Kansas Recovery Services Contract - Self-Employed

Description

How to fill out Recovery Services Contract - Self-Employed?

If you need to be thorough, acquire, or create official document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Employ the website's simple and user-friendly search to find the documents you require.

A selection of templates for business and personal purposes are categorized by types and states, or keywords. Use US Legal Forms to obtain the Kansas Recovery Services Contract - Self-Employed in just a few clicks.

Step 5. Complete the transaction. You may use your Visa or Mastercard or PayPal account to finalize the purchase.

Step 6. Choose the format of the legal form and download it to your device. Step 7. Complete, modify, and print or sign the Kansas Recovery Services Contract - Self-Employed. Every legal document template you purchase is yours forever. You will have access to every form you downloaded in your account. Visit the My documents section and select a form to print or download again. Be proactive and obtain, and print the Kansas Recovery Services Contract - Self-Employed with US Legal Forms. There are numerous professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms customer, Log In to your account and click the Download option to locate the Kansas Recovery Services Contract - Self-Employed.

- You can also access forms you have previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

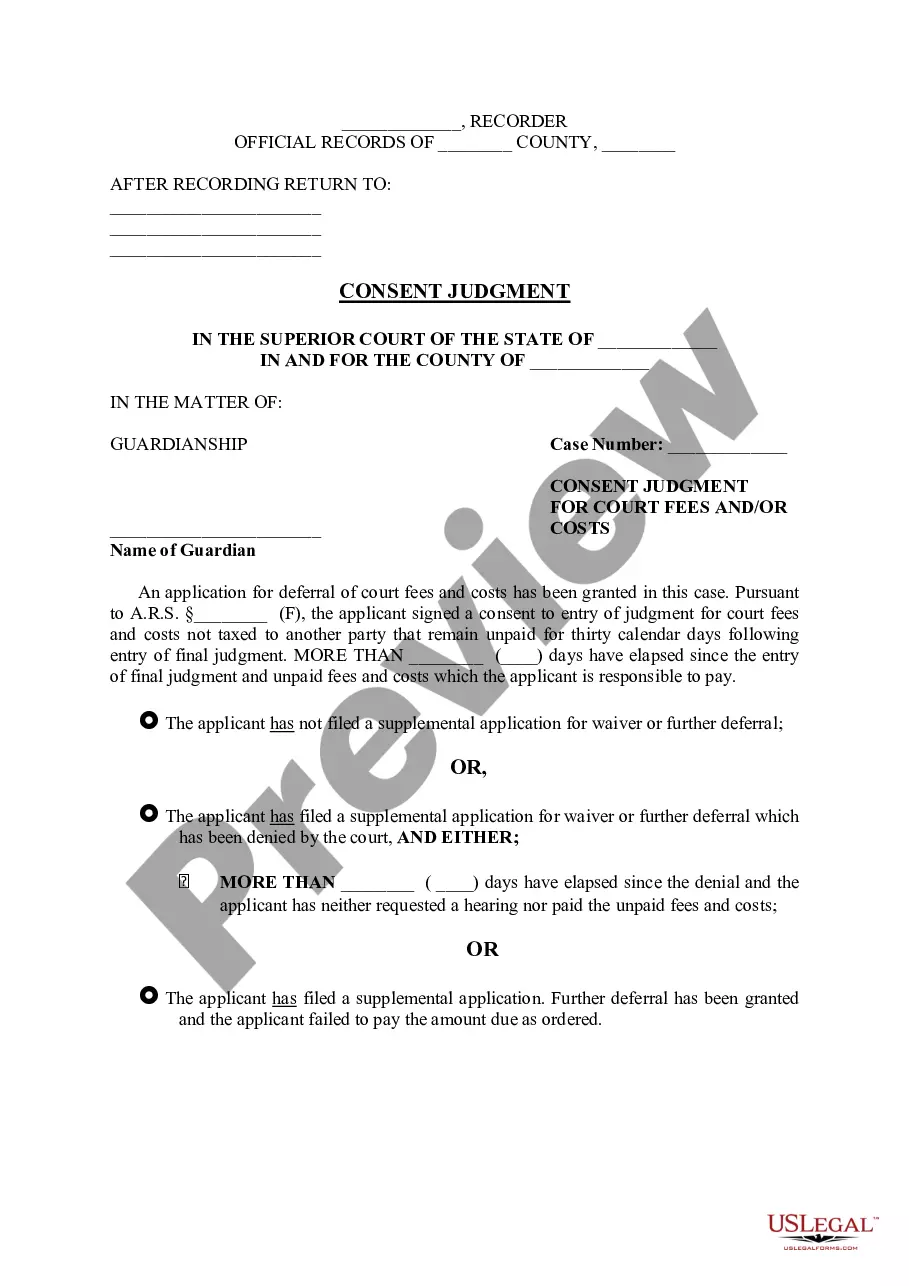

- Step 2. Use the Preview option to review the form's details. Don't forget to read the instructions.

- Step 3. If you are not satisfied with the form, utilize the Search area at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have located the form you need, select the Purchase now option. Choose the pricing plan you prefer and provide your information to register for an account.

Form popularity

FAQ

Generally, labor services are not taxable in Kansas unless they fall into specific categories, such as installations or repairs. If your work is governed by a Kansas Recovery Services Contract - Self-Employed, understanding the exact nature of your services can help clarify tax obligations. Keeping informed about applicable tax regulations will safeguard your business.

Kansas source income includes income earned from services performed within the state. If you operate under a Kansas Recovery Services Contract - Self-Employed, it’s essential to identify which portions of your income qualify as Kansas source income. This awareness impacts your tax filings and overall financial strategy.

