Kansas Elimination of the Class A Preferred Stock

Description

How to fill out Elimination Of The Class A Preferred Stock?

It is possible to commit several hours on-line attempting to find the authorized document web template that meets the state and federal requirements you will need. US Legal Forms provides a large number of authorized kinds that happen to be reviewed by specialists. You can actually down load or print out the Kansas Elimination of the Class A Preferred Stock from our support.

If you currently have a US Legal Forms bank account, you may log in and click the Acquire key. Afterward, you may complete, revise, print out, or indicator the Kansas Elimination of the Class A Preferred Stock. Each and every authorized document web template you get is the one you have forever. To obtain yet another version of any bought kind, go to the My Forms tab and click the related key.

If you are using the US Legal Forms website the first time, adhere to the easy recommendations below:

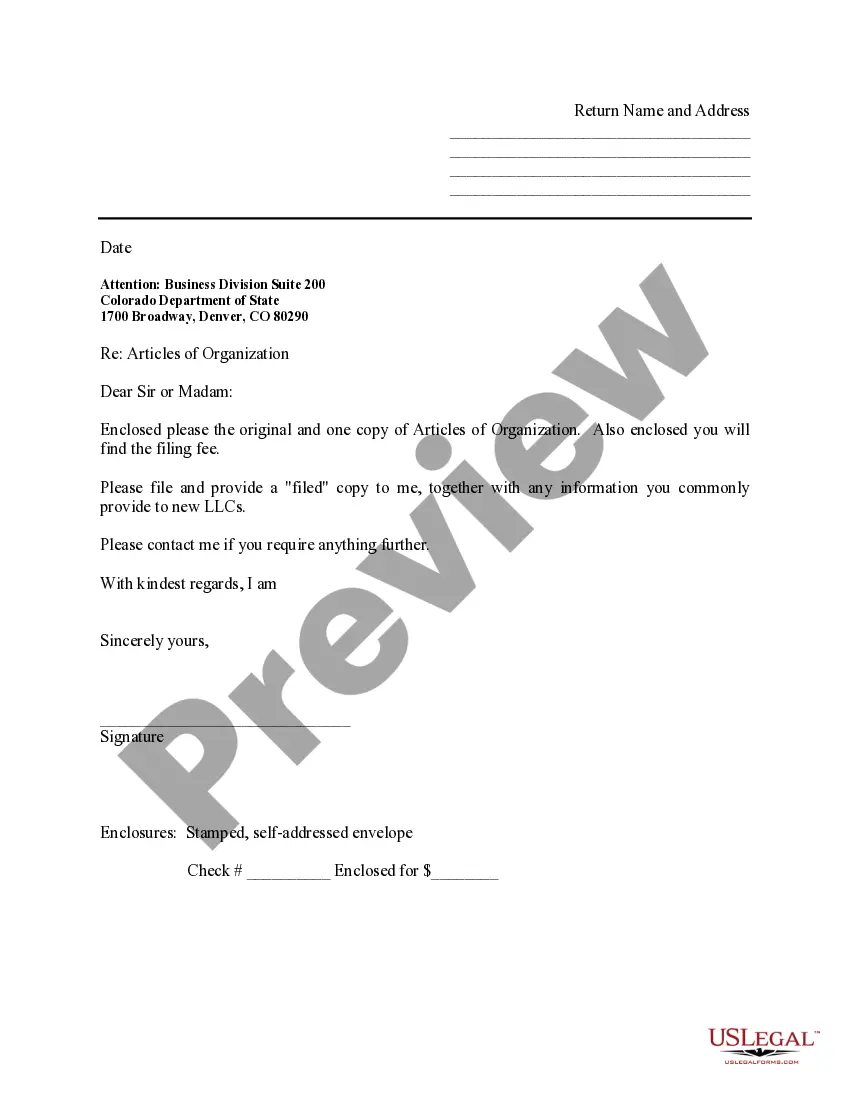

- Initial, be sure that you have selected the right document web template for your county/city that you pick. Read the kind information to ensure you have chosen the correct kind. If accessible, make use of the Review key to look from the document web template at the same time.

- In order to locate yet another version from the kind, make use of the Lookup area to discover the web template that suits you and requirements.

- After you have located the web template you would like, click on Purchase now to proceed.

- Choose the pricing plan you would like, enter your qualifications, and register for a free account on US Legal Forms.

- Complete the financial transaction. You can use your charge card or PayPal bank account to cover the authorized kind.

- Choose the file format from the document and down load it for your system.

- Make alterations for your document if needed. It is possible to complete, revise and indicator and print out Kansas Elimination of the Class A Preferred Stock.

Acquire and print out a large number of document layouts making use of the US Legal Forms website, that provides the biggest selection of authorized kinds. Use expert and condition-distinct layouts to handle your business or personal demands.

Form popularity

FAQ

If we currently have preferred stock outstanding with a 9% dividend rate, a $50 par value and a $45 market price, then the current cost of preferred stock would be 10%. However, with flotation costs, we would use a price of $42.98 [($45)*(1 ? . 045)] to calculate the cost of preferred and would get kp to be 10.47%.

The Series K Preferred Stock will initially accrue dividends at a fixed rate per annum of 6.375% from the original issue date to, but excluding, (or, if not a business day, the next succeeding business day), and will accrue dividends thereafter at a floating rate per annum equal to three-month U.S. dollar ...

IShares Preferred and Income Securities ETF (PFF) VanEck Preferred Securities ex Financials ETF (PFXF) First Trust Preferred Securities and Income ETF (FPE) Invesco Preferred ETF (PGX) SPDR ICE Preferred Securities ETF (PSK) Global X U.S. Preferred ETF (PFFD) Global X SuperIncome Preferred ETF (SPFF)

McDonald's Corporation Common Stock (MCD)

You can usually tell the difference between a company's common and preferred stock by glancing at the ticker symbol. The ticker symbol for preferred stock usually has a P at the end of it, but unlike common stock, ticker symbols can vary among systems; for example, Yahoo!

Real-Life Example & Figures To raise capital and avoid bankruptcy, Ford issued a series of preferred shares with a 6.5% dividend. This meant that every preferred share an investor bought was guaranteed a 6.5% return on the initial investment every year in the form of dividends.

Typically, preferred stock ticker symbols are the same as the company's common stock but with an additional letter to designate the series of preferred stock. For example, if you want to invest in Bank of America Series E preferred stock, the ticker symbol is BAC-E at many brokers.

They calculate the cost of preferred stock by dividing the annual preferred dividend by the market price per share. Once they have determined that rate, they can compare it to other financing options.