Kansas Supplemental Retirement Plan

Description

How to fill out Supplemental Retirement Plan?

US Legal Forms - among the largest libraries of authorized varieties in the USA - gives an array of authorized record layouts you may obtain or print out. Using the web site, you can get thousands of varieties for company and personal reasons, categorized by groups, states, or key phrases.You can get the latest models of varieties just like the Kansas Supplemental Retirement Plan within minutes.

If you already have a membership, log in and obtain Kansas Supplemental Retirement Plan through the US Legal Forms library. The Download key will show up on each and every type you perspective. You have accessibility to all in the past acquired varieties within the My Forms tab of the account.

In order to use US Legal Forms initially, listed here are basic instructions to get you started:

- Be sure to have picked the right type for the town/county. Go through the Review key to review the form`s content. See the type explanation to actually have selected the right type.

- If the type doesn`t suit your requirements, use the Lookup industry at the top of the display screen to find the one who does.

- When you are content with the form, confirm your decision by clicking the Acquire now key. Then, opt for the pricing plan you prefer and offer your references to register to have an account.

- Approach the financial transaction. Make use of bank card or PayPal account to perform the financial transaction.

- Choose the structure and obtain the form on your system.

- Make adjustments. Load, modify and print out and indication the acquired Kansas Supplemental Retirement Plan.

Each web template you added to your account does not have an expiration time which is yours forever. So, in order to obtain or print out another version, just check out the My Forms portion and then click about the type you want.

Get access to the Kansas Supplemental Retirement Plan with US Legal Forms, probably the most considerable library of authorized record layouts. Use thousands of specialist and status-certain layouts that meet up with your organization or personal demands and requirements.

Form popularity

FAQ

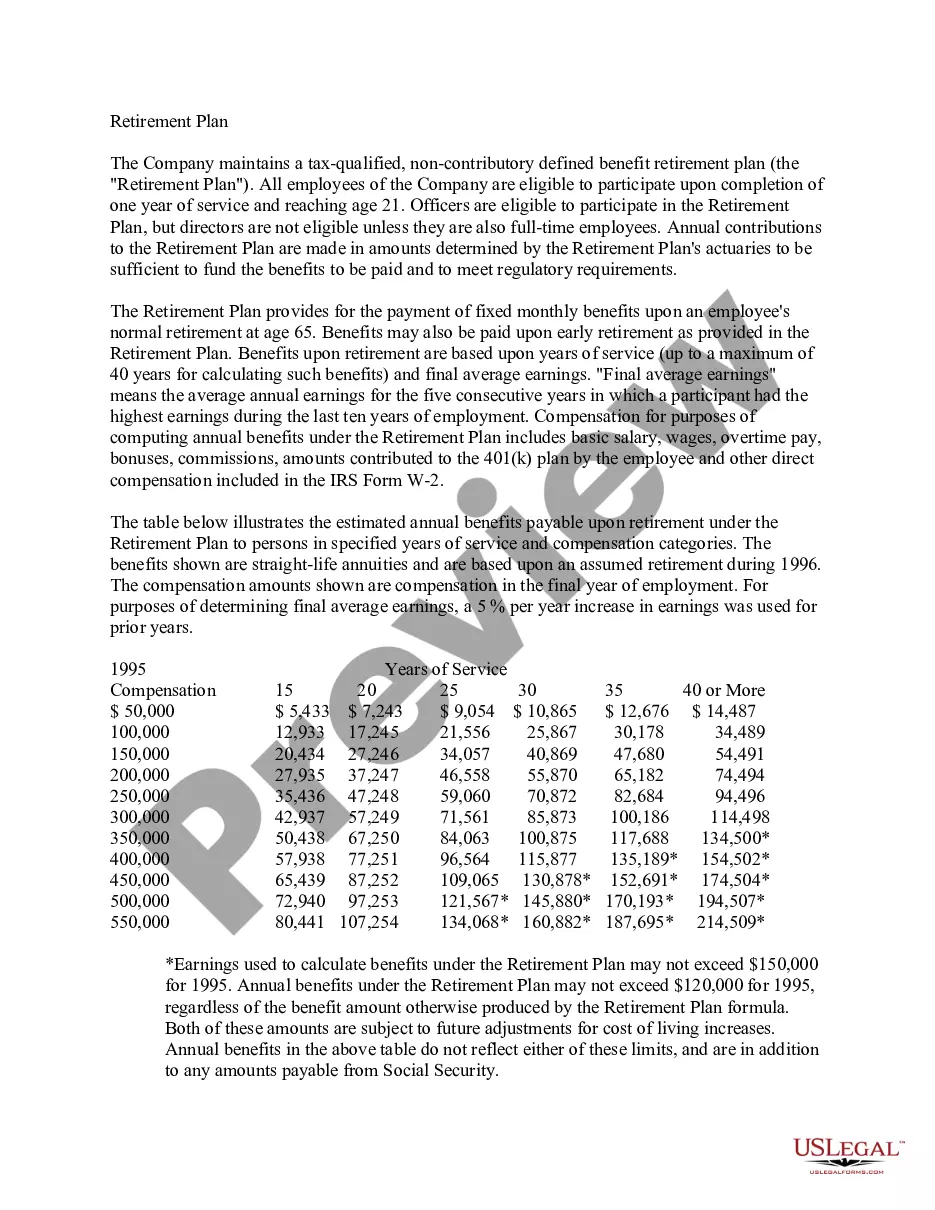

KPERS 1: If you are under age 45, a year of service generally costs about 6 percent of your annual salary (or final average salary, whichever is higher). KPERS 2: If you are under age 37, a year of service costs about 6 percent of your salary. After age 35, the actuarial cost increases significantly.

