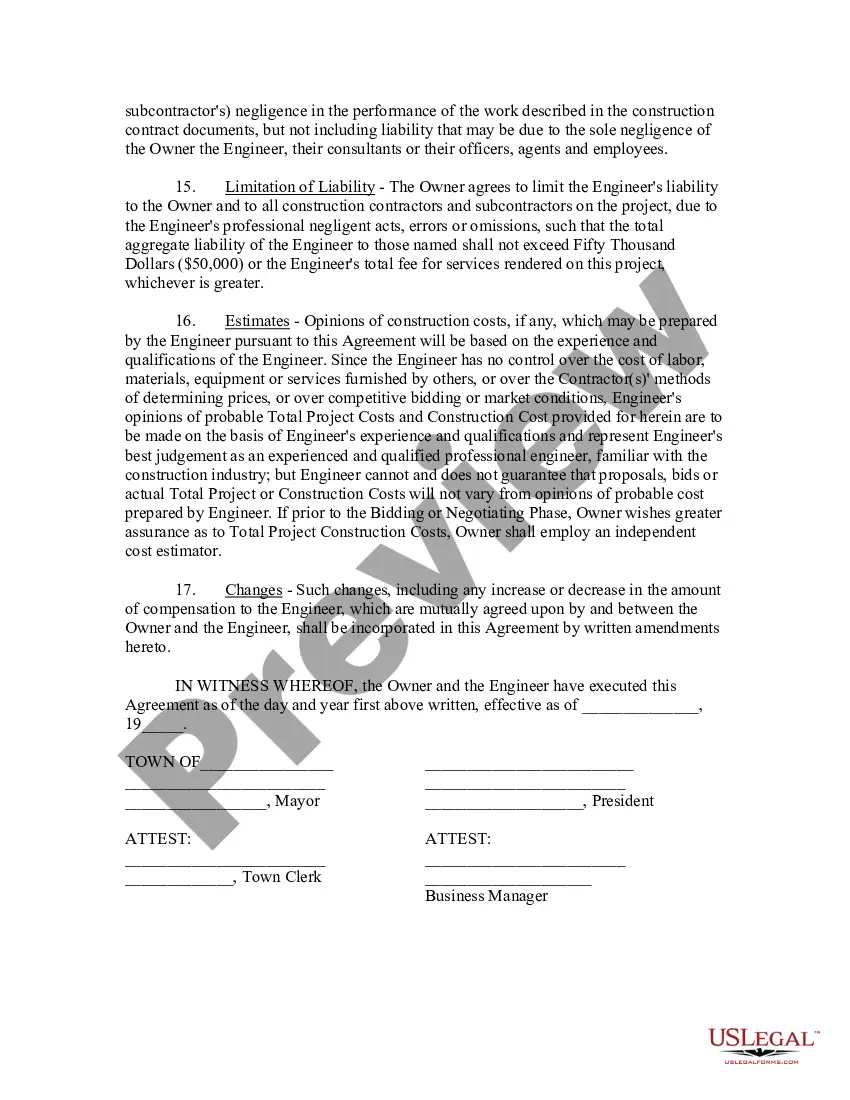

Kansas Engineering Contract between Municipality and Engineering Firm

Description

How to fill out Engineering Contract Between Municipality And Engineering Firm?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a diverse selection of legal document templates that you can obtain or print.

By using the website, you can access thousands of forms for business and personal needs, organized by categories, states, or keywords. You can find the most recent versions of forms such as the Kansas Engineering Contract between Municipality and Engineering Firm within moments.

If you already have an account, Log In and obtain the Kansas Engineering Contract between Municipality and Engineering Firm from the US Legal Forms library. The Download button will appear on every form you view. You have access to all previously saved forms in the My documents section of your account.

Complete the transaction. Use your credit card or PayPal account to process the payment.

Select the format and download the form onto your device. Make modifications. Fill out, edit, print, and sign the saved Kansas Engineering Contract between Municipality and Engineering Firm. Each template you download is permanent and has no expiration date. Therefore, if you wish to download or print another copy, simply revisit the My documents section and click on the form you require. Access the Kansas Engineering Contract between Municipality and Engineering Firm with US Legal Forms, the most extensive library of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal requirements and specifications.

- Ensure you have selected the appropriate form for your city/region.

