Kansas Farm Hand Services Contract - Self-Employed

Description

How to fill out Farm Hand Services Contract - Self-Employed?

If you need to finish, download, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the site's user-friendly and convenient search to locate the documents you require. Numerous templates for business and personal purposes are categorized by types and states, or keywords.

Use US Legal Forms to obtain the Kansas Farm Hand Services Contract - Self-Employed in just a few clicks.

Every legal document template you purchase is yours permanently. You have access to every form you downloaded within your account. Click the My documents section and select a form to print or download again.

Be proactive and download and print the Kansas Farm Hand Services Contract - Self-Employed with US Legal Forms. There are thousands of professional and state-specific forms you can use for your business or personal needs.

- If you are already a US Legal Forms user, Log In to your account and click on the Download button to retrieve the Kansas Farm Hand Services Contract - Self-Employed.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct region/state.

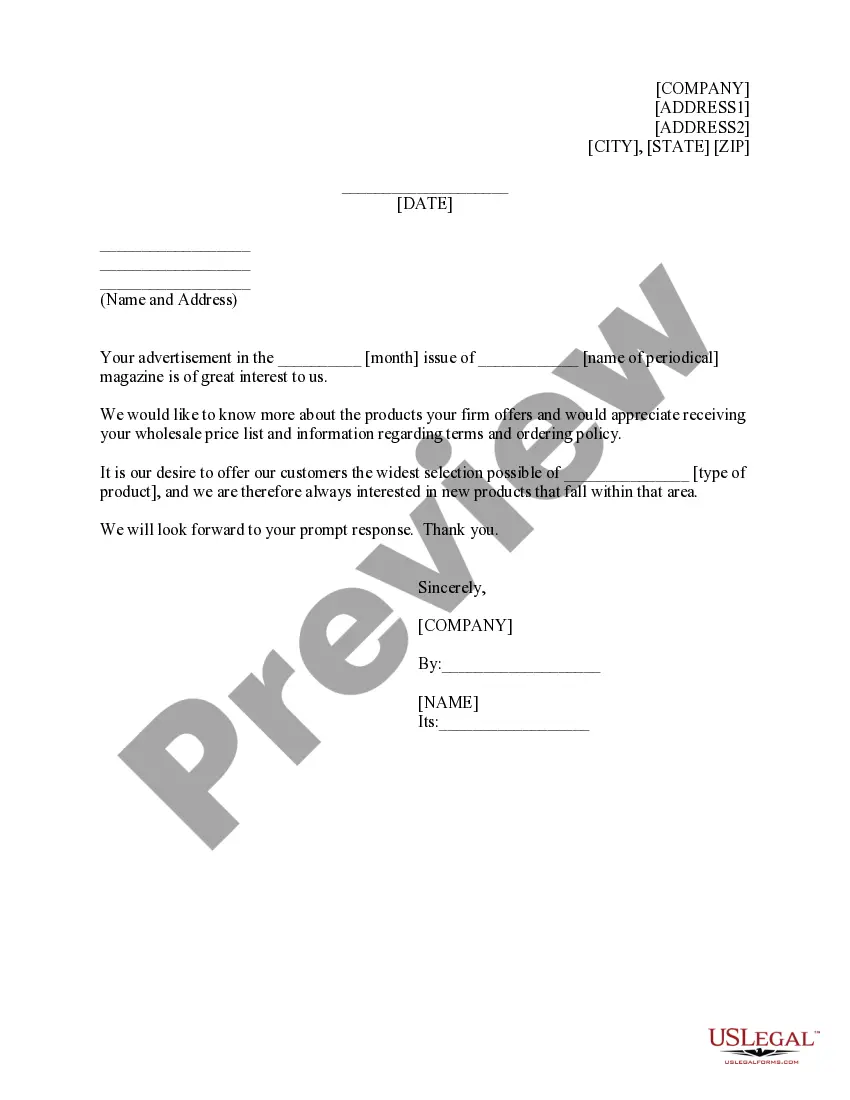

- Step 2. Utilize the Preview feature to review the form's content. Don’t forget to check the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal form template.

- Step 4. Once you have found the form you need, click on the Get now button. Choose the payment plan you prefer and enter your details to register for the account.

- Step 5. Process the payment. You can use your credit card or PayPal account to complete the transaction.

- Step 6. Select the format of the legal form and download it onto your device.

- Step 7. Fill out, modify, and print or sign the Kansas Farm Hand Services Contract - Self-Employed.

Form popularity

FAQ

Writing a self-employment contract involves several key steps. Begin by detailing the scope of services, payment details, and both parties' rights and responsibilities. You may find a Kansas Farm Hand Services Contract - Self-Employed helpful for creating a solid framework that adheres to legal standards. A well-drafted contract can protect your interests and clarify expectations from the outset.

To write a self-employed contract, start by outlining the services you provide and the terms of payment. Specify deadlines, obligations, and any other relevant conditions to avoid misunderstandings. Utilizing a Kansas Farm Hand Services Contract - Self-Employed template can simplify this process, ensuring you cover all necessary details. Clear documentation fosters professional relationships and sets mutual expectations.

Yes, you can write your own legally binding contract as long as it meets your state’s legal requirements. To ensure validity, the contract must include clear terms, signatures from both parties, and comply with local laws. A Kansas Farm Hand Services Contract - Self-Employed is an excellent reference to guide you through the process. By creating a tailored document, you can address specific needs and expectations.

You can show proof of self-employment by providing your tax return or a recent 1099 form. Additionally, keep records of your business activities, invoices, and client contracts. If you are using a Kansas Farm Hand Services Contract - Self-Employed, this document can also serve as evidence of your professional status. Maintaining organized records will make verification easier for you or anyone who requires proof.

To write a contract for a 1099 employee, focus on clearly defining the services they will provide. Include essential information such as payment terms and the scope of work. Be sure to use a Kansas Farm Hand Services Contract - Self-Employed template to ensure all legal requirements are met. Using a well-structured format will protect both parties involved.

In Kansas, numerous items are exempt from sales tax, often focusing on essential goods and services. For example, many agricultural items and services related to a Kansas Farm Hand Services Contract - Self-Employed may qualify for tax exemption. Always check local laws to ensure your understanding is up to date.

Yes, the taxability of service contracts in Kansas depends on the type of services provided. In cases related to farming, such as those in a Kansas Farm Hand Services Contract - Self-Employed, some contracts might not be taxable. It’s advisable to consult with a tax professional to clarify your specific situation.

To write off small farm expenses, start by keeping detailed records of all relevant costs. Include expenses related to your Kansas Farm Hand Services Contract - Self-Employed for the best financial management. Familiarizing yourself with the IRS guidelines on farming expenses can also assist you in maximizing your deductions.

Service charges are taxed because they are often seen as part of the total payment for services rendered. When you engage in a Kansas Farm Hand Services Contract - Self-Employed, it’s important to know that these charges can fall under taxable services if certain criteria are met. By understanding your obligations, you can avoid unexpected expenses.

In Kansas, certain labor services may not be subject to sales tax. These typically include agricultural services, such as those performed under a Kansas Farm Hand Services Contract - Self-Employed. Understanding which services you provide can help you minimize your tax burden while ensuring compliance.