Kansas Accredited Investor Suitability

Description

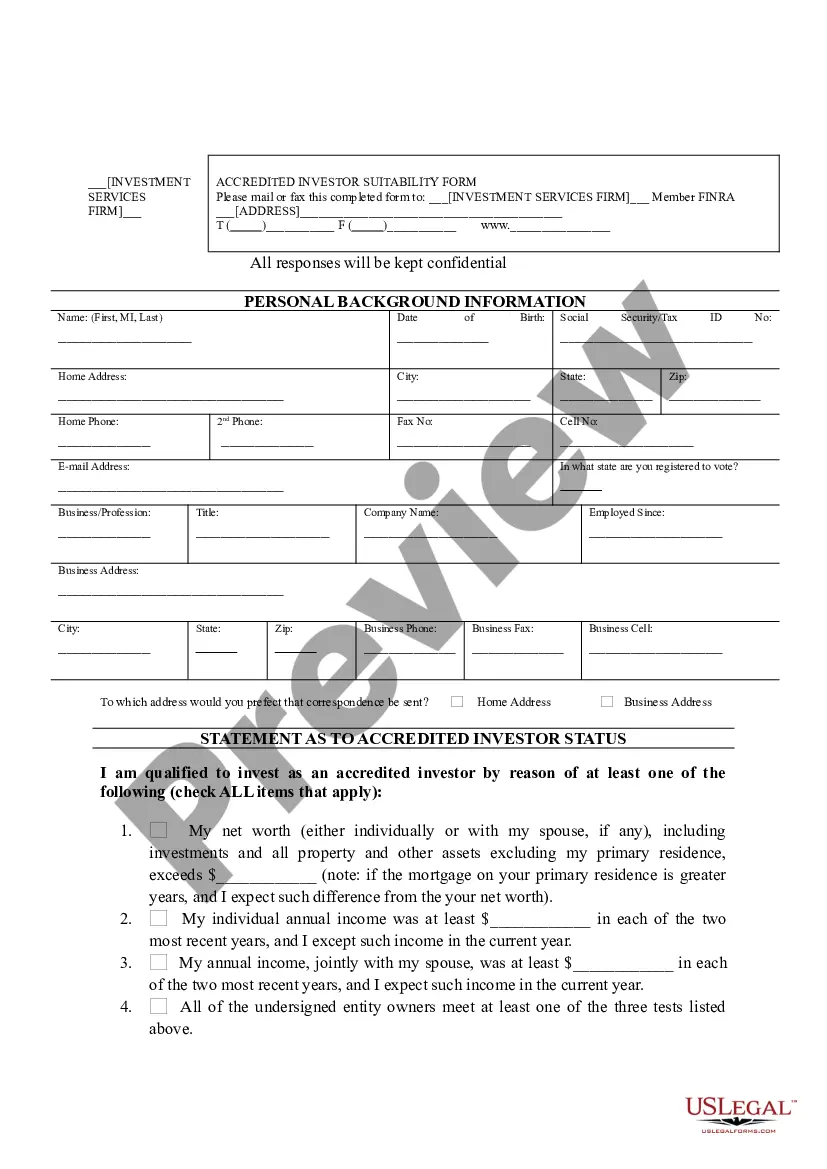

To become an accredited investor the (SEC) requires certain wealth, income or knowledge requirements. The investor must fall into one of three categories. Firms selling unregistered securities must put investors through their own screening process to determine if investors can be considered an accredited investor.

The Verifying Individual or Entity should take reasonable steps to verify and determined that an Investor is an "accredited investor" as such term is defined in Rule 501 of the Securities Act, and hereby provides written confirmation. This letter serves to help the Entity determine status.

How to fill out Accredited Investor Suitability?

Are you presently in the position that you will need papers for possibly enterprise or individual functions virtually every working day? There are tons of lawful papers layouts available online, but getting kinds you can rely is not effortless. US Legal Forms delivers 1000s of develop layouts, like the Kansas Accredited Investor Suitability, which can be published to satisfy state and federal demands.

Should you be presently knowledgeable about US Legal Forms internet site and possess an account, basically log in. Following that, you may down load the Kansas Accredited Investor Suitability design.

Unless you have an account and would like to begin using US Legal Forms, abide by these steps:

- Get the develop you need and make sure it is for the appropriate metropolis/area.

- Utilize the Preview option to analyze the shape.

- See the outline to ensure that you have chosen the right develop.

- In the event the develop is not what you`re trying to find, utilize the Research field to find the develop that fits your needs and demands.