- Click the Preview button to examine the form's content.

- Review the form description to confirm that you have chosen the correct document.

- If the form does not meet your needs, utilize the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, affirm your selection by clicking the Acquire now button.

- Next, choose your preferred payment plan and provide your details to create an account.

Form popularity

FAQ

The mission of the Architectural & Engineering (A&E) Contracts Program is to provide optimal customer service to our clients in producing A&E contracts in a timely manner and in accordance with the Department of Water Resources goals and objectives.

Kansas imposes a 6.5 percent (effective July 1, 2015) percent state retailers' sales tax, plus applicable local taxes on the: Retail sale, rental or lease of tangible personal property; Labor services to install, apply, repair, service, alter, or maintain tangible personal property, and.

WHAT PURCHASES ARE EXEMPT? Only goods or merchandise intended for resale (inventory) are exempt. Tools, equipment, fixtures, supplies, and other items purchased for business or personal use are TAXABLE since the buyer is the final consumer of the property.

Service agreements are contracts between a customer or client and the person or business providing the service. It defines the relationship, the responsibilities of each party, the compensation or payment and the services that will be provided, among other things.

As a general rule, all of these items are subject to sales tax when purchased by contractors and subcontractors. Labor services of installing or applying tangible personal property is subject to sales tax (as a general rule).

Three Common Construction ContractsFIXED PRICE. Fixed price construction contracts, also commonly referred to as lump sum or stipulated sum contracts, are the most common types of construction contracts.COST PLUS.GUARANTEED MAXIMUM PRICE.

GENERAL RULE: MATERIALS ARE TAXABLE All contractors (whether contractors or contractor-retailers) are considered to be the final user or consumer of the materials they install for others, and must pay Kansas sales or use tax on them. Under K.S.A.

The basic elements that should be addressed in an agreement between an owner and architect include (1) the owner's objectives for the project, (2) the architect's scope of services and a description of the drawings or other deliverables the architect is to furnish; (3) the fees to be paid for providing those services

