Kansas Self-Employed Excavation Service Contract

Description

How to fill out Self-Employed Excavation Service Contract?

Locating the appropriate authorized document template can be quite a challenge. Naturally, there are numerous templates accessible online, but how do you find the legal form you need? Utilize the US Legal Forms website. The service offers thousands of templates, including the Kansas Self-Employed Excavation Service Contract, which you can use for business and personal purposes. All of the documents are verified by professionals and comply with federal and state regulations.

If you are currently registered, Log In to your account and click on the Download button to obtain the Kansas Self-Employed Excavation Service Contract. Use your account to search through the legal documents you have previously purchased. Visit the My documents section of your account and download another copy of the document you need.

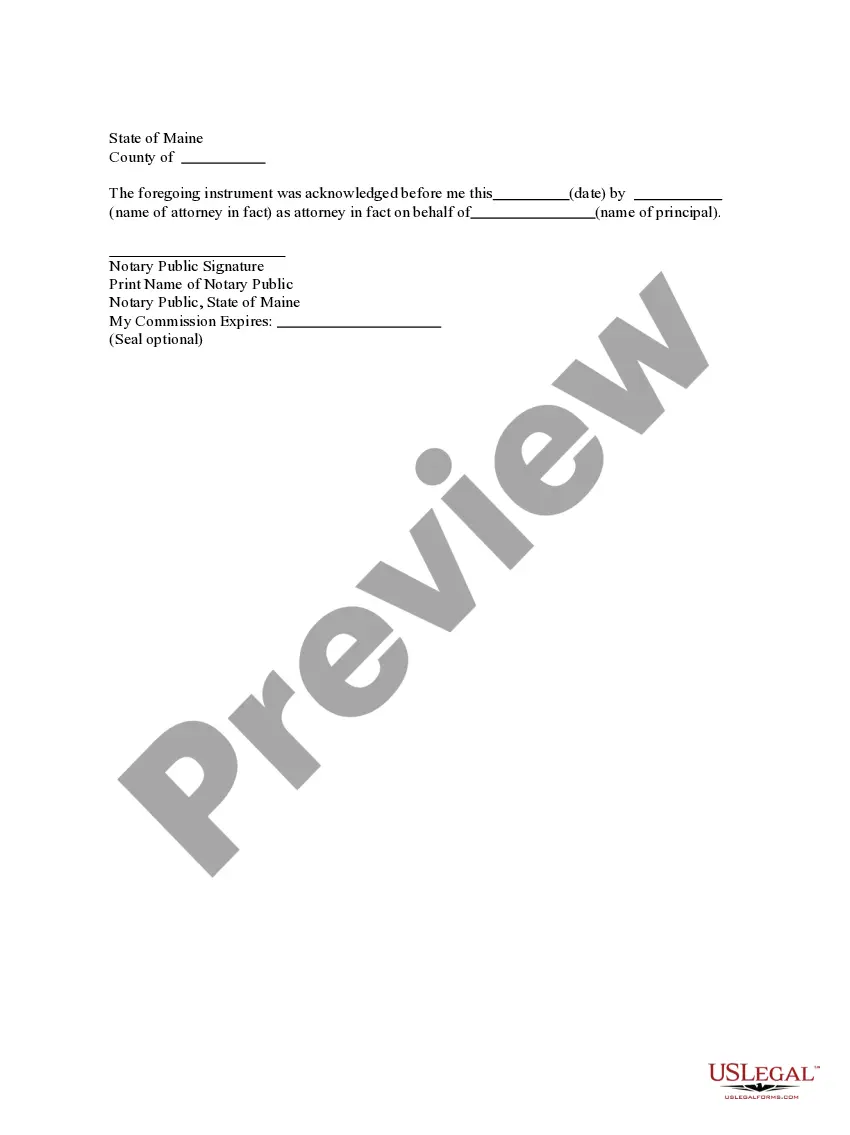

If you are a new user of US Legal Forms, here are simple steps that you should follow: First, ensure you have selected the correct document for your city/region. You can browse the form using the Preview button and review the document details to confirm this is indeed the right one for you. If the document does not meet your requirements, use the Search field to find the appropriate form. Once you are confident that the document is suitable, click on the Get now button to obtain the form. Select the pricing plan you want and enter the necessary information. Create your account and place an order using your PayPal account or Visa or Mastercard. Choose the file format and download the legal document template to your device. Complete, edit, print, and sign the downloaded Kansas Self-Employed Excavation Service Contract.

