Kansas Memorandum to Stop Direct Deposit

Description

How to fill out Memorandum To Stop Direct Deposit?

Locating the appropriate legitimate document design can be a challenge.

Certainly, there are many templates available online, but how will you find the exact form you require? Utilize the US Legal Forms website.

The service offers a vast selection of templates, including the Kansas Memorandum to Halt Direct Deposit, which you can use for business and personal purposes.

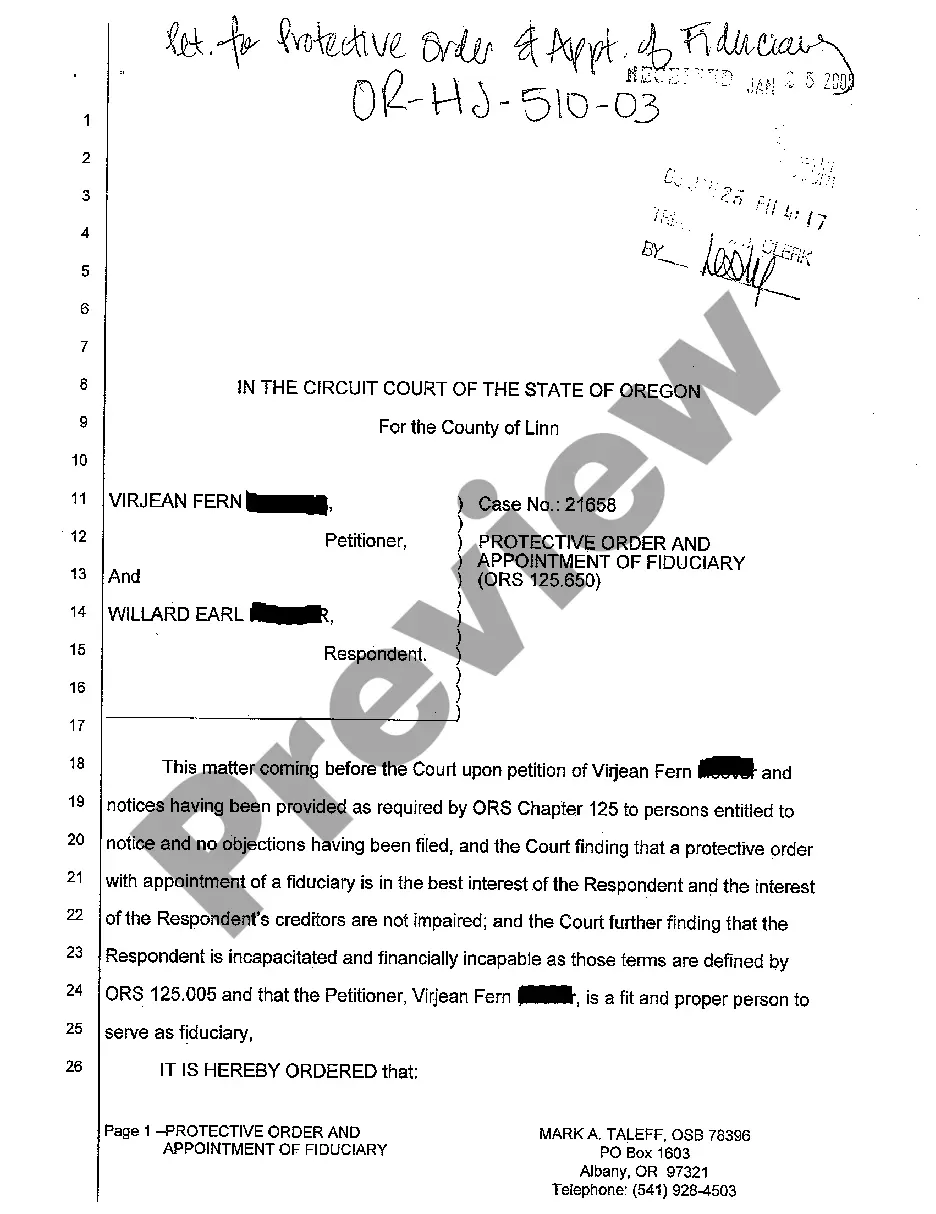

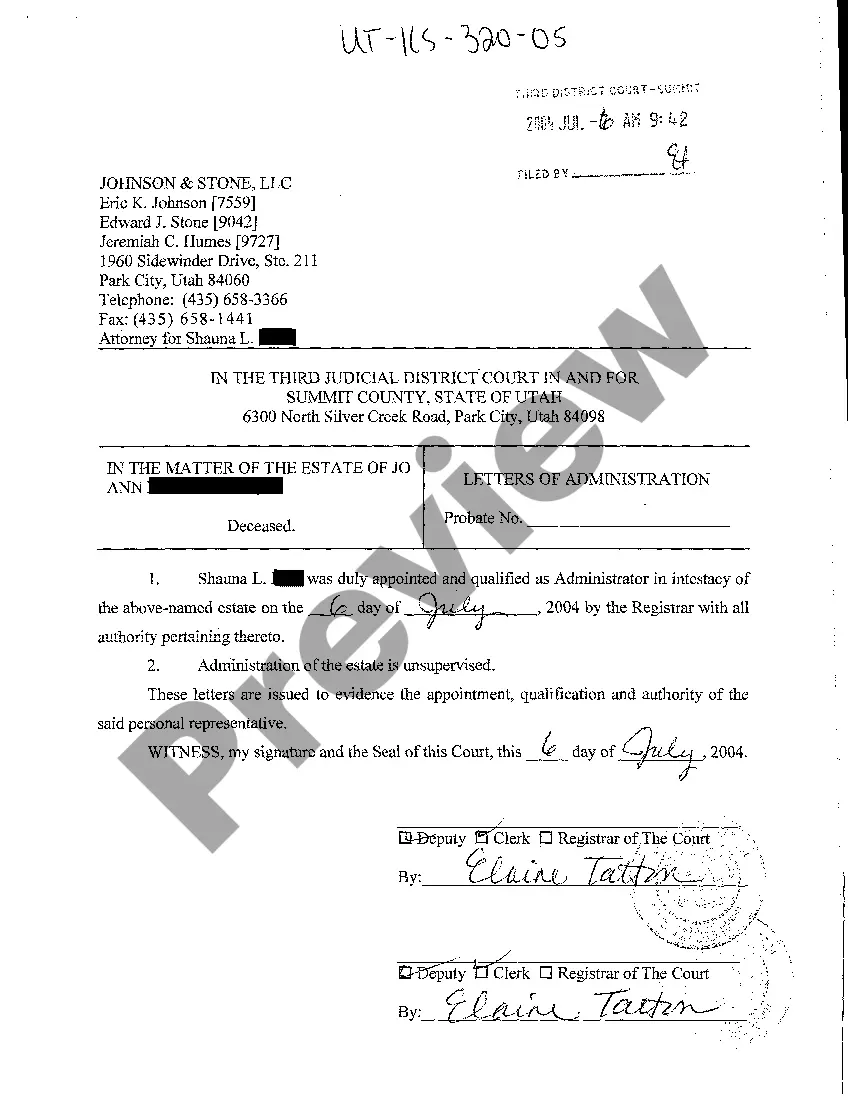

You can browse the template using the Review option and check the form description to confirm it is suitable for you.

- All forms are reviewed by professionals and comply with federal and state regulations.

- If you are already registered, Log In to your account and click the Download button to obtain the Kansas Memorandum to Halt Direct Deposit.

- Use your account to search for the legal forms you have purchased previously.

- Visit the My documents tab in your account to download another copy of the documents you need.

- If you are a new customer of US Legal Forms, here are some simple steps you can follow.

- First, ensure you have selected the right form for your city/region.

Form popularity

FAQ

O Your Balance of Net Pay account will be assigned the Priority Value of '999' (the highest Deposit Order value) so that all other allocations are processed before that one.

Yes. The National Automated Clearinghouse Association (NACHA) guidelines say that an employer is permitted to reverse a direct deposit within five business days. Assuming there is no applicable state law that overrides this guideline, an employer must follow it.

