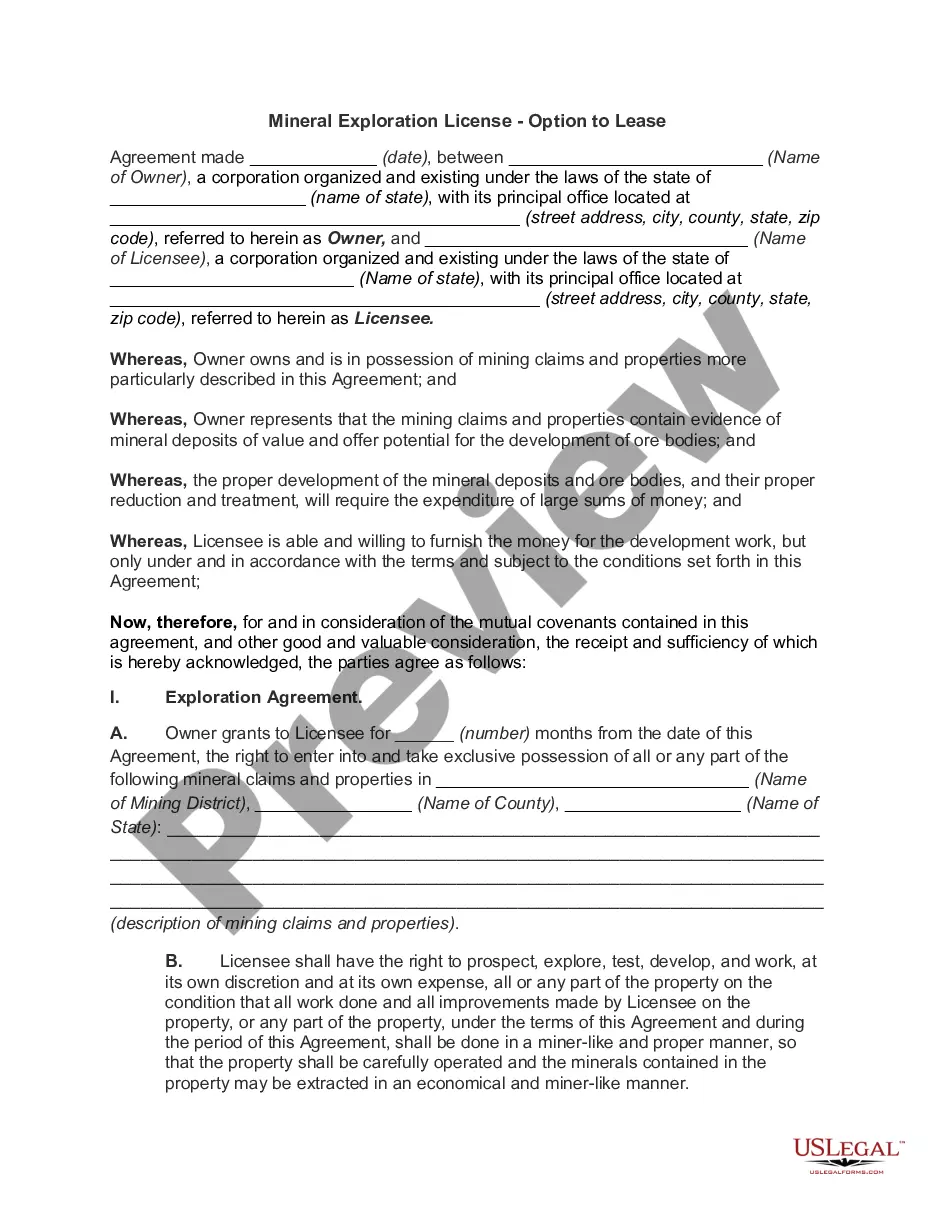

Kansas Stock Option Plan Stock Option Plan which provides for grant of Incentive Stock Options, Nonqualified Stock Options, and Exchange Options

Description

How to fill out Stock Option Plan Stock Option Plan Which Provides For Grant Of Incentive Stock Options, Nonqualified Stock Options, And Exchange Options?

