Kansas Combined Declaration and Assignment

Description

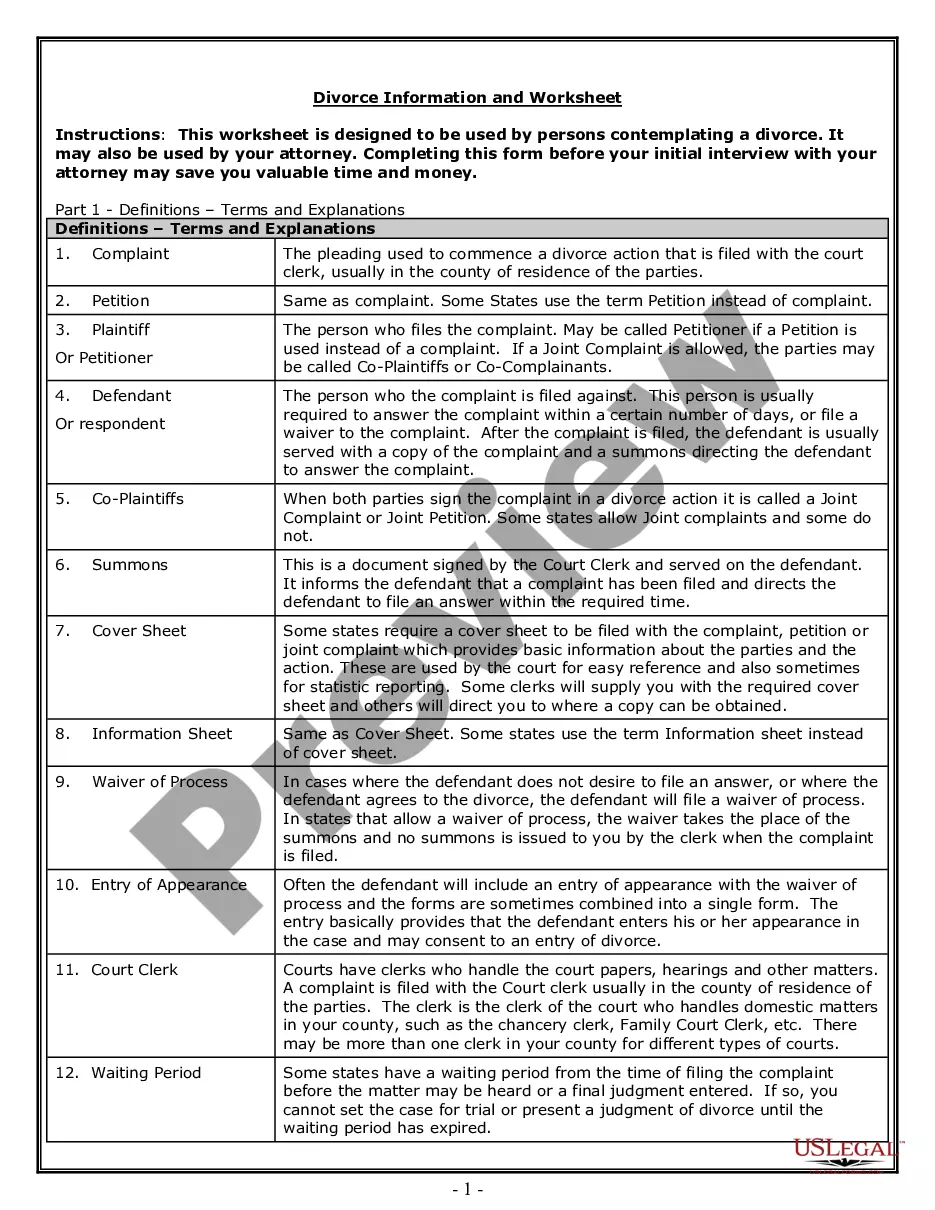

How to fill out Combined Declaration And Assignment?

If you wish to comprehensive, down load, or print out legal file layouts, use US Legal Forms, the greatest assortment of legal kinds, that can be found on-line. Utilize the site`s simple and easy handy lookup to find the files you require. Different layouts for organization and individual reasons are categorized by groups and states, or search phrases. Use US Legal Forms to find the Kansas Combined Declaration and Assignment in just a few clicks.

If you are presently a US Legal Forms client, log in to your account and click the Acquire switch to get the Kansas Combined Declaration and Assignment. Also you can gain access to kinds you previously delivered electronically in the My Forms tab of your respective account.

If you use US Legal Forms the first time, refer to the instructions beneath:

- Step 1. Make sure you have chosen the form for the right metropolis/nation.

- Step 2. Make use of the Preview method to examine the form`s information. Do not overlook to read the information.

- Step 3. If you are not satisfied together with the type, make use of the Search field near the top of the display to get other models in the legal type template.

- Step 4. When you have identified the form you require, click on the Purchase now switch. Opt for the costs strategy you favor and add your references to register for an account.

- Step 5. Approach the transaction. You may use your Мisa or Ьastercard or PayPal account to complete the transaction.

- Step 6. Pick the file format in the legal type and down load it on your own gadget.

- Step 7. Complete, modify and print out or indication the Kansas Combined Declaration and Assignment.

Each and every legal file template you buy is your own permanently. You have acces to every single type you delivered electronically inside your acccount. Click on the My Forms segment and select a type to print out or down load once again.

Compete and down load, and print out the Kansas Combined Declaration and Assignment with US Legal Forms. There are many expert and status-certain kinds you may use for the organization or individual requirements.

Form popularity

FAQ

Kansas does not have a separate extension request form. If you are entitled to a refund, an extension is not required to file the return after the original due date. To pay the balance due for an extension, use the Kansas Corporate Payment Voucher (K-120V) and mark the box indicating an extension payment.

Each corporation filing a Kansas income tax return using the combined income method of reporting with more than one entity of the combined group doing business in Kansas, may report the total Kansas combined income and pay the tax due by filing one Kansas income tax return.

In fact, most of the states that use market-based rules for sourcing sales of services have also adopted a single-factor sales apportionment formula. Examples include California (elective), Georgia, Illinois, Iowa, Maine, Michigan, Minnesota (post-2013), Utah (post-2012, for certain industries), and Wisconsin.

Corporations may opt to use a two-factor (sales and property) apportionment formula to calculate tax liability if the payroll factor for a taxable year exceeds 200 percent of the average of the property and sales factors.

Apportionment is the determination of the percentage of a business' profits subject to a given jurisdiction's corporate income or other business taxes. U.S. states apportion business profits based on some combination of the percentage of company property, payroll, and sales located within their borders.

Therefore, while Kansas NOLs incurred after Dec. 31, 2017, may now be carried forward indefinitely, the federal 80% limitation added by the TCJA and the CARES Act's temporary suspension of this limitation for NOLs carried forward to 2019 and 2020 will apply for Kansas income tax purposes.

Corporate income tax is assessed against every corporation doing business in Kansas or deriving income from sources within Kansas.

What is the standard Kansas apportionment formula? Corporations that have taxable income from business activity both in and outside Kansas must assign business to Kansas using an equally weighted three-factor apportionment formula consisting of a property factor, payroll factor, and sales factor.