Kansas Use of Company Equipment

Description

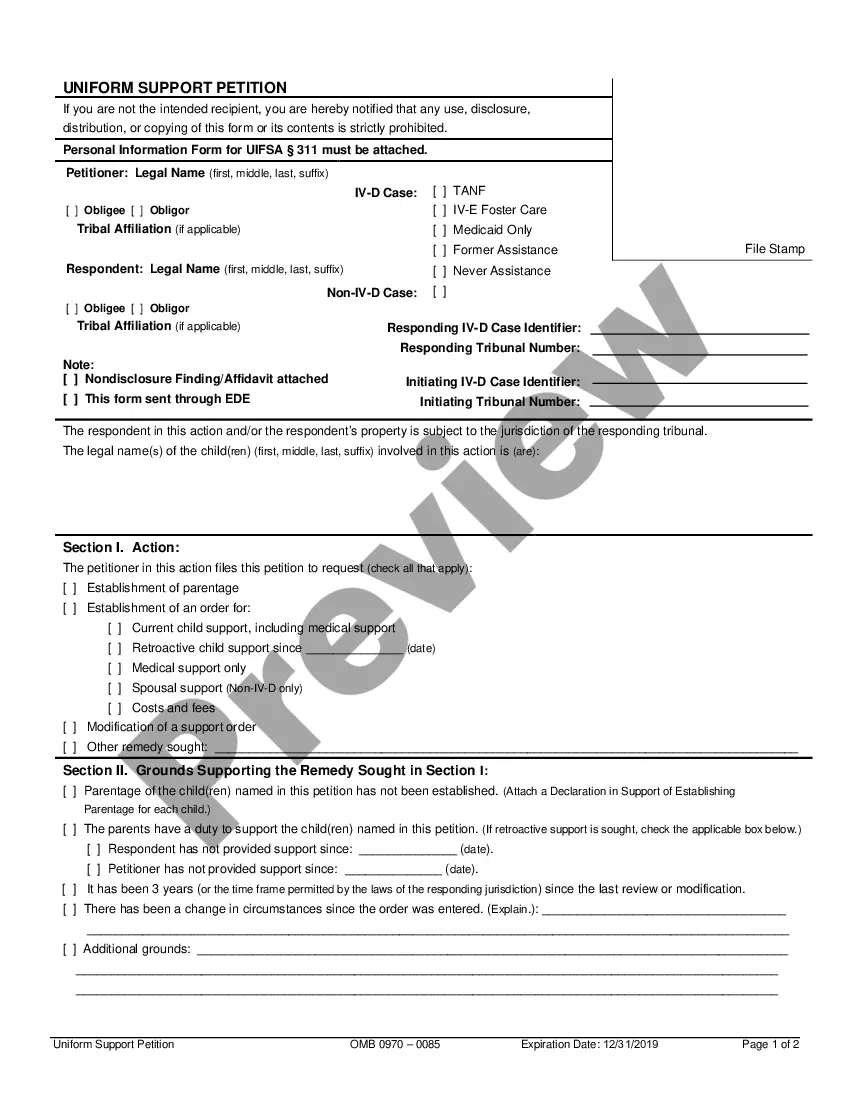

How to fill out Use Of Company Equipment?

If you want to sum up, acquire, or create valid document templates, utilize US Legal Forms, the largest collection of valid forms available online.

Make use of the website's straightforward and user-friendly search feature to find the documents you need.

Numerous templates for business and personal purposes are categorized by type and state, or by keywords.

Every legal document format you download is yours permanently. You have access to any form you downloaded in your account.

Click on the My documents section and select a form to print or download again. Stay competitive and acquire and print the Kansas Use of Company Equipment with US Legal Forms. There are millions of specialized and state-specific forms available for your business or personal needs.

- Use US Legal Forms to find the Kansas Use of Company Equipment in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Get button to retrieve the Kansas Use of Company Equipment.

- You can also access forms you previously downloaded from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow these steps.

- Step 1. Make sure you have selected the form for the correct city/state.

- Step 2. Utilize the Preview option to review the form's content. Don't forget to read the summary.

- Step 3. If you are unsatisfied with the form, use the Search box at the top of the screen to find other forms in the legal document style.

- Step 4. Once you find the form you need, select the Get now button, choose your pricing plan, and enter your details to sign up for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the transaction.

- Step 6. Choose the format of the legal document and download it to your device.

- Step 7. Complete, revise, and print or sign the Kansas Use of Company Equipment.

Form popularity

FAQ

In Kansas, rental income is typically subject to sales tax, but this can vary based on the type of equipment being rented. For practical guidance, consult with a tax expert to determine whether the Kansas use of company equipment impacts your rental obligations. If you want to streamline your understanding of these regulations, consider using US Legal Forms to access tailored documents and forms.

Farm equipment in Kansas is generally considered tax exempt when it is used for agricultural purposes. However, this exemption applies only if the equipment is utilized in the production of agricultural products. To ensure compliance and avoid potential tax issues, it is wise to explore the specifics of Kansas use of company equipment with a qualified tax professional or legal advisor.

In Kansas, various items are not subject to sales tax, including certain food items, prescription drugs, and specific services. Understanding these exemptions helps businesses manage their costs while utilizing Kansas Use of Company Equipment effectively. Moreover, knowing which items are tax-exempt allows companies to maintain compliance and optimize their financial resources. For detailed guidance, consider using the USLegalForms platform, which can simplify your understanding of Kansas tax laws.

Some items are exempt from sales and use tax, including:Sales of certain food products for human consumption (many groceries)Sales to the U.S. Government.Sales of prescription medicine and certain medical devices.Sales of items paid for with food stamps.

Lease or rental of equipment with an operator, is providing a service and therefore is taxable if the service being performed by the equipment operator is taxable.

Equipment renting payments are considered external expenses and are therefore deductible from the company's taxable profit under common law provisions. This taxable profit determines the taxable portion of earnings for corporation tax, or income tax.

Sales Tax Exemptions in KansasAll construction materials and prescription drugs (including prosthetics and devices used to increase mobility) are considered to be exempt. While groceries are not tax exempt, any food that is used to provide meals for the elderly or homebound is considered to be exempt from taxes.

Rental income is subject to the earnings tax to the extent that the rental, ownership, management, or operation of the property from which the income is derived constitutes a business activity of the taxpayer in whole or in part.

WHAT PURCHASES ARE EXEMPT? Only goods or merchandise intended for resale (inventory) are exempt. Tools, equipment, fixtures, supplies, and other items purchased for business or personal use are TAXABLE since the buyer is the final consumer of the property.

Sales Tax Exemptions in KansasAll construction materials and prescription drugs (including prosthetics and devices used to increase mobility) are considered to be exempt. While groceries are not tax exempt, any food that is used to provide meals for the elderly or homebound is considered to be exempt from taxes.