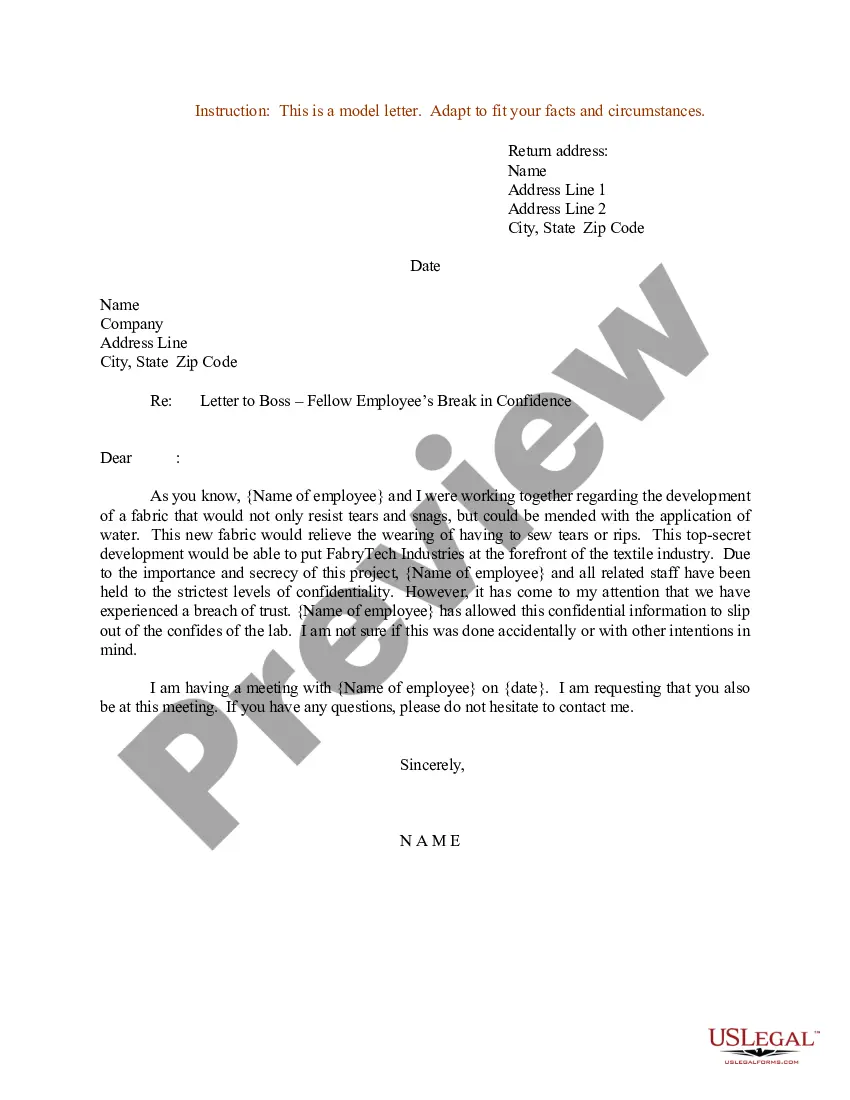

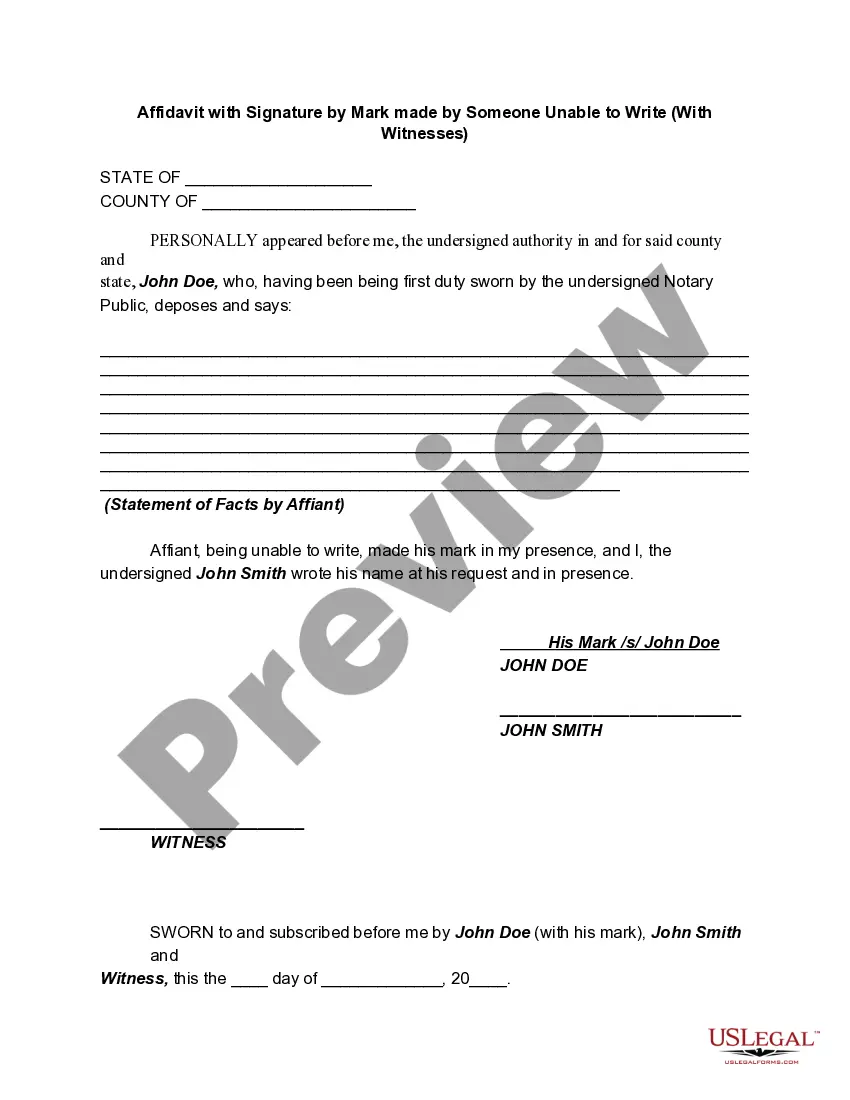

It is possible to invest hours on-line attempting to find the authorized papers web template that suits the federal and state requirements you need. US Legal Forms offers a large number of authorized varieties that happen to be examined by pros. You can easily download or printing the Kansas Stock Option Plan Stock Option Plan which provides for grant of Incentive Stock Options, Nonqualified Stock Options, and Exchange Options from our service.

If you currently have a US Legal Forms account, you can log in and then click the Acquire button. Following that, you can full, modify, printing, or signal the Kansas Stock Option Plan Stock Option Plan which provides for grant of Incentive Stock Options, Nonqualified Stock Options, and Exchange Options. Every single authorized papers web template you acquire is yours for a long time. To have yet another duplicate of any purchased form, check out the My Forms tab and then click the corresponding button.

Should you use the US Legal Forms site the very first time, follow the basic guidelines listed below:

- Initially, be sure that you have chosen the right papers web template to the state/city that you pick. Read the form explanation to ensure you have selected the appropriate form. If available, take advantage of the Review button to look with the papers web template as well.

- If you would like find yet another model of your form, take advantage of the Search industry to discover the web template that fits your needs and requirements.

- After you have discovered the web template you want, click on Acquire now to proceed.

- Find the pricing prepare you want, type your references, and sign up for an account on US Legal Forms.

- Full the transaction. You can use your bank card or PayPal account to cover the authorized form.

- Find the formatting of your papers and download it to the system.

- Make modifications to the papers if necessary. It is possible to full, modify and signal and printing Kansas Stock Option Plan Stock Option Plan which provides for grant of Incentive Stock Options, Nonqualified Stock Options, and Exchange Options.

