Kansas Renunciation of Legacy

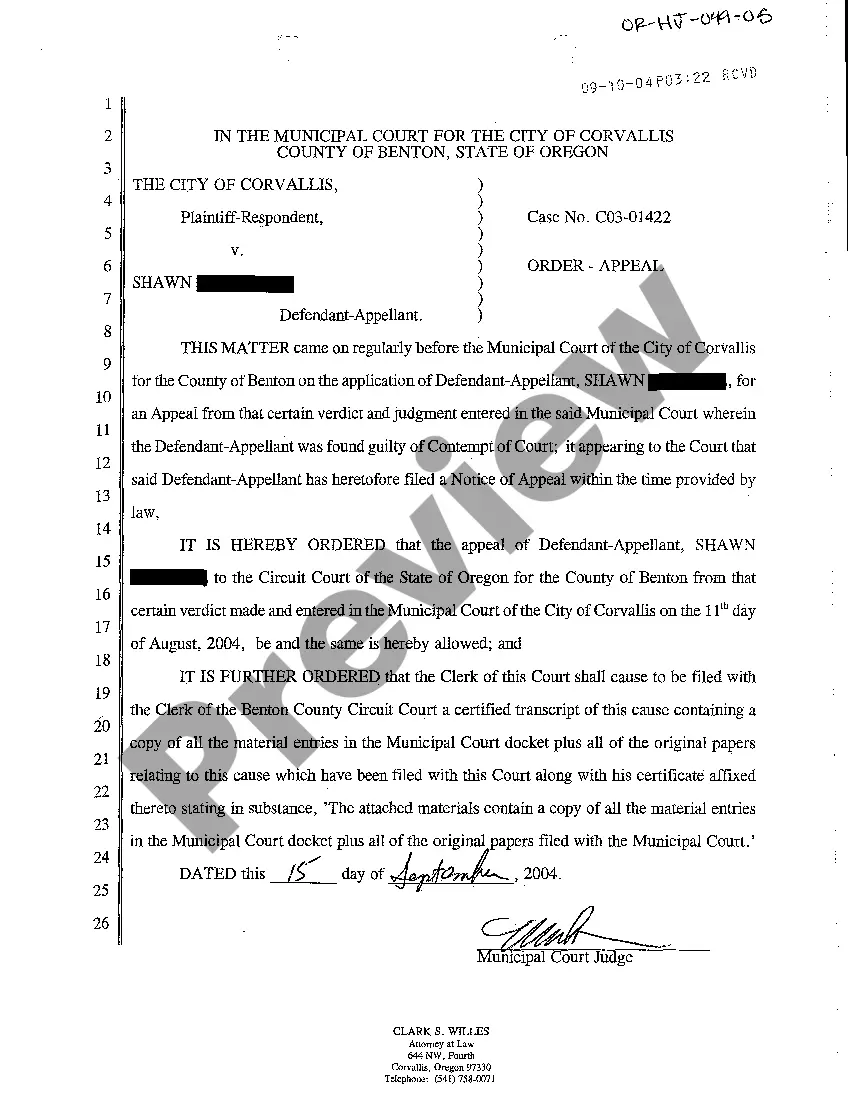

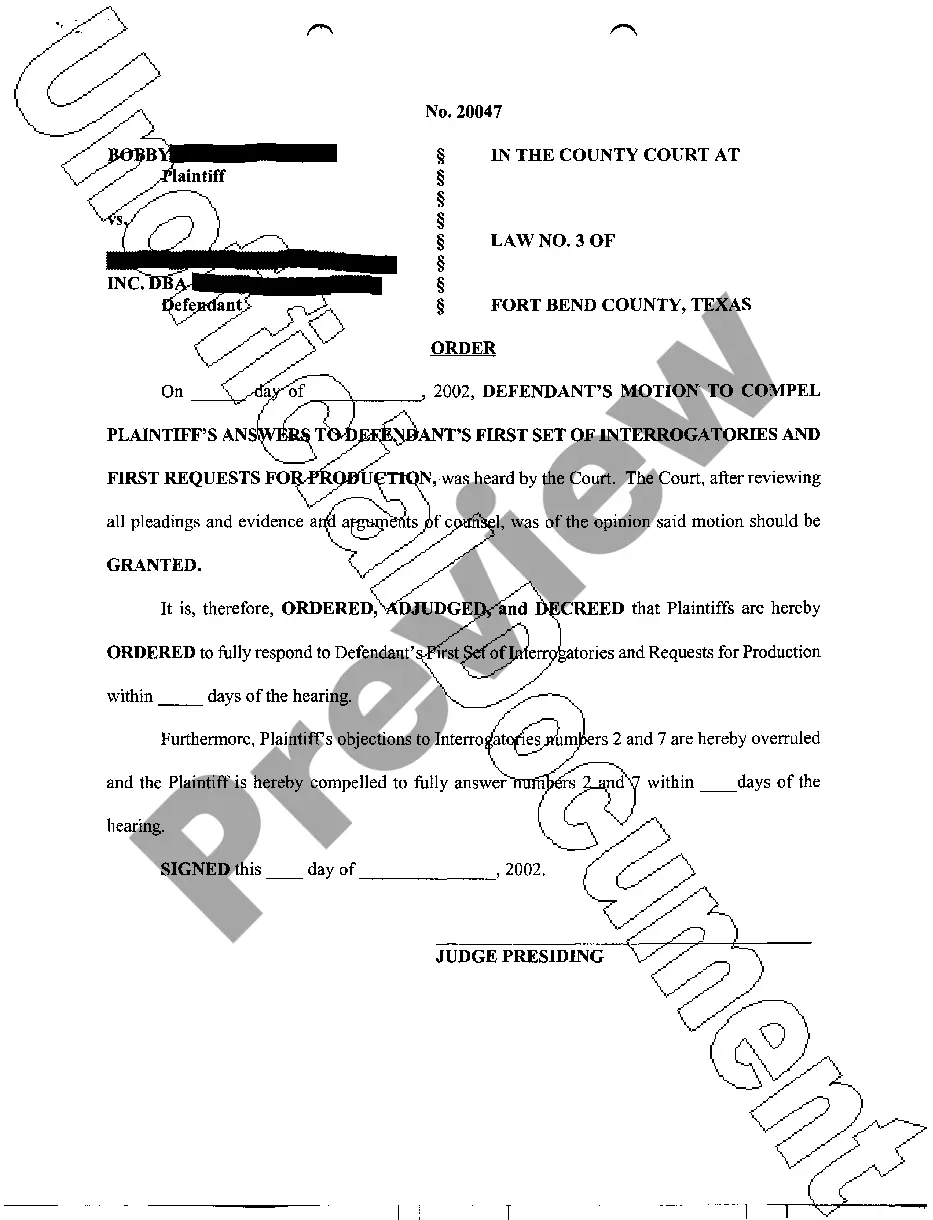

Description

How to fill out Renunciation Of Legacy?

You are able to invest hours online looking for the legitimate document template that fits the state and federal requirements you want. US Legal Forms provides 1000s of legitimate forms that are reviewed by experts. You can actually obtain or print the Kansas Renunciation of Legacy from the support.

If you have a US Legal Forms account, you can log in and click the Download switch. Following that, you can total, change, print, or signal the Kansas Renunciation of Legacy. Every single legitimate document template you buy is yours permanently. To acquire another backup associated with a purchased kind, proceed to the My Forms tab and click the corresponding switch.

If you use the US Legal Forms website the very first time, keep to the simple instructions beneath:

- Initially, ensure that you have chosen the correct document template for that county/city of your liking. Read the kind description to make sure you have chosen the appropriate kind. If available, use the Preview switch to appear with the document template too.

- If you would like find another variation of the kind, use the Research area to find the template that meets your needs and requirements.

- After you have discovered the template you need, click on Acquire now to move forward.

- Find the prices prepare you need, key in your credentials, and register for a merchant account on US Legal Forms.

- Complete the financial transaction. You may use your Visa or Mastercard or PayPal account to cover the legitimate kind.

- Find the formatting of the document and obtain it in your system.

- Make alterations in your document if required. You are able to total, change and signal and print Kansas Renunciation of Legacy.

Download and print 1000s of document themes using the US Legal Forms website, which offers the largest variety of legitimate forms. Use expert and status-distinct themes to handle your business or specific needs.

Form popularity

FAQ

