Kansas Stock Option Grants and Exercises and Fiscal Year-End Values

Description

How to fill out Stock Option Grants And Exercises And Fiscal Year-End Values?

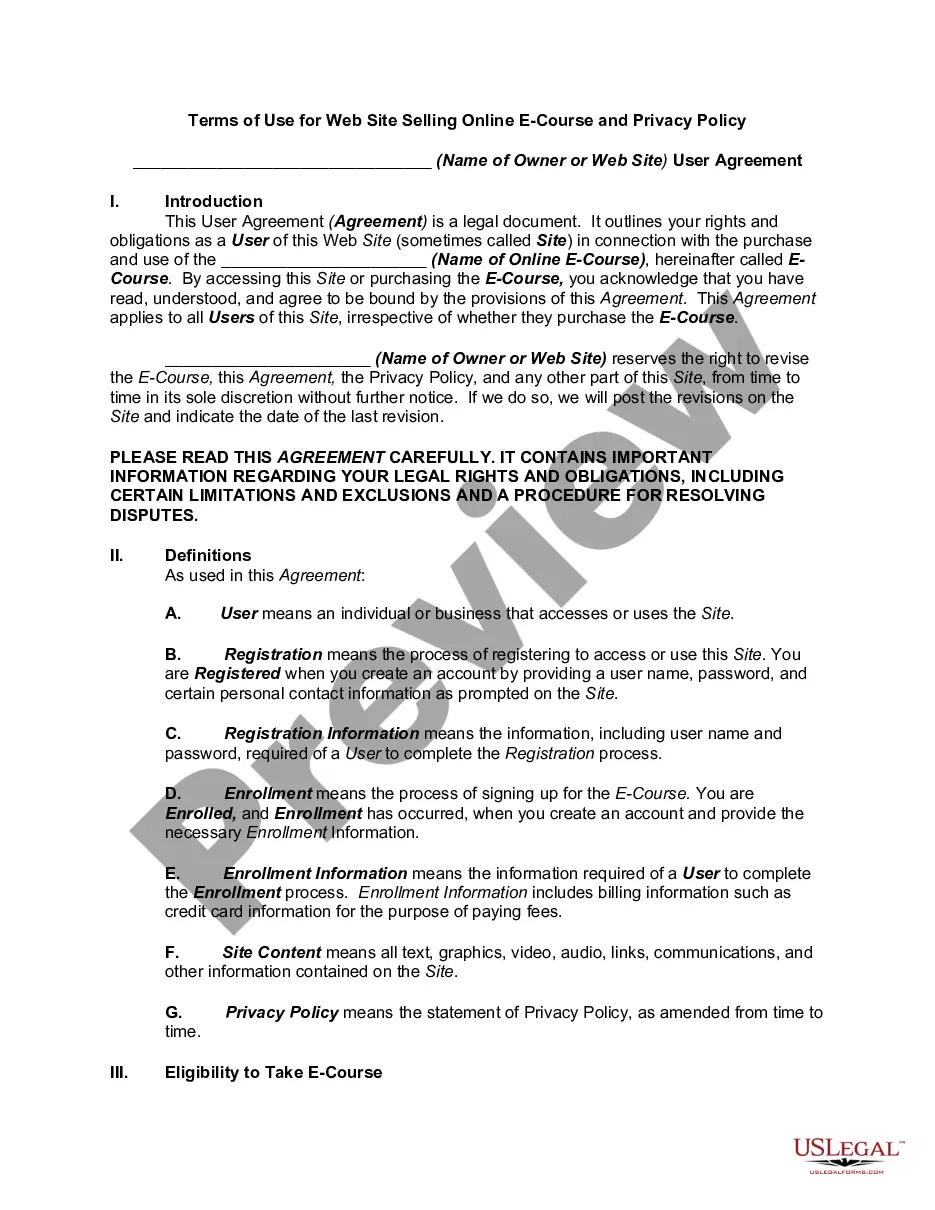

US Legal Forms - one of several most significant libraries of authorized kinds in the United States - delivers a variety of authorized file layouts it is possible to down load or printing. While using website, you may get thousands of kinds for business and person reasons, categorized by classes, claims, or keywords.You can find the most up-to-date variations of kinds much like the Kansas Stock Option Grants and Exercises and Fiscal Year-End Values within minutes.

If you have a monthly subscription, log in and down load Kansas Stock Option Grants and Exercises and Fiscal Year-End Values from the US Legal Forms local library. The Down load switch will appear on each form you view. You have access to all formerly downloaded kinds inside the My Forms tab of your respective bank account.

In order to use US Legal Forms the very first time, here are simple recommendations to help you started off:

