Kansas Payroll Deduction Authorization Form for Optional Matters - Employee

Description

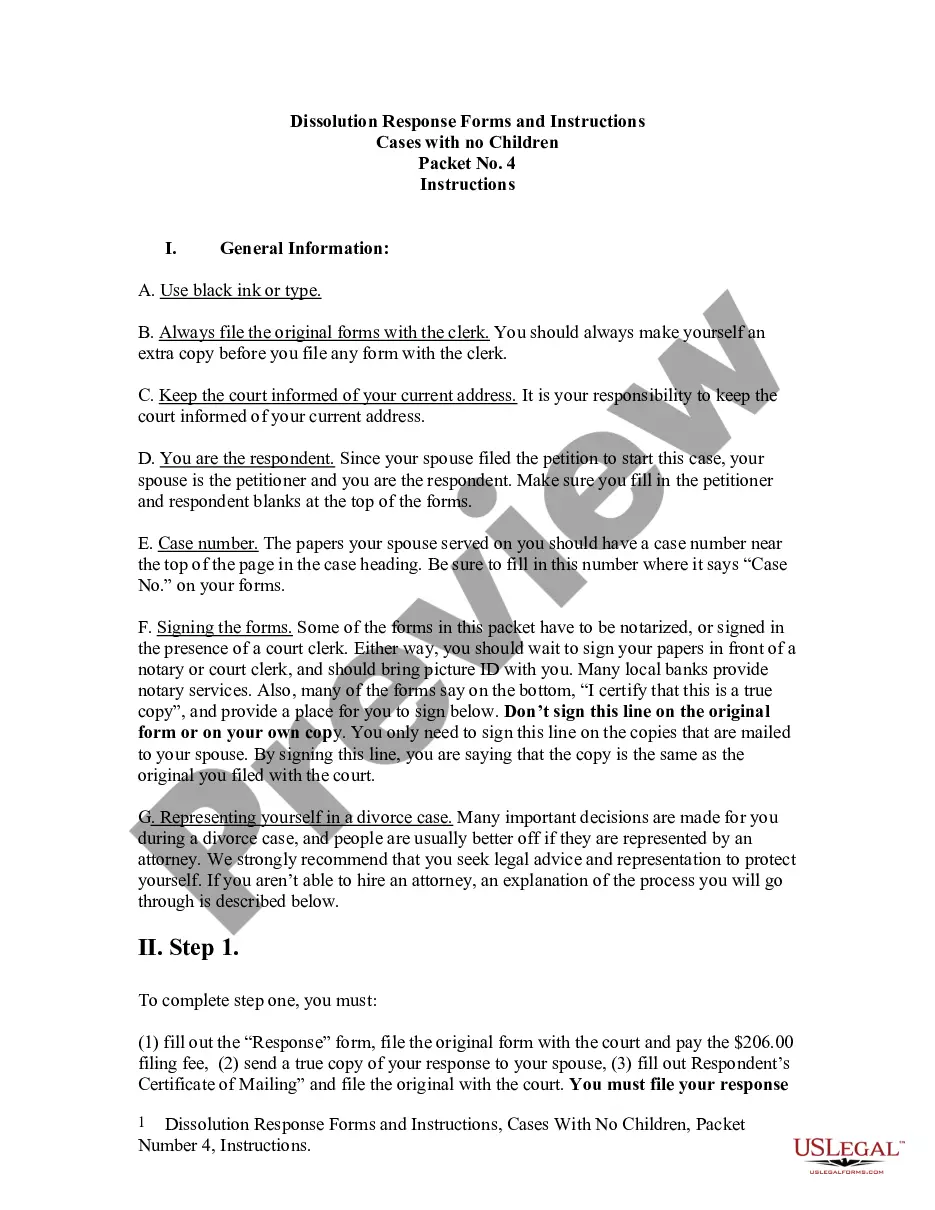

How to fill out Payroll Deduction Authorization Form For Optional Matters - Employee?

