Full text and guidelines for the Victims of Terrorism Relief Act of 2001, IRC 5891 (STRUCTURED SETTLEMENT FACTORING TRANSACTIONS.)

Kansas Victims of Terrorism Relief Act of 2001

Description

How to fill out Victims Of Terrorism Relief Act Of 2001?

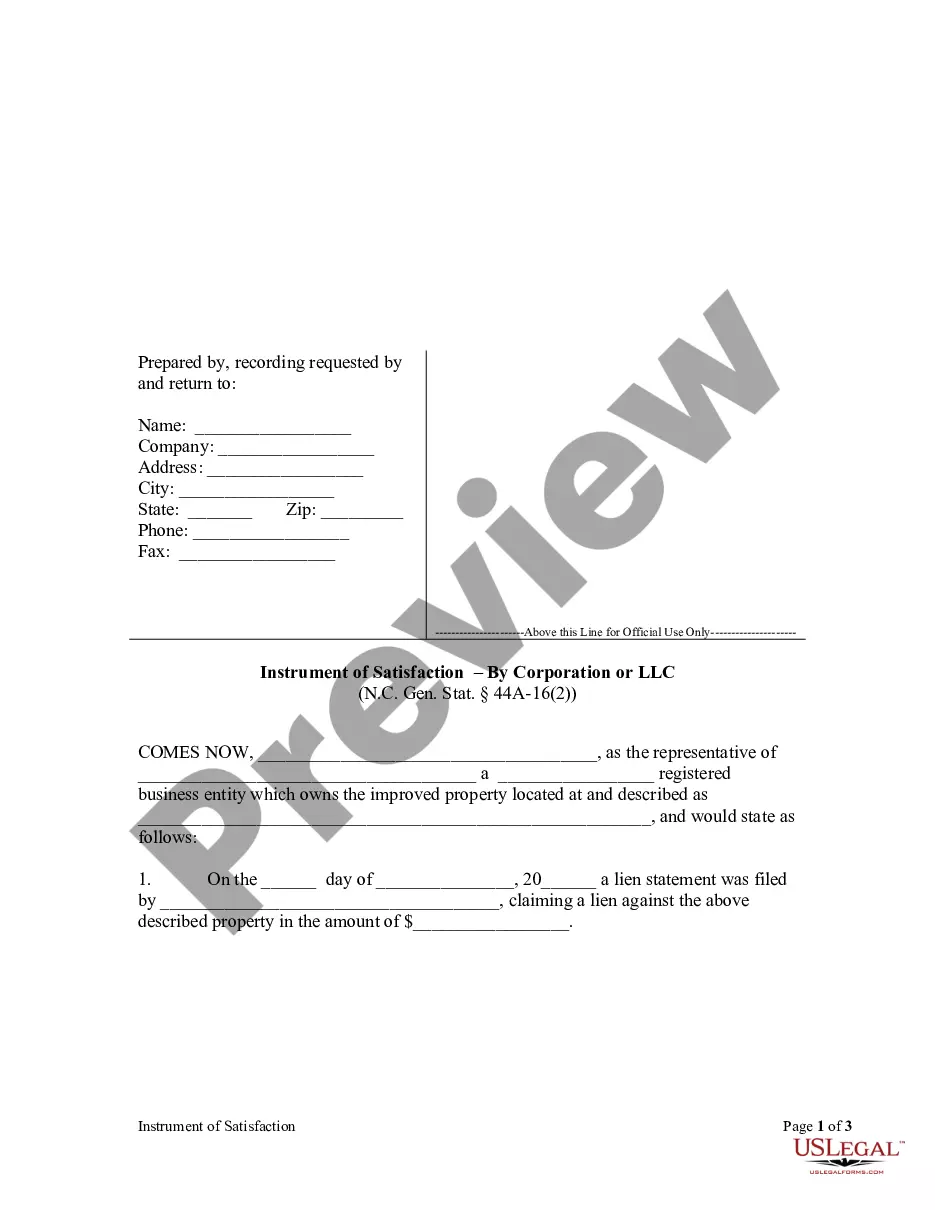

Finding the right authorized record format might be a have a problem. Of course, there are tons of templates available on the net, but how can you get the authorized kind you require? Use the US Legal Forms website. The assistance gives thousands of templates, such as the Kansas Victims of Terrorism Relief Act of 2001, which can be used for business and personal demands. Each of the kinds are checked out by professionals and fulfill state and federal specifications.

Should you be presently signed up, log in for your bank account and click the Down load key to have the Kansas Victims of Terrorism Relief Act of 2001. Use your bank account to check from the authorized kinds you possess ordered in the past. Proceed to the My Forms tab of the bank account and obtain yet another copy of the record you require.

