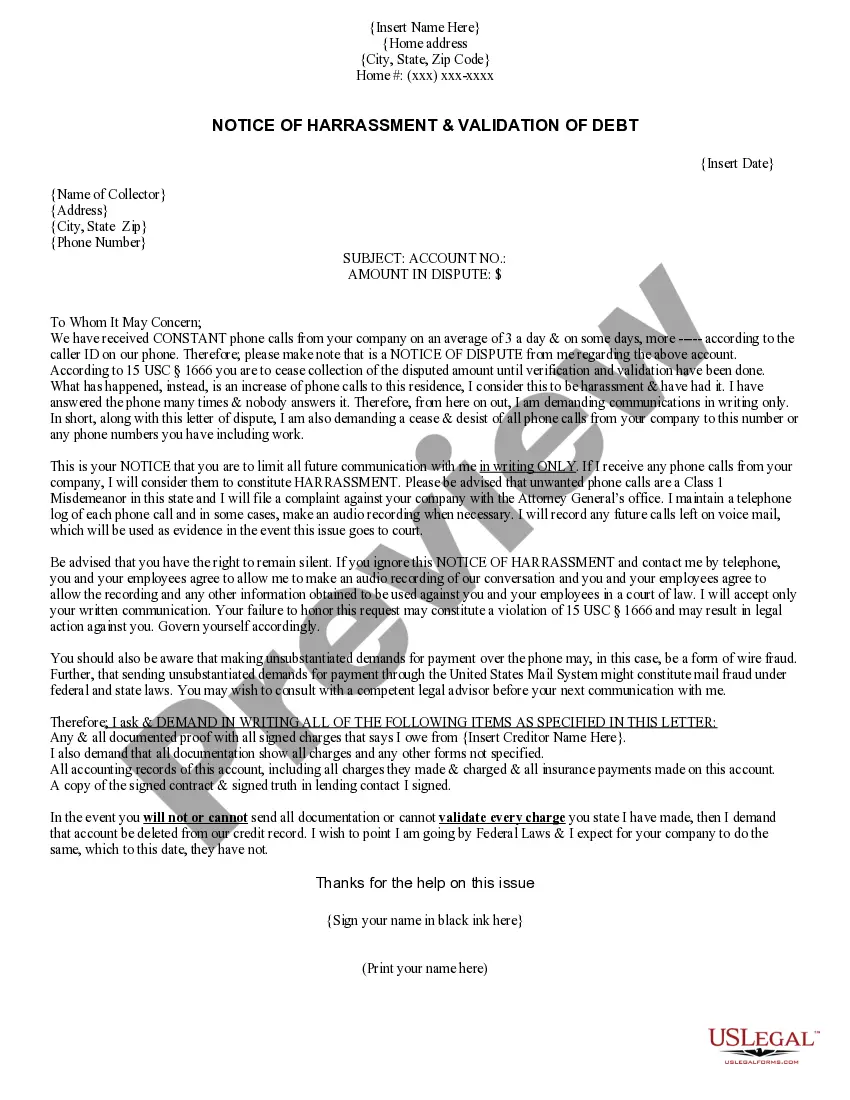

This NOTICE OF HARRASSMENT & VALIDATION OF DEBT is to be used when creditors call you repeatedly and mail you letters too. This form includes a cease and desist and a validation of debt, 2 letters in one.

Kansas Notice of Harassment and Validation of Debt

Description

How to fill out Notice Of Harassment And Validation Of Debt?