Locating the appropriate format for legal documents can be a considerable challenge.

Of course, there are numerous templates accessible online, yet how will you find the specific legal form you require? Utilize the US Legal Forms site.

This platform offers thousands of templates, such as the Kansas Payroll Deduction Authorization Form for Optional Matters - Employee, which you can utilize for both business and personal needs.

You can preview the form using the Review button and read the form details to ensure it is suitable for you.

- All the documents are reviewed by experts and comply with federal and state regulations.

- If you are already registered, Log In to your account and click the Obtain button to access the Kansas Payroll Deduction Authorization Form for Optional Matters - Employee.

- Use your account to browse through the legal forms you may have previously purchased.

- Visit the My documents section of your account to download another copy of the document you require.

- If you are a new customer of US Legal Forms, here are simple instructions you should follow.

- First, ensure you have selected the correct form for your particular city or county.

Form popularity

FAQ

Yes, tax withholdings are generally mandatory in the United States for state income tax, Social Security, and Medicare. Employers must comply with these requirements to avoid penalties. They can simplify their processes by using the Kansas Payroll Deduction Authorization Form for Optional Matters - Employee. This form ensures that withholdings are handled accurately and helps employees take control of their deductions.

Most states in the U.S. require mandatory state tax withholding for employees. However, the specific requirements can differ from state to state. Using tools like the Kansas Payroll Deduction Authorization Form for Optional Matters - Employee can greatly simplify the withholding process. It is essential to check with your state's tax regulations to confirm details about withholding responsibilities.

Yes, Kansas does require state withholding for employees. Employers must deduct state income tax from employees' wages based on a specific formula. Moreover, utilizing the Kansas Payroll Deduction Authorization Form for Optional Matters - Employee can assist employees in managing their withholdings effectively. This form provides clarity and ensures that the correct amount is withheld from each paycheck.

Yes, employers are generally required to withhold Kansas City earnings tax from employees' wages. This applies to those who work within the city limits. To ensure compliance, employers can use the Kansas Payroll Deduction Authorization Form for Optional Matters - Employee. This form helps streamline the withholding process, making it easier for both employers and employees.

