Kansas Acoustical Contractor Agreement - Self-Employed

Description

How to fill out Acoustical Contractor Agreement - Self-Employed?

You might spend countless hours online searching for the valid document template that satisfies the federal and state requirements you desire. US Legal Forms offers a vast selection of valid forms that are assessed by professionals.

You can conveniently download or print the Kansas Acoustical Contractor Agreement - Self-Employed from their services. If you already possess a US Legal Forms account, you can sign in and click on the Download button. After that, you can fill out, modify, print, or sign the Kansas Acoustical Contractor Agreement - Self-Employed.

Every valid document template you obtain is yours permanently. To get another copy of any purchased form, go to the My documents section and click on the relevant button.

Choose the format of the document and download it to your device. Make changes to the document if needed. You can fill out, edit, sign, and print the Kansas Acoustical Contractor Agreement - Self-Employed. Download and print countless document templates from the US Legal Forms website, which offers the largest variety of valid forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have chosen the correct document template for your area/town of preference. Review the form description to confirm you have selected the right template.

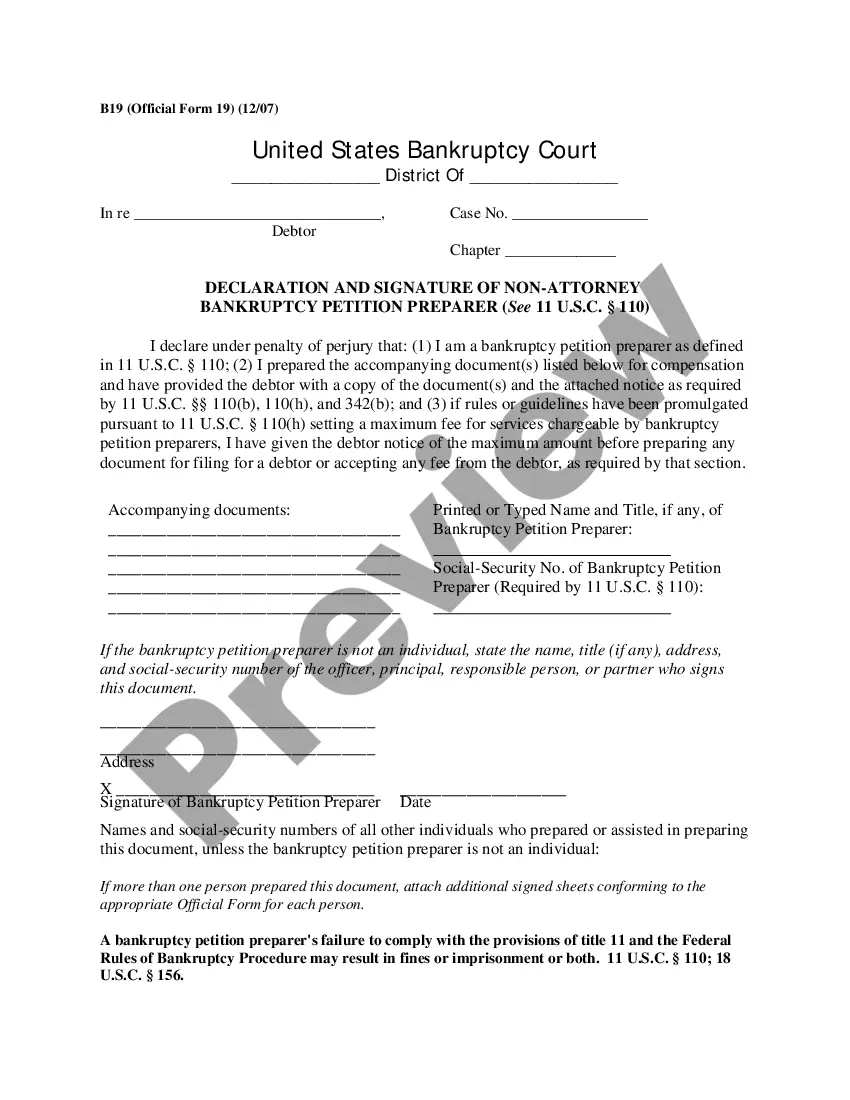

- If available, utilize the Preview button to view the document template as well.

- If you wish to find another version of the template, use the Lookup section to locate the template that suits your requirements.

- Once you have found the template you need, click Acquire now to proceed.

- Select the pricing plan you prefer, enter your credentials, and register for an account on US Legal Forms.

- Complete the transaction. You can use your credit card or PayPal account to pay for the valid form.

Form popularity

FAQ

To file taxes as an independent contractor, keep track of your income and expenses throughout the year. You will report your earnings using Schedule C on your tax return, so it’s vital to maintain thorough records. Make sure to consider all deductions applicable to the Kansas Acoustical Contractor Agreement - Self-Employed in order to optimize your tax obligations.

Writing an independent contractor agreement requires a clear outline of the terms. Start with the basic details such as the names of the parties involved and the services provided. Include aspects like payment rates and timelines, while ensuring that your agreement reflects the nuances of the Kansas Acoustical Contractor Agreement - Self-Employed for precision and compliance.

Filling out an independent contractor agreement involves outlining your services, payment structure, and the duration of the contract. Be sure to incorporate specific details that adhere to the Kansas Acoustical Contractor Agreement - Self-Employed framework to ensure clarity and legality. After completion, both parties should review and sign the document to solidify the agreement.

Setting up as a self-employed contractor entails several steps. Begin by registering your business name and obtaining any necessary licenses in your state. Next, consider creating a comprehensive Kansas Acoustical Contractor Agreement - Self-Employed to outline your services and obligations, ensuring that you’ve established a clear working relationship with your clients.

To fill out an independent contractor form, start by providing your basic information, including your name and address. Next, clearly state your services and payment terms in relation to your work, ensuring that your entries align with the Kansas Acoustical Contractor Agreement - Self-Employed. Finally, review the form for accuracy before submission.

Yes, a contractor typically qualifies as self-employed. They operate as independent workers, managing their own business operations and finances. In the context of a Kansas Acoustical Contractor Agreement - Self-Employed, this means they are responsible for their own taxes, insurance, and adhering to regulations. Understanding this relationship is key to establishing clear expectations and responsibilities in your agreements.

To write a Kansas Acoustical Contractor Agreement - Self-Employed, start by clearly stating the names of both parties involved. Include the scope of work, payment terms, and project deadlines to ensure clarity. It is also essential to outline any specific regulations or standards relevant to acoustical work. By using a well-structured template, like those from USLegalForms, you can simplify this process and create a legally sound agreement.

Absolutely, independent contractors are categorized as self-employed. This means they have control over their work and the means by which they complete it. Being self-employed allows for flexibility, but it also comes with added responsibility. Documenting agreements with a Kansas Acoustical Contractor Agreement - Self-Employed ensures that both you and your clients understand the terms of your working relationship.

Choosing between 'self-employed' and 'independent contractor' often depends on the context. Both terms indicate a non-employee status, but 'independent contractor' specifically refers to individuals providing services under a contract. Clarity in terminology can enhance professionalism. Using terms consistent with the Kansas Acoustical Contractor Agreement - Self-Employed can reinforce your business standing.

Writing an independent contractor agreement involves outlining the terms of service, payment details, and obligations of both parties. Begin by specifying the scope of work, deadlines, and compensation structure. Additionally, include clauses on confidentiality, termination, and dispute resolution. The Kansas Acoustical Contractor Agreement - Self-Employed is a great template to ensure comprehensive coverage of these important aspects.