Should you be a whole new end user of US Legal Forms, listed below are simple guidelines that you should adhere to:

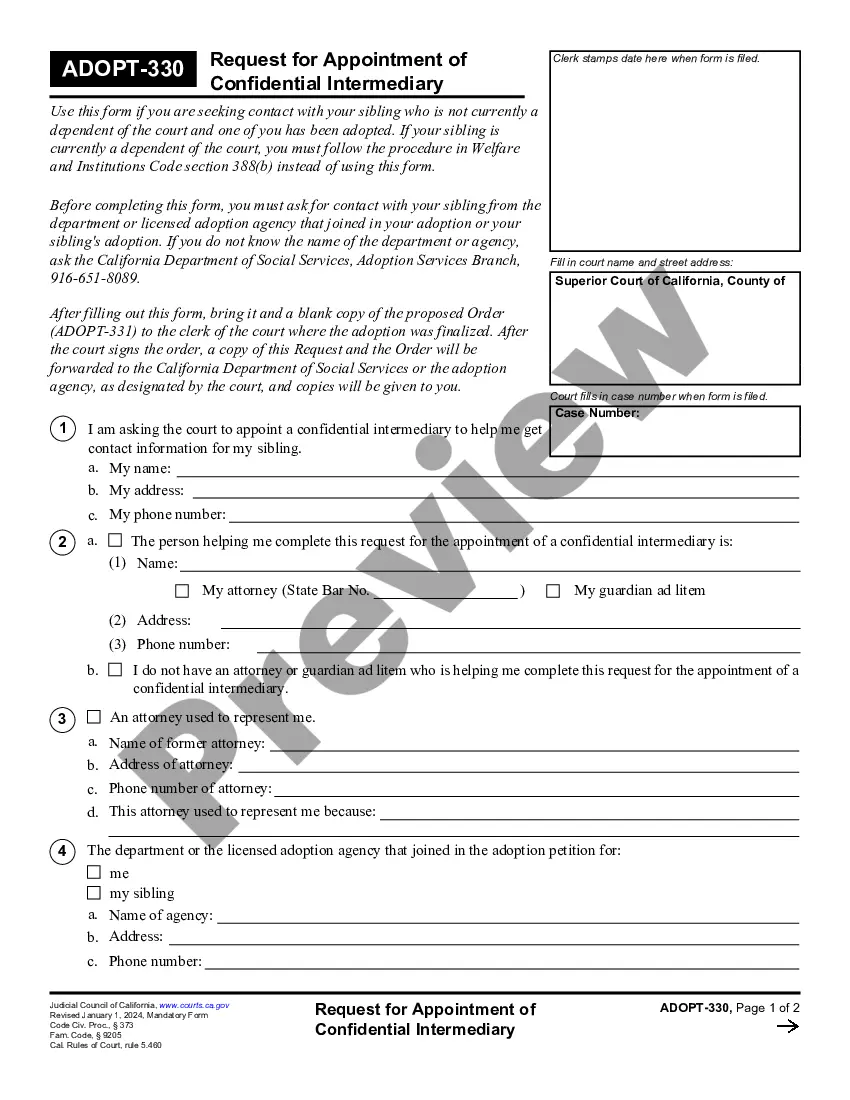

- Initially, be sure you have chosen the right kind for your personal town/state. It is possible to look over the shape utilizing the Review key and browse the shape explanation to ensure it will be the right one for you.

- In case the kind fails to fulfill your preferences, utilize the Seach discipline to obtain the proper kind.

- When you are certain the shape is proper, click on the Purchase now key to have the kind.

- Opt for the pricing plan you want and type in the needed details. Build your bank account and purchase the order with your PayPal bank account or credit card.

- Opt for the file structure and download the authorized record format for your product.

- Total, change and printing and indicator the received Kansas Victims of Terrorism Relief Act of 2001.

US Legal Forms is the greatest catalogue of authorized kinds where you can see numerous record templates. Use the service to download expertly-made documents that adhere to state specifications.

Form popularity

FAQ

The Fund has paid more than $3.3 billion to victims in four rounds of distributions.

At the end of the process $7 billion was awarded to 97% of the families.

An act to amend the Internal Revenue Code of 1986 to provide tax relief for victims of the terrorist attacks against the United States, and for other purposes.

Tax information: VCF awards are not subject to federal income tax. See 26 U.S.C. §139(f). Bankruptcy proceedings: The VCF cannot advise you on how your award may be treated if the victim or recipient of the award has filed for bankruptcy protection.