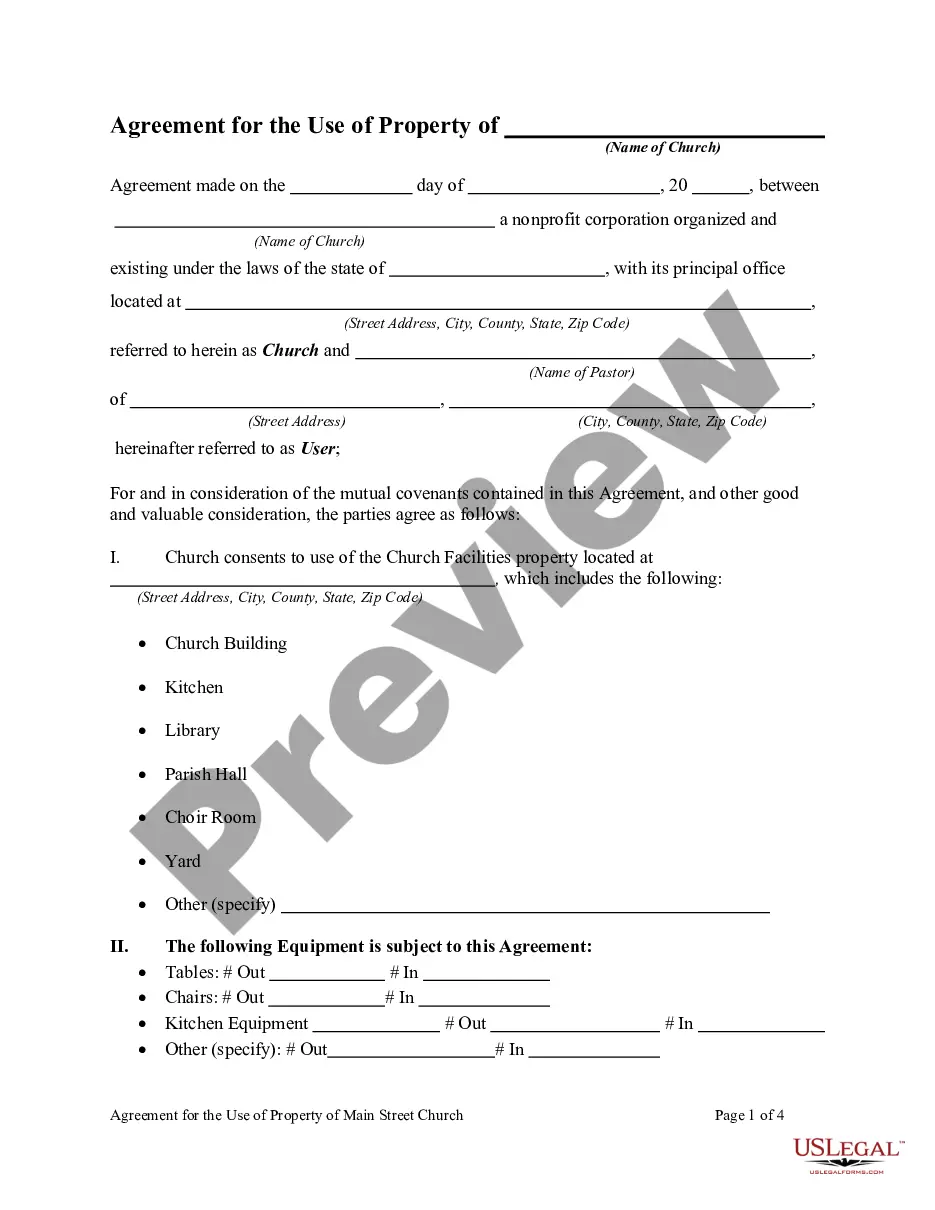

- Be sure to have picked the proper form for your city/region. Click the Preview switch to examine the form`s content material. Read the form outline to ensure that you have selected the proper form.

- If the form doesn`t suit your demands, make use of the Look for discipline on top of the screen to get the one who does.

- If you are pleased with the form, confirm your selection by clicking the Get now switch. Then, opt for the costs strategy you like and offer your accreditations to sign up for the bank account.

- Procedure the purchase. Make use of your credit card or PayPal bank account to accomplish the purchase.

- Pick the structure and down load the form on your device.

- Make adjustments. Fill out, modify and printing and signal the downloaded Kansas Stock Option Grants and Exercises and Fiscal Year-End Values.

Every format you included in your bank account lacks an expiration date and it is your own eternally. So, if you wish to down load or printing an additional backup, just visit the My Forms area and click in the form you will need.

Obtain access to the Kansas Stock Option Grants and Exercises and Fiscal Year-End Values with US Legal Forms, by far the most substantial local library of authorized file layouts. Use thousands of professional and condition-distinct layouts that meet up with your company or person requirements and demands.

Form popularity

FAQ

Every stock option has an exercise price, also called the strike price, which is the price at which a share can be bought. In the US, the exercise price is typically set at the fair market value of the underlying stock as of the date the option is granted, in order to comply with certain requirements under US tax law.

FMV influences the price employees, contractors, and other common stock option recipients must pay to purchase their stock options (also known as the strike price). The strike price must be greater than or equal to the FMV stated in the 409A valuation.

Total stock compensation expense is calculated by taking the number of stock options granted and multiplying by the fair market value on the grant date.

Exercise Price ? Also known as the strike price, the grant price is the price at which you can buy the shares of stock. Regardless of the future value of that particular stock, the option holder will have the right to buy the shares at the grant price rather than the current, actual price.

You can't exercise your options before the vesting date or after the expiration date. Here's a summary of the terminology you will see in your employee stock option plan: Grant price/exercise price/strike price: The specified price at which your employee stock option plan says you can purchase the stock.

Option grants are a type of employee compensation that allows employees to purchase company stock at a discounted price. While option grants have many benefits for employers and employees, they also come with risks and tax implications that should be carefully considered.

Grant Date Fair Value means a value arrived at by projecting future stock prices for the Company and the Peer Companies while allowing for greater flexibility and customization of the assumptions and plan design parameters which is necessary to value the Adjusted EBITDA RSUs with a Relative TSR Multiplier.

If you have 1,000 options in a company with 100 million shares outstanding, your ownership stake is . 001%. Multiply your ownership stake by the company's current $1 billion valuation to find that your options are theoretically worth $10,000 minus the costs to exercise (strike price and taxes; more on that below).