Kansas Renunciation of Legacy by Child of Testator

Description

How to fill out Renunciation Of Legacy By Child Of Testator?

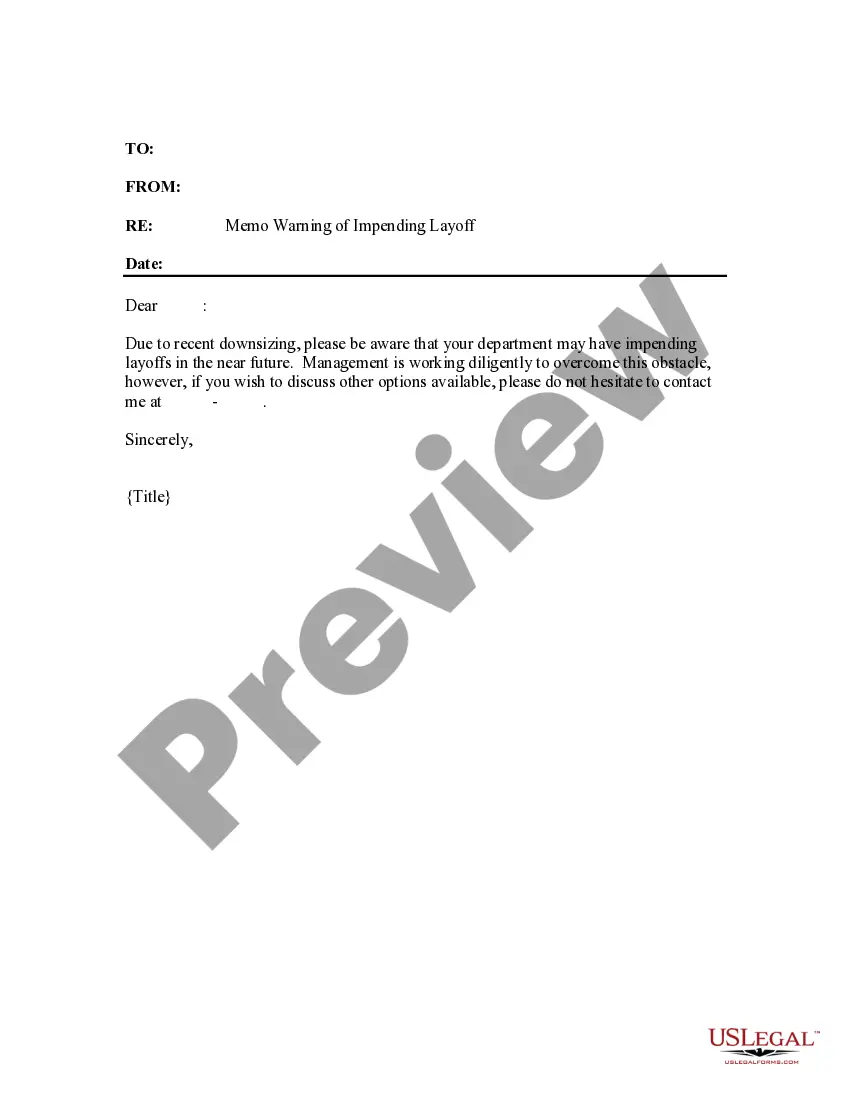

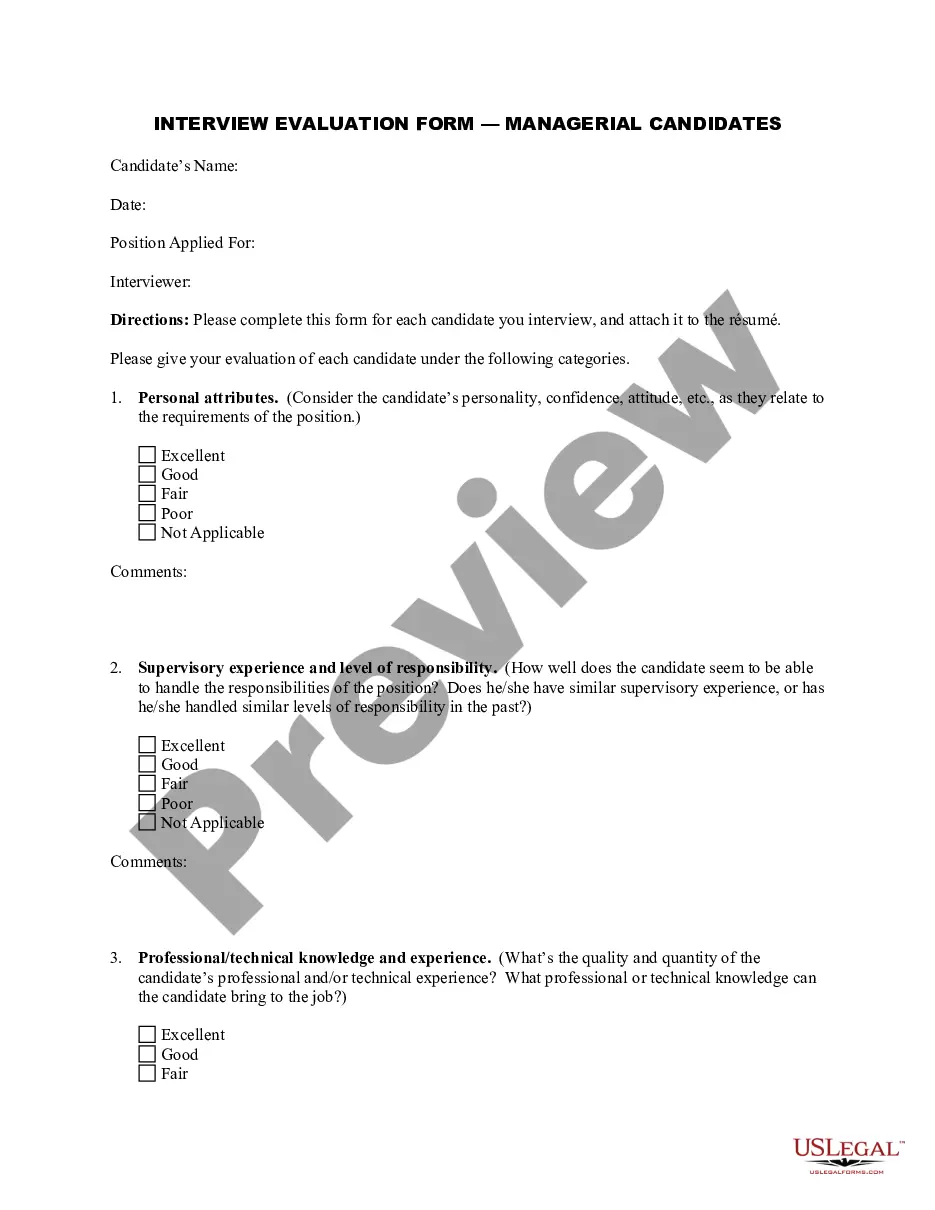

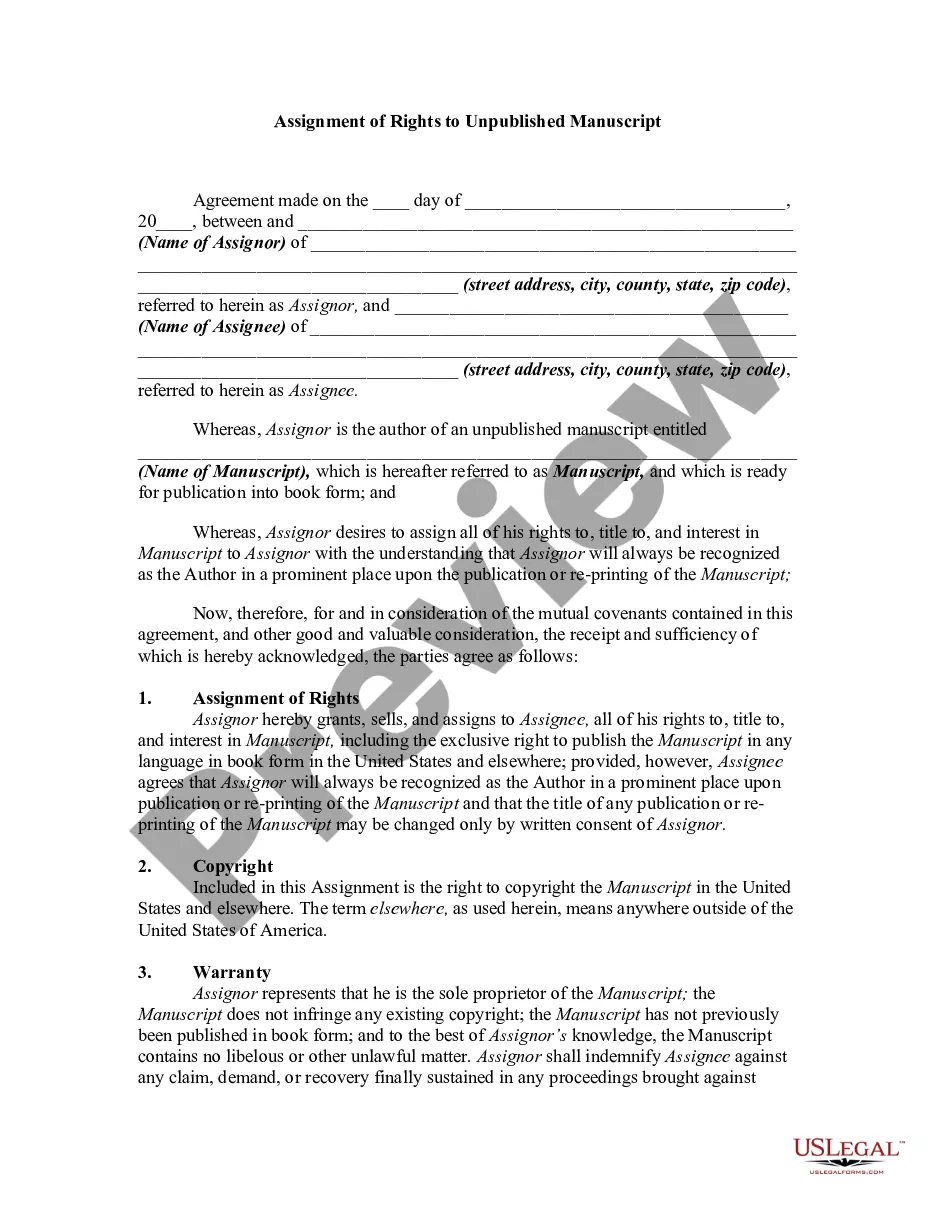

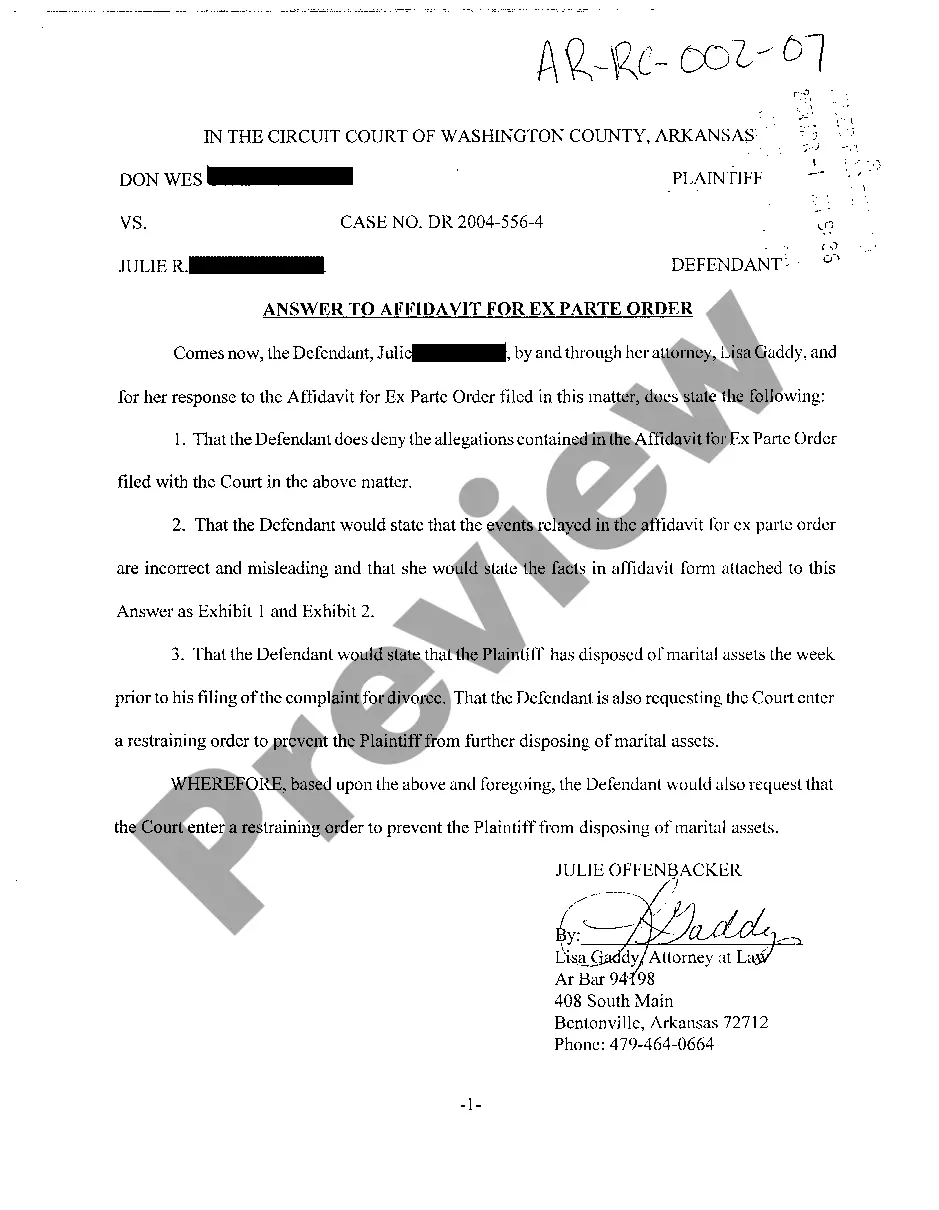

If you wish to total, acquire, or print legitimate papers layouts, use US Legal Forms, the most important assortment of legitimate varieties, which can be found on-line. Make use of the site`s easy and hassle-free search to find the papers you require. Various layouts for organization and individual uses are sorted by types and suggests, or search phrases. Use US Legal Forms to find the Kansas Renunciation of Legacy by Child of Testator in just a handful of click throughs.

When you are previously a US Legal Forms consumer, log in in your account and then click the Acquire switch to get the Kansas Renunciation of Legacy by Child of Testator. You can also gain access to varieties you formerly saved inside the My Forms tab of your account.

Should you use US Legal Forms the first time, follow the instructions below:

- Step 1. Make sure you have selected the shape for that correct town/country.

- Step 2. Take advantage of the Review solution to check out the form`s content. Don`t forget to read the explanation.

- Step 3. When you are not satisfied together with the form, take advantage of the Lookup industry on top of the display to discover other variations in the legitimate form format.

- Step 4. Once you have identified the shape you require, go through the Purchase now switch. Select the prices strategy you favor and include your qualifications to register on an account.

- Step 5. Process the purchase. You should use your Мisa or Ьastercard or PayPal account to perform the purchase.

- Step 6. Find the formatting in the legitimate form and acquire it on your own product.

- Step 7. Total, modify and print or signal the Kansas Renunciation of Legacy by Child of Testator.

Every single legitimate papers format you buy is your own property eternally. You might have acces to each form you saved with your acccount. Select the My Forms area and decide on a form to print or acquire yet again.

Remain competitive and acquire, and print the Kansas Renunciation of Legacy by Child of Testator with US Legal Forms. There are thousands of specialist and state-certain varieties you can utilize for the organization or individual requires.

Form popularity

FAQ

In Kansas, the following assets are subject to probate: Solely-owned property: Any asset that was solely owned by the deceased person with no designated beneficiary is subject to probate. This could include bank accounts, cars, houses, personal belongings, and business interests.

IF the deceased had no will and left only real estate to the surviving spouse and other family members, a ?Determination of Descent? proceeding may be started at any time 6 months after death. This proceeding takes about 30 days to complete and is often used when reasons to probate administration do not exist.

Anti-lapse statute in effect at testator's death applicable in action to determine whether heirs of deceased beneficiary succeed to his interest.

If the decedent's spouse and at least one of their children survive them, the spouse inherits half of the decedent's estate, and the other half is distributed amongst the children (or amongst the children and the children's descendants if one or more of the decedent's children did not survive them) per stirpes.

Options for keeping your estate out of probate Living trusts. Joint property ownership. Payable-on-death designations. Transfer-on-death deeds. Transfer-on-death registration.

Stat. § 59-1504. Whenever a decedent by will makes a provision for the compensation of his or her executor, that shall be taken as such executor's full compensation, unless the executor files a written instrument, renouncing all claim to the compensation provided for in the will.

Estate Tax Qualified Disclaimer A disclaimer must be in writing. The disclaimer must be given to the estate's representative no later than nine months after the decedent's death. The disclaiming person cannot accept the asset or any benefit from the asset.

However, most assets held in the sole name of the deceased person require probate before being transferred to the beneficiaries named in a will. If the funds in the estate are $40,000 or less, no probate is necessary and all that is required is an affidavit from the heir(s) and a copy of the death certificate.