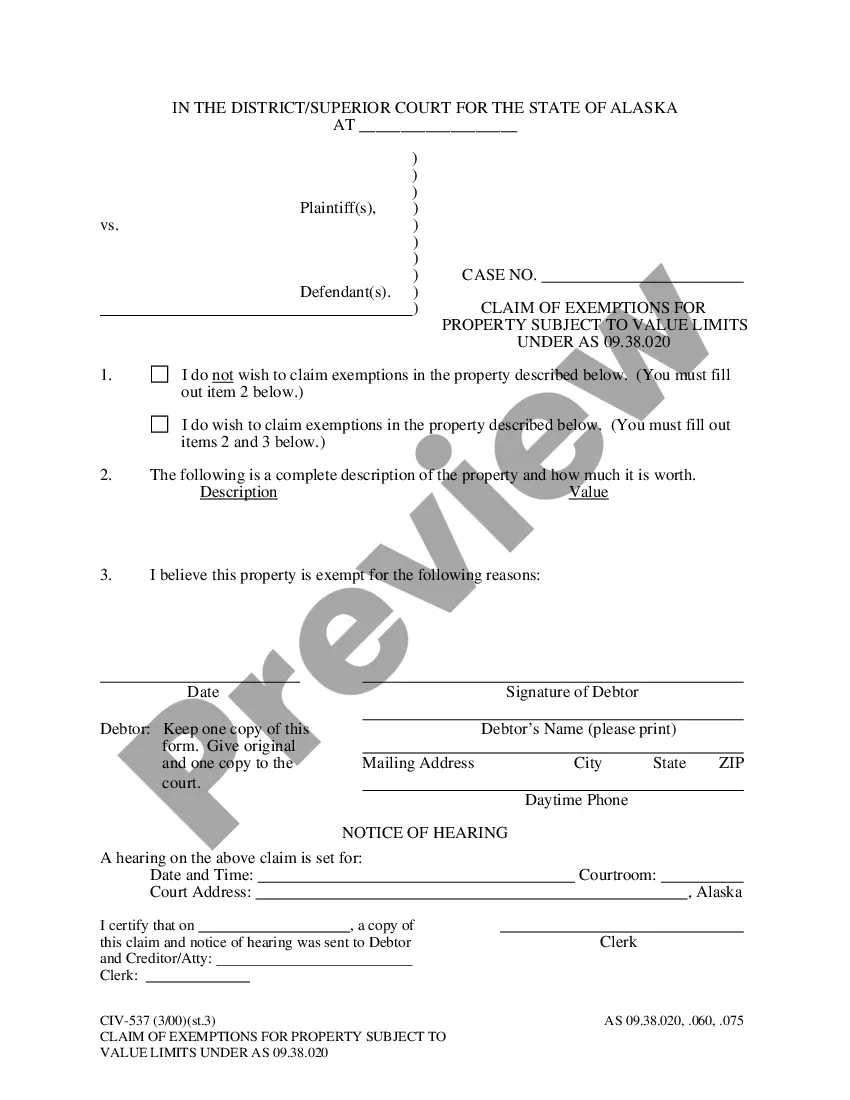

How to fill out Statement To Add To Credit Report?

It is feasible to spend hours online attempting to locate the sanctioned document template that meets the state and federal requirements you need.

US Legal Forms provides thousands of legal forms that are reviewed by experts.

It is easy to obtain or print the Kansas Statement to Add to Credit Report from our services.

- If you possess a US Legal Forms account, you may Log In and then click the Acquire button.

- Afterward, you may complete, edit, print, or sign the Kansas Statement to Add to Credit Report.

- Each legal document template you purchase is yours indefinitely.

- To obtain another copy of the purchased form, navigate to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, confirm that you have selected the correct document template for the region/town you choose.

- Review the form outline to ensure you have selected the right form.

- If available, utilize the Review button to examine the document template as well.

- If you wish to obtain another version of the form, use the Search field to locate the template that meets your needs.

- Once you have found the template you desire, click on Get now to proceed.

- Choose the pricing plan you prefer, enter your details, and register for an account on US Legal Forms.

- Complete the transaction.

- You can use your Visa or Mastercard or PayPal account to pay for the legal form.

- Select the format of the document and download it to your device.

- Make alterations to your document if possible.

- You can complete, edit, sign, and print the Kansas Statement to Add to Credit Report.

- Download and print thousands of document templates using the US Legal Forms site, which offers the largest selection of legal forms.

- Utilize professional and state-specific templates to address your business or personal requirements.

Form popularity

FAQ

Building your credit from 500 to 700 requires consistent effort and time, typically taking several months to a few years. Focus on making timely payments, reducing your debt, and using credit responsibly. Integrate a Kansas Statement to Add to Credit Report to address any negative remarks that may impact your score. With dedication and smart financial practices, you can achieve your goal and improve your credit profile.

To add a statement to your credit report, you first need to contact the credit bureau that holds your report. Provide a clear and concise statement explaining your situation, which can include a Kansas Statement to Add to Credit Report to clarify any negative marks. The bureau will review your request and, if approved, include your statement in your credit file. This process can enhance your credit profile by providing context to lenders.

Improving your credit score significantly in a short time is possible with focused strategies. Start by paying down outstanding debts, especially high credit card balances. Additionally, ensure you dispute any inaccuracies on your report, which includes utilizing a Kansas Statement to Add to Credit Report if necessary. By actively managing your credit utilization and payment history, you can see a notable boost in your score.

To raise your credit score by 200 points in 30 days, start by checking your credit report for errors. Disputing inaccuracies can quickly improve your score. Additionally, consider using a Kansas Statement to Add to Credit Report, which can provide context for late payments or other negative marks. Finally, reduce your credit utilization by paying down debts and keeping credit card balances low to boost your score effectively.

Putting a freeze on your credit can be a good idea if you are concerned about identity theft. A freeze restricts access to your credit report, making it more difficult for fraudsters to open accounts in your name. However, keep in mind that if you need to apply for credit, you will need to temporarily lift the freeze, so weigh your options carefully.

Yes, you can include a statement on your credit report, and it is often limited to around 100 words. This brief statement allows you to clarify any issues or provide context about your credit history. Using a Kansas Statement to Add to Credit Report ensures that your message is conveyed effectively and may help improve your creditworthiness.

To add something to your credit report, you typically need to work with the credit reporting agency. This involves submitting your request along with any necessary documentation. If you are adding a Kansas Statement to Add to Credit Report, ensure that your explanation is clear and relevant, as this can positively affect how creditors perceive your history.

Achieving an 800 credit score in 45 days requires strategic actions. Focus on paying down existing debts, making timely payments, and reducing your credit utilization ratio. Additionally, consider adding a Kansas Statement to Add to Credit Report to clarify any past issues that may influence your score positively.

To add a statement to your credit report, you need to contact the credit reporting agencies directly. You can submit your statement in writing, making sure to include your personal information and the specific details you want to add. Using a Kansas Statement to Add to Credit Report can streamline this process, ensuring that your message is clear and concise.

Yes, you can add a statement to your credit report. This feature allows you to explain any discrepancies or highlight important information. By using a Kansas Statement to Add to Credit Report, you can provide context about your credit history, which may help lenders understand your situation better.