- Once you get the appropriate develop, click on Purchase now.

- Choose the rates prepare you want, submit the specified details to produce your money, and pay for the transaction using your PayPal or bank card.

- Choose a practical document file format and down load your copy.

Get each of the papers layouts you have purchased in the My Forms food list. You can aquire a further copy of Kansas Accredited Investor Suitability any time, if possible. Just click the needed develop to down load or printing the papers design.

Use US Legal Forms, probably the most comprehensive selection of lawful kinds, in order to save efforts and stay away from mistakes. The assistance delivers professionally manufactured lawful papers layouts that can be used for an array of functions. Generate an account on US Legal Forms and start producing your life a little easier.

Form popularity

FAQ

A married couple can meet the accredited investor requirements if they have combined income of $300,000. Alternatively, investors with a net worth of $1 million, excluding their primary residence will qualify as an accredited investor.

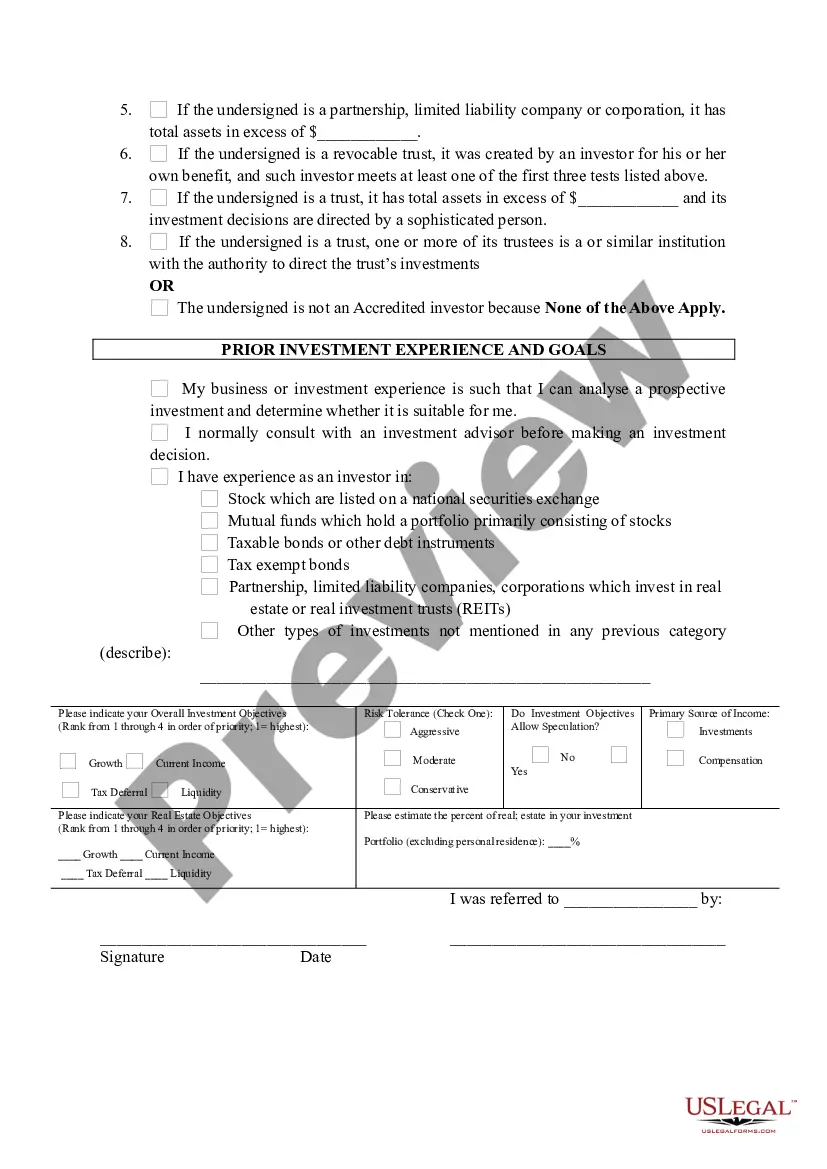

The SEC in 2020 issued rules in Release No. 33-10824, Accredited Investor Definition, allowing investors holding certain professional licenses, such as a Series 7, to qualify as accredited, even if they fall short of meeting the income or asset tests.