Take advantage of US Legal Forms to simplify your legal documentation needs and ensure you have the right forms at your disposal.

- US Legal Forms is the largest collection of legal documents available.

- Utilize the service to acquire professionally-crafted paperwork that meet state regulations.

- Explore various document templates for your needs.

- Access a wide range of forms for multiple purposes.

- Ensure compliance with all necessary legal standards.

- Streamline your document acquisition process.

Form popularity

FAQ

A contractor does not have to have an LLC, but it is often recommended for those serious about their business. An LLC can shield you from personal liability, which is especially important in the excavation industry due to the potential risks involved. When you take on a Kansas Self-Employed Excavation Service Contract, forming an LLC can offer peace of mind and professional standing. For guidance on establishing an LLC, uslegalforms can provide valuable resources.

Choosing between an LLC and operating as an independent contractor depends on your business goals and risk tolerance. An LLC can provide liability protection and potential tax advantages, while being an independent contractor offers simplicity in management. If you plan to engage in a Kansas Self-Employed Excavation Service Contract, having an LLC could enhance your credibility and protect your personal assets. You can find resources and support for this decision on uslegalforms.

You do not necessarily need an LLC to operate as a contractor, but forming one can offer significant benefits. An LLC can provide personal liability protection, separating your personal assets from your business liabilities. If you are engaged in a Kansas Self-Employed Excavation Service Contract, having an LLC may provide you with added security and professionalism. You might consider exploring the options available on uslegalforms to help establish your business.

In many states, including Arkansas, some minor home repairs and maintenance tasks can be performed without a contractor's license. However, excavation work typically requires proper licensing to ensure safety and compliance with local regulations. When you draft a Kansas Self-Employed Excavation Service Contract, it is wise to confirm which tasks fall under licensed activities. For clarity and legal assurance, consulting uslegalforms can be very helpful.

While Arkansas has specific regulations regarding contractor licenses, it is essential to note that the requirements can vary based on the type of work and the location. For excavation services, you may not need a license in certain areas, but having one can enhance your credibility and protect your business. If you're considering a Kansas Self-Employed Excavation Service Contract, understanding local licensing requirements is crucial. You can find guidance on this through platforms like uslegalforms.

Whether to add tax to your invoice for services in Kansas depends on the nature of the service provided. In many cases, labor for contracts, like a Kansas Self-Employed Excavation Service Contract, may not be taxable, but materials might be. It's important to consult with a tax professional or utilize resources like uslegalforms to clarify your invoicing practices.

To become a contractor in Kansas, you must meet various requirements, including age, experience, and education. Typically, you will need to pass an exam and provide proof of insurance. For those interested in a Kansas Self-Employed Excavation Service Contract, understanding these requirements is crucial for smooth business operations.

In Kansas, construction labor is generally not subject to sales tax if it is part of a service contract. However, certain materials or supplies used during the project may be taxable. When drafting a Kansas Self-Employed Excavation Service Contract, you should clearly outline what is taxable to ensure transparency and compliance with tax regulations.

The timeline for obtaining a contractor's license in Kansas can vary, typically taking several weeks to a few months. It largely depends on the type of license you are pursuing and the completeness of your application. If you are looking to establish a Kansas Self-Employed Excavation Service Contract, starting early in the licensing process is advisable to avoid delays.

Yes, contractors in Kansas generally need to be licensed to operate legally. This requirement helps ensure that contractors meet specific standards and regulations. If you are engaging in work related to a Kansas Self-Employed Excavation Service Contract, confirming your licensing status is essential for compliance and professionalism.