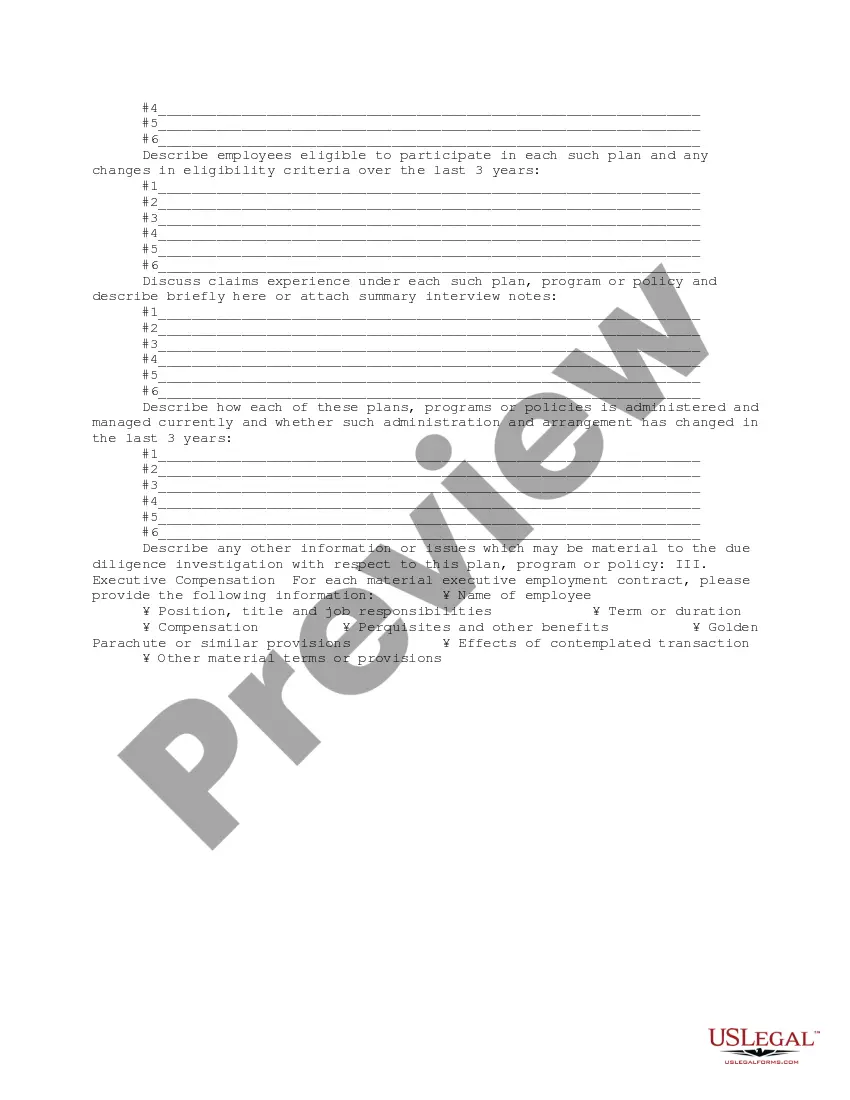

Kansas Employee Benefit Plan Workform

Description

How to fill out Employee Benefit Plan Workform?

US Legal Forms - among the largest collections of valid documents in the United States - offers a broad selection of legitimate form templates that you can download or print.

By utilizing the website, you can find thousands of forms for business and personal purposes, sorted by categories, states, or keywords. You can access the latest editions of forms like the Kansas Employee Benefit Plan Workform in moments.

If you have an account, Log Into the US Legal Forms library to download the Kansas Employee Benefit Plan Workform. The Download button will appear on every form you view. You can access all previously downloaded forms from the My documents section of your account.

Process the payment. Use your credit card or PayPal account to complete the transaction.

Choose the format and download the form to your device. Make adjustments. Fill out, modify, and print and sign the downloaded Kansas Employee Benefit Plan Workform. Each template you added to your account does not expire and is yours permanently. Therefore, if you wish to download or print another copy, simply navigate to the My documents section and click on the form you need. Access the Kansas Employee Benefit Plan Workform with US Legal Forms, one of the most extensive libraries of legitimate document templates. Utilize thousands of professional and state-specific templates that meet your business or personal requirements and specifications.

- Make sure you have selected the correct form for your area/county.

- Click on the Preview button to review the content of the form.

- Read the form description to ensure you have chosen the correct form.

- If the form does not meet your needs, use the Search box at the top of the screen to find a suitable one.

- If you are satisfied with the form, confirm your selection by clicking the Purchase now button.

- Then, select the pricing plan you prefer and provide your details to register for an account.

Form popularity

FAQ

401(k) retirement plans are a popular employee benefit because employees can use the plans to put pre-tax compensation towards their retirement, maximizing their contributions. Employers may also match the funds employees contribute, further enhancing the advantages of a 401(k) plan.

Each year participating teachers contribute 6 percent of their salary to their retirement. The state manages these retirement funds and guarantees at least 4 percent annual interest. Additionally, teachers earn contribution rate "credits" based on their years of experience.

KPERS invests the money and pays you interest throughout your career. You also build retirement credits while you work. Both grow in value over time. When you are eligible for retirement, KPERS will pay you a lifetime monthly benefit based on your account balance and your retirement credits.

Traditionally, most benefits used to fall under one of the four major types of employee benefits, namely:Medical insurance.Life insurance.Retirement plans.Disability insurance.

Here is a list of popular employee benefits in the United States:Health insurance.Paid time off (PTO) such as sick days and vacation days.Flexible and remote working options.Life insurance.Short-term disability.Long-term disability.Retirement benefits or accounts.Financial planning resources.More items...?06-Jan-2022

Here is a list of popular employee benefits in the United States:Health insurance.Paid time off (PTO) such as sick days and vacation days.Flexible and remote working options.Life insurance.Short-term disability.Long-term disability.Retirement benefits or accounts.Financial planning resources.More items...?

In general, your benefit is taxable for federal income tax and not for Kansas state tax.

Employee welfare plans or welfare benefit plans These plans provide medical, health, and hospitalization benefits or income in the event of sickness, accident, or death. participants and/or employers to make tax-deferred contributions, that plan participants can access later (e.g., after they are 59½ years old).

Kansas offers teachers access to its public employee pension fund, ensuring teachers are well supported throughout their retirement. In Kansas, you're eligible to receive full pension benefits if you meet the following retirement qualifications: At age 65 with five years of service credit.

The amount you contributed from your salary to Kansas Public Employees' Retirement System (KPERS) is subject to Kansas Income Tax. Since the amount contributed is not subject to Federal Income Tax you will need to make a specific entry on your Kansas Income Tax Return.