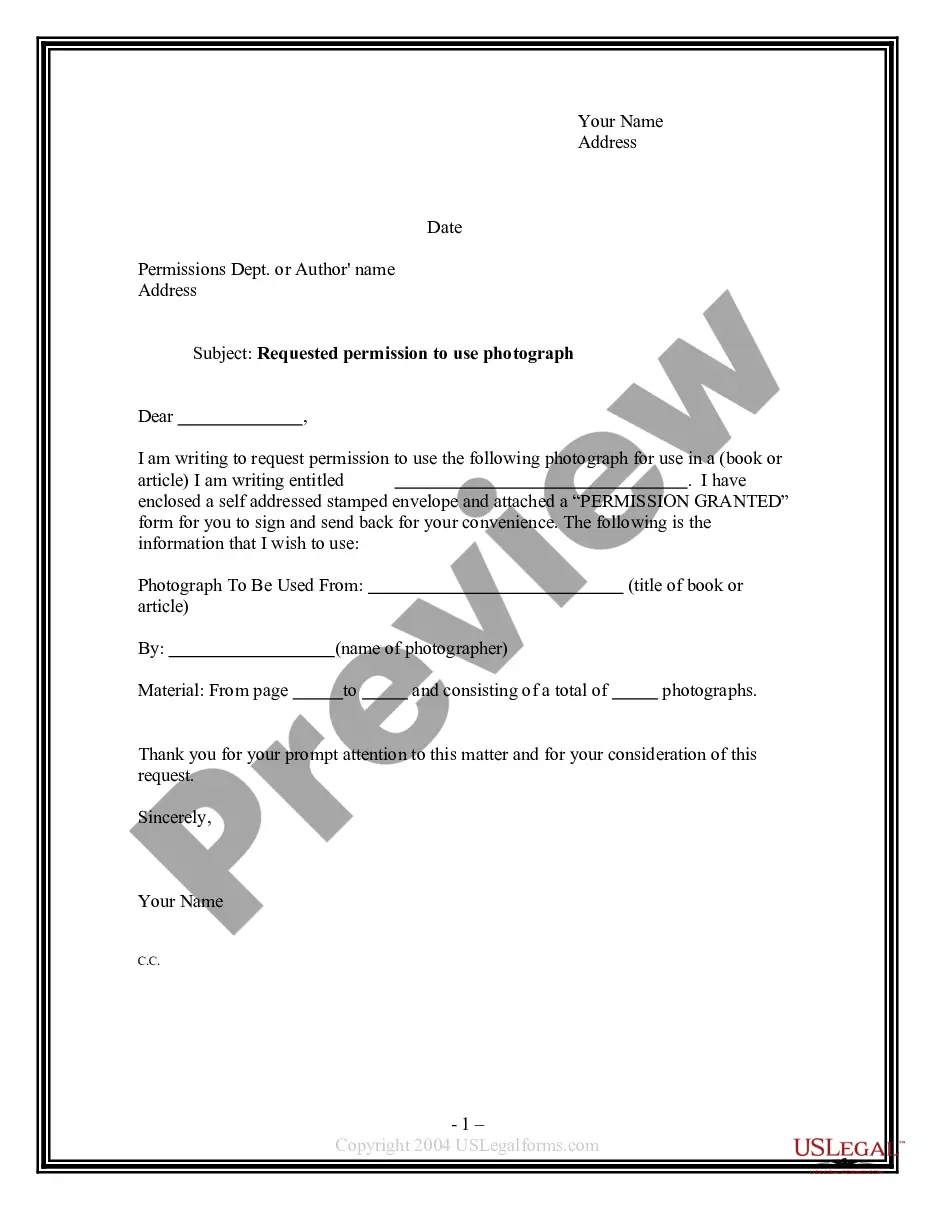

You can spend numerous hours online searching for the legal document template that meets the state and federal requirements you desire.

US Legal Forms offers a vast array of legal forms that are reviewed by experts.

You can easily download or print the Kansas Notice of Harassment and Validation of Debt from my services.