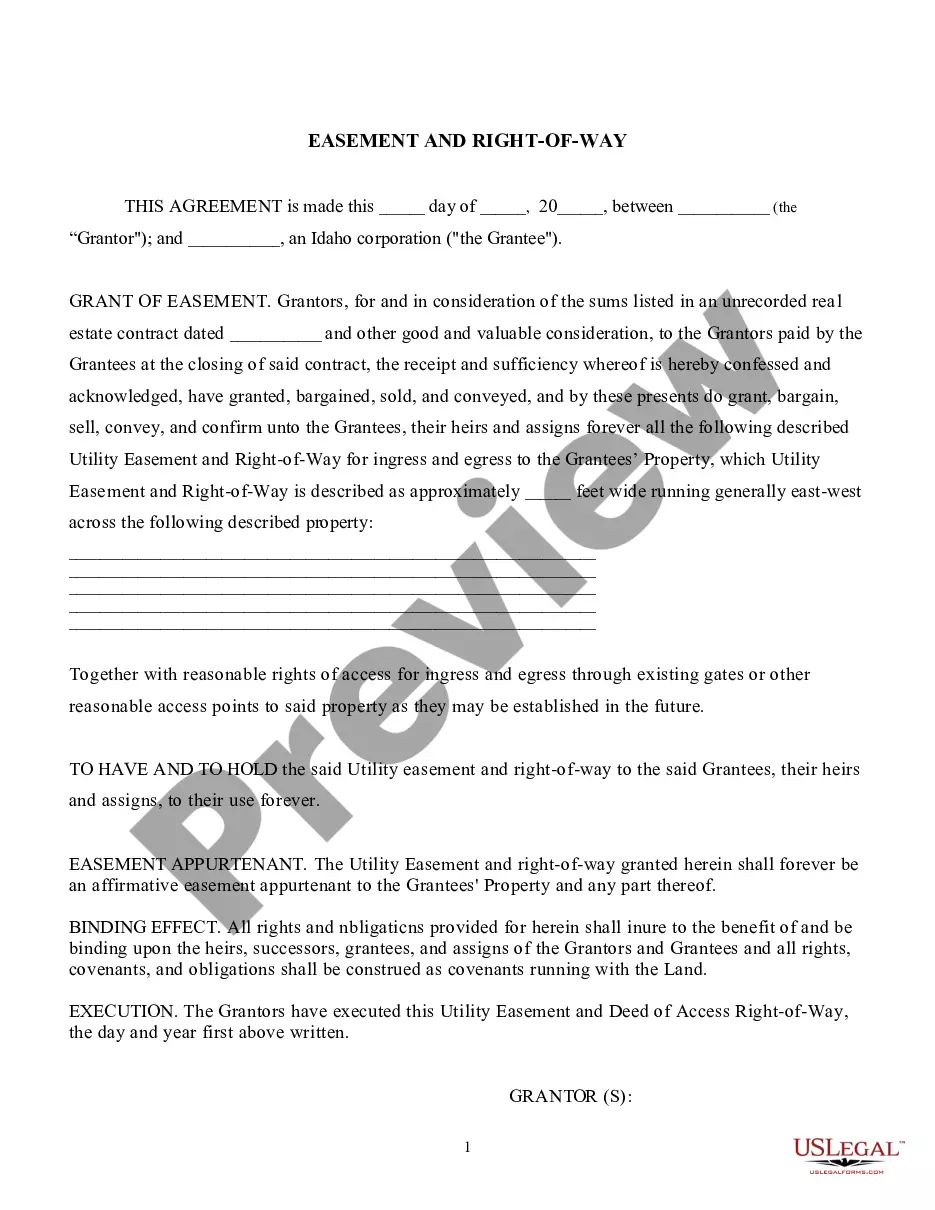

A payroll deduction authorization form is a document employees fill out to specify the deductions they approve from their salaries. This form includes details about the amounts, purposes, and timing of the deductions. By using the Kansas Payroll Deduction Authorization Form for Optional Matters - Employee, you ensure that your payroll deductions are processed smoothly and meet all legal requirements.

A payroll deduction agreement is a contract between an employee and employer that outlines the specific amounts to be deducted from the employee's paycheck. This agreement ensures clarity and mutual understanding of the deduction process. Utilizing the Kansas Payroll Deduction Authorization Form for Optional Matters - Employee can simplify this process and enhance financial planning for both parties.

Payroll deduction authorization refers to the process through which employees allow their employers to withhold a specific amount from their paychecks. This deduction can be for various reasons like healthcare, retirement savings, or even union dues. Completing a Kansas Payroll Deduction Authorization Form for Optional Matters - Employee ensures that the deductions are done correctly and in accordance with state regulations.

The personal exemption for Kansas income tax allows taxpayers to reduce their taxable income. It is essential to familiarize yourself with the specific exemption amount as it can change from year to year. Understanding these exemptions will help you make better financial decisions, especially when considering completing a Kansas Payroll Deduction Authorization Form for Optional Matters - Employee.

The new salary law in Kansas adjusts minimum wage rates and outlines salary regulations for certain employees. This law also impacts how employers handle payroll deductions. It's essential to stay informed about these changes to ensure compliance with payroll obligations, particularly those related to the Kansas Payroll Deduction Authorization Form for Optional Matters - Employee.

The new hire report form for Kansas is a document that employers must submit for all new employees, which helps with tax and benefits tracking. This report ensures compliance with state laws regarding employee records. Completing this form accurately can work hand in hand with the Kansas Payroll Deduction Authorization Form for Optional Matters - Employee for smoother transitions into employment.