Kansas Summary of Terms of Proposed Private Placement Offering

Description

How to fill out Summary Of Terms Of Proposed Private Placement Offering?

US Legal Forms - one of many largest libraries of legal varieties in the States - delivers an array of legal file layouts you may download or print out. Utilizing the website, you can find thousands of varieties for company and personal purposes, sorted by classes, states, or keywords and phrases.You can find the most up-to-date versions of varieties like the Kansas Summary of Terms of Proposed Private Placement Offering within minutes.

If you already possess a membership, log in and download Kansas Summary of Terms of Proposed Private Placement Offering from the US Legal Forms catalogue. The Download button will show up on each type you perspective. You gain access to all earlier saved varieties within the My Forms tab of the profile.

If you want to use US Legal Forms the first time, here are simple guidelines to obtain started:

- Make sure you have chosen the proper type for your personal town/region. Select the Preview button to check the form`s information. Look at the type description to ensure that you have chosen the right type.

- In case the type does not suit your needs, use the Research field on top of the screen to obtain the one which does.

- When you are content with the shape, affirm your option by clicking on the Purchase now button. Then, select the pricing prepare you prefer and provide your accreditations to register to have an profile.

- Approach the purchase. Make use of your Visa or Mastercard or PayPal profile to complete the purchase.

- Pick the structure and download the shape in your device.

- Make changes. Fill out, change and print out and indicator the saved Kansas Summary of Terms of Proposed Private Placement Offering.

Each design you put into your bank account does not have an expiration particular date which is your own permanently. So, if you want to download or print out another backup, just proceed to the My Forms area and click in the type you want.

Gain access to the Kansas Summary of Terms of Proposed Private Placement Offering with US Legal Forms, probably the most substantial catalogue of legal file layouts. Use thousands of professional and express-particular layouts that fulfill your business or personal needs and needs.

Form popularity

FAQ

While an offering memorandum is used in a private placement, a summary prospectus is the disclosure document provided to investors by mutual fund companies before or at the time of sale to the public.

An offering memorandum is a document issued to potential investors in a private placement deal. The offering memorandum spells out the private placement's objectives, risks, financials, and deal terms.

A Private Placement Memorandum (?PPM?), also known as a private offering document and confidential offering memorandum, is a securities disclosure document used in a private offering of securities by a private placement issuer or an investment fund (collectively, the ?Issuer?).

A Private Placement Memorandum (PPM) is a securities disclosure document used by a company (issuer) that is engaged in a private offering of securities. A PPM serves as a single, comprehensive document outlining the material details about the offering.

Under the Securities Act of 1933, any offer to sell securities must either be registered with the SEC or meet an exemption. Issuers and broker-dealers most commonly conduct private placements under Regulation D of the Securities Act of 1933, which provides three exemptions from registration.

Technically, when raising funds under Regulation D or any other SEC exemption, there's no strict requirement to utilize a Private Placement Memorandum (PPM).