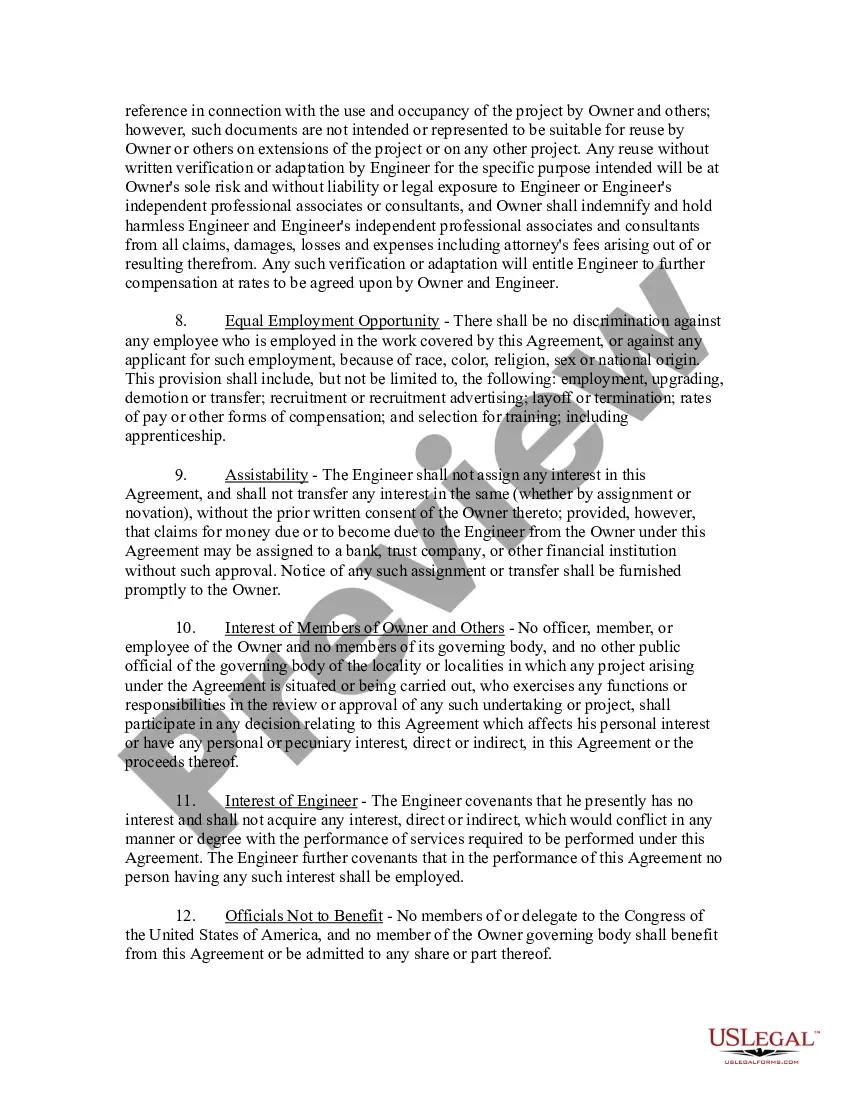

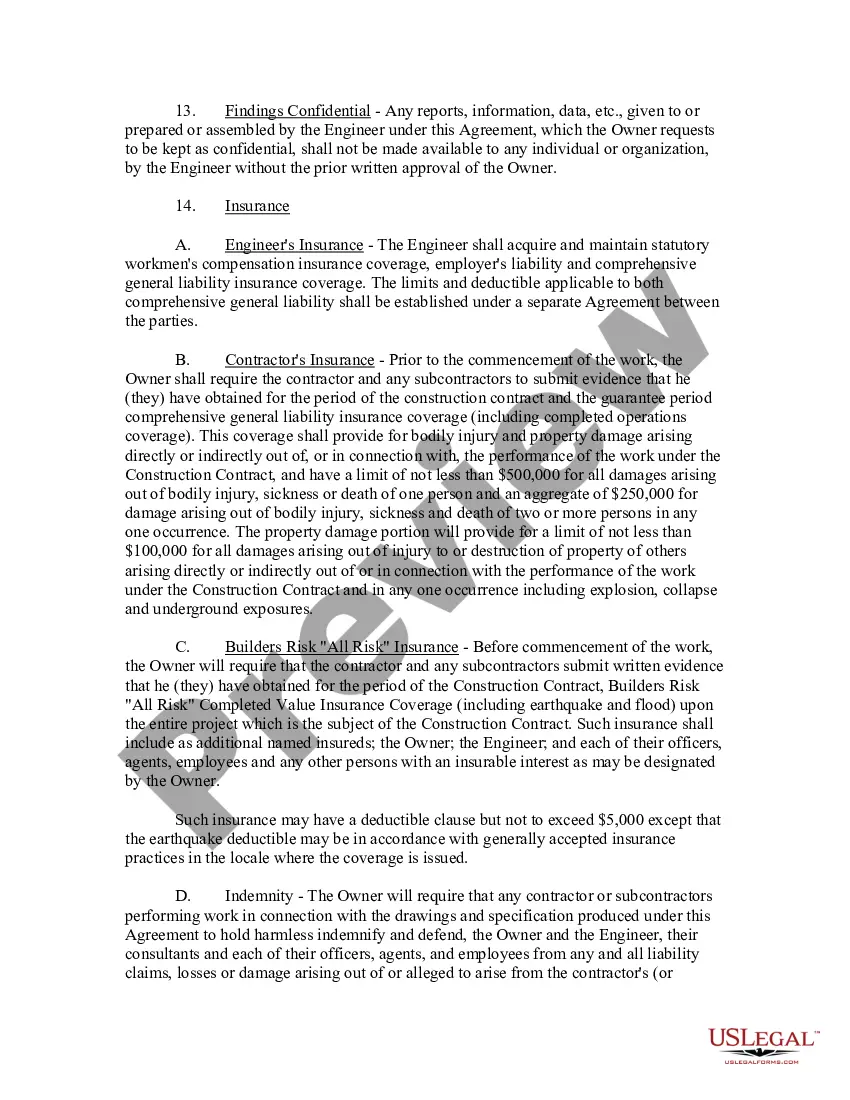

Engineering contracts are legal agreements between a business and an engineering company detailing services promised, and payment for those services.

However, in California many types of labor charges are subject to tax. Tax applies to charges for producing, fabricating, or processing tangible personal property for your customers. Generally, if you perform taxable labor in California, you must obtain a seller's permit and report and pay tax on your taxable sales.