When will I be paid? If there are no issues on your claim, payments are normally received two to three business days after you file your weekly claim. Please note: If you file your weekly claim on Sunday or Monday, the payment is typically issued on Tuesday. Allow 2 - 3 business days for payments to be deposited.

A deposit is normally rejected for one of two reasons: The address we hold for you doesn't match the one registered with your bank, or. The payment fails online.

Cancellation by the Financial Institution: The financial institution receiving the direct deposits may cancel direct deposit. The institution must provide you and your payroll office 30 days written notice of the cancellation. The cancellation will not take effect until the Research Foundation processes it.

Here's how:In the Review and Create Paychecks window while paying employees, select the Open Paycheck Detail button.Uncheck the Use Direct Deposit option.Select Save & Close.

How do I set up direct deposit? Log in to your account on GetKansasBenefits.gov and select Payment Options. Select direct deposit and fill out the required banking information.

Give your bank a "stop payment order" Even if you have not revoked your authorization with the company, you can stop an automatic payment from being charged to your account by giving your bank a "stop payment order" . This instructs your bank to stop allowing the company to take payments from your account.

To cancel your direct deposit, you must contact your employer or the payor of your benefits. They will tell you how to cancel the service.

Banks may not hold cash or electronic payments, direct deposit, money orders, Treasury checks; Federal Reserve Bank and Federal Home Loan checks, cashier's, certified, or teller's checks, and state or local government checks, along with the first $5,000 of traditional checks that are not in question (next-day items).