Kansas Authorize Sale of fractional shares

Description

How to fill out Authorize Sale Of Fractional Shares?

Are you currently in a placement in which you will need files for either company or personal reasons just about every time? There are tons of authorized document layouts available on the Internet, but locating kinds you can trust isn`t straightforward. US Legal Forms provides a huge number of kind layouts, like the Kansas Authorize Sale of fractional shares, that happen to be created in order to meet federal and state requirements.

When you are previously informed about US Legal Forms web site and get your account, simply log in. Next, it is possible to download the Kansas Authorize Sale of fractional shares template.

If you do not have an profile and need to begin using US Legal Forms, adopt these measures:

- Discover the kind you require and make sure it is to the right city/area.

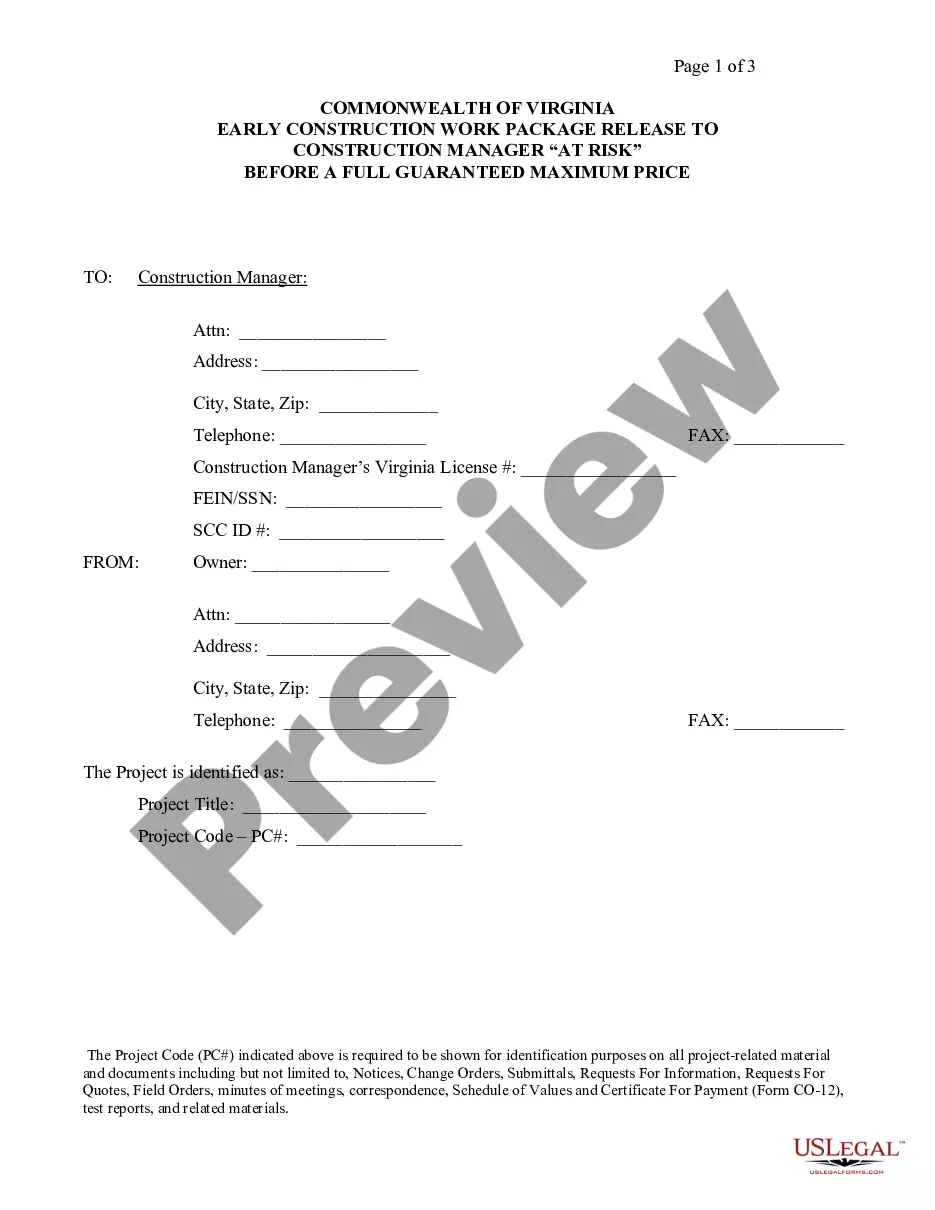

- Take advantage of the Review option to examine the form.

- Browse the description to actually have selected the correct kind.

- When the kind isn`t what you`re seeking, take advantage of the Research field to obtain the kind that suits you and requirements.

- When you obtain the right kind, click on Get now.

- Pick the prices prepare you want, fill out the necessary information to make your account, and purchase your order making use of your PayPal or charge card.

- Choose a handy document formatting and download your duplicate.

Get all of the document layouts you have bought in the My Forms menu. You can get a further duplicate of Kansas Authorize Sale of fractional shares anytime, if required. Just select the required kind to download or printing the document template.

Use US Legal Forms, one of the most substantial selection of authorized types, to save lots of some time and steer clear of errors. The support provides professionally made authorized document layouts that you can use for a variety of reasons. Create your account on US Legal Forms and initiate producing your daily life a little easier.

Form popularity

FAQ

Kansas Income Tax Brackets and Rates: Single, Head of Household, or Married Filing Separately For the portion of your Kansas taxable income that's over:But not over:Your tax rate for the 2021 tax year is:$0$2,5000%$2,500$15,0003.10%$15,000$30,0005.25%$30,000?5.70%1 more row

The Kansas Partnership return must be completed by every enterprise that has income or loss derived from Kansas sources regardless of the amount of income or loss. Income or loss derived from Kansas sources includes income or loss attributed to.

If you filed federal form 7004 with the Internal Revenue Service for an extension of time, enclose a copy of that form with your completed K-120S to automatically receive a six-month extension for Partnerships and S Corporations to file your Kansas return. Kansas does not have a separate extension request form.

When the IRS approves you for electronic filing of tax returns, Kansas automatically accepts you. Signature requirements for Kansas are fulfilled through IRS efile procedures. Kansas does not have a signature form.

Kansas residents and nonresidents of Kansas earning income from Kansas sources are required to annually file an income tax return, K-40.

Corporations which elect under subchapter S of the Internal Revenue Code not to be taxed as a corporation must file a Kansas Partnership or S Corporation Return (Form K-120S). All other corporations must file a Form K-120.