If available, use the Review button to view the document template as well. If you want to obtain another version of the form, use the Lookup field to find the template that fits you and your needs. Once you have found the template you want, click Purchase now to proceed. Select the pricing plan you prefer, enter your credentials, and create an account on US Legal Forms. Complete the transaction. You can use your credit card or PayPal account to purchase the legal document. Choose the format of the document and download it to your device. Make changes to the document if necessary. You can fill out, edit, sign, and print the Kansas Notice of Harassment and Validation of Debt. Access and print a wide variety of document templates using the US Legal Forms website, which offers the largest collection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you already have a US Legal Forms account, you can Log In and click on the Acquire button.

- Then, you can fill out, modify, print, or sign the Kansas Notice of Harassment and Validation of Debt.

- Each legal document template you obtain is yours permanently.

- To get another copy of the acquired form, go to the My documents tab and click on the relevant button.

- If you are visiting the US Legal Forms website for the first time, follow the simple instructions below.

- First, make sure you have selected the correct document template for the region/area you choose.

- Review the form details to ensure you have selected the right form.

Form popularity

FAQ

The 11-word phrase to stop debt collectors is: 'I do not owe this debt, please cease all communication.' This phrase can invoke your rights under the Kansas Notice of Harassment and Validation of Debt. Use this statement when communicating with collectors to assert your position. However, it is advisable to follow up with a formal letter for clarity and documentation.

An example of a debt validation letter includes your personal details, the creditor's name, and a clear statement that you dispute the debt. Reference the Kansas Notice of Harassment and Validation of Debt to add credibility to your request. The letter should include a request for documentation proving the debt and state your intention to cease communication until validation is received. Using a template from US Legal Forms can simplify this process.

To prepare a debt validation letter, start by stating your name and address, followed by the creditor's information. Clearly request validation of the debt, citing the Kansas Notice of Harassment and Validation of Debt for authority. Include a deadline for the creditor to respond and keep a copy for your records. This proactive step can help you manage disputes effectively.

Filling out a debt validation letter involves providing your personal information, the creditor's details, and a clear request for validation of the debt. It's essential to reference the Kansas Notice of Harassment and Validation of Debt to support your request. Be sure to state that you are disputing the debt and ask for documentation that proves the debt is valid. This letter can help protect your rights and clarify your obligations.

To effectively answer a summons for debt collection in Kansas, first read the summons carefully, noting the deadlines. Your response must be filed with the court and sent to the creditor. You can use the Kansas Notice of Harassment and Validation of Debt to help structure your answer, ensuring you include any defenses or disputes regarding the debt. A well-prepared response can potentially stop the collection process.

You can report harassment from debt collectors to the Federal Trade Commission and your state’s attorney general. These agencies take complaints seriously and can take action against violators. Additionally, documenting your experiences and referencing the Kansas Notice of Harassment and Validation of Debt can strengthen your case. Consider using platforms like uslegalforms for guidance and resources as you navigate this process.

To file a debt validation claim, start by sending a written request to the debt collector asking for detailed documentation of the debt. In your request, reference the Kansas Notice of Harassment and Validation of Debt, which outlines your rights. Be clear and concise in your communication, and keep copies of all correspondence. After you file, the collector must cease collection efforts until they provide the requested validation.

Yes, debt validation is a good idea, as it allows you to verify that a debt is legitimate before making any payments. By requesting validation, you can ensure that the debt collector has the proper documentation to support their claim. Utilizing the Kansas Notice of Harassment and Validation of Debt can empower you in this process. This step helps protect you from potential scams and ensures you are only paying valid debts.

If you experience harassment from a debt collector, you can file a complaint with the Consumer Financial Protection Bureau and your state’s attorney general. It is essential to document all interactions and maintain records of any Kansas Notice of Harassment and Validation of Debt you receive. Additionally, consider seeking legal advice to understand your rights and options. This proactive approach can help you address the issue effectively.

To dispute the validity of a debt, you should send a written request to the debt collector asking for proof of the debt. This request can include your Kansas Notice of Harassment and Validation of Debt, which protects your rights during this process. Ensure you keep a copy of your correspondence for your records. Once the debt collector receives your dispute, they must investigate and respond to you.