Kansas Milker Services Contract - Self-Employed

Description

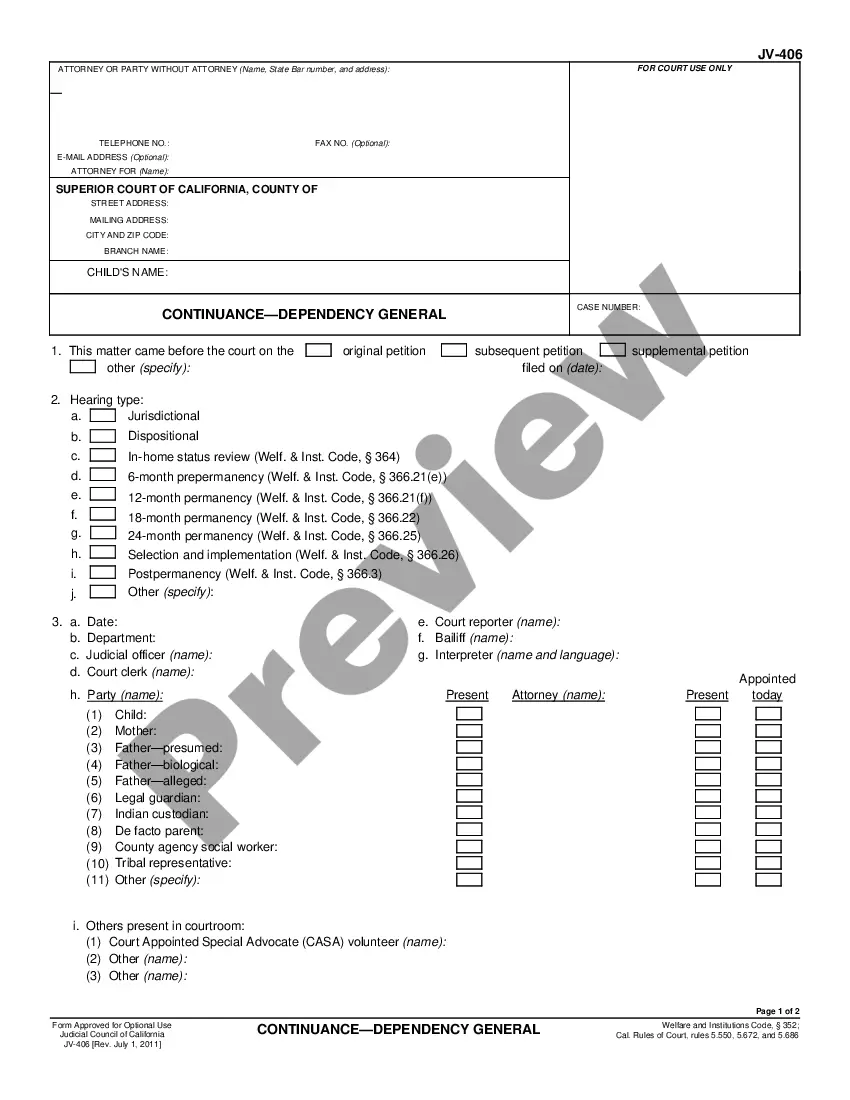

How to fill out Milker Services Contract - Self-Employed?

Are you currently in the location where you require documents for either business or personal reasons almost every working day.

There is a wide range of authentic document templates accessible on the web, but finding forms you can rely on isn’t straightforward.

US Legal Forms offers an extensive collection of form templates, including the Kansas Milker Services Contract - Self-Employed, which can be crafted to meet state and federal requirements.

When you obtain the right form, click Purchase now.

Choose the pricing option you prefer, provide the necessary information to create your account, and complete the transaction using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Next, you can download the Kansas Milker Services Contract - Self-Employed template.

- If you do not have an account and wish to begin using US Legal Forms, follow these steps.

- Locate the form you desire and ensure it is for the correct city/state.

- Use the Preview button to review the form.

- Read the description to make sure that you have selected the correct document.

- If the form isn’t what you are looking for, use the Search field to find the form that suits your needs and requirements.

Form popularity

FAQ

While freelancing without a contract is possible, it is risky and not advisable. A contract helps define the scope of work and payment terms, reducing the likelihood of disputes. A Kansas Milker Services Contract - Self-Employed can provide that necessary protection and give peace of mind as you pursue freelance opportunities.

In Kansas, an operating agreement is not legally required for an LLC, but it is highly recommended. This document outlines the management structure and operating procedures of your business. Having this agreement can clarify your responsibilities as a contractor and boost your credibility, especially when using a Kansas Milker Services Contract - Self-Employed.

Not having a contract can lead to misunderstandings and disputes regarding the work relationship. Without a written agreement, you might struggle to enforce your rights or prove your terms. Therefore, using a Kansas Milker Services Contract - Self-Employed can prevent potential issues and ensure clear communication with your clients.

The need for a license as an independent contractor varies by industry and location. In Kansas, specific services may require licensing, while others do not. Therefore, ensure that you check the requirements for your specific field and consider a Kansas Milker Services Contract - Self-Employed to navigate any legal considerations.

While it is not legally required to have a contract when you're self-employed, it is highly recommended. A contract, such as the Kansas Milker Services Contract - Self-Employed, outlines the terms of your services and safeguards your rights. It helps avoid misunderstandings and establishes professional boundaries.

Yes, you can be classified as a 1099 employee without a formal contract, but it's not advisable. A written agreement protects both parties and clarifies expectations. Utilizing a Kansas Milker Services Contract - Self-Employed can provide that clarity and serve as a reference for your business dealings.

Having an LLC provides legal protection and can help separate your personal assets from your business liabilities. However, you do not need an LLC to work as a contractor. It's crucial, though, to have a Kansas Milker Services Contract - Self-Employed that details your professional arrangements and protects your interests.

Being self-employed means you run your own business and have the freedom to choose your clients and work schedule. In contrast, a contractor usually works for another business under specific terms outlined in a contract. The Kansas Milker Services Contract - Self-Employed clarifies these terms and ensures you understand your rights and responsibilities.

Certain labor services are considered non-taxable in Kansas, including some types of agricultural services and labor. When working under a Kansas Milker Services Contract - Self-Employed, it is important to understand which of your services may qualify. To clarify these details and ensure proper tax handling, consulting resources available at USLegalForms can be very helpful.

In Kansas, not all contractors must obtain a state license. However, specific industries, including certain commercial services, may have licensing requirements. When engaging in a Kansas Milker Services Contract - Self-Employed, it is essential to verify whether your services fall under these regulations. USLegalForms can provide guidance on necessary compliance for your area of work.