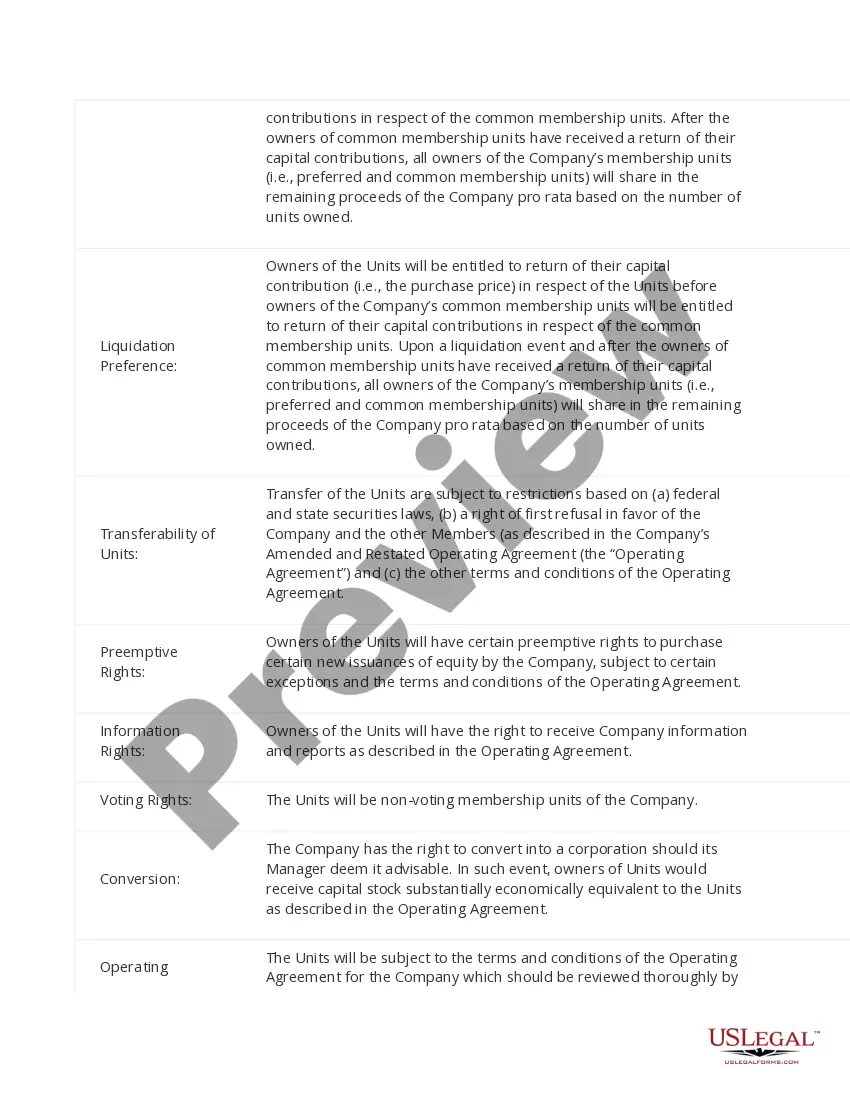

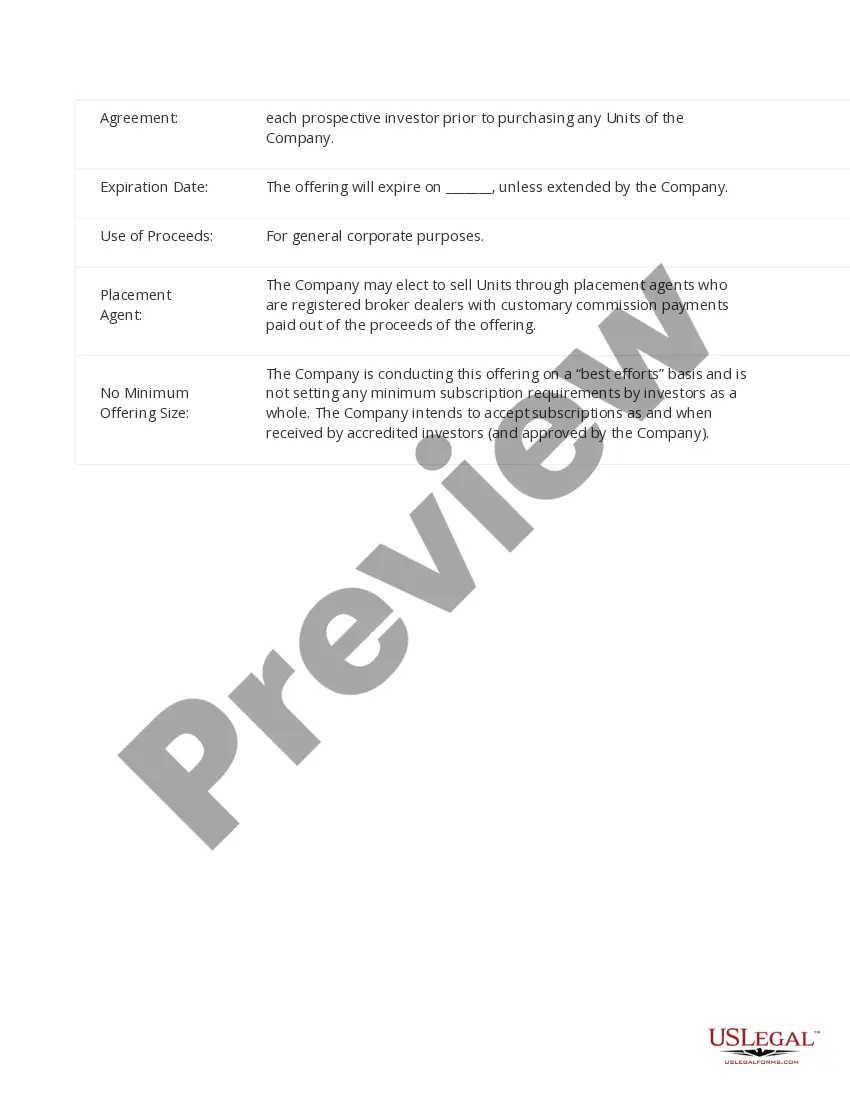

Executive Summary An overarching goal in this section of the private placement is to give investors an overview of the transaction, the high level structure of the investment and details on the market and opportunities.

Typically PPMs contain: a complete description of the security offered for sale, the terms of the sales, and fees; capital structure and historical financial statements; a description of the business; summary biographies of the management team; and the numerous risk factors associated with the investment.