Kansas Sample Letter for Order Approving Third and Final Accounting

Description

How to fill out Sample Letter For Order Approving Third And Final Accounting?

Are you within a place that you need to have documents for possibly business or person functions just about every day time? There are plenty of lawful file web templates available online, but locating types you can depend on is not effortless. US Legal Forms provides 1000s of form web templates, like the Kansas Sample Letter for Order Approving Third and Final Accounting, which can be written to satisfy federal and state specifications.

Should you be previously familiar with US Legal Forms internet site and get an account, simply log in. Next, you may obtain the Kansas Sample Letter for Order Approving Third and Final Accounting design.

Unless you come with an profile and would like to start using US Legal Forms, abide by these steps:

- Get the form you require and make sure it is for that correct city/area.

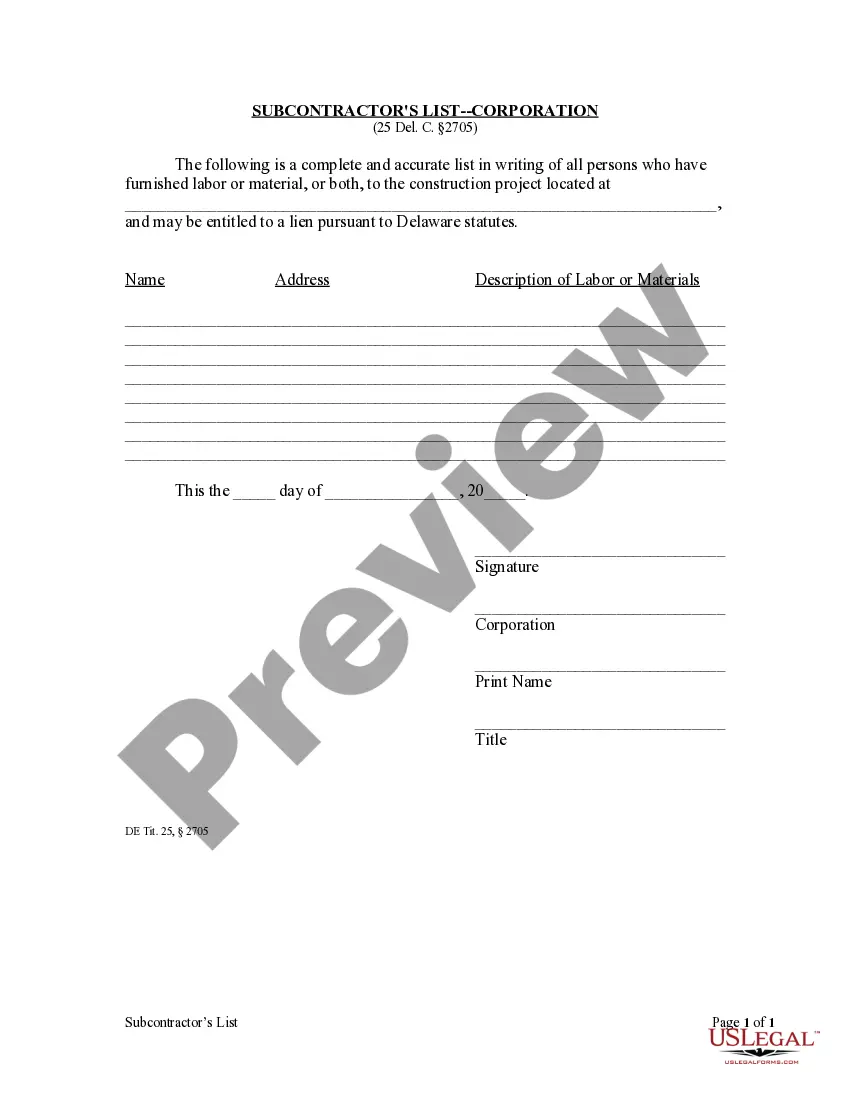

- Use the Review switch to examine the form.

- Look at the outline to actually have chosen the right form.

- When the form is not what you`re trying to find, use the Look for field to discover the form that fits your needs and specifications.

- When you obtain the correct form, simply click Get now.

- Opt for the costs prepare you desire, complete the necessary details to make your money, and pay for the transaction making use of your PayPal or credit card.

- Pick a handy data file format and obtain your duplicate.

Find every one of the file web templates you might have bought in the My Forms food list. You can obtain a more duplicate of Kansas Sample Letter for Order Approving Third and Final Accounting whenever, if possible. Just go through the necessary form to obtain or print out the file design.

Use US Legal Forms, by far the most substantial assortment of lawful kinds, to save time and stay away from errors. The service provides expertly created lawful file web templates that you can use for an array of functions. Generate an account on US Legal Forms and start producing your way of life a little easier.