Kansas Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status

Description

How to fill out Charitable Trust With Creation Contingent Upon Qualification For Tax Exempt Status?

You might spend hours online looking for the legal document template that meets the state and federal requirements you desire.

US Legal Forms offers thousands of legal forms that are reviewed by experts.

It is easy to obtain or print the Kansas Charitable Trust with Creation Dependent on Qualification for Tax Exempt Status from the service.

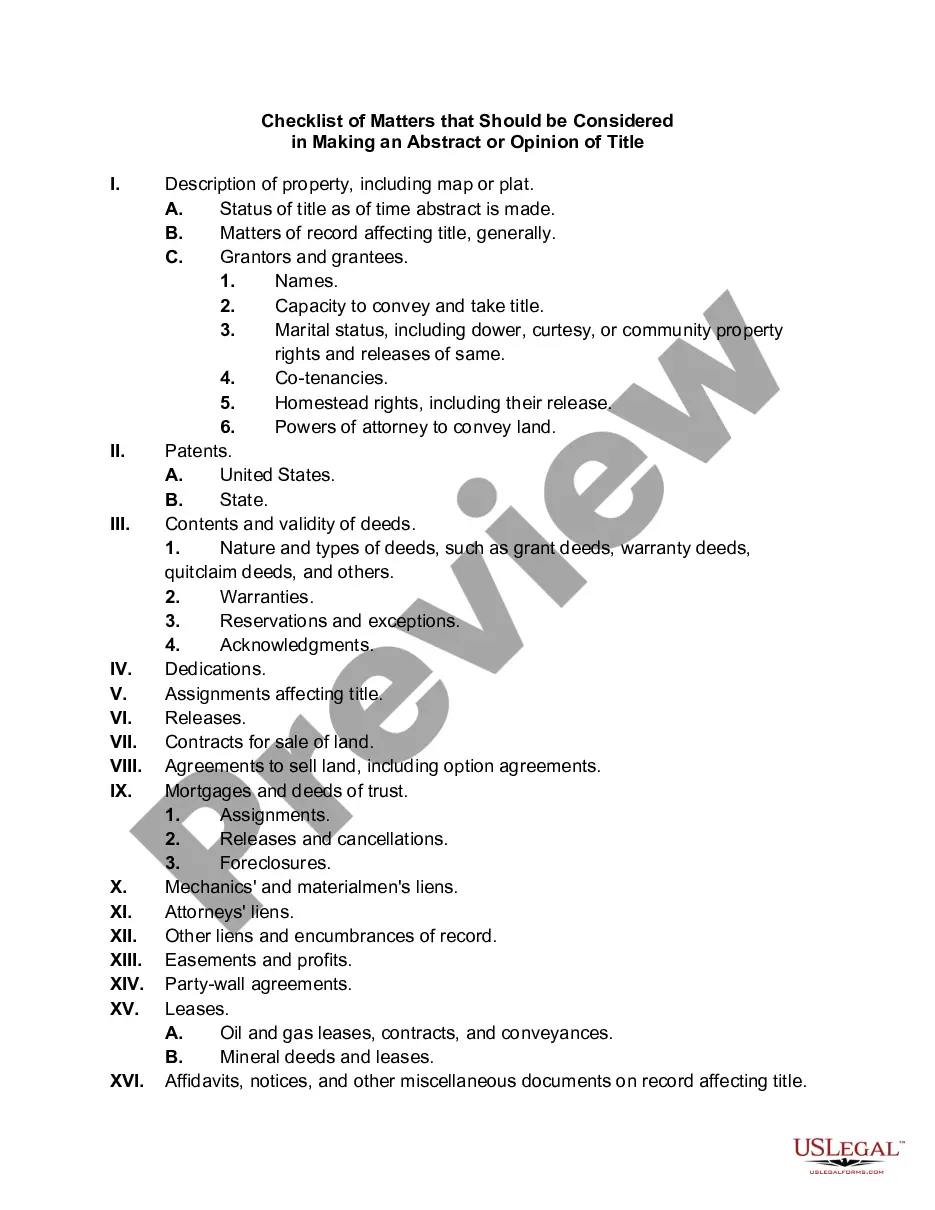

First, ensure that you have selected the correct document template for the region/city of your choice. Review the form description to confirm you have chosen the right form. If available, use the Review button to look through the document template as well.

- If you already have a US Legal Forms account, you can Log In and click on the Download button.

- Afterward, you can fill out, modify, print, or sign the Kansas Charitable Trust with Creation Dependent on Qualification for Tax Exempt Status.

- Every legal document template you purchase is yours permanently.

- To get another copy of any purchased form, go to the My documents section and click on the appropriate button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

Form popularity

FAQ

Both a will and a trust serve important roles in estate planning, but their usefulness varies based on individual needs. A Kansas Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status allows for specific tax advantages that a will may not offer. Ultimately, the best choice depends on your financial situation and objectives. Consulting with a legal professional can help you determine which option is best for your unique circumstances.

