Kansas Fixed Asset Removal Form

Description

How to fill out Fixed Asset Removal Form?

Have you ever found yourself in a situation where you require documents for either business or personal uses almost every day.

There are numerous valid document templates available online, but finding ones you can trust isn't easy.

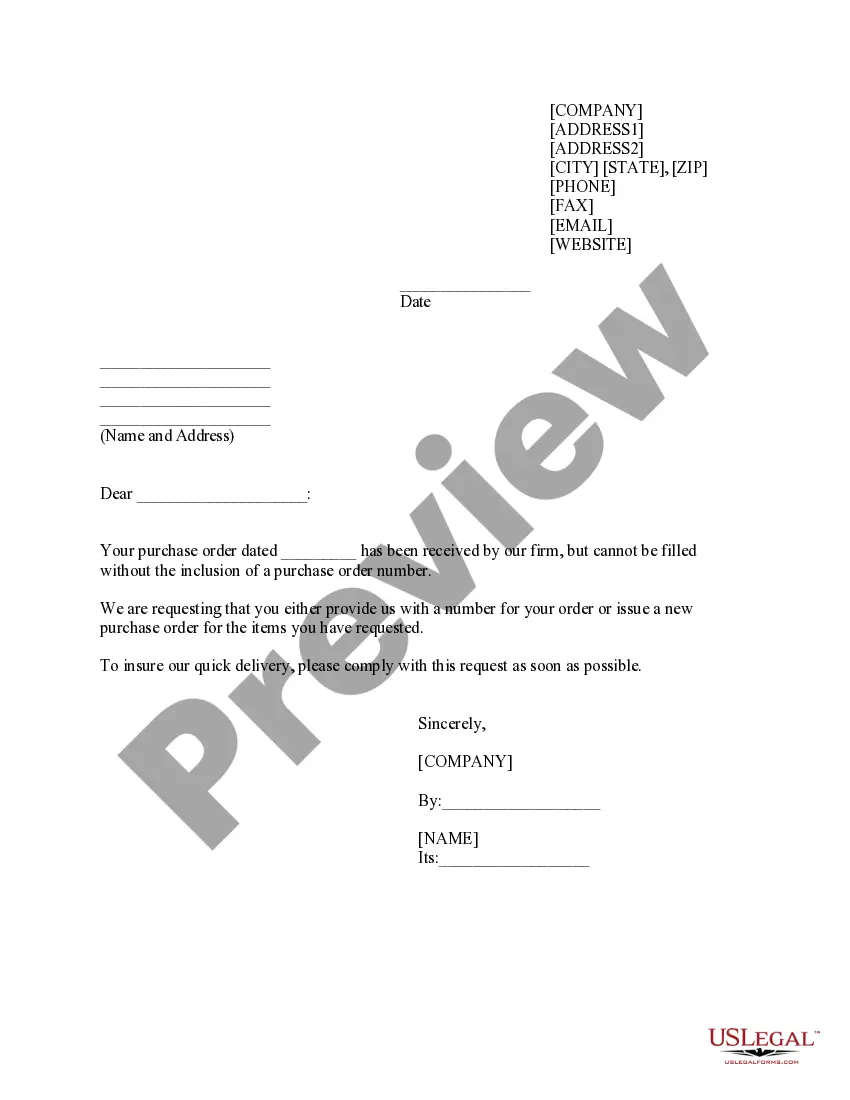

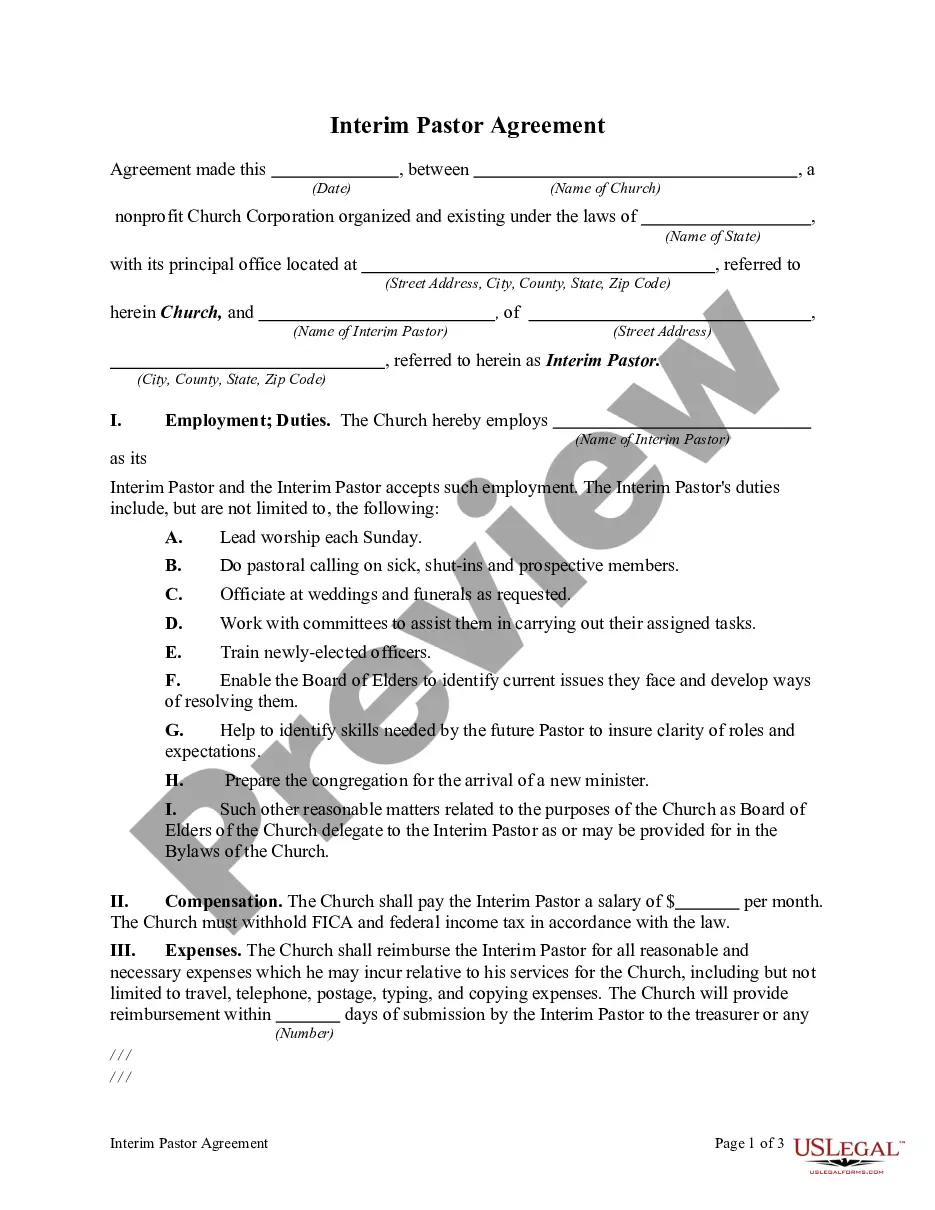

US Legal Forms provides a vast selection of form templates, including the Kansas Fixed Asset Removal Form, designed to comply with federal and state regulations.

Once you find the right form, click Buy now.

Choose the pricing plan you prefer, fill in the necessary details to create your account, and pay for your order using your PayPal or credit card.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- Afterward, you can download the Kansas Fixed Asset Removal Form template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Locate the form you need and verify that it is for the correct area/region.

- Use the Review option to assess the form.

- Read the information to ensure you have selected the correct form.

- If the form isn't what you're looking for, utilize the Search field to find a form that fits your requirements and needs.

Form popularity

FAQ

Asset disposal is the elimination of an asset from a company's records, typically by selling or scrapping it. These are often long-term assets that contributed to generating profits, such as machinery, technology or company vehicles.

The overall concept for the accounting for asset disposals is to reverse both the recorded cost of the fixed asset and the corresponding amount of accumulated depreciation. Any remaining difference between the two is recognized as either a gain or a loss.