IF the deceased had no will and left only real estate to the surviving spouse and other family members, a ?Determination of Descent? proceeding may be started at any time 6 months after death. This proceeding takes about 30 days to complete and is often used when reasons to probate administration do not exist.

Revoking the deed. You have two options: (1) sign and record a revocation or (2) record another TOD deed, leaving the property to someone else. You cannot use your will to revoke or override a TOD deed.

If the person who dies was married and has a surviving spouse, the entire estate generally passes over to this spouse if there are no children from the marriage. If a spouse and children survive the deceased, the estate's assets are divided in half equally between the spouse and the surviving children.

Statute of limitations in contracts for sale. (1) An action for breach of any contract for sale must be commenced within four years after the cause of action has accrued. By the original agreement the parties may reduce the period of limitation to not less than one year but may not extend it.

Legal heirs may apply for a Decedent's Title, Form TR-83a, or use the Claim of Heir Affidavit, Form TR-83b, by completing either of the forms and taking the completed form, the Lienholder Consent to Transfer Ownership, Form TR-128, and a copy of the current registration or verification of ownership to their local ...

Estate Tax Qualified Disclaimer A disclaimer must be in writing. The disclaimer must be given to the estate's representative no later than nine months after the decedent's death. The disclaiming person cannot accept the asset or any benefit from the asset.

A TOD is a document that can be prepared and signed at any time. It directs the transfer of your interest in property to another person at the moment of your death. It doesn't avoid creditors or SRS Estate Recovery. It doesn't avoid taxes (although only very large estates are taxed in Kansas now).

(a) An interest in real estate may be titled in transfer-on-death, TOD, form by recording a deed signed by the record owner of such interest, designating a grantee beneficiary or beneficiaries of the interest. Such deed shall transfer ownership of such interest upon the death of the owner.