Kansas Approval of option grant

Description

How to fill out Approval Of Option Grant?

Have you been in a position the place you require papers for sometimes enterprise or specific functions nearly every working day? There are a lot of legal papers layouts available on the Internet, but finding versions you can rely is not straightforward. US Legal Forms offers thousands of develop layouts, much like the Kansas Approval of option grant, which are composed to satisfy federal and state demands.

If you are currently knowledgeable about US Legal Forms internet site and possess an account, simply log in. Afterward, you can acquire the Kansas Approval of option grant format.

If you do not provide an accounts and would like to begin using US Legal Forms, adopt these measures:

- Obtain the develop you want and make sure it is to the right city/area.

- Utilize the Preview key to examine the form.

- Browse the explanation to actually have chosen the proper develop.

- In case the develop is not what you are trying to find, take advantage of the Lookup field to find the develop that meets your needs and demands.

- Once you find the right develop, click Buy now.

- Select the costs program you need, fill out the desired information to make your money, and purchase the transaction making use of your PayPal or credit card.

- Decide on a hassle-free document structure and acquire your version.

Get all the papers layouts you possess bought in the My Forms food list. You can aquire a more version of Kansas Approval of option grant at any time, if necessary. Just go through the essential develop to acquire or print out the papers format.

Use US Legal Forms, the most substantial selection of legal forms, in order to save time and steer clear of faults. The service offers appropriately made legal papers layouts which can be used for an array of functions. Create an account on US Legal Forms and commence making your daily life easier.

Form popularity

FAQ

Employees do not owe federal income taxes when the option is granted or when they exercise the option. Instead, they pay taxes when they sell the stock. However, exercising an ISO produces an adjustment for purposes of the alternative minimum tax unless the stock is sold in the same year that the option is exercised.

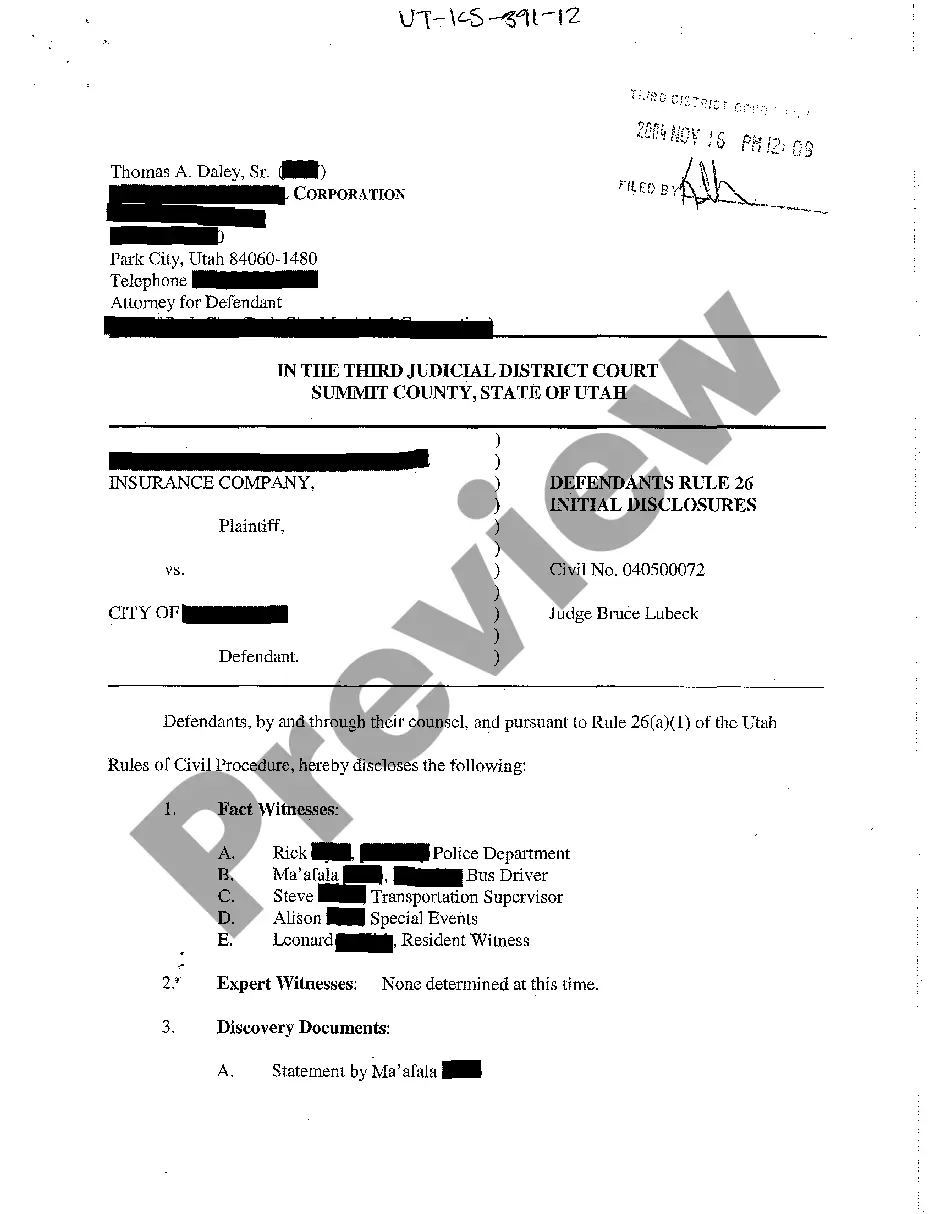

The Company's board of directors must approve all stock option grants, including the name of the recipient, the number of shares, the vesting schedule and the exercise price. This can be done either in a board meeting or via unanimous written consent.

Option grants are a type of employee compensation that allows employees to purchase company stock at a discounted price. While option grants have many benefits for employers and employees, they also come with risks and tax implications that should be carefully considered.

A stock grant provides the recipient with value?the corporate stock. By contrast, stock options only offer employees the opportunity to purchase something of value. They can acquire the corporate stock at a set price, but the employees receiving stock options still have to pay for those stocks if they want them.

Once the grant has vested, they still don't own anything in the company. Rather, they now own the option to purchase these shares. The jargon for actually buying these shares is termed ?exercising options.? When it comes to exercising options, employees need to spend some money before they can actually make some money.

What are option agreements? Option grants are how companies award equity to employees. Signing an offer letter isn't enough. The option agreement outlines all the details of an employee's option grant. The option agreement is a more detailed version of an offer letter.