When an asset reaches the end of its useful life and is fully depreciated, asset disposal occurs by means of a single entry in the general journal. The accumulated depreciation account is debited, and the relevant asset account is credited.

A disposal account is a gain or loss account that appears in the income statement, and in which is recorded the difference between the disposal proceeds and the net carrying amount of the fixed asset being disposed of.

The accounting for disposal of fixed assets can be summarized as follows:Record cash receive or the receivable created from the sale: Debit Cash/Receivable.Remove the asset from the balance sheet. Credit Fixed Asset (Net Book Value)Recognize the resulting gain or loss. Debit/Credit Gain or Loss (Income Statement)

The Fixed Asset Disposal Form Template is used to document the disposal of old or faulty equipment. Include information such as the name of the person who authorized the disposal, the method of disposal as well as details about costs in case the asset wsa sold.

Depreciation and loss on disposal of fixed assets are both expense items found on the income statement, while EBITDA (earnings before interest, taxes, depreciation and amortization) is a measure of income that is often reported as a discrete item on the income statement, although it is not required to be under

The accounting for disposal of fixed assets can be summarized as follows:Record cash receive or the receivable created from the sale: Debit Cash/Receivable.Remove the asset from the balance sheet. Credit Fixed Asset (Net Book Value)Recognize the resulting gain or loss. Debit/Credit Gain or Loss (Income Statement)

Disposal of fixed assets is accounted for by removing cost of the asset and any related accumulated depreciation and accumulated impairment losses from balance sheet, recording receipt of cash and recognizing any resulting gain or loss in income statement.