It's a lump-sum cash award, designed to offset the effects of your reduced pension contributions due to your service-related disability.

The employee's total elective deferrals to all of these plans combined cannot exceed the annual deferral limit ($22,500 in 2023; $20,500 in 2022; $19,500 in 2020 and 2021). See How Much Salary Can You Defer if You're Eligible for More Than One Retirement Plan.

Supplemental contributions Type of limit2023403b under age 50$22,500403b age 50 and over$30,000Compensation limit (employer's matched retirement contributions are limited to matches made on this amount of salary)$330,000

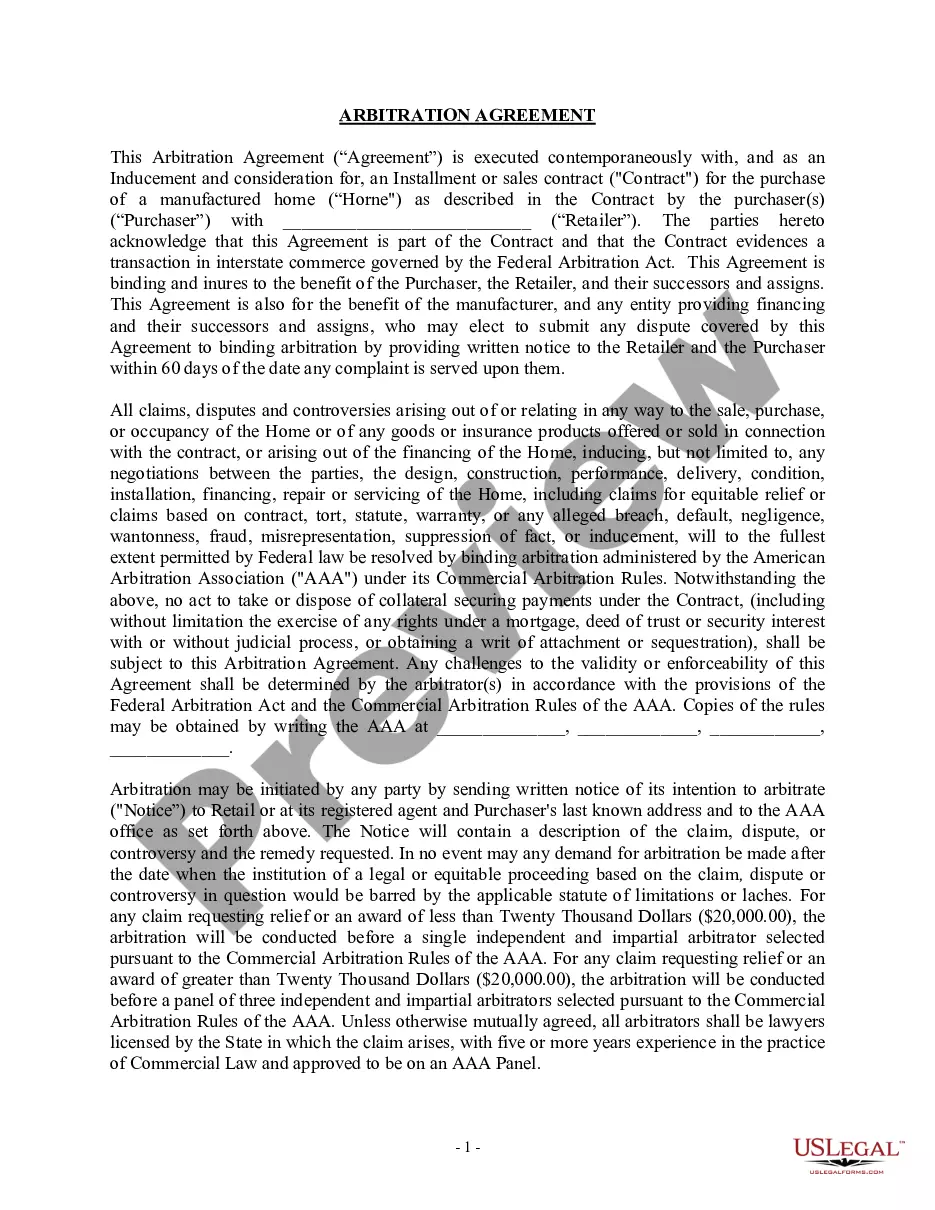

Key Takeaways. A SERP is a non-qualified retirement plan offered to executives as a long term incentive. Unlike in a 401(k) or other qualified plan, SERPs offer no immediate tax advantages to the company or the executive. When the benefits are paid, the company deducts them as a business expense.

The employer buys the insurance policy, pays the premiums, and has access to its cash value. The employee receives supplemental retirement income paid for through the insurance policy. Once the employee receives income in retirement, that benefit is taxable. At that point, the employer receives a tax deduction.

SERPs are paid out as either one lump sum or as a series of set payments from an annuity, with different tax implications for each method, so choose carefully.

A supplemental retirement plan gives your top employees a chance to save more once they've maxed out their contribution to a qualified plan, which can increase engagement and retention.