Kansas Nonqualified Stock Option Plan of Medicore, Inc., for officers, directors, consultants, key employees

Description

How to fill out Nonqualified Stock Option Plan Of Medicore, Inc., For Officers, Directors, Consultants, Key Employees?

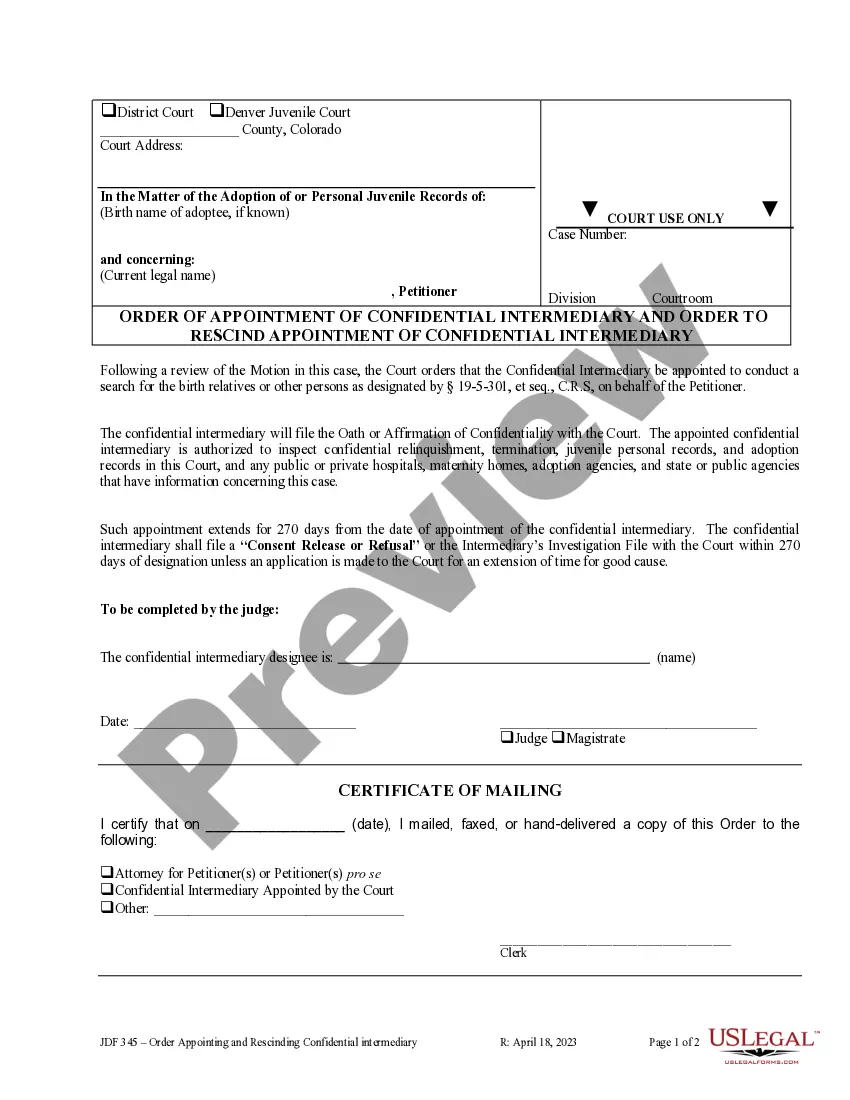

It is possible to invest several hours on the web searching for the lawful record web template which fits the state and federal demands you require. US Legal Forms offers a large number of lawful varieties which are reviewed by professionals. It is simple to acquire or print the Kansas Nonqualified Stock Option Plan of Medicore, Inc., for officers, directors, consultants, key employees from my service.

If you already possess a US Legal Forms bank account, you are able to log in and click the Obtain key. After that, you are able to full, revise, print, or indication the Kansas Nonqualified Stock Option Plan of Medicore, Inc., for officers, directors, consultants, key employees. Each and every lawful record web template you get is your own forever. To obtain an additional backup associated with a purchased form, visit the My Forms tab and click the related key.

If you use the US Legal Forms website initially, stick to the straightforward directions listed below:

- Initial, make certain you have chosen the proper record web template for that area/city of your choosing. Read the form information to make sure you have chosen the right form. If readily available, make use of the Review key to check with the record web template at the same time.

- If you want to get an additional variation in the form, make use of the Look for area to obtain the web template that meets your requirements and demands.

- After you have located the web template you desire, click Buy now to continue.

- Choose the rates program you desire, type your accreditations, and register for a merchant account on US Legal Forms.

- Complete the financial transaction. You can use your charge card or PayPal bank account to purchase the lawful form.

- Choose the formatting in the record and acquire it to the system.

- Make adjustments to the record if required. It is possible to full, revise and indication and print Kansas Nonqualified Stock Option Plan of Medicore, Inc., for officers, directors, consultants, key employees.

Obtain and print a large number of record web templates using the US Legal Forms Internet site, which provides the greatest selection of lawful varieties. Use specialist and state-certain web templates to deal with your small business or individual needs.

Form popularity

FAQ

Here's a real-world example: If you exercise one of these NSOs, you'll pay your company $3 to buy a share. But the IRS views that share to be worth $35. The difference between the $3 and the $35 counts as a $32 phantom gain (also called the spread). The phantom gain is taxed at ordinary income rates.

Examples of NSOs If you had the option to purchase 100 shares, you could pay $1,000 to exercise those options at $10 per share. If the stock price rose to $20 per share, you could exercise the options for $1,000, then sell the 100 shares for $20 per share, or $2,000. You'd make $1,000 in profit.

So start off right: Plan ahead. Your first step is planning. ... Manage your equity. ... Set some guidelines for stock options. ... Get a 409A valuation. ... Use the 409A to set the strike price. ... Adopt your vesting and cliff schedule. ... Set an expiration timeline. ... Create an ESO agreement and get your board's approval.

Non-qualified stock options require payment of income tax of the grant price minus the price of the exercised option. NSOs might be provided as an alternative form of compensation. Prices are often similar to the market value of the shares.

Non-qualified Stock Options (NSOs) are stock options that, when exercised, result in ordinary income under US tax laws on the difference, calculated on the exercise date, between the exercise price and the fair market value of the underlying shares.

In this situation, you exercise your option to purchase the shares but you do not sell the shares. Your compensation element is the difference between the exercise price ($25) and the market price ($45) on the day you exercised the option and purchased the stock, times the number of shares you purchased.

ESOs are a form of equity compensation granted by companies to their employees and executives. Like a regular call option, an ESO gives the holder the right to purchase the underlying asset?the company's stock?at a specified price for a finite period of time.

Options that exceed the $200,000 threshold are ?non-qualified securities? and thus do not qualify for the Stock Option Deduction.