Kansas Employee Payroll Records Checklist

Description

How to fill out Employee Payroll Records Checklist?

Have you been in a situation where you require documents for either business or personal use nearly all the time.

There is a wide range of legal document templates accessible online, yet finding reliable versions can be challenging.

US Legal Forms provides a vast array of form templates, such as the Kansas Employee Payroll Records Checklist, which can be tailored to satisfy state and federal regulations.

Once you find the correct form, click Buy now.

Choose the pricing plan you prefer, fill in the required details to create your account, and complete the payment using your PayPal or Visa or Mastercard.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- Afterward, you can download the Kansas Employee Payroll Records Checklist template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Select the form you need and verify that it corresponds to the appropriate region/county.

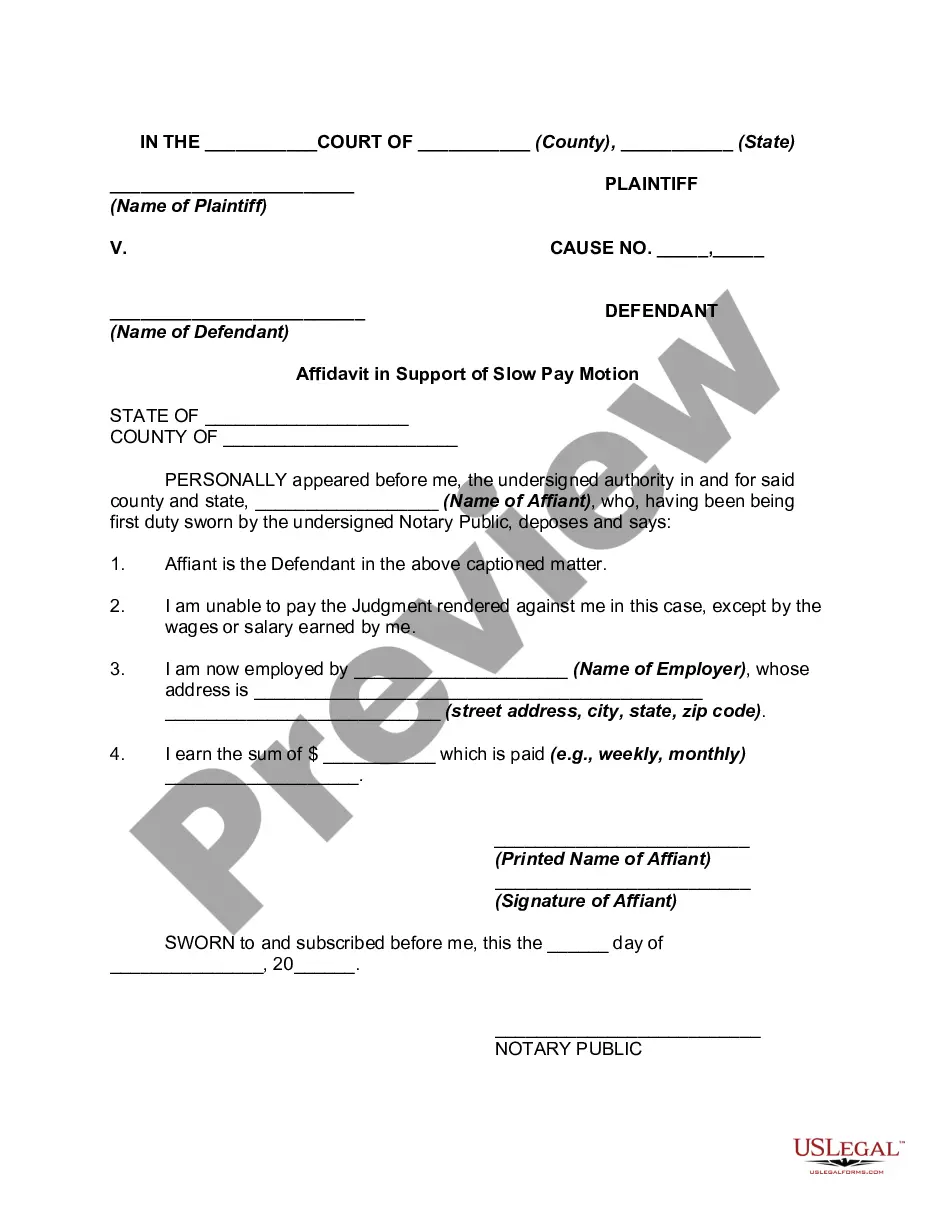

- Utilize the Review button to scrutinize the document.

- Check the description to ensure you have picked the correct form.

- If the form does not meet your specifications, use the Search bar to find a form that satisfies your needs.

Form popularity

FAQ

We will withhold 3.5 percent of your weekly benefit amount for state income taxes and 10 percent for federal income taxes. For example, if your weekly benefit amount is $200 we will withhold $7 for Kansas income taxes and $20 for federal taxes.

The vast majority of companies and employees use direct deposit. But cash and paper checks are also options. Make sure that you are paying your employees at least the Kansas minimum wage, which is the same as the federal minimum wage, $7.25 per hour. You can pay your federal and Kansas state taxes online.

You must be wholly or partially unemployed each week. If you work less than full time, you may also be considered unemployed as long as your gross weekly wages do not exceed your Weekly Benefit Amount (WBA).

Steps to Hiring your First Employee in KansasStep 1 Register as an Employer.Step 2 Employee Eligibility Verification.Step 3 Employee Withholding Allowance Certificate.Step 4 New Hire Reporting.Step 5 Payroll Taxes.Step 6 Workers' Compensation Insurance.Step 7 Labor Law Posters and Required Notices.

They could determine the size and delivery of your paycheck, for example.5 forms to complete when starting a new job. You might be wondering why you need to be prepared for your new-hire paperwork.I-9 documents.W-4 form.Direct deposit form.Benefits enrollment.Company-specific paperwork.

Each new employee will need to fill out the I-9 Employment Eligibility Verification Form from U.S. Citizenship and Immigration Services.

Kansas. State Taxes on Unemployment Benefits: Kansas taxes unemployment benefits to the same extent they're taxed under federal law.

The New Hire Reporting form (K-CNS 436) is fillable and can be submitted via mail or fax to (888) 219-7798. Login to the KansasEmployer.gov site. Choose the Select button that corresponds to the "Enter new hire information" option. Enter the hiring company's FEIN and Kansas Serial Number.

The most common types of employment forms to complete are:W-4 form (or W-9 for contractors)I-9 Employment Eligibility Verification form.State Tax Withholding form.Direct Deposit form.E-Verify system: This is not a form, but a way to verify employee eligibility in the U.S.

Liability Requirements Most employers liable for Kansas unemployment tax also are liable for the FUTA tax if: Employment is agricultural and you employ 10 or more workers in any portion of 20 different weeks in a calendar year, or have a payroll of $20,000 or more cash wages in any calendar quarter.