Kansas Statement of Current Monthly Income for Use in Chapter 11 - Post 2005

Description

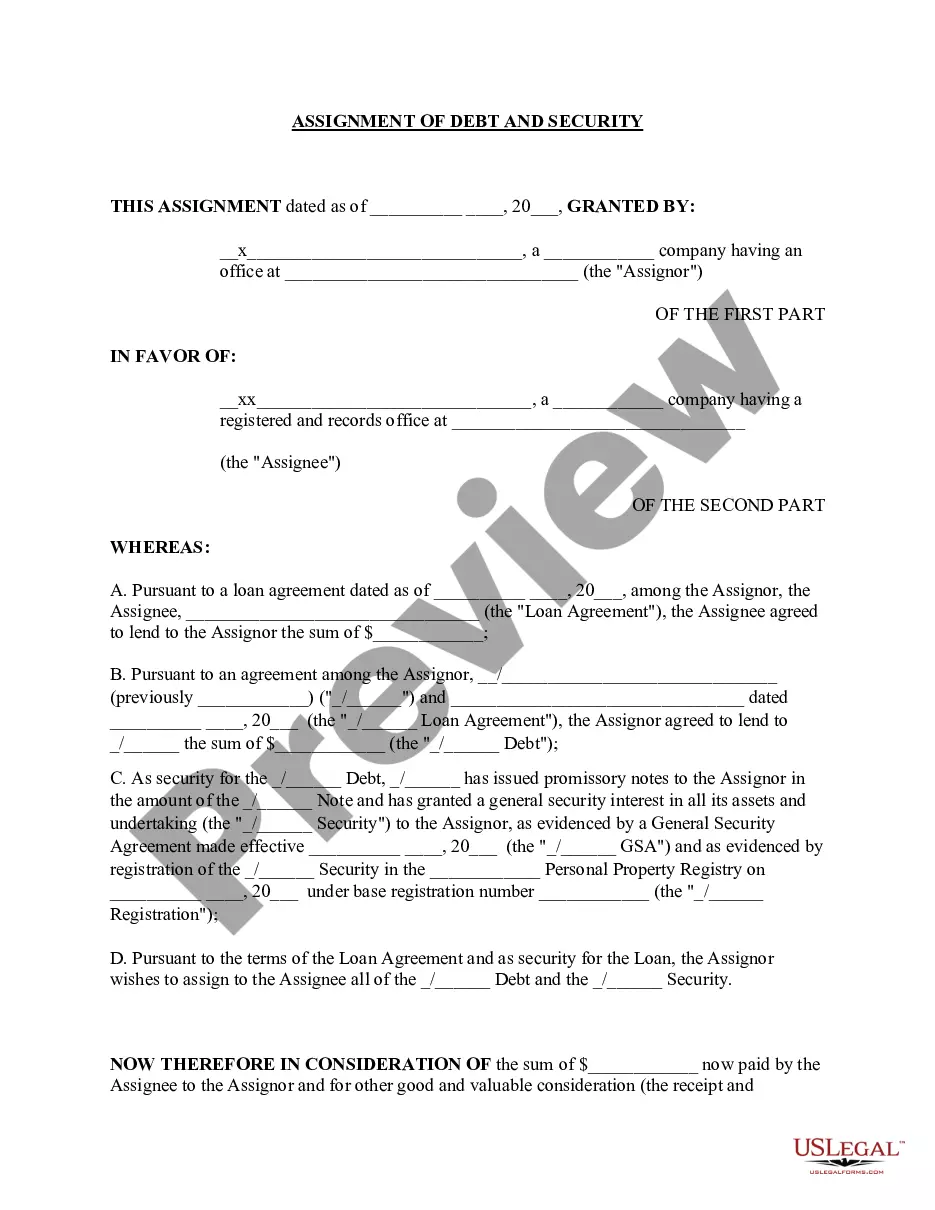

How to fill out Statement Of Current Monthly Income For Use In Chapter 11 - Post 2005?

If you have to comprehensive, down load, or print out legitimate record layouts, use US Legal Forms, the greatest collection of legitimate types, which can be found on-line. Make use of the site`s easy and convenient search to get the documents you want. Numerous layouts for organization and person reasons are categorized by groups and states, or search phrases. Use US Legal Forms to get the Kansas Statement of Current Monthly Income for Use in Chapter 11 - Post 2005 in just a couple of mouse clicks.

If you are presently a US Legal Forms buyer, log in in your account and click on the Down load button to find the Kansas Statement of Current Monthly Income for Use in Chapter 11 - Post 2005. You can also access types you formerly delivered electronically inside the My Forms tab of your own account.

If you work with US Legal Forms the very first time, follow the instructions beneath:

- Step 1. Make sure you have chosen the shape for the correct city/country.

- Step 2. Make use of the Preview solution to look over the form`s information. Don`t forget to see the outline.

- Step 3. If you are unhappy with all the develop, use the Lookup discipline on top of the monitor to find other models from the legitimate develop template.

- Step 4. Once you have found the shape you want, go through the Get now button. Select the rates plan you prefer and add your qualifications to sign up for the account.

- Step 5. Method the purchase. You can use your credit card or PayPal account to complete the purchase.

- Step 6. Find the file format from the legitimate develop and down load it in your system.

- Step 7. Full, modify and print out or signal the Kansas Statement of Current Monthly Income for Use in Chapter 11 - Post 2005.

Every single legitimate record template you buy is yours eternally. You possess acces to every single develop you delivered electronically within your acccount. Go through the My Forms area and pick a develop to print out or down load once again.

Remain competitive and down load, and print out the Kansas Statement of Current Monthly Income for Use in Chapter 11 - Post 2005 with US Legal Forms. There are millions of professional and state-particular types you can utilize for your personal organization or person demands.

Form popularity

FAQ

The means test is calculated by comparing the debtor's average income for the past six months (current monthly income), annualized, to the median income for households of the same size in the debtor's state of residence.

The Chapter 13 disposable income test is the court's way of ensuring that all your disposable income is going towards repaying your debts during your repayment period. Prior to approving any chapter 13 repayment plan, you must show that what you are paying is your best effort.

Calculation of Current Monthly Income: To begin the means test, debtors calculate their current monthly income, which equates to twice the gross income earned in the six months leading up to the bankruptcy filing.

You can earn a high income and still pass the means test if you have substantial expenses like a hefty mortgage, multiple car payments, taxes, childcare, health care, or care of an elderly or disabled person. However, if your disposable income is more than a certain sum, you will not be able to file.