Acquire and printing a large number of papers templates using the US Legal Forms web site, which offers the most important assortment of authorized varieties. Use specialist and status-distinct templates to deal with your business or personal requirements.

Form popularity

FAQ

ISOs have more favorable tax treatment than non-qualified stock options (NSOs) in part because they require the holder to hold the stock for a longer time period. This is true of regular stock shares as well.

Nonqualified: Employees generally don't owe tax when these options are granted. When exercising, tax is paid on the difference between the exercise price and the stock's market value. They may be transferable. Qualified or Incentive: For employees, these options may qualify for special tax treatment on gains.

Stock options grant employees the right to purchase shares, but it's not an obligation for them to do so. ISOs have the potential for favorable tax treatment. If a stock option isn't an ISO, it's typically referred to as a nonqualified stock option. NQOs don't qualify for special tax treatment.

What is a Qualified Stock Option? A qualified stock option confers special tax benefits on the employees of a corporation. This stock option is not reportable as taxable income to the employee at the time of grant, nor when the employee later exercises the option to buy stock.

Employee Stock Purchase Plan: Qualified or Non-qualified This means that there is more flexibility in how a non-qualified plan can be designed, but a qualified plan is treated more favorably on taxation as there's no taxable event when shares are purchased.

What Is a Non-Qualified Stock Option (NSO)? A non-qualified stock option (NSO) is a type of employee stock option wherein you pay ordinary income tax on the difference between the grant price and the price at which you exercise the option.

Non-qualified stock options are issued at a grant price. The grant price is the price at which you can buy the company stock. Your options come with a vesting schedule. During the time between the grant date of your options and the day they vest, you can't exercise your option.

Non-qualified Stock Options (NSOs) are stock options that, when exercised, result in ordinary income under US tax laws on the difference, calculated on the exercise date, between the exercise price and the fair market value of the underlying shares.