In Kansas, handyman work can be taxable depending on the services provided. If your services relate to repairs or modifications subject to sales tax, you may need to collect it under a Kansas Recovery Services Contract - Self-Employed. This detail is essential for staying compliant and maintaining your business's financial health.

Whether you need to add tax to your invoice depends on the nature of your services. If they fall under taxable categories, you should include sales tax for a Kansas Recovery Services Contract - Self-Employed. This proactive approach ensures clarity for clients and helps you remain compliant with state tax laws.

Yes, a Kansas LLC must file a tax return if it has revenue. Even if your LLC operates under a Kansas Recovery Services Contract - Self-Employed, it is essential to meet your filing requirements on time. This action helps you maintain good standing with the state and avoid penalties while enjoying the benefits of being self-employed.

Excise tax in Kansas applies to specific services, including telecommunications and certain utilities. If you operate under a Kansas Recovery Services Contract - Self-Employed, it’s crucial to know which services you provide might incur this tax. Understanding your tax obligations ensures you remain compliant and can focus on your business.

In Kansas, repair labor is typically not subject to sales tax. However, it is important to understand the nuances of the Kansas Recovery Services Contract - Self-Employed. Certain repairs may fall under taxable services if they are part of a larger transaction involving tangible personal property. Ensuring compliance can help you avoid potential tax issues.

Yes, you can write your own legally binding contract, provided it includes all essential elements such as offer, acceptance, consideration, and mutual intent to create a legal relationship. For the Kansas Recovery Services Contract - Self-Employed, ensure clarity around obligations and expectations. Utilizing templates from trusted platforms like uslegalforms can simplify the process and ensure compliance with legal standards.

To write a self-employment contract, clarify your services, payment terms, and any specific conditions pertinent to your role. Ensure you include the relevant details aligning with the Kansas Recovery Services Contract - Self-Employed. Using a comprehensive platform like uslegalforms can guide you through constructing a contract that fulfills legal requirements while protecting your interests.

You can show proof of self-employment by providing documentation like tax returns, business licenses, or contracts such as the Kansas Recovery Services Contract - Self-Employed. It's helpful to maintain organized records of your income and expenses, as this can further substantiate your self-employed status. Confirming your business registration with local authorities may also lend additional credibility.