Kansas Living Trust with Provisions for Disability

Description

How to fill out Living Trust With Provisions For Disability?

US Legal Forms - one of the largest repositories of legal documents in the USA - offers a variety of legal form templates you can download or print.

By using the website, you can access thousands of forms for business and personal purposes, categorized by types, states, or keywords.

You can find the latest versions of forms such as the Kansas Living Trust with Provisions for Disability in a matter of minutes.

If the form doesn't suit your needs, utilize the Search box at the top of the screen to find one that does.

If you are satisfied with the form, confirm your choice by clicking the Download now button. Then, select the payment plan you prefer and provide your information to register for an account.

- If you possess a monthly subscription, Log In and retrieve the Kansas Living Trust with Provisions for Disability from the US Legal Forms library.

- The Download button will appear on every form you view.

- You can access all previously downloaded forms in the My documents section of your account.

- To use US Legal Forms for the first time, follow these simple instructions to get started.

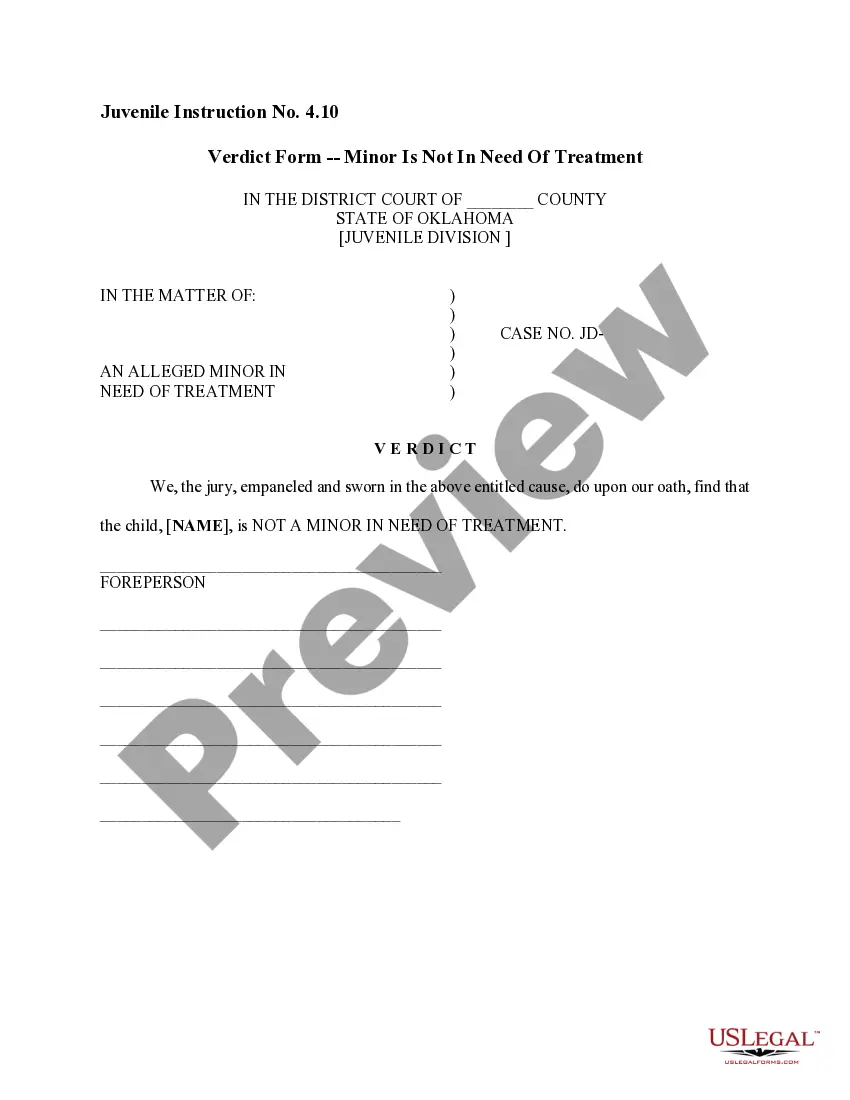

- Ensure you have chosen the correct form for your city/county. Click the Preview button to review the form's details.

- Check the form summary to ensure you have selected the right one.

Form popularity

FAQ

Drawbacks of a Living TrustPaperwork. Setting up a living trust isn't difficult or expensive, but it requires some paperwork.Record Keeping. After a revocable living trust is created, little day-to-day record keeping is required.Transfer Taxes.Difficulty Refinancing Trust Property.No Cutoff of Creditors' Claims.

The Kansas living trust is a document that enables an individual (the Grantor) to transfer ownership of their property into an entity to be distributed to a Beneficiary (or Beneficiaries) upon the Grantor's death.

How Much Does a Trust Cost? If you hire an attorney to build your trust, you'll likely pay more than $1,000, and fees will be higher for couples. You can also use online software to create trust documents at a cheaper rate.

A trust can remain open for up to 21 years after the death of anyone living at the time the trust is created, but most trusts end when the trustor dies and the assets are distributed immediately.

Most living trusts are revocable, meaning they can be changed or deleted during the settlor's life. An irrevocable living trust becomes permanent once it is created. A living trust in Kansas may be created if the settlor lives in Kansas, the trustee lives or works in Kansas, or trust property is located in Kansas.

You can create a living trust through two different ways: you can hire an attorney or you can use an online program. Hiring an attorney will cost you more than $1,000. If you choose to use the DIY approach, you'll spend a few hundred dollars.

Most living trusts are revocable, meaning they can be changed or deleted during the settlor's life. An irrevocable living trust becomes permanent once it is created. A living trust in Kansas may be created if the settlor lives in Kansas, the trustee lives or works in Kansas, or trust property is located in Kansas.

A Special Disability Trust (SDT) is a special type of trust that allows parents and immediate family members to plan for current and future needs of a person with severe disability. The trust can pay for reasonable care, accommodation and other discretionary needs of the beneficiary during their lifetime.

You can create a living trust through two different ways: you can hire an attorney or you can use an online program. Hiring an attorney will cost you more than $1,000. If you choose to use the DIY approach, you'll spend a few hundred dollars.

According to § 58a-402, in order to create a living trust, the Grantor (trust maker) must be of right mind or capacity to form a trust and they must indicate an intention to do so. They will also be required to designate their Beneficiary(ies) and Trustee, and assign duties for the latter to perform.