Kansas Depreciation Schedule

Description

How to fill out Depreciation Schedule?

Selecting the appropriate legal document format may feel like a struggle.

Obviously, there are numerous templates accessible online, but how do you obtain the legal format you require.

Visit the US Legal Forms website. The platform offers an extensive array of templates, including the Kansas Depreciation Schedule, suitable for both commercial and personal use.

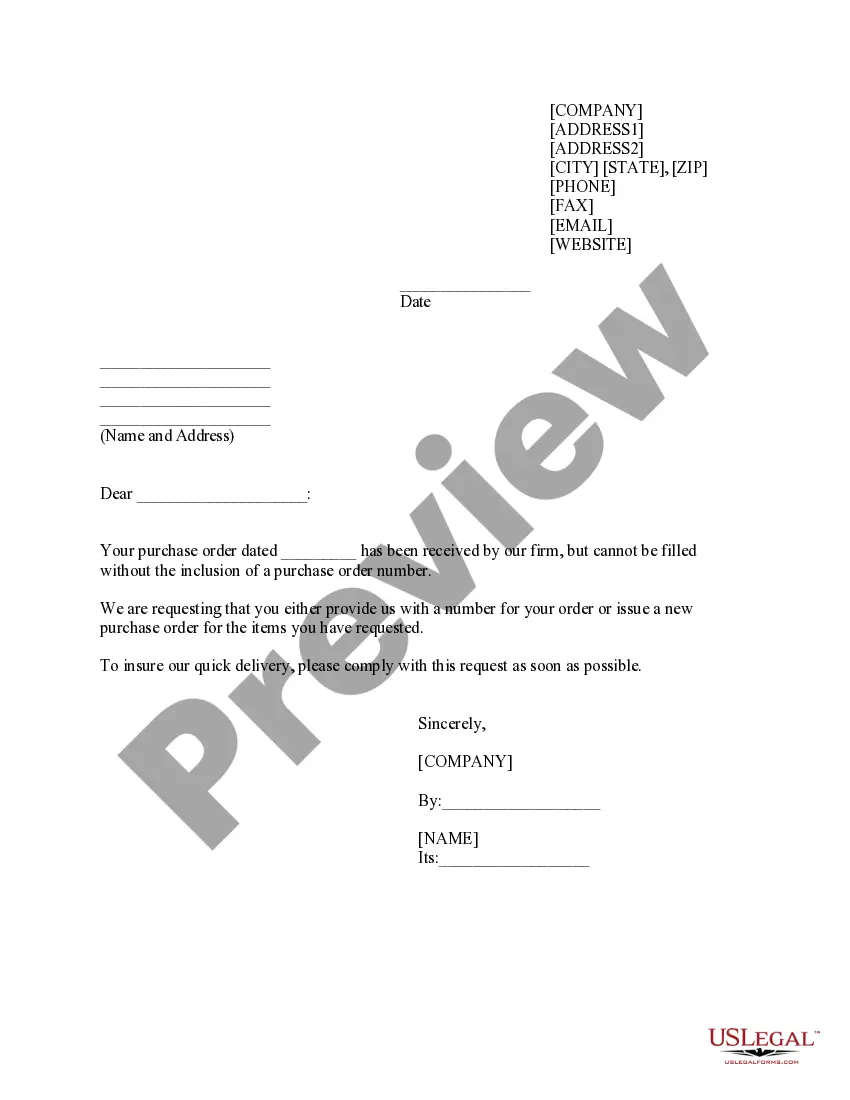

You can preview the document using the Preview button and review the document outline to confirm it is suitable for your needs.

- All forms are reviewed by professionals and comply with federal and state regulations.

- If you are already registered, sign in to your account and click the Download button to access the Kansas Depreciation Schedule.

- Use your account to browse through the legal documents you have previously ordered.

- Navigate to the My documents section of your account and download another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps to follow.

- First, ensure you have selected the correct document for your city/state.

Form popularity

FAQ

The Business Personal Property Division appraises all business' tangible personal property, also known as commercial and industrial machinery and equipment. Article 11, Section 1 of the Kansas Constitution establishes that these assets are assessed at 25 percent of their appraised value.

Personal property may be leased, loaned, rented, consigned, or owned. The basic categories include: furniture, fixtures, plant equipment, office equipment, machinery, boats, aircraft, mobile homes, and recreational vehicles.

Kansas collects a 7.3% to 8.775% state sales tax rate on the purchase of all vehicles. There are also local taxes up to 1%, which will vary depending on region. In addition to taxes, car purchases in Kansas may be subject to other fees like registration, title, and plate fees.

Personal Property Tax Calculation Formula To determine how much you owe, perform the following two-part calculation: Estimated Market Value of the Property X Assessment Rate (33 1/3%) = Estimated Assessed Value. Estimated Assessed Value / 100 X Total Tax Rate = Estimated Tax Bill.

The expensing deduction for this item is $1,160 to use as a subtraction from Kansas income. For corporate purposes this is subtracted from income after apportionment on line 18 of Form K-120 or K-121.

The assessment rate for individual personal property is 30% of the appraised value, except for truck beds, which are on schedule 5 at 25% of the appraised value. Manufactured housing is assessed at 11.5% of the appraised value.

30% is the assessment rate for property in the motor vehicle or other subclass of personal property.

You will pay property tax when you initially register a vehicle and each year when you renew your vehicle registration. Use the Kansas Department of Revenue Vehicle Property Tax Calculator to estimate vehicle property tax by make/model/year, VIN or RV weight/year, for a partial or full registration year.