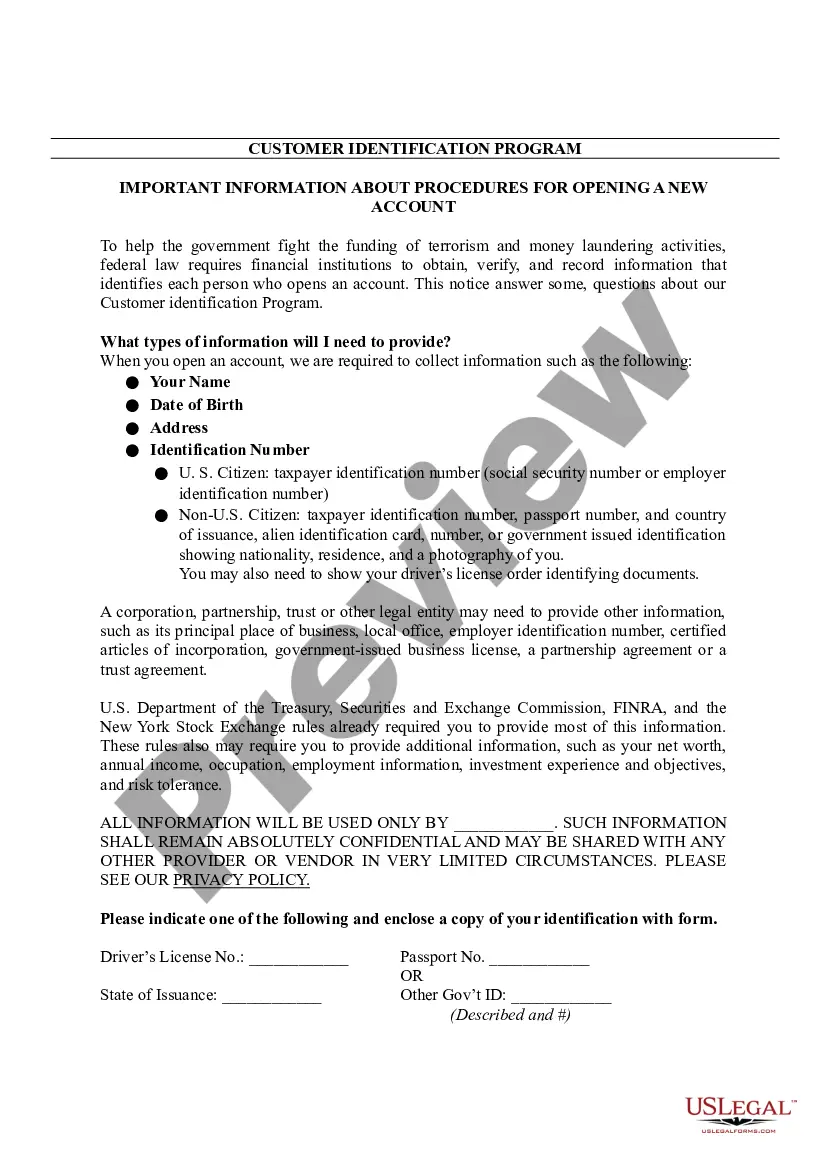

To confirm their status as an accredited investor, an investor can submit official documents for net worth and income verification, including: Tax returns. Pay stubs. Financial statements. IRS forms. Credit report. Brokerage statements. Tax assessments.

How to invest without being an accredited investor requires only that the investor has a net worth of less than $1 million. This includes the net worth of his or her spouse. The investor must also have earned $200,000 or more annually for the last two years.

In the U.S., an accredited investor is anyone who meets one of the below criteria: Individuals who have an income greater than $200,000 in each of the past two years or whose joint income with a spouse is greater than $300,000 for those years, and a reasonable expectation of the same income level in the current year.

Any investment can be characterized by three factors: safety, income, and capital growth. Every investor has to pick an appropriate mix of these three factors. One will be preeminent. The appropriate mix for you will change over time as your life circumstances and needs change.

Summary. H.R. 2797 would require the Securities and Exchange Commission (SEC) to develop an exam and certify people who pass as ?accredited investors,? which would allow them to make investments for which they are not currently eligible.

How to invest without being an accredited investor requires only that the investor has a net worth of less than $1 million. This includes the net worth of his or her spouse. The investor must also have earned $200,000 or more annually for the last two years.

Net worth over $1 million, excluding primary residence (individually or with spouse or partner) Income over $200,000 (individually) or $300,000 (with spouse or partner) in each of the prior two years, and reasonably expects the same for the current year.

Net worth over $1 million, excluding primary residence (individually or with spouse or partner) Income over $200,000 (individually) or $300,000 (with spouse or partner) in each of the prior two years, and reasonably expects the same for the current year.