Tax exemption status for your organisationNon profit organisations should register as a Public Benefit Organisation and specifically apply for tax exemption in terms of section 10(1)(cA)(i) of the Income Tax Act. This means that you do not have to pay income tax on donations received.

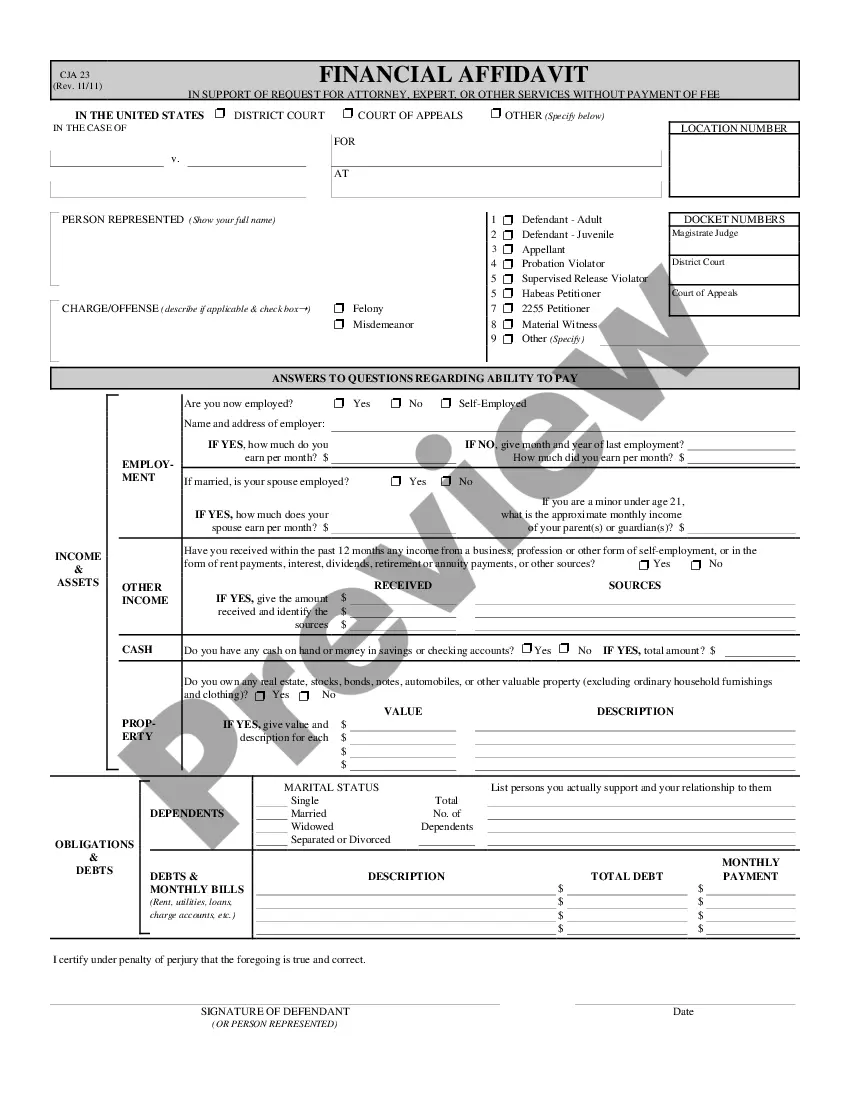

To claim exempt status on purchases, the qualified entity and organization must be authorized by statute and provide to the retailer a department issued Tax Entity Exemption Certificate. The certificate must be completed and signed by an authorized agent of the organization and presented to the seller.

Exemption Requirements - 501(c)(3) Organizations To be tax-exempt under section 501(c)(3) of the Internal Revenue Code, an organization must be organized and operated exclusively for exempt purposes set forth in section 501(c)(3), and none of its earnings may inure to any private shareholder or individual.

Organizations organized and operated exclusively for religious, charitable, scientific, testing for public safety, literary, educational, or other specified purposes and that meet certain other requirements are tax exempt under Internal Revenue Code Section 501(c)(3).

Nonprofit organizations are not automatically considered to be tax exempt. The Kansas Legislature determines by statute which organizations and entities are exempt from sales tax on their purchases. Kansas does not exempt all nonprofit organizations.

All construction materials and prescription drugs (including prosthetics and devices used to increase mobility) are considered to be exempt. While groceries are not tax exempt, any food that is used to provide meals for the elderly or homebound is considered to be exempt from taxes.

To claim exempt status on purchases, the qualified entity and organization must be authorized by statute and provide to the retailer a department issued Tax Entity Exemption Certificate. The certificate must be completed and signed by an authorized agent of the organization and presented to the seller.

For the purposes of PSLF, eligible not-for-profit organizations include a organizations that are tax exempt under section 501(c)(3) of the Internal Revenue Code (IRC), or other not-for-profit organizations that provide a qualifying service.

A qualified charitable organization is recognized as tax-exempt in the pursuit of philanthropic, nonprofit, or civic activities. Section 501(c)(3) is the specific portion of the U.S. Internal Revenue Code (IRC) and a specific tax category for nonprofit organizations.